| 1. Accounts Receivable Credit Memo |

| 1.1. Prerequisites for A/R Credit Memos |

Users MUST have full rights to the "AR Offsets, Write-offs & CM" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. |

| 1.2. Introduction for A/R Credit Memos |

A Credit Memo can be created from two modules: the Accounts Receivable Credit Memo module or the RMA (Return Material Authorization) module.

The Accounts Receivable Credit Memo section provides the ability to issue Credit memos against specific Invoice (Invoice CM) or create a General CM. An Invoice Credit Memo will debit SCRAP and credit COGS. If a partial credit is required without returned goods, create a General Credit Memo. For returned goods, create an RMA . The RMA (Return Material Authorization) module notifies receiving to expect a return from a Customer. The authorization also allows for reworking/replacing the order so that the user doesn’t have to go to another screen to create a Sales Order. Once the RMA is received, a Credit Memo automatically forwards to the Accounting Accounts Receivable Credit Memo module where it can be viewed and printed. Rather than issuing an invoice Credit memo, the user may wish to use the RMA module instead. Please refer to the RMA (Return Material Authorization) Management manual. Note: DO NOT use this module to create a Credit Memo if it involves return of inventory from a Customer, use the RMA process. If the RMA is created from an Invoice the CM type will be "Invoice", if the RMA is a stand-alone the CM type will be "General".

See the attached word document <<How_CM_Affect_GL_Accts_090106.docx>> for further detail on how the different types of Credit Memo's affect the GL Accounts.

|

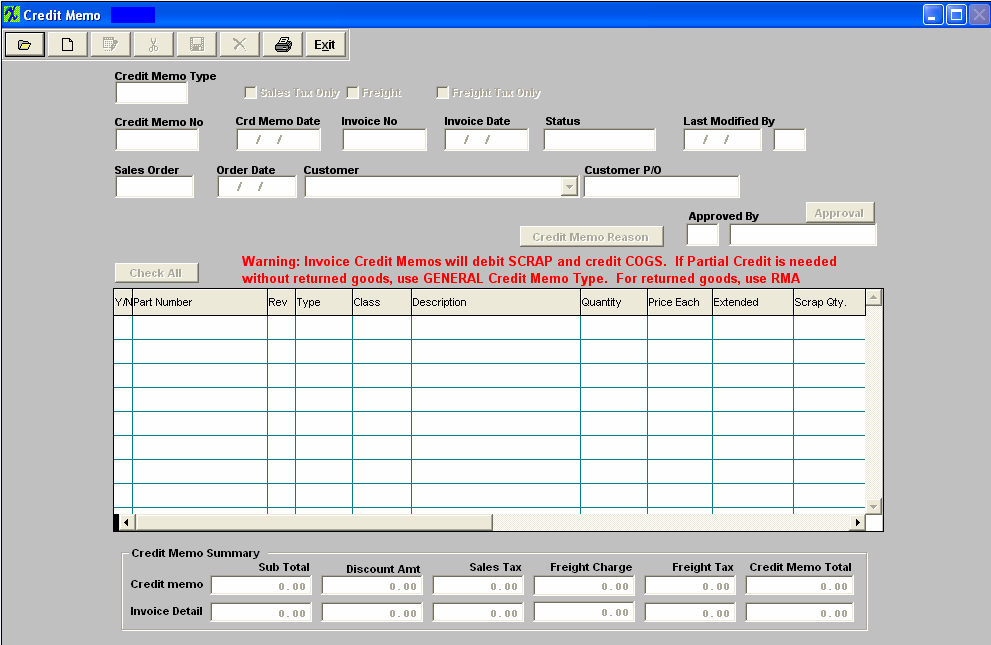

| 1.3. Fields & Definitions for A/R Credit Memo | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Credit Memo Field Definitions:

Credit Memo Summary/Credit Memo Line:

Credit Memo Summary/Invoice Detail Line:

