| 1. Accounts Payable Management (AP) |

| 1.1. Prerequisties for Accounts Payable | ||||

Prerequisites Required for ACCOUNTS PAYABLE activity:

|

| 1.2. Introduction to Accounts Payable |

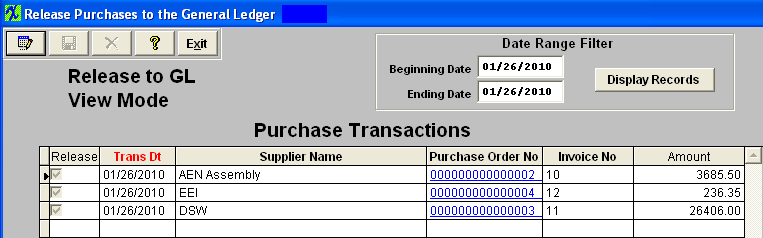

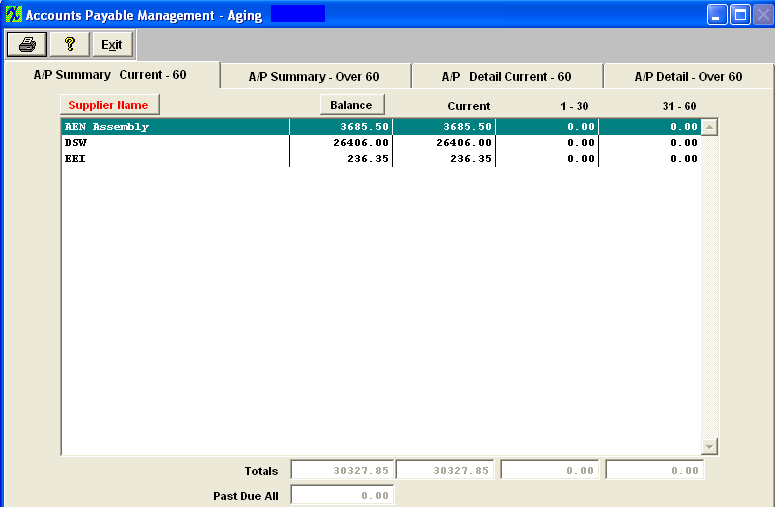

The process of entering a payable produces an entry into the Accounts Payable Aging module of the ManEx System. This dynamic nature of the process ensures that the aging reports always display the current payables status regardless of whether an item has been posted into the General Ledger. In order for the aging report to match the balances as shown in the balance sheet and account inquiry screens, the user must first release the payables and checks written information. This creates the underlying journal entries which then may be posted into the general ledger system. |

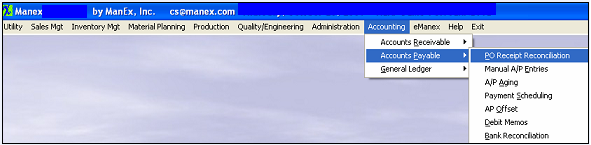

| 1.3. PO Receipt Reconciliation |

| 1.3.1. Prerequisites for PO Receipt Reconciliation |

|

Users MUST have full rights to the "PO Reconcilliation" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. The Purchase Order line item has been received and inspected. |

| 1.3.2. Introduction for PO Receipt Reconciliation |

The PO Receivable Reconciliation provides on screen and printed reports to assist the tracking and payment of outstanding payables. Once the Purchase Order line item has been received and inspected, the received information will forward from the Receiving module to the Accounts Payable Purchase Order Reconciliation. |

| 1.3.3. Fields & Definitions for PO Receipt Reconciliation |

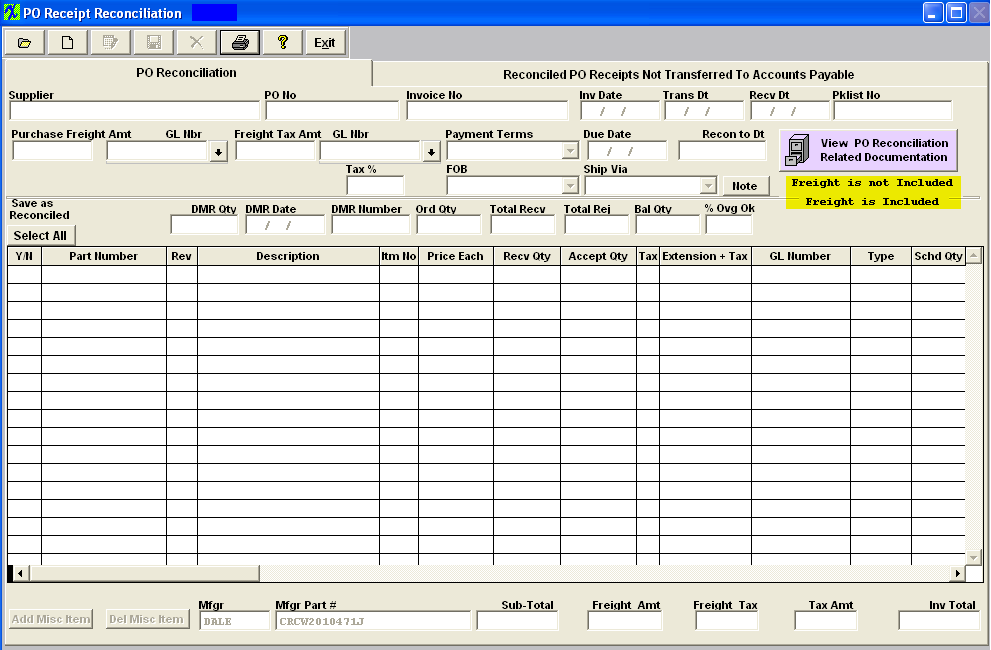

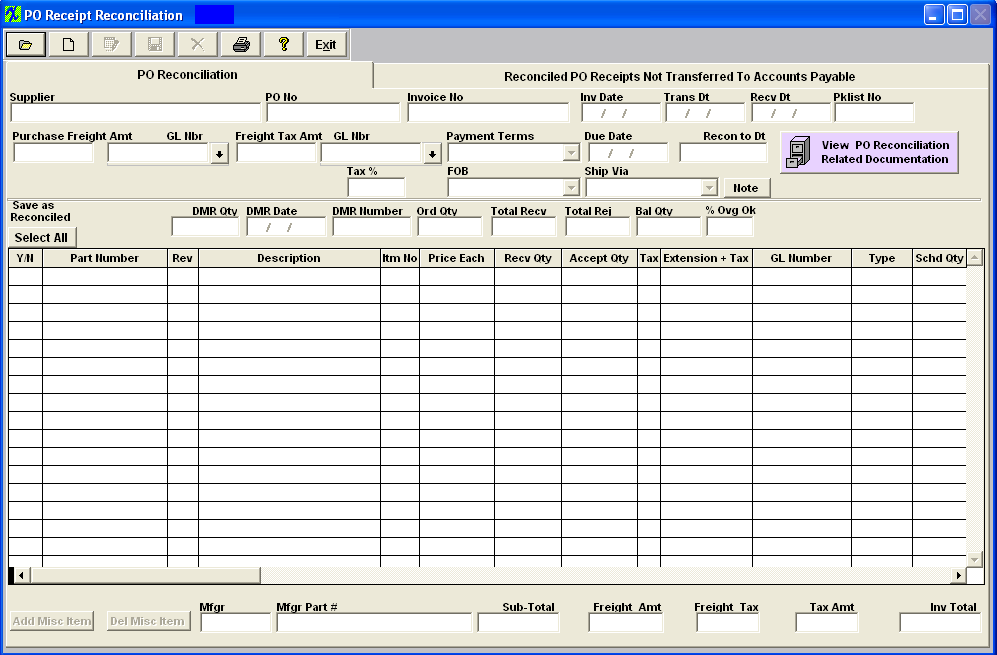

| 1.3.3.1. PO Reconciliation Tab | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PO Reconciliation Field Definitions

For the item number highlighted:

|

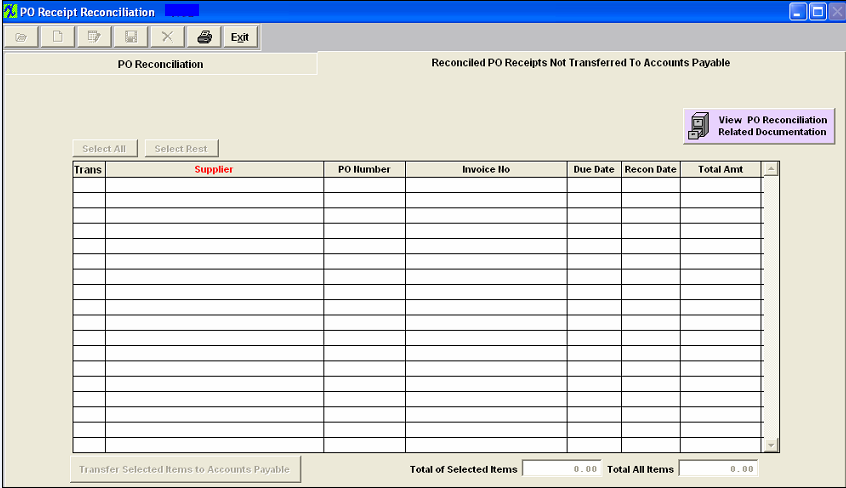

| 1.3.3.2. Reconciled PO Receipts not Transferred to A/P Tab | ||||||||||||||||||||||||||

|

| 1.3.4. How To ..... for PO Receipt Reconciliation |

| 1.3.4.1. Find a PO Reconciliation Record | ||||||||

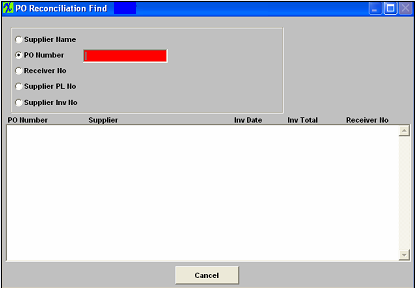

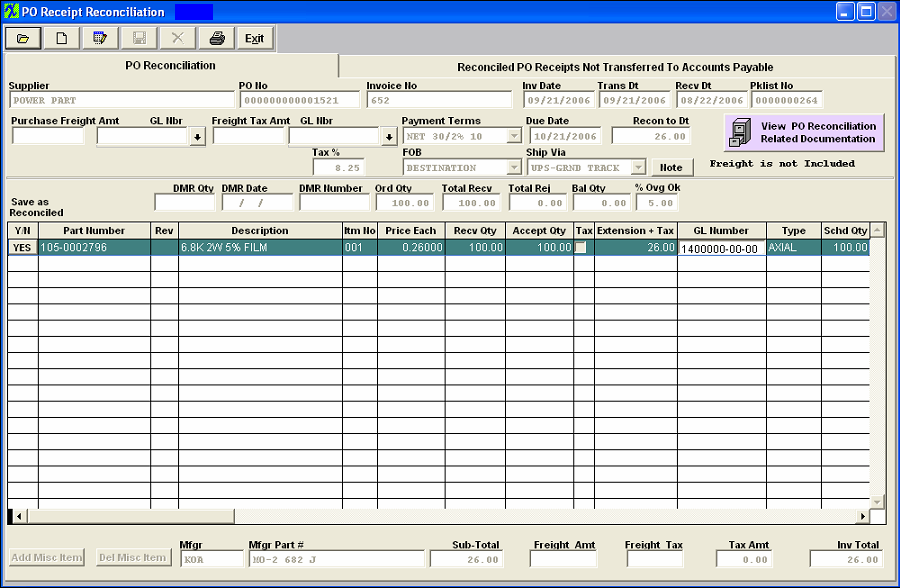

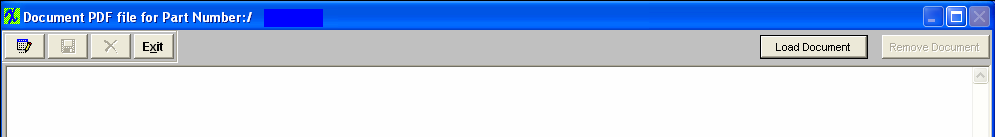

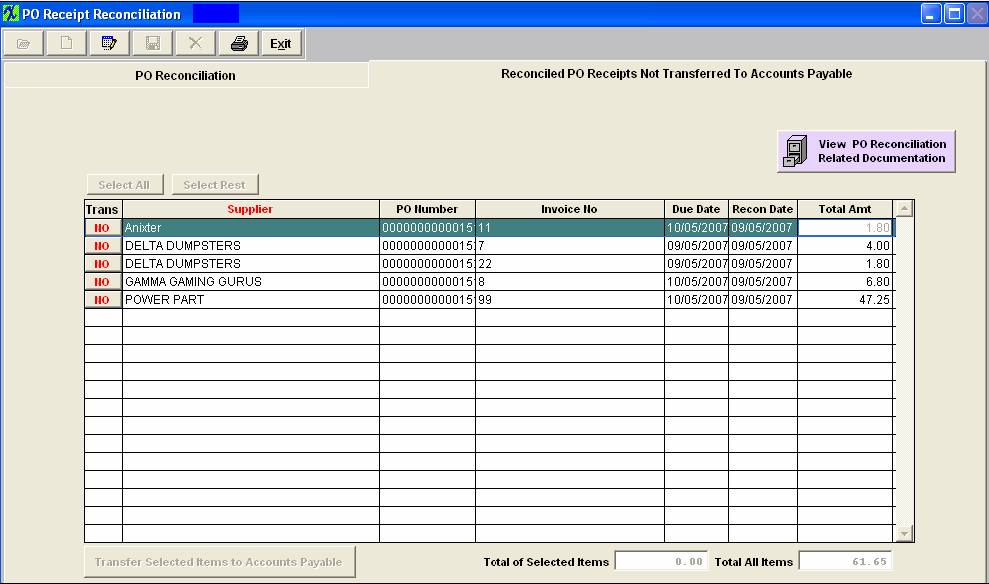

The following screen will appear:

Depress the Find Record action icon.

