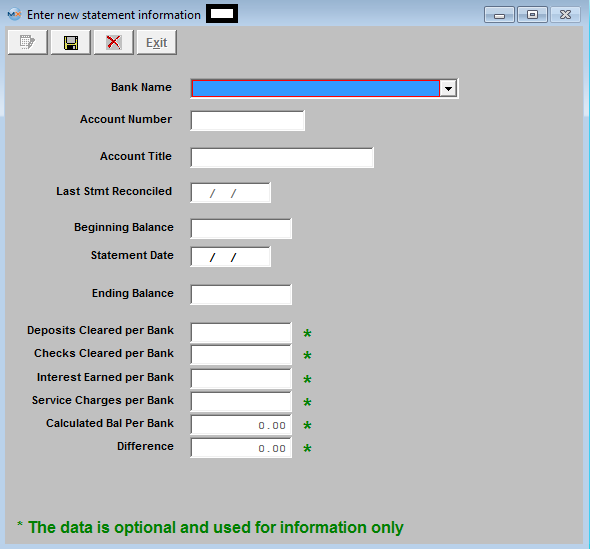

Bank Reconciliation Enter New Statement Information Field and Definitions:

| Bank Name |

The name of the bank which is being reconciled |

| Account Number |

The number that the bank has for this account |

| Account Title |

The G/L title for this bank |

| Last Statement Reconciled |

The date of the last reconciliation for this bank will default into this field. This field is editable when the users process a Bank Statement for the first time, but will only allow you to enter a date that is earlier than the Statement Date that is being processed. This will prevent the user from accidentally entering in the exact same date or later than the Statement Date being processed. |

| Beginning Balance |

Beginning Balance for this account |

| Statement Date |

The date of the bank statement |

| Ending Balance |

The ending balance per the bank statement |

| Deposits Cleared per Bank |

This is the total of all of the cleared deposits per the bank statement |

| Checks Cleared per Bank |

This is the total of all of the cleared checks per the bank statement |

| Interest Earned per Bank |

This is the amount of any interest credited to the bank account by the bank. Upon the final save after the reconciliation is complete, the appropriate journal entry is created |

| Service Charges per Bank |

This is the amount of any charges debited to the bank account by the bank. Upon the final save after the reconciliation is complete, the appropriate journal entry is created. |

| Calculated Balance per Bank |

This amount is the opening balance + deposits cleared – checks cleared + interest earned – service charges and should equal the exact amount of the ending balance per the bank statement |

| Difference |

This would be any difference between the New Ending Balance per Bank and the Calculated Balance per Bank. This amount should be zero. |

|