The GST (Primary) tax and PST (Secondary) tax is divided into the Sales tax and Freight tax on the Credit Memo Summary/Invoice Detail Line: For Example: Primary Tax (GST): 144*10% (sales tax) + 0 (no freight tax is calculated) =$14.40 Secondary Tax (PST): 144*8% (sales tax) + 12*8% (Freight tax) = $12.48 Divided into sales tax and freight tax: Sales Tax: 144*10% (sales tax) + 144*8% (sales tax) = $25.92 Freight Tax 0 (from primary tax) + 12*8% (from secondary tax) = $0.96

|

| 1.4. How To ...... for A/R CRedit Memos |

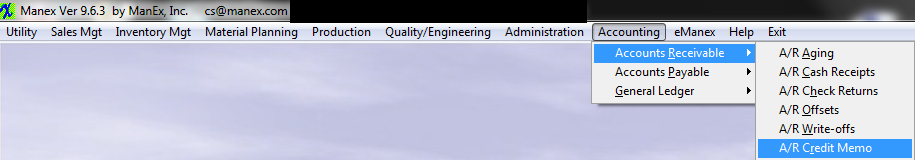

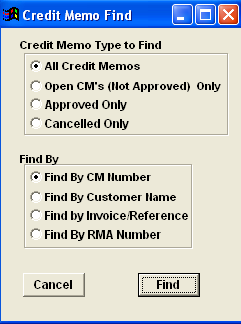

| 1.4.1. Find an A/R Credit Memo | ||||||

The following screen will appear:

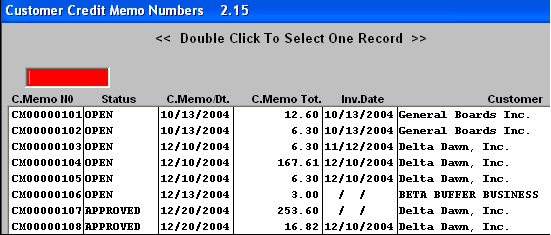

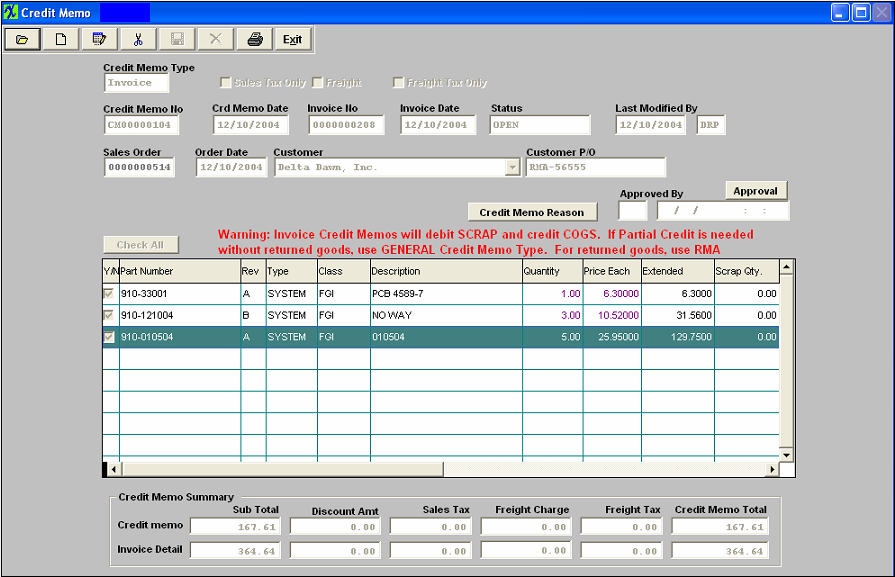

Once an existing Credit Memo has been selected, the detail screen for that CM will be displayed:

|

| 1.4.2. Edit an A/R Credit Memo |

Find an Exising Credit Memo with an "OPEN" status.

Depress the Edit record action icon.