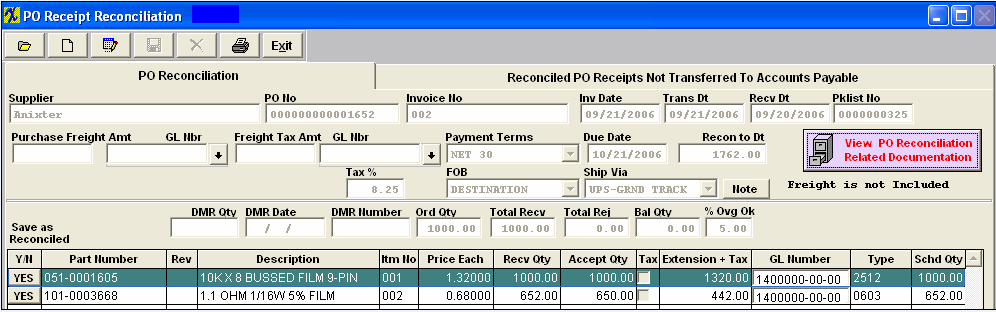

Once the Find Process is completed, the applicable data will appear. NOTE: The Edit button will only be available if the PO Receipt has NOT been transferred to AP.

|

| 1.3.4.2. Add a PO Reconciliation Record | ||||||||||||||

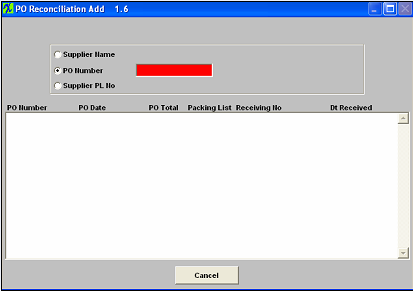

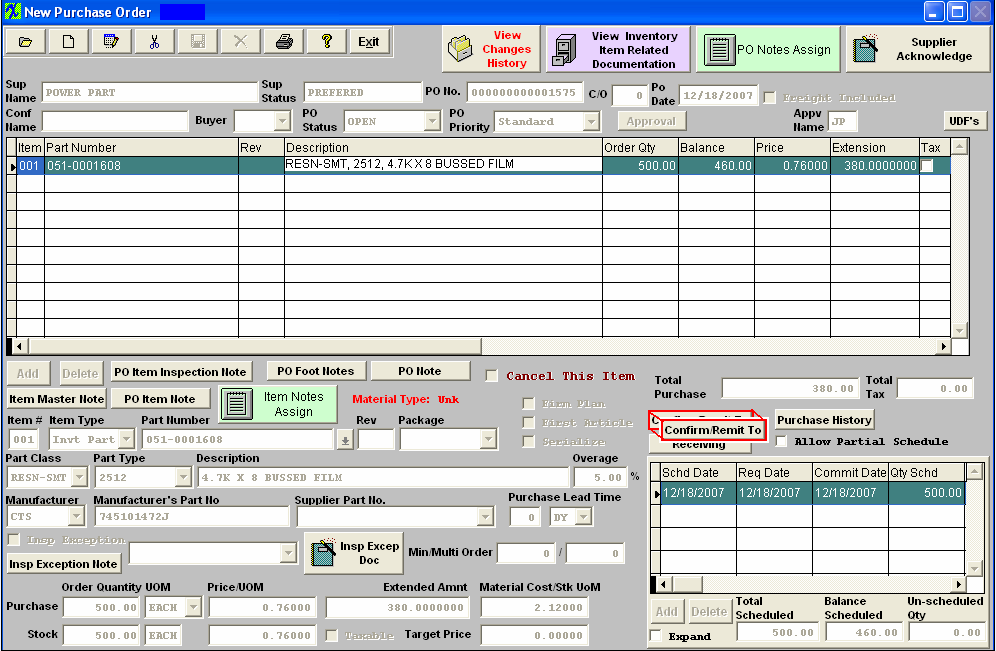

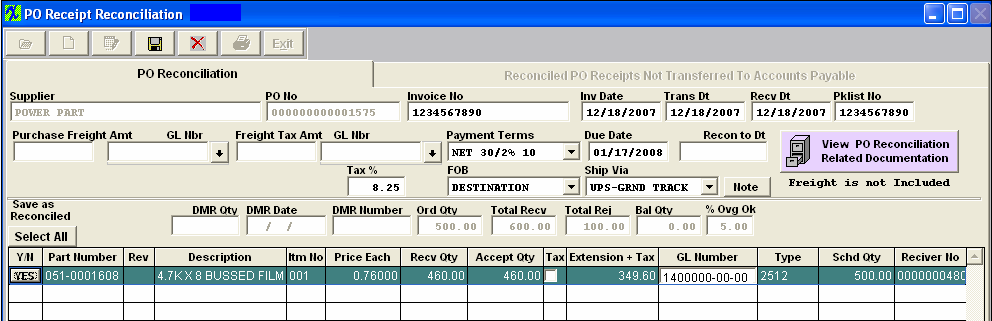

The following screen will appear:

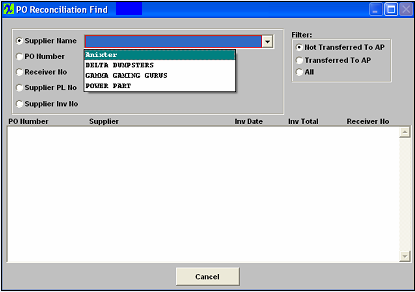

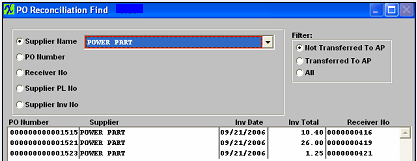

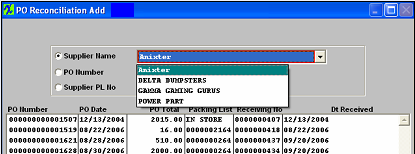

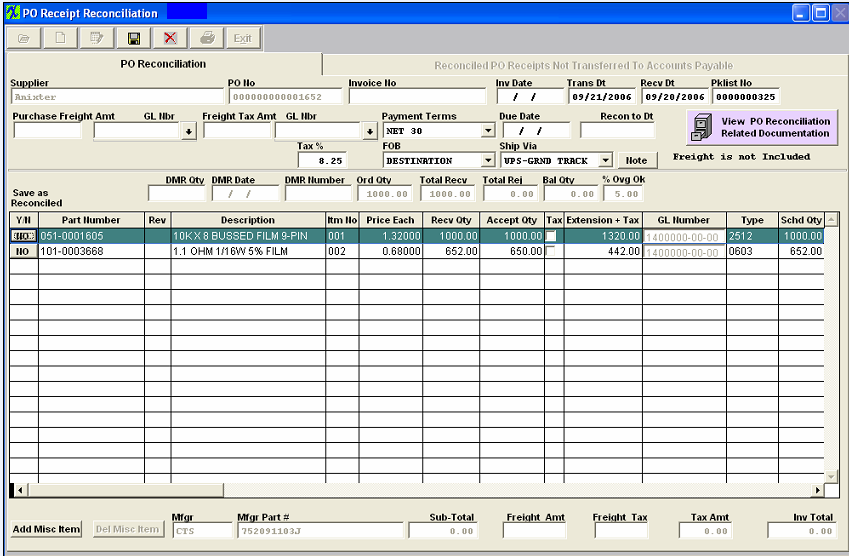

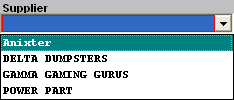

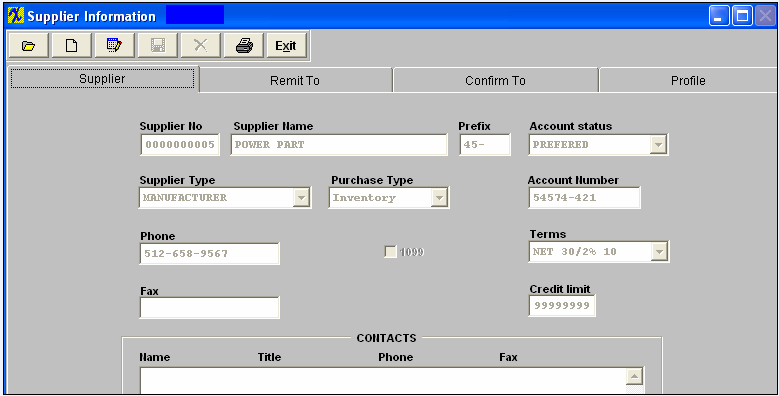

Depress the Add Record action icon. The following screen will appear: Select the Find by radio button; Supplier Name, PO Number or Supplier PL No. If you select by Supplier Name, a list of Suppliers will appear. Once the desired Supplier is selected, a further selection screen will appear. Highlight and double click on the desired Receiving No. If you decide to search by PO Number or Supplier PL No., type the PO Number or Supplier PL into the red box. The screen will fill with the following data:

Type in the Invoice Number and Invoice Date. If you want to enter a different Transaction Date and/or Received Date, you may do so.

If there is Freight or Freight Tax associated with the invoice, type the amount into the field.

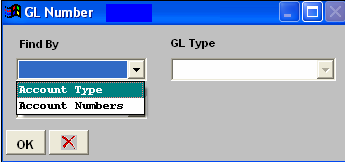

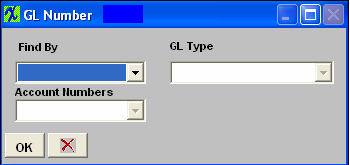

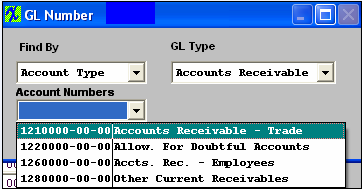

Type in the GL NUMBER or search by depressing the down arrow next to the field. The following selection screen will appear: Depress the arrow next to the Find By field. Select either Find By Account Type or Account Numbers.

If you selected by Account Type, the following listing will appear, once you’ve depressed the down arrow next to the GL Type field: Scroll up or down until the appropriate range is found.

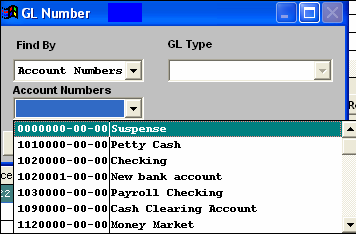

Then depress the down arrow next to the Account Numbers field. The following selection for the posting account will appear: You may change the payment terms or the due date, as desired. If you wish to add a note regarding this Supplier Invoice, depress the Note button. Depress the Edit button. Type in the note. Depress the Save button. Depress the Exit button. If any portion of the Invoice is subject to tax, enter the tax percentage in the Tax % box. The user may change the FOB or Ship Via fields by depressing on the applicable down arrow and making a new selection.

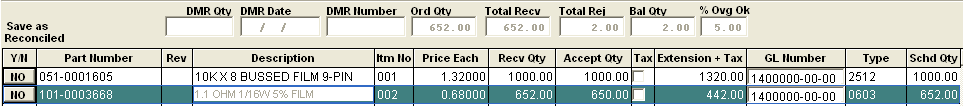

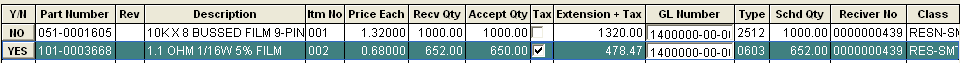

Once a line item is highlighted in the lower section, information regarding DMR, Original Order Quantity, etc. will appear, as follows:

All of the line items on the PO which have been accepted will appear in the lower section. Note: The user will not be able to overpay an invoice. Only those quantities which have been ACCEPTED in PO Receiving will forward. The user may toggle on the Yes/No to reconcile. The user may change the Price Each. If the line item is subject to tax, check that box.

If there is a miscellaneous item associated with the invoice which was not included in the PO, the user may depress the Add Misc Item button at the bottom of the screen. Type in the description of the item, the pricing, whether or not subject to tax, the accepted quantity and type in or select the GL Number. Entering Negative Amounts Note: The user may enter a NEGATIVE amount within this screen. Say to record a Coupon or something of that nature. The user should NOT record an early payment discount here as that is handled by the Payment Scheduling module.

Depress the Add Miscellaneous Item button. Type in the description. Type in the price, as a negative amount. Type in the accepted quantity as 1. Type in or select the General Ledger account number. Once all is completed, depress the Save record action button at the top of the screen.

|

| 1.3.4.3. Edit a PO Reconciliation Record | ||

The following screen will appear:  Select the record to edit using the Open/Find a record button. Once the Find Process is completed, the applicable data will appear. NOTE: The Edit button will only be available if the PO Receipt has NOT been transferred to AP. All editing for Purchase Order Invoices already transferred to the Accounts Payable MUST be edited in the Manual Invoicing module. |

| 1.3.4.4. Transfer an PO Reconciled PO Receipt to A/P |

Transfer Reconciled PO's to Accounts Payable

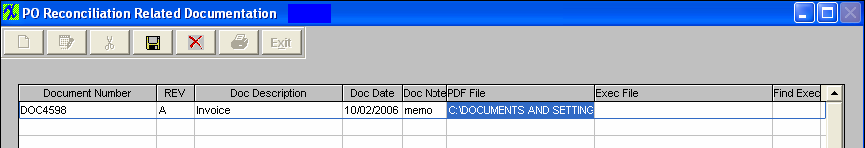

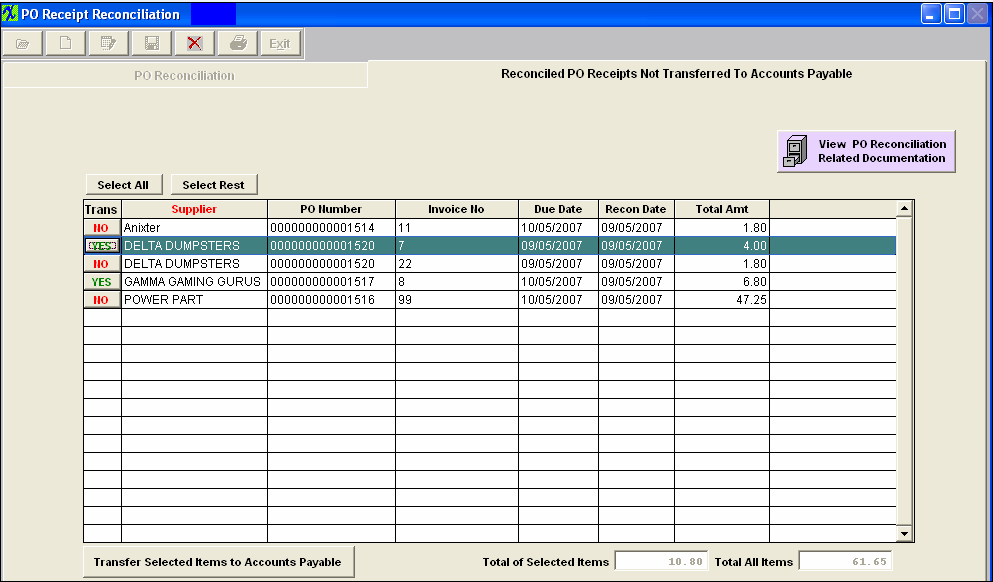

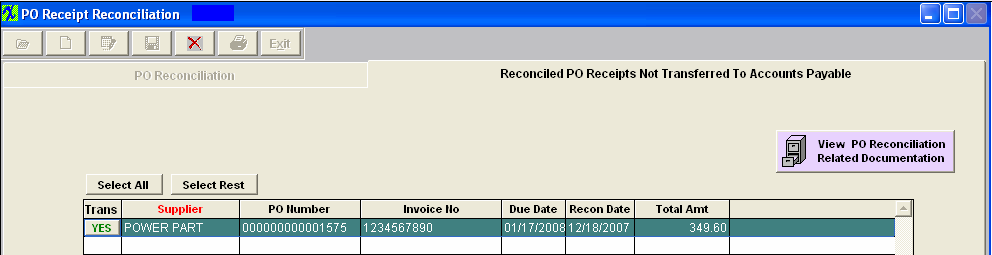

The following screen lists all of the Reconciled PO Receipts, which have not yet been transferred into Accounting Payable.

Depress the Edit Record Icon. Toggle on the Yes/No column if desired, or depress the Select All button.  Once all selections are made, depress the "Transfer Selected items to Accounts Payable" button. Note: The Reconciled Invoices can’t be scheduled for payment unless they are TRANSFERRED. |

| 1.3.4.5. Attach a Related Document |

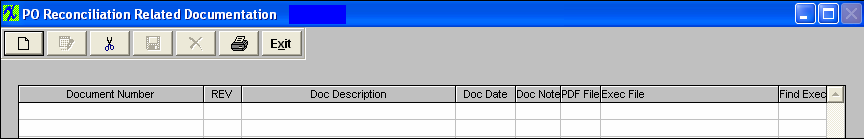

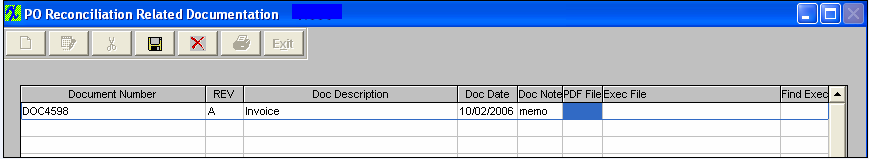

Find an existing PO Reconciliation Record, or Add a new PO Reconciliation record. Depress the The following screen will appear:

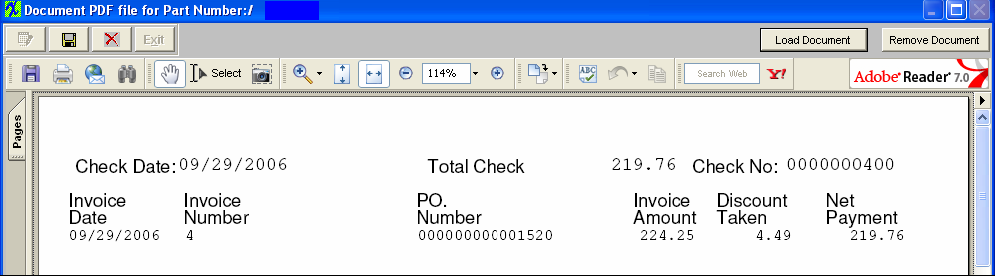

Depress the Add record icon, enter in a Document Number, REV, Doc Description, Doc Date, Doc Note; To load a document double click in the PDF File field and the following screen will appear:

Depress the Load Document button and the following screen will appear: The PDF screen will allow you to load almost any type of document; (Word, Excel, pdf, Images, etc .... ) Locate the document and double click on it and the document will populate screen.

Depress the Save record icon to save or depress the Abandon changes icon to abandon changes. The following screen will appear:

Depress the Save record icon to save or depress the Abandon changes icon to abandon changes. Once documents are saved the "View PO Reconciliation Related Documentation" button will display in Red.

|

| 1.3.5. Reports for PO Receipt Reconcilitation | ||||||||||

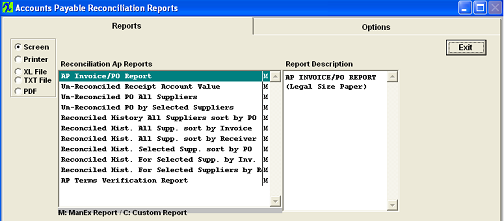

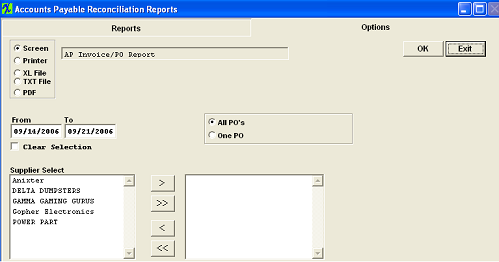

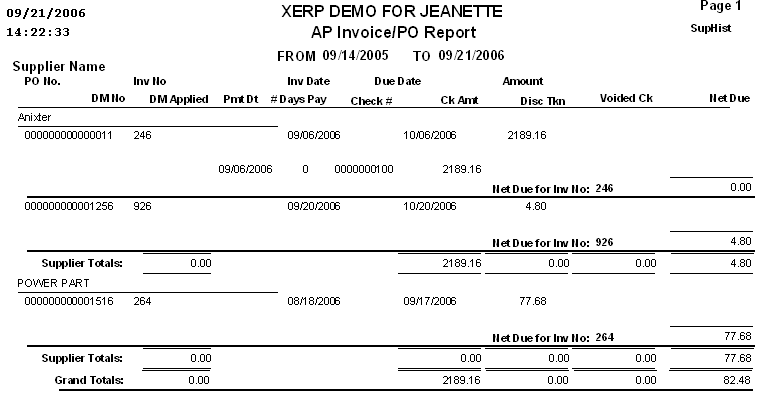

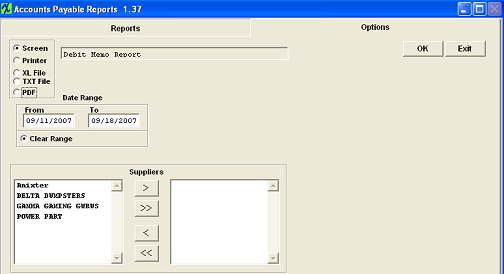

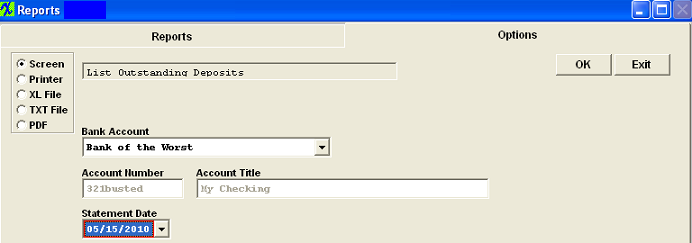

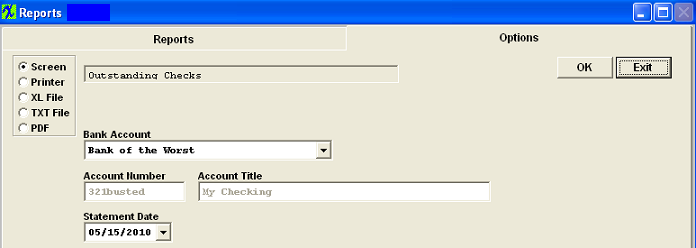

To obtain the AP Reconciliation reports, depress the Reports button. The following screen will appear: Select one of the radio buttons for the output you desire. Select from Screen, Printer, XL File, TXT File, or PDF. Highlight the report. Depress the option tab. AP Invoice/PO Report

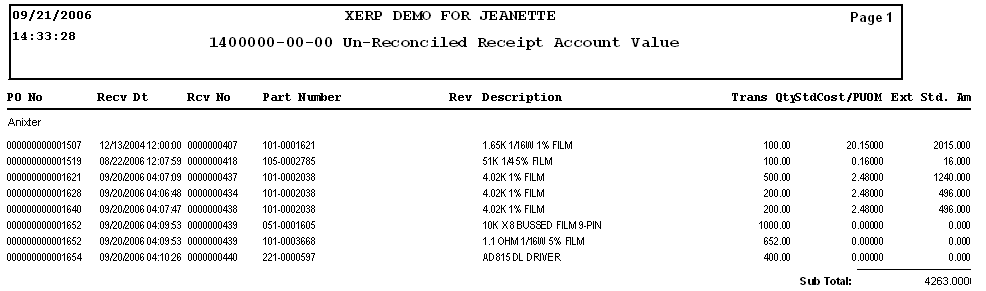

Un-Reconciled Receipt Account Value - This report will show ALL records that affect the GL Account. Including Receipts waiting to be reconciled and items that were rejected at receiving and wailting for a DMR to be processed through the system.

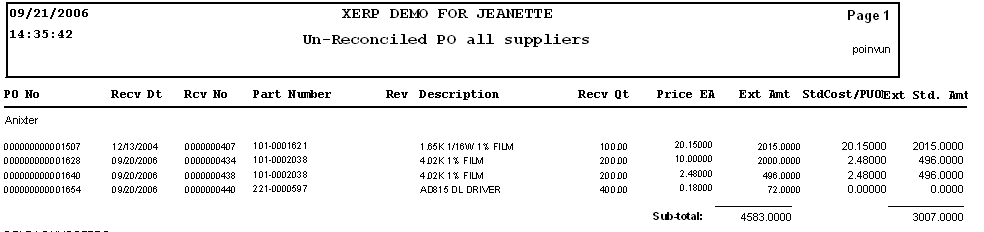

Un-Reconciled PO All Suppliers - This report wil only list receipts that are waiting to be reconciled within AP.

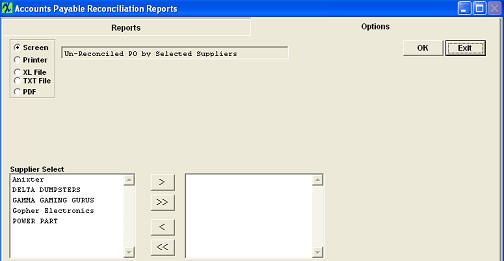

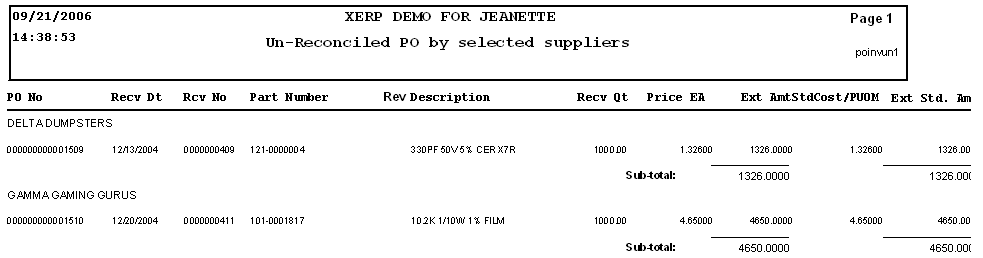

Un-Reconciled PO by Selected Suppliers

The following screen will be displayed. Highlight the Supplier(s) of interest. Depress the > button. If you want all of the Suppliers, depress the >> button. Depress the Ok button. The following report will be displayed.