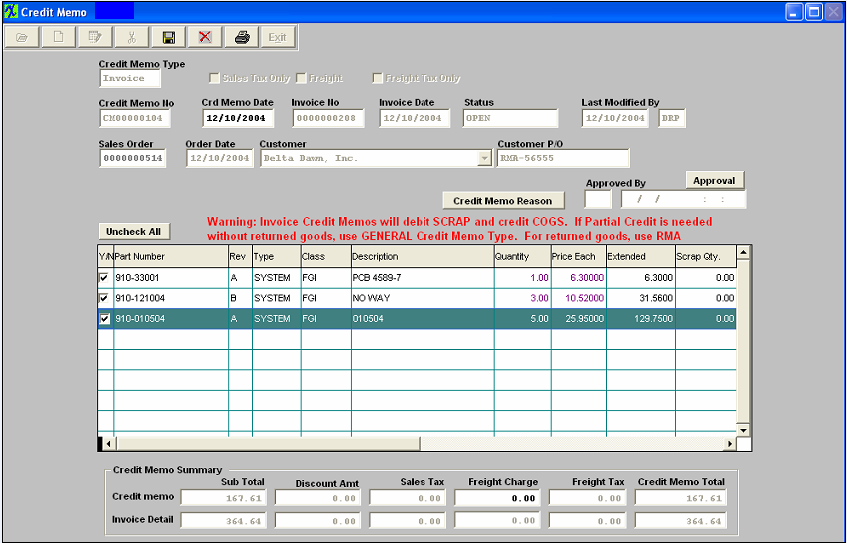

When in the edit mode the Credit Memo Date is editable. User can also check or uncheck line item numbers to be credited. Once the Status changes from OPEN to APPROVED the Credit Memo can no longer be edited.

|

| 1.4.3. Add an A/R Credit Memo |

| 1.4.3.1. Invoice Credit Memo | ||

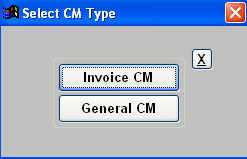

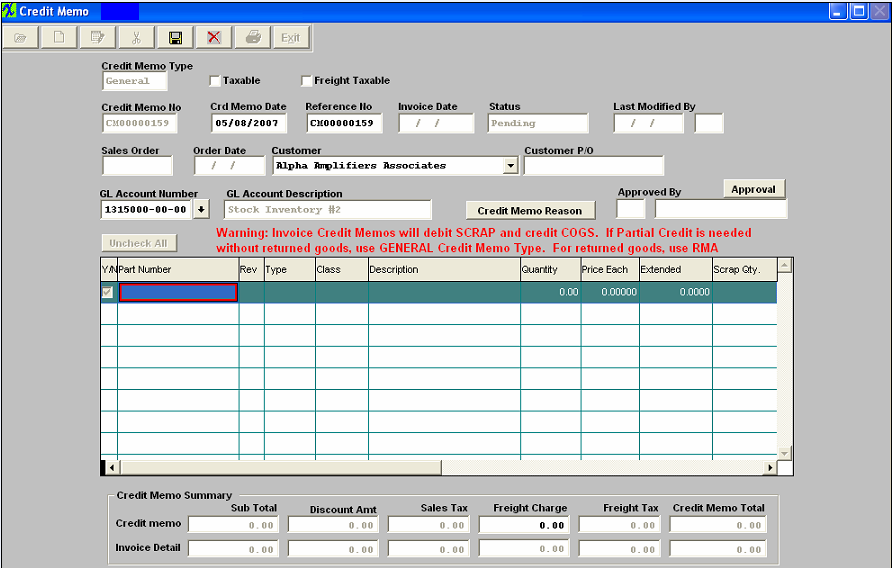

The following screen will appear:

|

| 1.4.3.2. General Credit Memo | ||||||||||

|

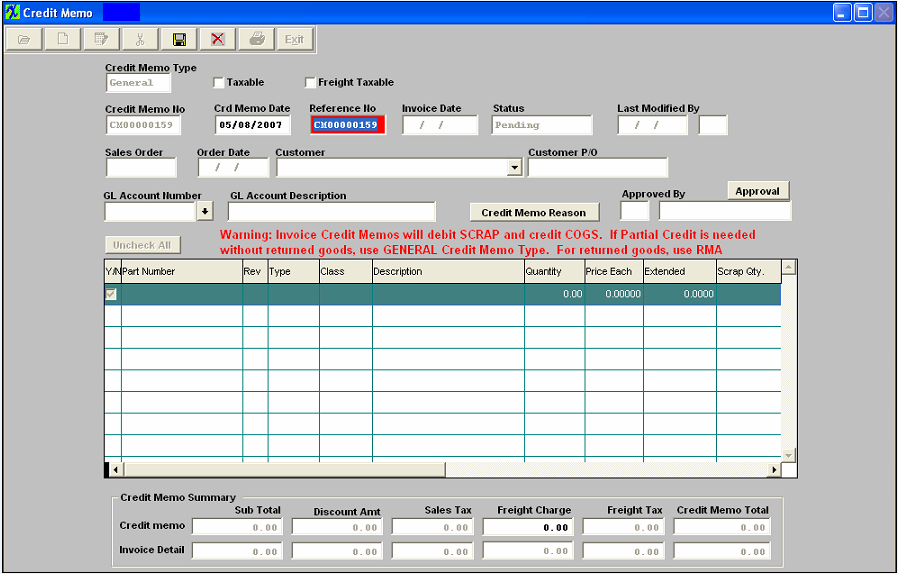

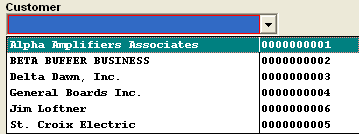

The following screen will appear:

The following screen will appear:

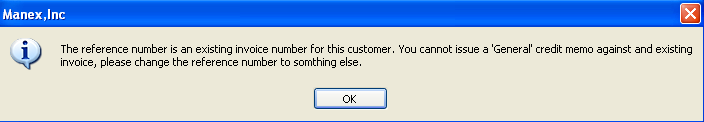

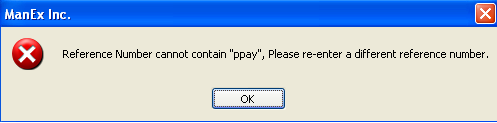

The Invoice Number field changes to a reference number, and the user enters a Reference Number for the Credit Memo. Note: The user is given a message if they use a reference number on a credit memo that has already been used for another customer and it will not allow them to save the credit memo if the customer and the reference number does not match.

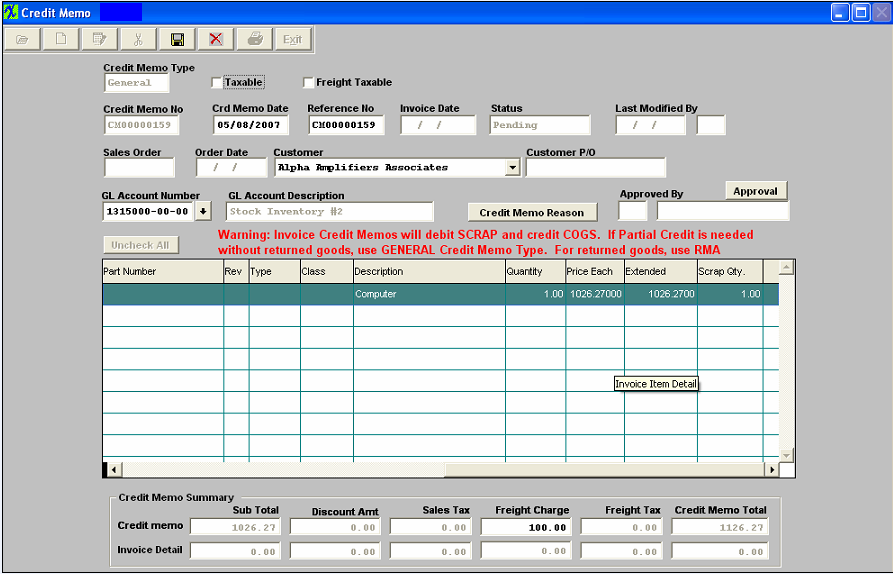

Check the Taxable box if applicable. Check the Freight Taxable box if applicable. Credit memo date will default in but user may change date if needed.