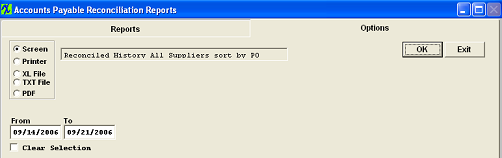

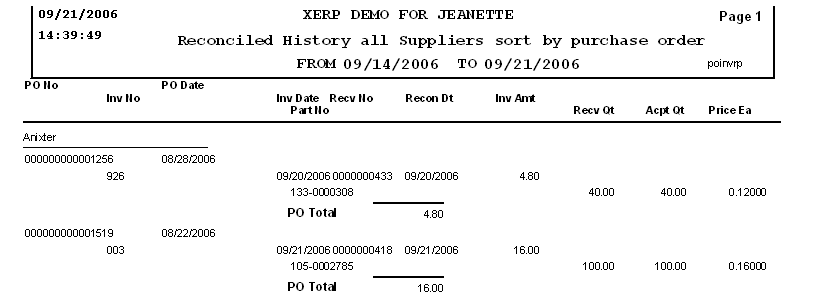

Reconciled History All Supplier sort by PO

The following report will be displayed.

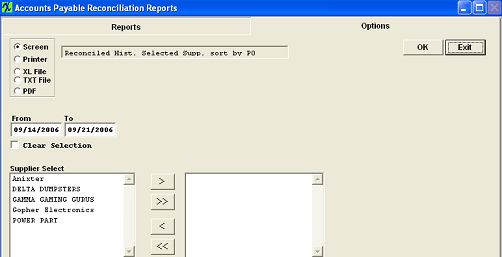

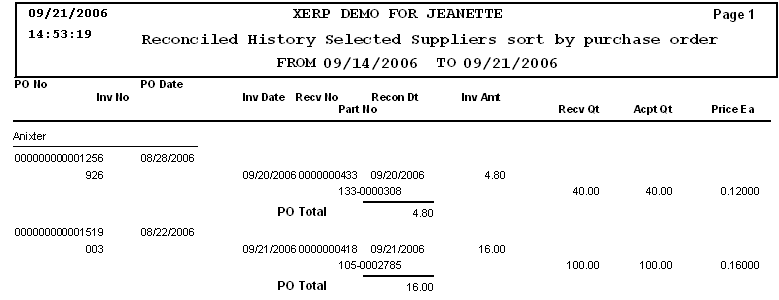

Reconciled History Selected Suppliers sort by PO

Highlight the Reconciled History for Selected Suppliers sort by PO report. (This report is also available to sort by Invoice or Receiver) Depress the Options Tab. The following screen will appear. Enter the From and To date range. Depress the Ok button. The following report will be displayed.

AP Terms Verification Report

|

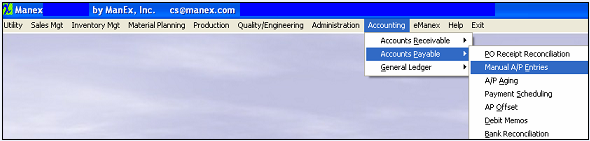

| 1.4. Manual A/P Entries |

| 1.4.1. Prerequisites for Manual A/P Entries |

Users MUST have full rights to the "Manual AP Entry" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. |

| 1.4.2. Introduction for Manual A/P Entries |

The Manual A/P Entries selection provides on screen and printed reports to assist the tracking and payment of manual invoice entries. The user may enter this module to input invoices which have no accompanying Purchase Order. The Recurring Payables selection provides the ability to set up a payment to a supplier on the frequency of your choosing and for the number of payments you determine. This module is also used to release recurring payables into the Accounts Payable Aging module. |

| 1.4.3. Fields & Definitions for Manual A/P Entries |

| 1.4.3.1. Manual AP Entry Tab | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

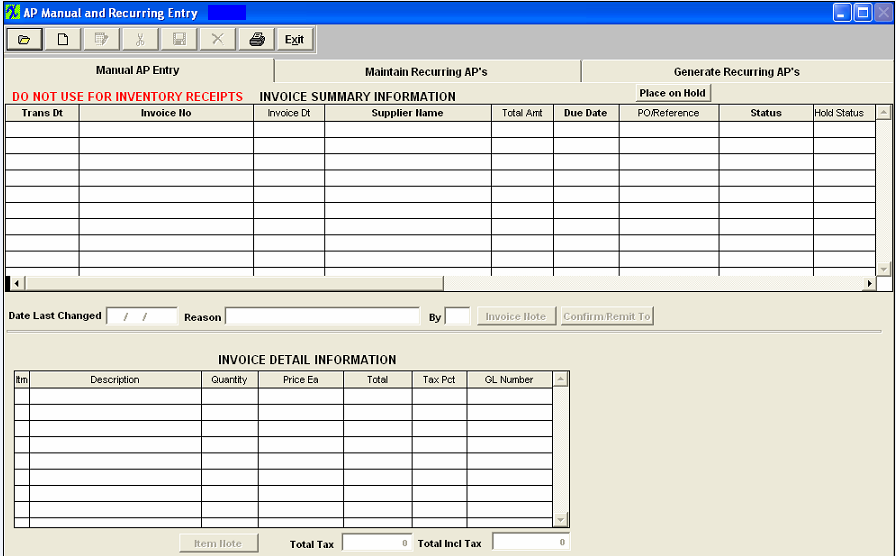

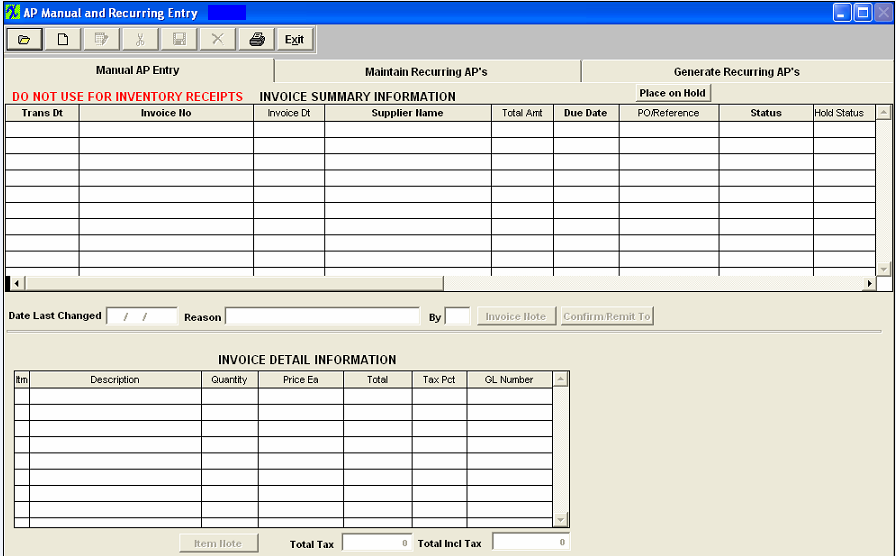

Manual AP Entry tab field Definitions

For the INVOICE highlighted:

The item number of the invoice. The description of the purchase. The amount purchased. We allow a fraction of a whole number in the qty within this module, because user may need to create a manual invoice for something that is measured in inches, feet, etc. Or another example is an invoice for 1.75 hours of work on something. The price to be paid to the supplier. The total of the invoice. The sales tax percentage the supplier charged the user. The General Ledger Number to which the item was charged. If lit in red, a note exists regarding the detail line. This is the total of the sales tax on all of the line items. This is the grand total of the invoice due the supplier. |

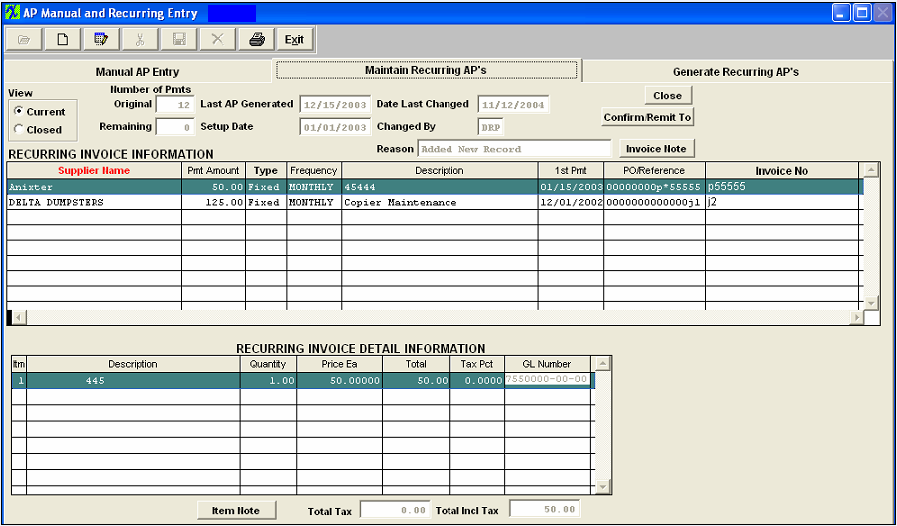

| 1.4.3.2. Maintain Recurring AP's Tab | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

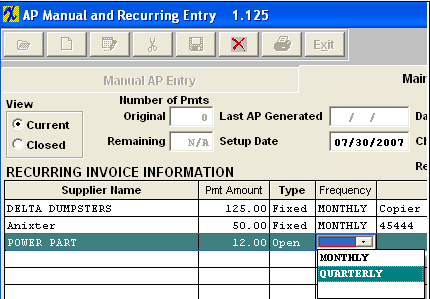

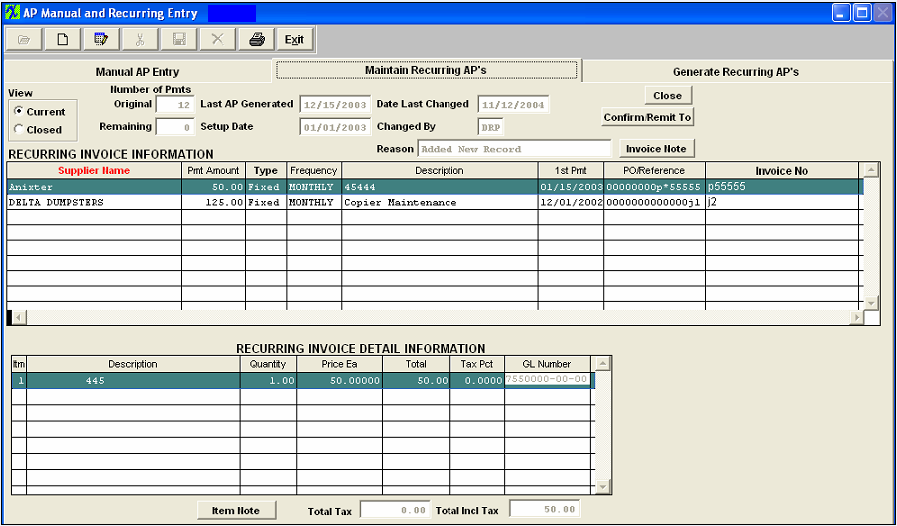

|

Maintain Recurring AP’s tab Field Definitions For the Recurring Payable highlighted, the screen will display:

RECURRING INVOICE INFORMATION

RECURRING INVOICE DETAIL INFORMATION

|

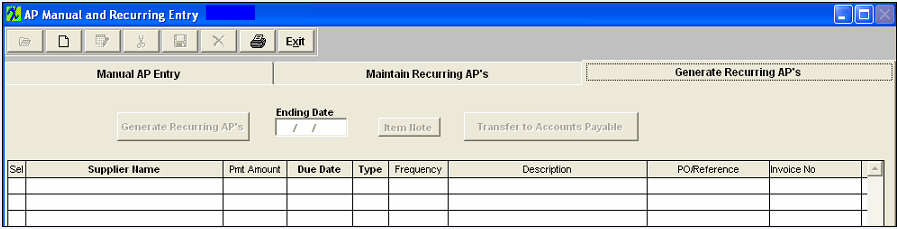

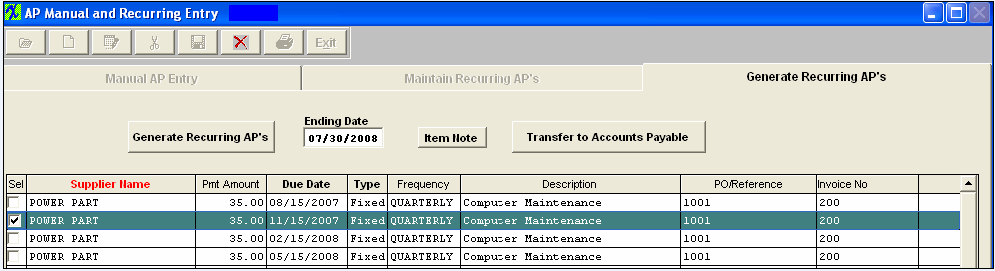

| 1.4.3.3. Generate Recurring AP's Tab | ||||||||||||||||||||||||||

Generate Recurring AP's tab

Overview This screen is used to generate the Recurring Accounts Payable and set them up for payment by transferring them into the A/P Aging module. Generate Recurring AP’s tab Field Definitions

|

| 1.4.4. How To ..... for Manual A/P Entries |

| 1.4.4.1. Manual AP Entry |

| 1.4.4.1.1. Find a Manual AP Entries | ||||||||||||||||||||||||||

|

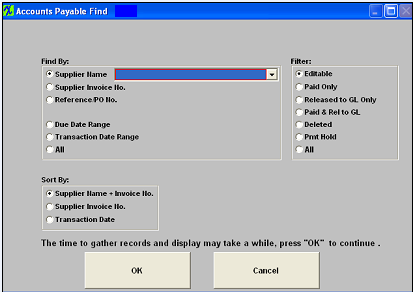

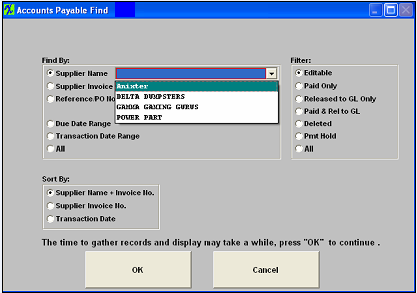

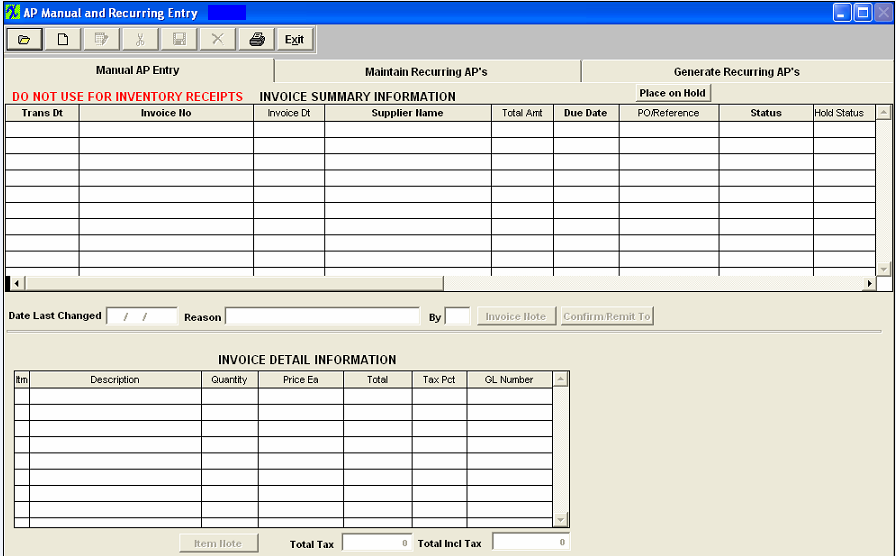

The following screen will appear:

Filter:

Sort By:

|

| 1.4.4.1.2. Add a Manual AP Entries | ||||||||||||||

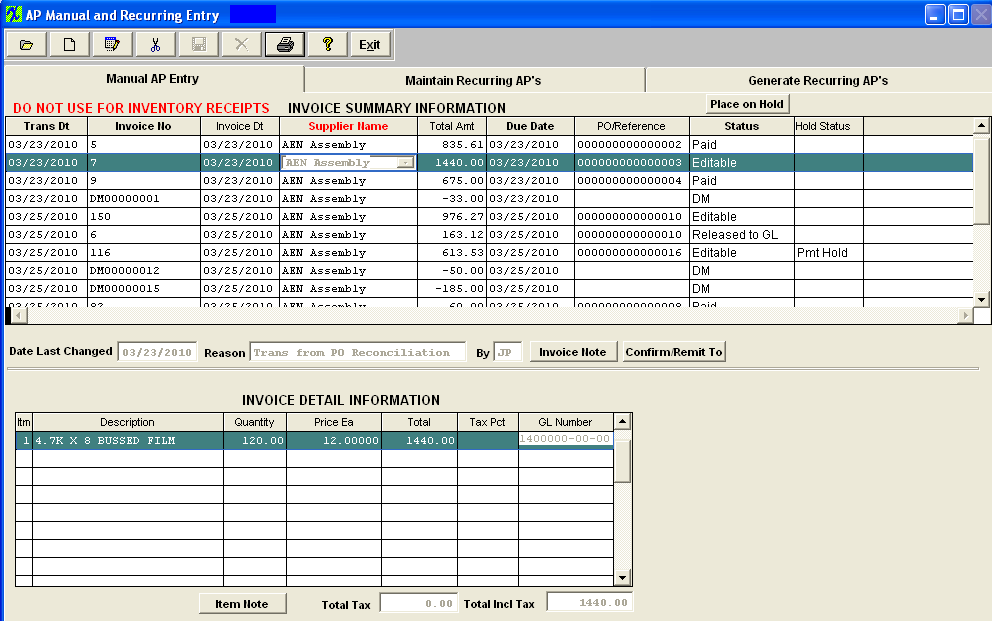

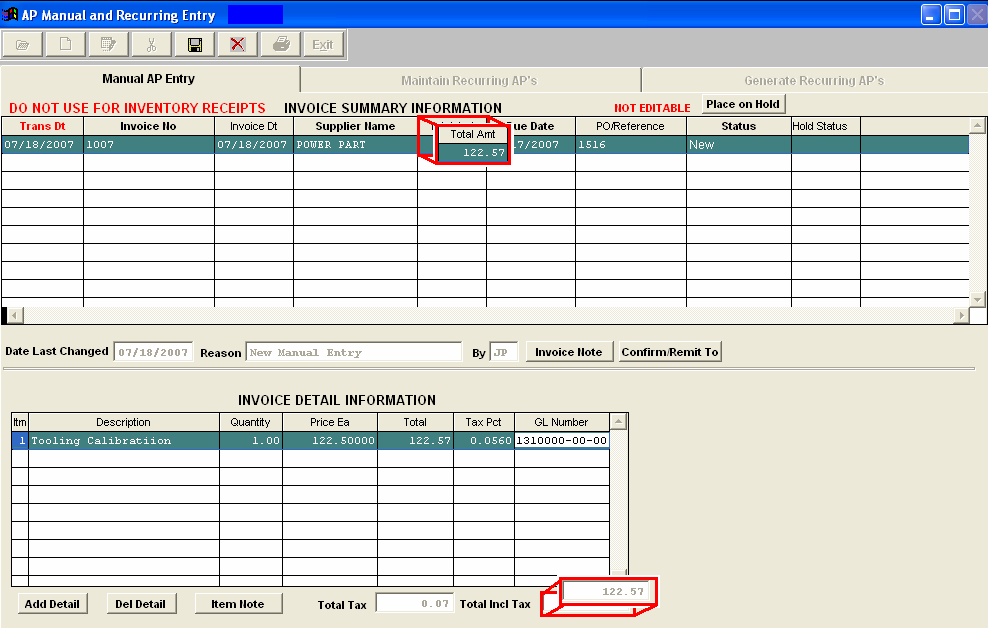

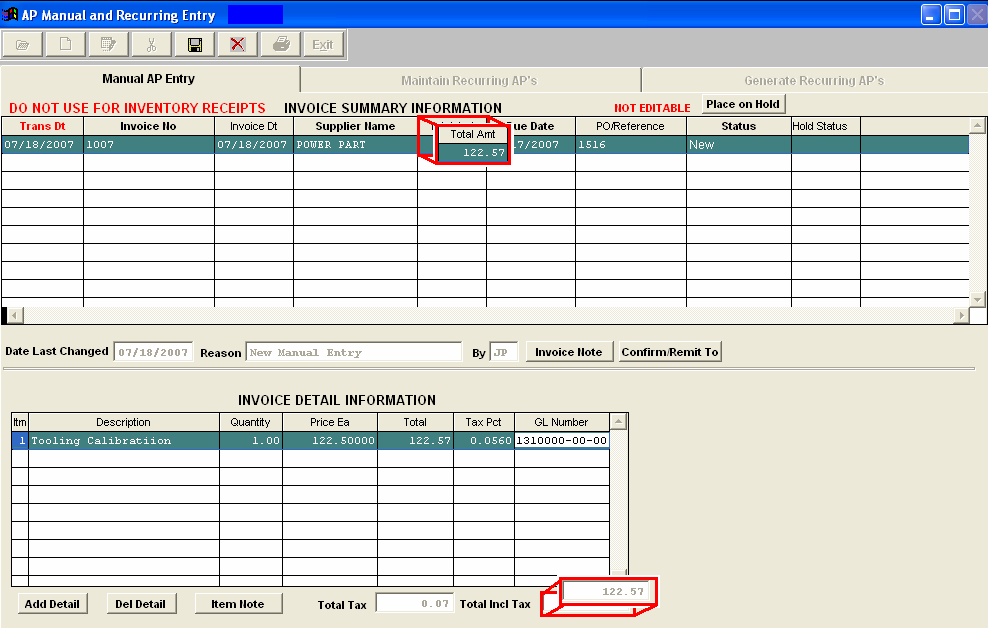

Adding Manual Invoices Manual AP Entry tab Note: Do NOT use for inventory receipts!

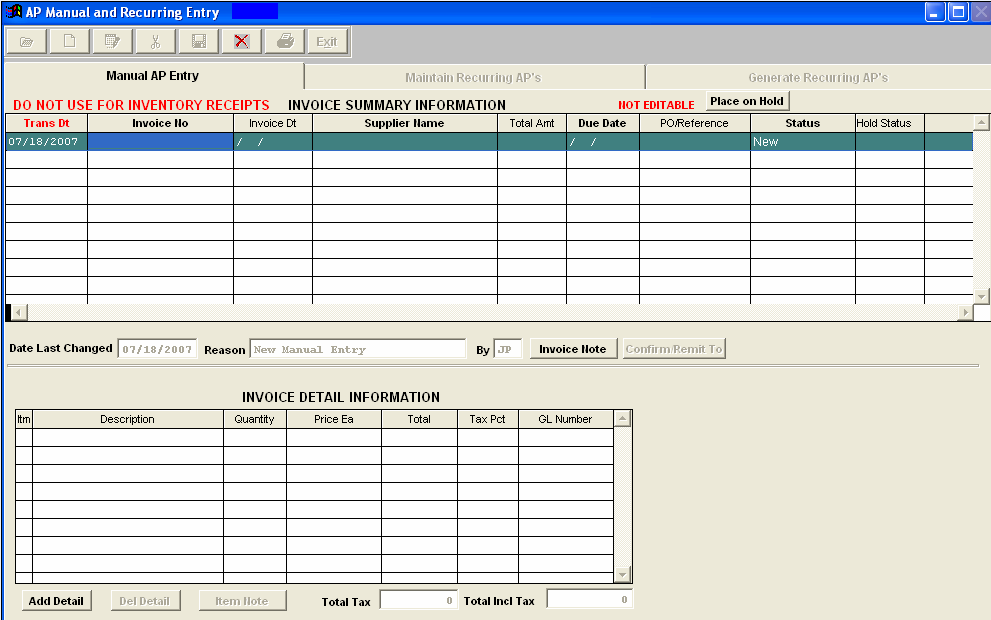

The following screen will appear:

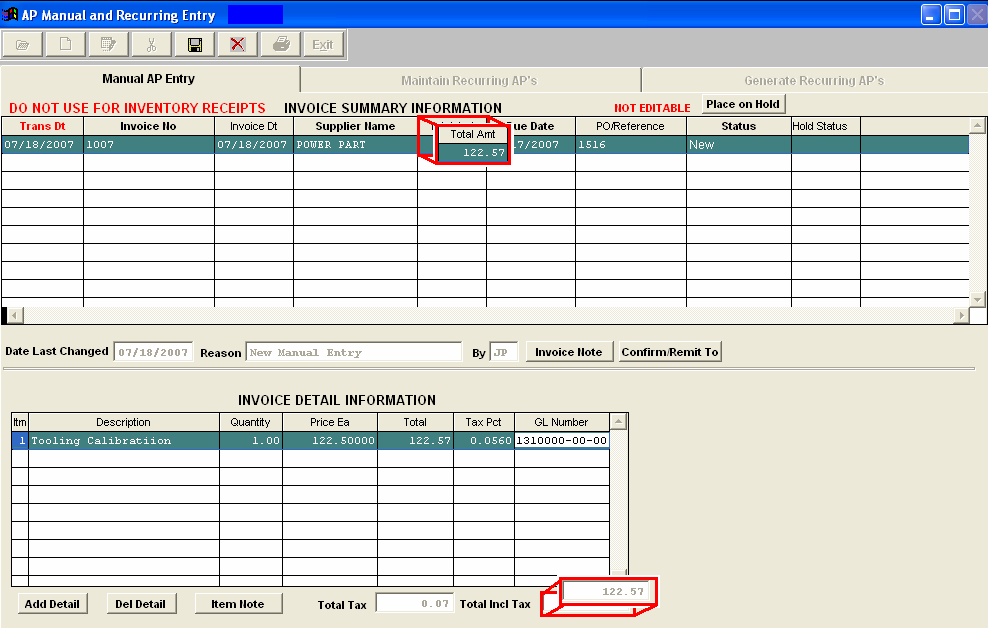

Select the Add button and enter in your password. The following screen will appear: If the transaction is for a period other than the one for the current date, enter in the changed date. Enter an Invoice Number ("DM" is disallowed as the two left characters of the invoice number) and Invoice Date.