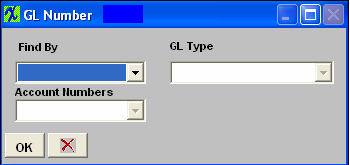

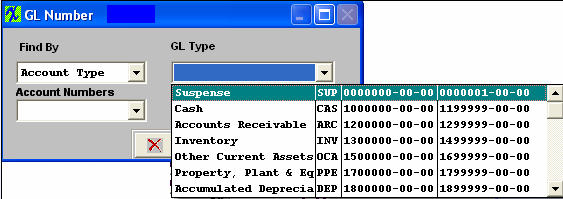

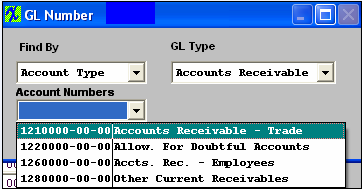

A General Ledger Account number must be supplied for a general Credit Memo. Note: When creating a General Credit Memo users should not select the same GL account number that is entered in the Actsetup for the Account Receivables. If you do, then the resulting transaction will debit and credit both the sane GL account number. The following GL screen will appear:

Select the method of finding the General Ledger Account number, by Account Type or Account Numbers. If you select Find By Account Type, depress the down arrow on the right hand side of the screen.

Select the desired Account Type, then select the Account Number.

Depress the OK button. If you select by account number, depress the down arrow next to the Account Numbers box and the accounts will appear. Highlight the Account Number you wish to use.

Then the user enters the description, quantity and price each to be credited. If the Taxable box is checked the Sales Tax will default in. If the Freight Taxable box is checked user must enter in the Freight Charge to be Credited as displayed below. The Credit Memo Total will calculate automatically.

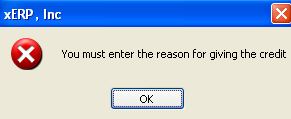

User MUST enter a reason for the Credit Memo before saving. If Credit Memo Reason is blank user will receive the following message.

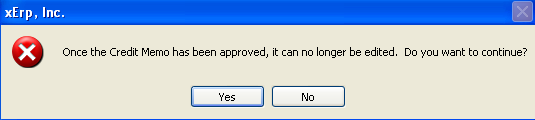

To enter the reason for the General Credit memo. Depress the Credit Memo Reason button. Depress the Edit button. Enter the Credit Memo Reason. Depress the Save button. Depress the Exit button. Then the Credit Memo may be saved and recorded by depressing the Save record action icon, or deleted by depressing the Abandon changes action icon. Depress the Approval button, and receive the following message.

Once Credit Memo has been approved the CM Status will change from Pending to Approved, and the CM will forward to the A/R Aging module. If desired, it may be Offset via the A/R Offset module. |

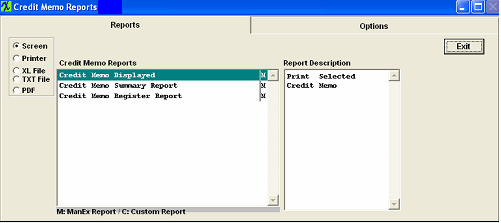

| 1.5. Reports for A/R Credit Memos | ||||||||

The Return Material Authorization module notifies receiving to expect a return from a Customer. The authorization also allows for reworking/replacing the order so that the user doesn’t have to go to another screen to create a Sales Order. Once the RMA is received, a Credit Memo automatically forwards to the Accounting Accounts Receivable Credit Memo module where it can be viewed and printed. To view the Credit Memo created in the Return Material Authorization module, use the Find procedure.