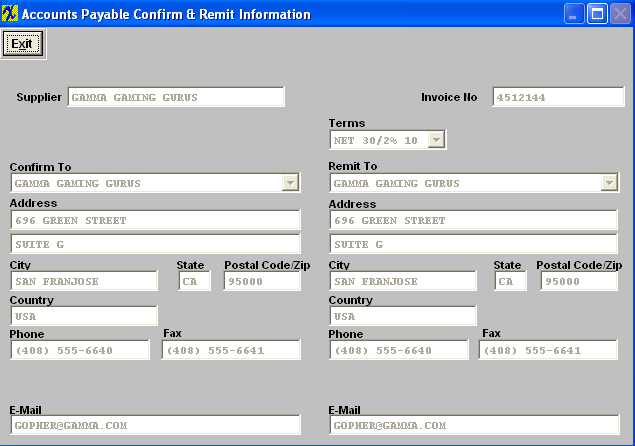

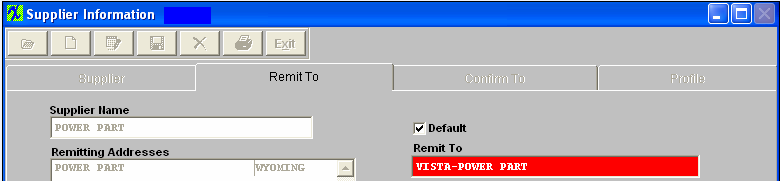

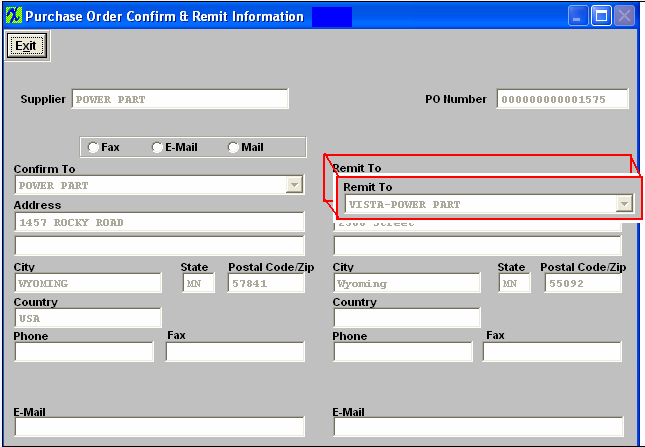

The Due Date will automatically update to reflect the terms the Supplier has for the user. Enter in the total amount of the Invoice, and a PO/Reference number. If you want to add an Invoice Note, depress the Invoice Note button. Depress the Edit button. Type in the invoice note. Depress the Save button. Depress the Exit button. If you want to check on the Supplier’s CONFIRM/REMIT TO information, depress that button. Information regarding the Supplier addresses will appear on the screen. The user may change the TERMS by depressing the down arrow next to the Terms field and selecting a new term. The user may also change the CONFIRM TO address or the REMIT TO address by depressing the arrows next to those fields and selecting a new address.

To add an Item Note, depress the Item Note button. Depress the Edit button. Type in the note. Depress the Save button. Depress the Exit button. The note button will light up in red. Continue to add detail using the above procedures until the entire invoice amount has been covered and exactly matches the total amount column in the top section of the screen.

Depress the Save button at the top of the screen the Status will update from "New" to "Editable". Note: If the two total amounts do not exactly match the Save button will not be available. Invoice will then be transfered to the Release and Post screen . Once the record has been released and posted to the GL the status will updated from "Editable" to "Released to GL".

|

| 1.4.4.1.3. Edit a Manual AP Entries | ||

Editing Manual AP Entries : If the Manual AP Entry Status is Editable and has NOT been released/posted to the GL, the user will have the ability to Edit the Invoice from the Manual AP Entry screen. All Editing for Purchase Order Invoices already transferred to the Accounts Payable Aging module MUST be edited in the Manual Invoicing module.

The Following Screen will appear:

Manual AP Entry using the Find Procedures

Depress the Edit button and type in your password. Make the desired changes. Type in the Reason for the change. If you change any of the amounts, make sure that the "Total Amt" field and the "Total Incl Tax" fields are equal. Note: If you change the total detail pricing, you must also change the total amount column at the top of the screen, otherwise the Save button will not be available.

The user may add notes to both the Invoice Notes and the Item Notes. Depress the Edit button. Depress the Note button. Depress the Edit button. Type in the note.Depress the Save button. Depress the Exit button. The note button will light up in red. The user may also change information in the Confirm/Remit To screen. Depress the Edit button. Depress the Confirm/Remit To button. The following screen will appear:

The user may change the TERMS by depressing the down arrow next to the Terms field and selecting a new term. The user may also change the CONFIRM TO address or the REMIT TO address by depressing the arrows next to those fields and selecting a new address. Once the edited changes are complete, depress the Save button. For future Finds, the most recent edited change reason will display. If there was more than one edited change, depress the Invoice Note button to see all of the changes.

|

| 1.4.4.1.4. Delete a Manual AP Entries | ||

Deleting an Manual AP Entry/Invoice

The following screen will appear:

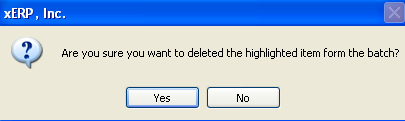

Type in your password, you will receive the following warning:

Depress the Yes button to complete the deletion.

Note: Upon Deletion the system will then completely remove the original transaction for the Manual AP Entry that was waiting to be Release/Posted to the GL. If the Invoice you want to delete is NOT editable, please follow the procedures below: If it’s a Manual Invoice or an MRO PO Invoice, use the Debit Memo procedures. If it’s an Inventory PO Invoice, use the DMR (Return to Vendor) procedures.

|

| 1.4.4.2. Maintain Recurring AP's |

| 1.4.4.2.1. Add a Recurring Payment | ||||||||||||||

Add a Recurring Payable

The following screen will appear:

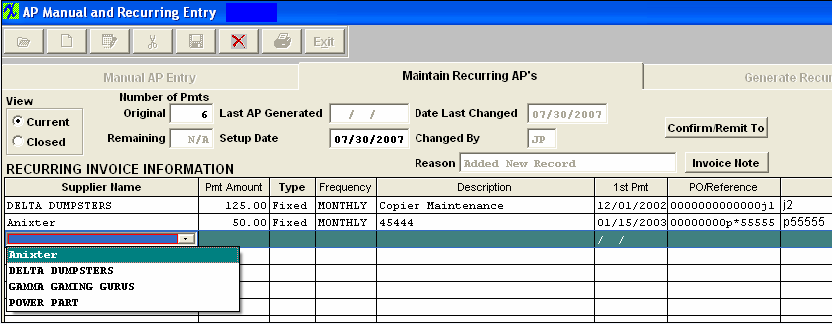

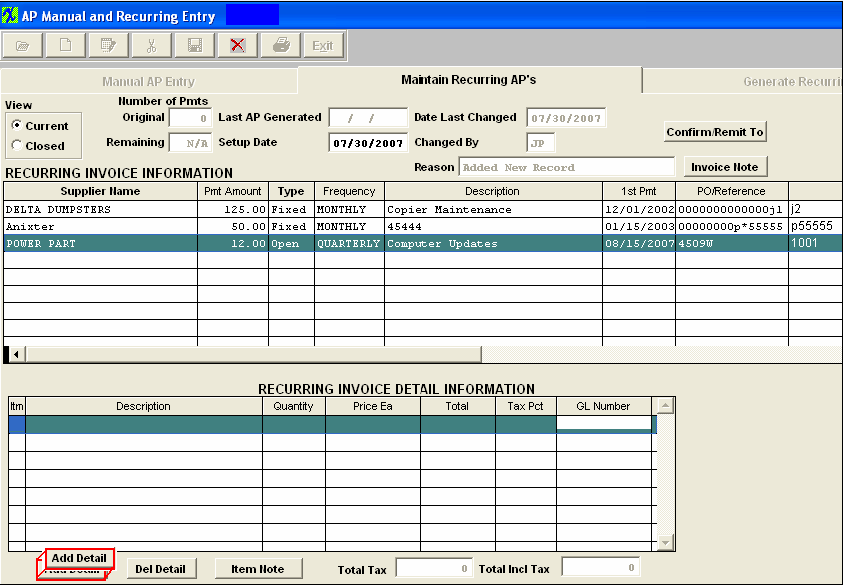

Go to the Maintain Recurring AP's tab

Depress the Add button at the top of the screen. Type in your password.

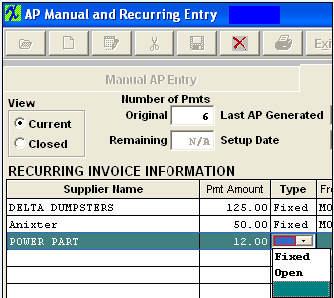

If the Recurring Payable is for a Fixed number of Payments, enter the Original Number of Payments Box. Depress the down arrow in the Supplier Name column. Select the Supplier from the drop down screen.

Type in the Payment Amount.

Type the description in the description box. Type in the 1st payment date. Type in the REFERENCE – PO Number or other.Type in the Invoice No.. Depress the Add Detail Button, located at the bottom of the screen. Enter the Item Number, Description, Quantity, Price Each, and Tax Pct.Type in the General Ledger Number.

Save the Record. Note: The Invoice Detail Total must equal the Payment Amount above before the system will allow you to save the record.

If you want to add an Item Note, depress that button. Depress the Edit button. Type in the note. Depress the Save button. Depress the Exit button. If you want to see the CONFIRM and REMIT TO addresses, depress that button. The following screen will be available:

You may select TERMS by depressing the down arrow next to the Terms field.Select the desired terms for the recurring invoice. You may select another CONFIRM or REMIT TO address for the vendor by depressing the down arrow next to that field. Select the desired address for the recurring invoice. |

| 1.4.4.2.2. Edit/Delete a Recurring AP | ||

Edit/Delete a Recurring Payable

The following screen will appear:

Go to the Maintain Recurring AP's tab

To Delete: Highlight the Recurring Payable you want to delete. Depress the Edit button. Type in your password. Depress the Delete button. Note: If there has been ANY transfer from Recurring to A/P Aging, the user will NOT be allowed to Edit or Delete. Instead, use the Close button to set the recurring to Inactive.

|

| 1.4.4.3. Generate Recurring AP's |

| 1.4.4.3.1. Generate a Recurring Payable | ||

Generate a Recurring Payable

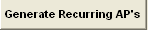

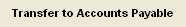

The following screen will appear:  Enter the Generate Reucrring AP's tab  To generate a Recurring Payable, depress the Add button. Type in your password. Type the Ending date into the field through which you wish the Recurring Payable to generate. Depress the Generate Recurring AP’s button. The ungenerated recurring payables through the Ending Date will populate the screen.