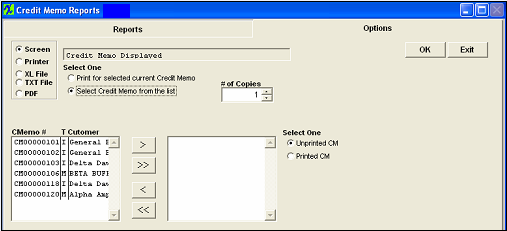

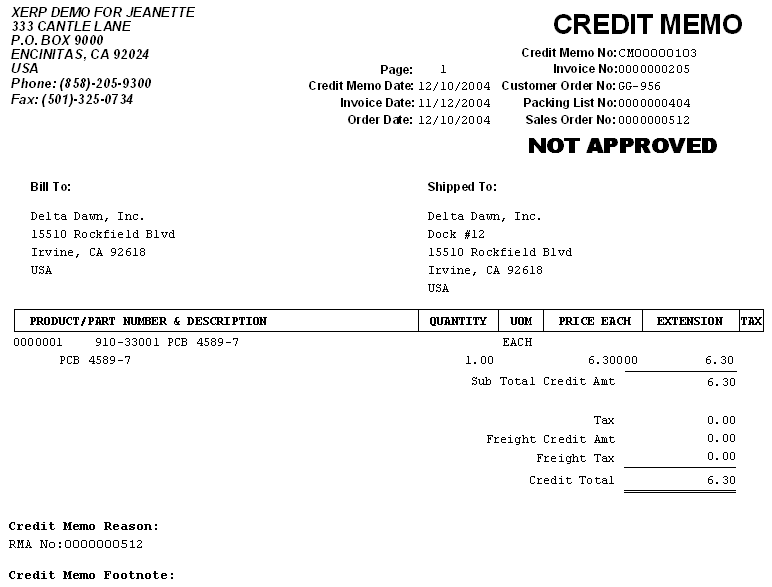

Credit Memo Displayed

The Following is printed:

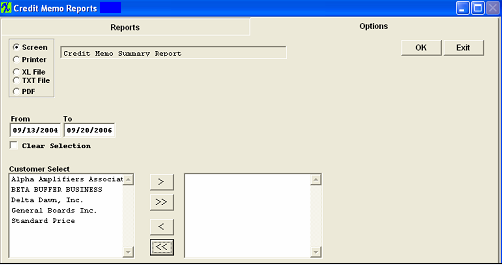

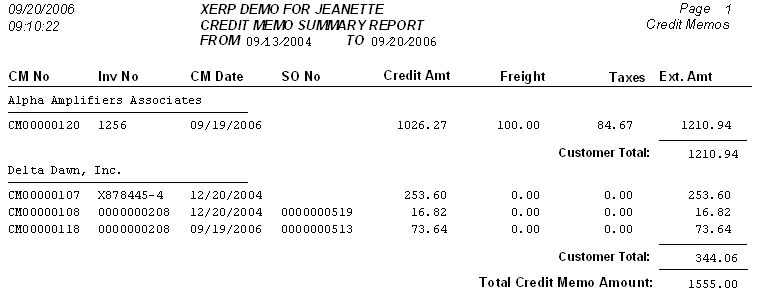

Credit Memo Summary Report:

Select the appropriate From and To Date Range. Select the Customers you want by highlighting the Customer then depressing the > button. If you want all of the Customers, depress the >> button. Your selection will appear in the right hand box. Depress the OK button The following report will appear:

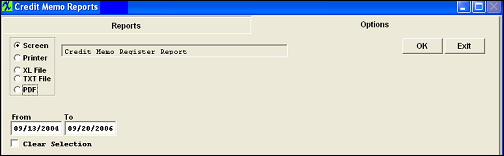

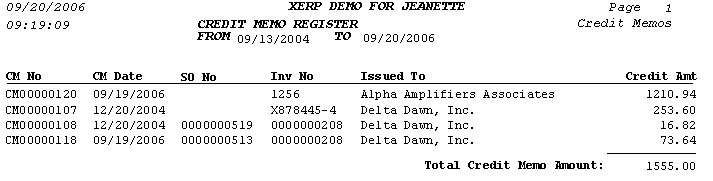

Credit Memo Register Report:

Select the appropriate From and To Date Range. Depress the OK button. The following report will be available:

|