Go down the Select column and check any Recurring Payable, which you want to transfer to Account Payable Aging module. Once you have made your selection(s) depress the "Transfer to Accounts Payable" button. NOTE: If the users skip selecting one or more payments and select a later payment for the same recurring AP for transfer to AP, the earlier payments will not be generated in later sessions and will be lost.

|

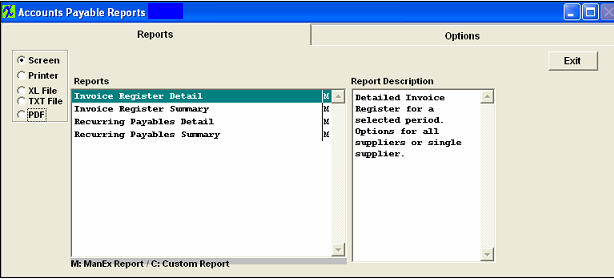

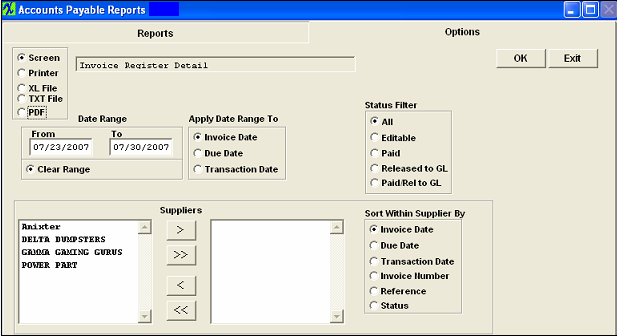

| 1.4.5. Reports for Manual A/P Entries | ||||||||||

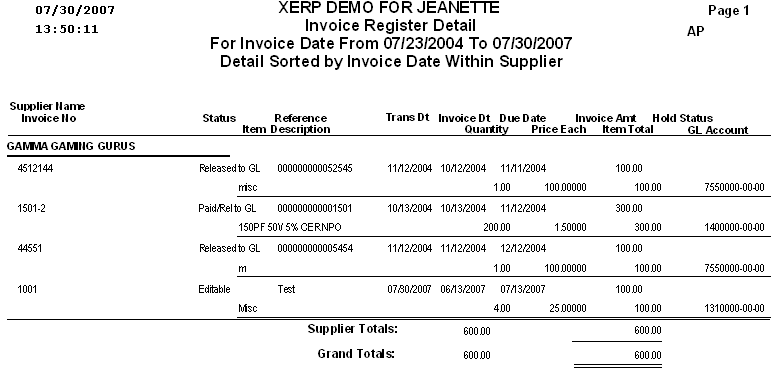

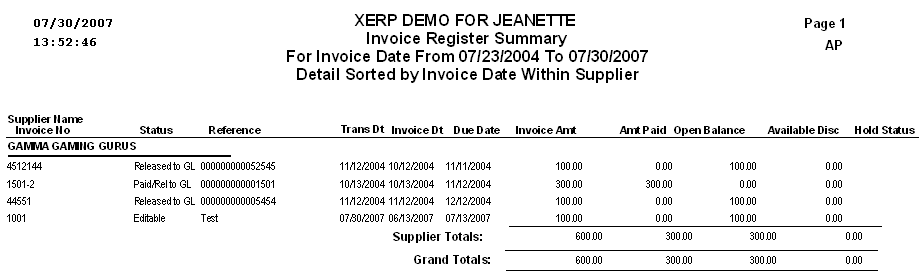

Invoice Register Detail

The following report will be displayed:

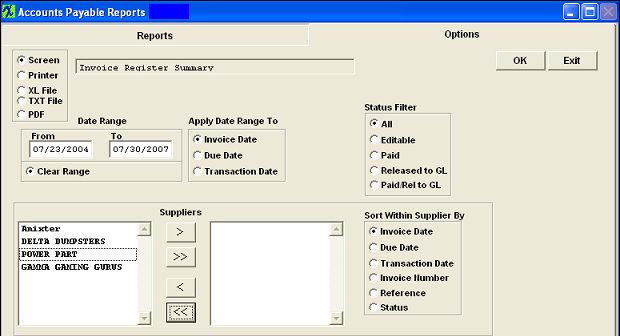

Invoice Register Summary

The following report will be displayed:

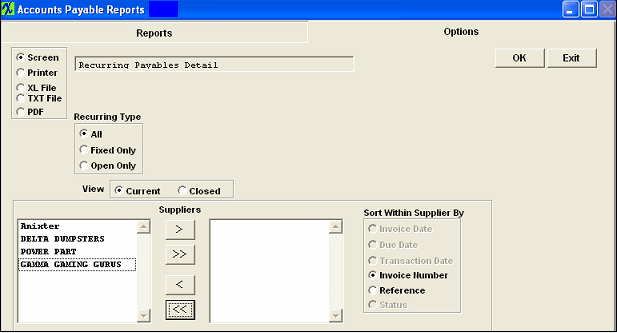

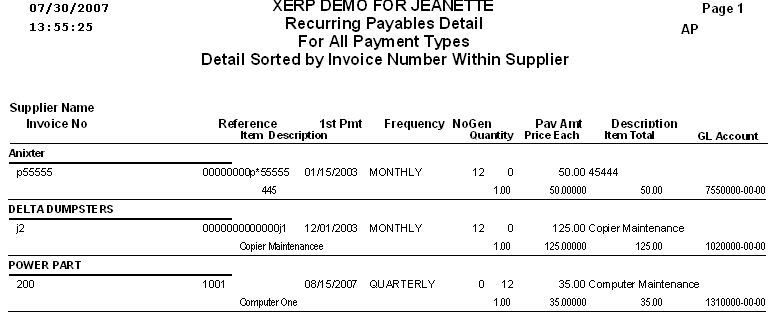

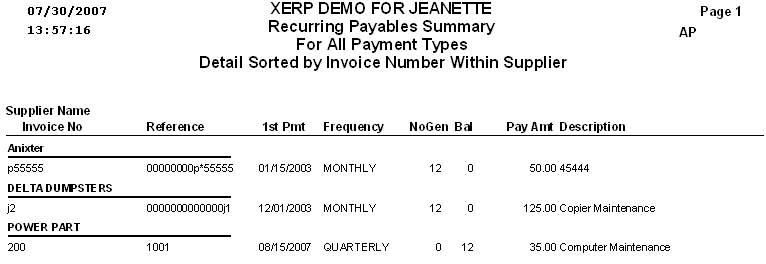

Recurring Payables Detail

The following report will be displayed:

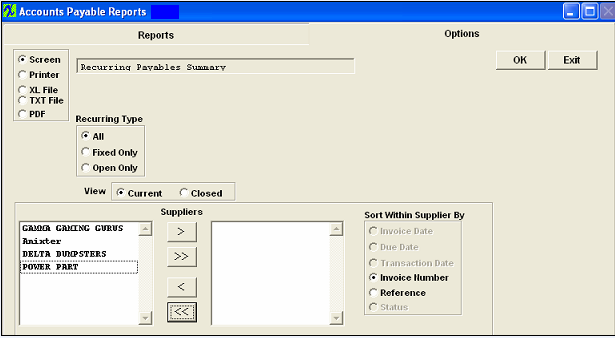

Recurring Payables Summary

The following report will be displayed:

|

| 1.5. A/P Aging |

| 1.5.1. Prerequisites for A/P Aging |

Users MUST have full rights to the "AP Aging, Reports" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. |

| 1.5.2. Introduction for A/P Aging |

The Accounts Payable Aging selection provides on screen and printed reports to assist the tracking and payment of outstanding payables. Note: the user cannot schedule for payment until such time as the Invoice to be paid appears in the A/P Aging. AP Prepayments are NOT considered outstanding payables so they will NOT be displayed on the AP Aging screen. Note: There are three modules which forward into the A/P Aging module. The PO Reconciliation module, Manual A/P Entries & Recurring Payments module and the Debit Memo module.

|

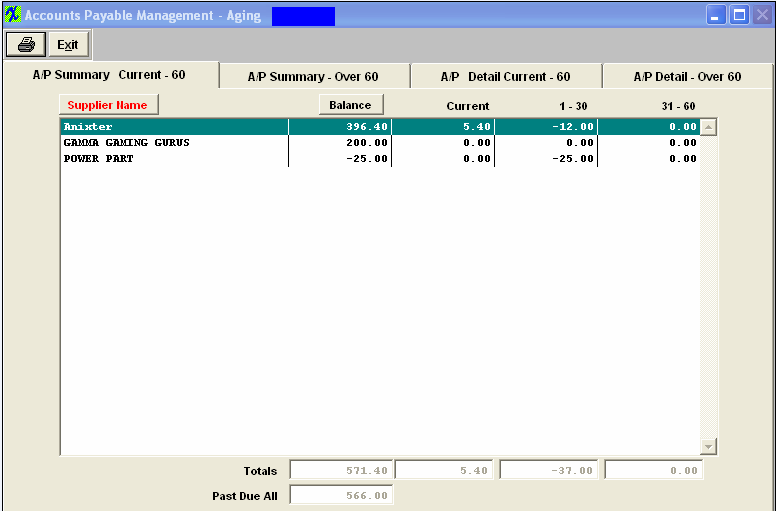

| 1.5.3. Fields & Definitions for A/P Aging |

| 1.5.3.1. A/P Summary Current-60 | ||||||||||||||

A/P Summary Current - 60 Tab

A/P Summary Current - 60 tab field Defintions

In the column below, the name of the supplier. The user may sort alpha by depressing the button. In the column below, the net due to the user for that supplier.T he user may sort on highest to lowest by depressing the button. The amount due to the user which is not past the due date. The amount due to the user which is 1 to 30 days past the due date. The amount due to the user which is 31 to 60 days past the due date. The totals line will display the totals for each column, Balance, Current, 1-30 and 31-60. The grand net total for all of the suppliers for amounts past the scheduled due date. |

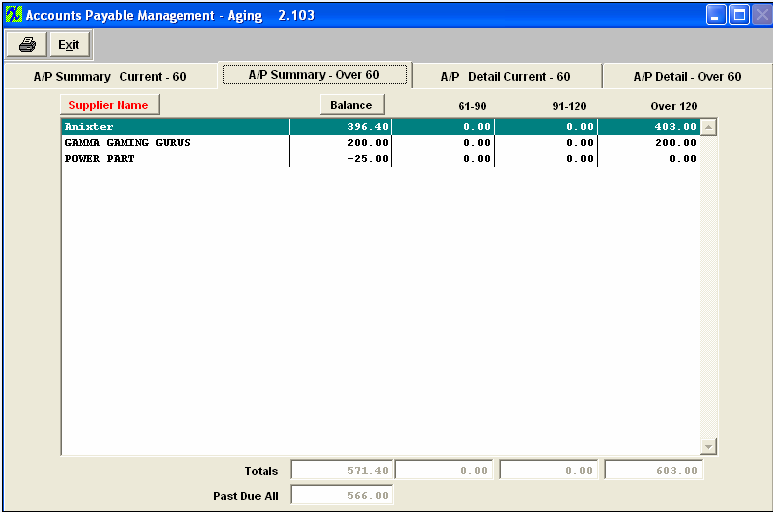

| 1.5.3.2. A/P Summary-Over 60 | ||||||||||||||

A/P Summary-Over 60 tab

A/P Summary-Over 60 tab field Definitions

Highlight the Supplier of interest.To view the detail, select the appropriate tab – A/P Detail Current – 60 or A/P Detail – Over 60.The detail for that Supplier will display. |

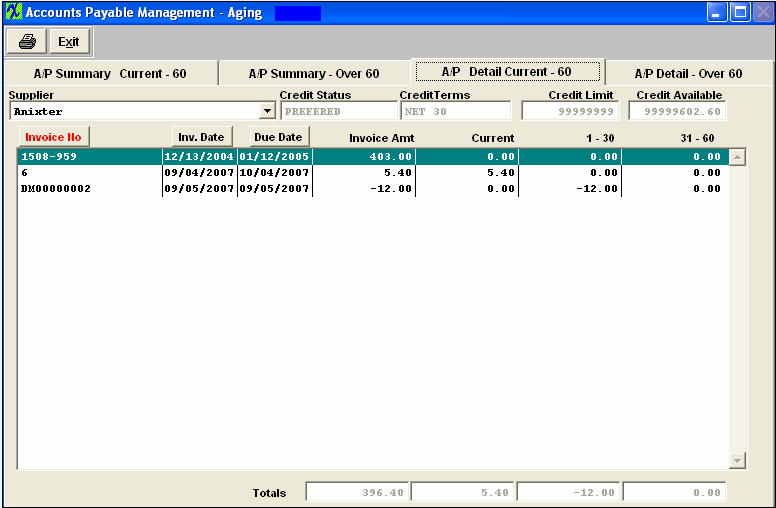

| 1.5.3.3. A/P Detail Current-60 | ||||||||||||||||||||||||||

A/P Detail Current- 60 tab

A/P Detail Current-60 tab field Defintions

The name of the Supplier being displayed. The status the supplier has with the user, Approved, On Probation, Disqualified, etc. These are the payment terms the supplier has for the user. This is the limit of credit that the supplier extends to the user. This is the amount of credit still available to the user after consideration of all of the open invoices. The date of the invoice.To sort by invoice date, depress that button. The date the payment is due to the supplier. To sort by Due Date, depress that button. The $ amount of the invoice. Invoices with scheduled due dates later than the current date. Invoices with due dates between 1 and 30 days past the scheduled due date. Invoices with due dates between 31 and 60 days past the scheduled due date. The total of the Invoice Amount, Current, 1-30 and 31-60 columns. To view another Supplier, depress on the down arrow next to the Supplier field. A list of Suppliers with open Invoices will display: Select the Supplier of choice. |

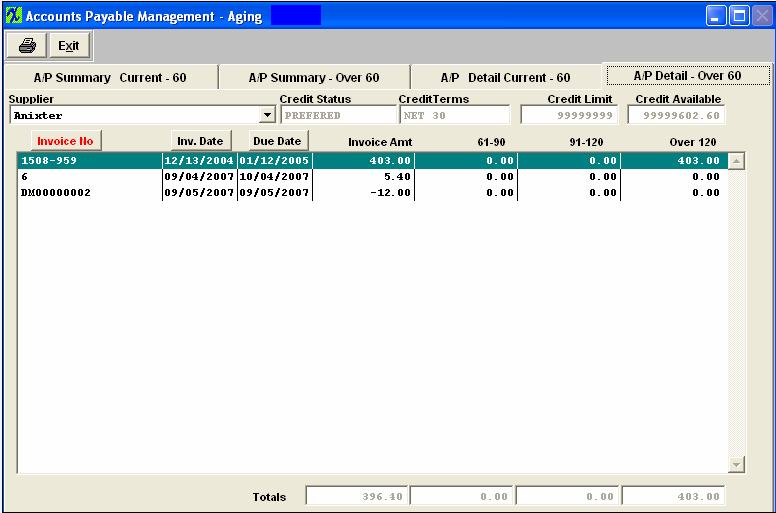

| 1.5.3.4. A/P Detail-Over 60 | ||||||||||||||||||||||||||

A/P Detail – Over 60 tab

A/P Detail Over- 60 tab field Definitions

The name of the Supplier being displayed. The status the supplier has with the user, Approved, On Probation, Disqualified, etc. These are the payment terms the supplier has for the user. This is the limit of credit that the supplier extends to the user. This is the amount of credit still available to the user after consideration of all of the open invoices. The supplier’s number for their invoice. To sort by invoice number, depress that button. The date of the supplier’s invoice.To sort by invoice date, depress that button. The date the payment is due to the supplier. To sort by Due Date, depress that button. The $ amount of the invoice. Invoices with due dates between 61 and 90 days past the scheduled due date. Invoices with due dates between 91 and 120 days past the scheduled due date. Invoices with due dates between 31 and 60 days past the scheduled due date. The total of the Invoice Amount, 61-90, 91-120 and over 120 columns. To view another Supplier, depress on the down arrow next to the Supplier field.A list of Suppliers with open Invoices will display:

Select the Supplier of choice. Note: The Invoice must be displaying in A/P Aging before it can be selected for payment. |

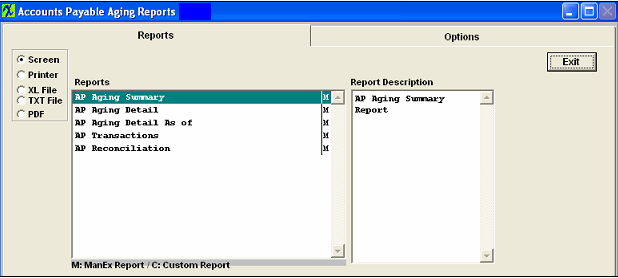

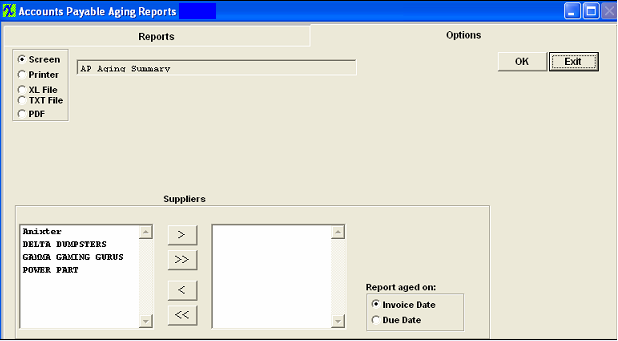

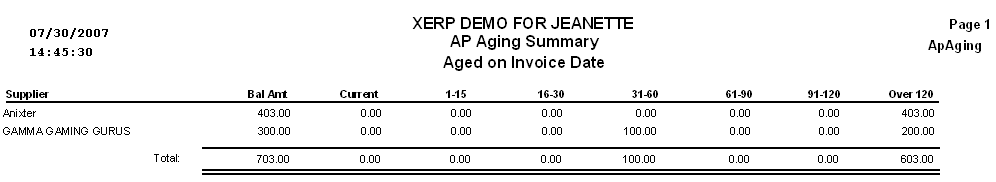

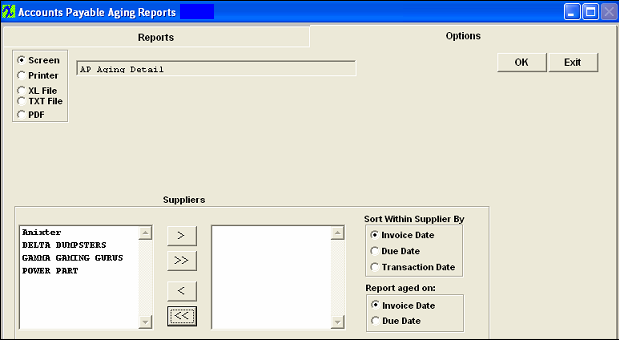

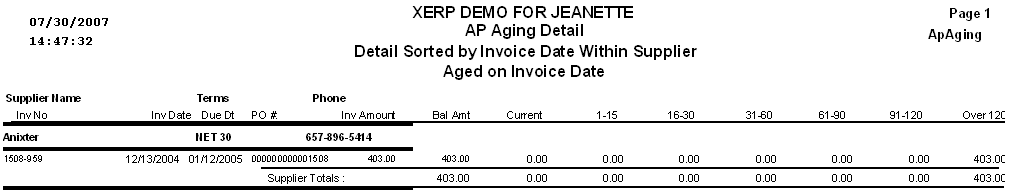

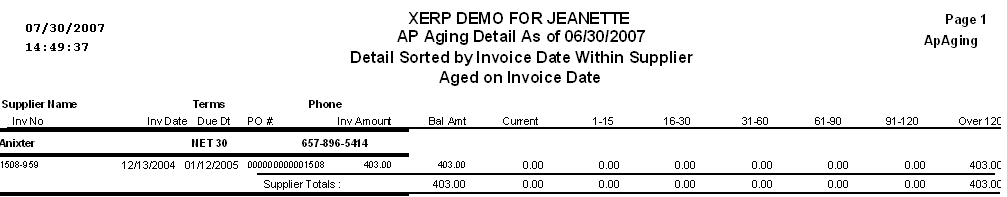

| 1.5.4. Reports for the A/P Aging | ||||||||||

AP Aging Summary

The following report will be displayed.

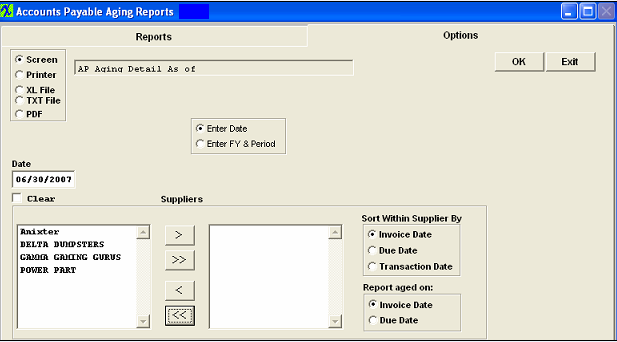

AP Aging Detail

The following report will be displayed.  AP Aging Detail As of

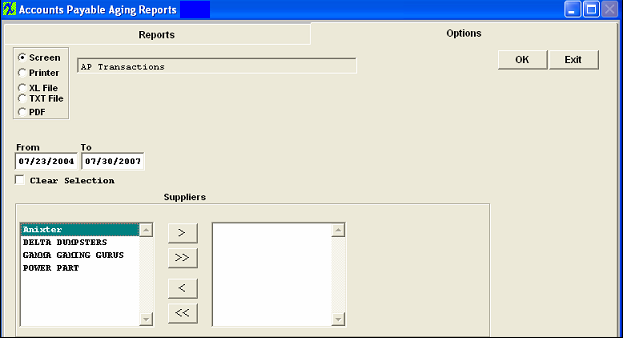

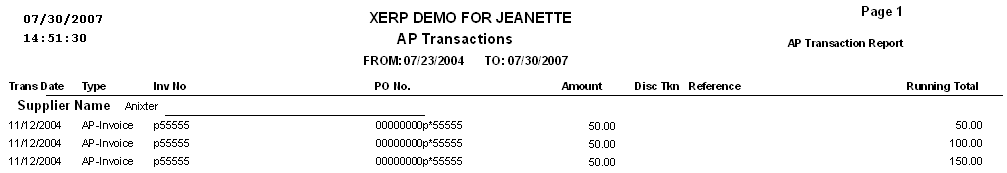

The following report will be displayed:  AP Transactions

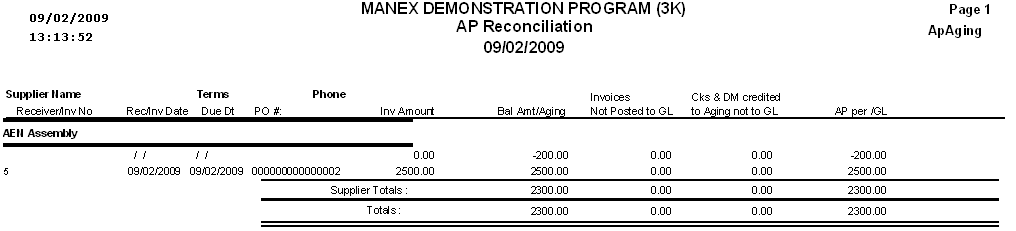

The following report will be displayed:  AP Reconciliation Report  |

| 1.6. Payment Scheduling |

| 1.6.1. Prerequisites for Payment Scheduling |

|

Users MUST have full rights to the "Check Scheduling and Issue" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. |

| 1.6.2. Introduction for Payment Scheduling |

The Payment Scheduling selection provides on screen ability to schedule payments to suppliers by due date, by supplier, or by batch. Note: In order to schedule a payment, the invoice must be displaying in the A/P Aging module.

The Issue Checks selection allows you to select a batch for check issuance or to record a manual check already written. The user may also void a previously written check in this module.

Note: This is a single user screen, so no more than one user can be in the edit or add mode at any given time. This is to prevent the users from selecting the same invoices and saving them into separate batches. However more than one user can enter the module to run and/or view the reports and view the check register screen.

|

| 1.6.3. Fields & Definitions for Payment Scheduling |

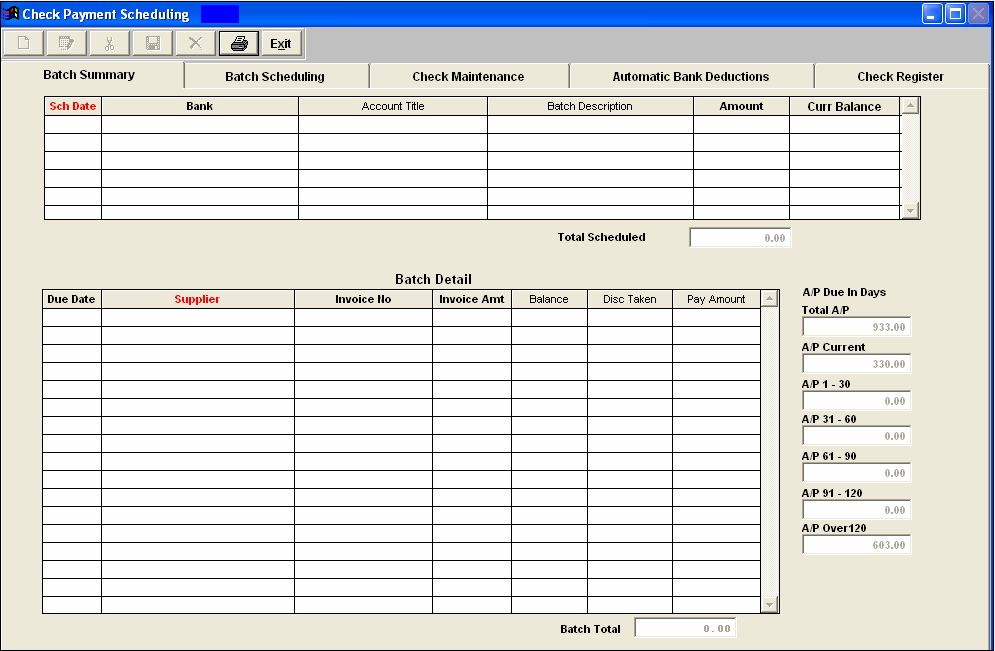

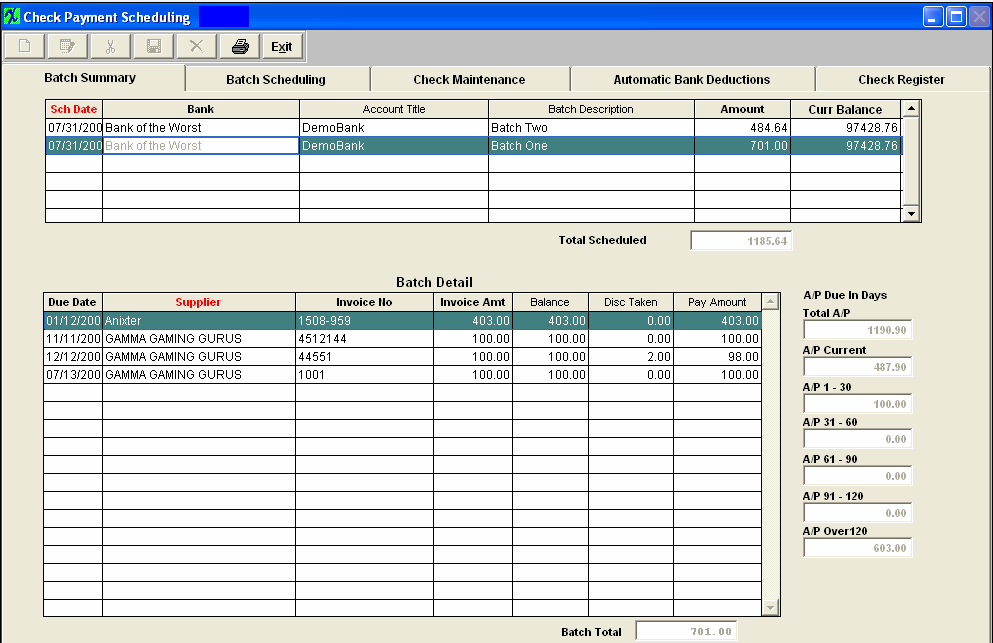

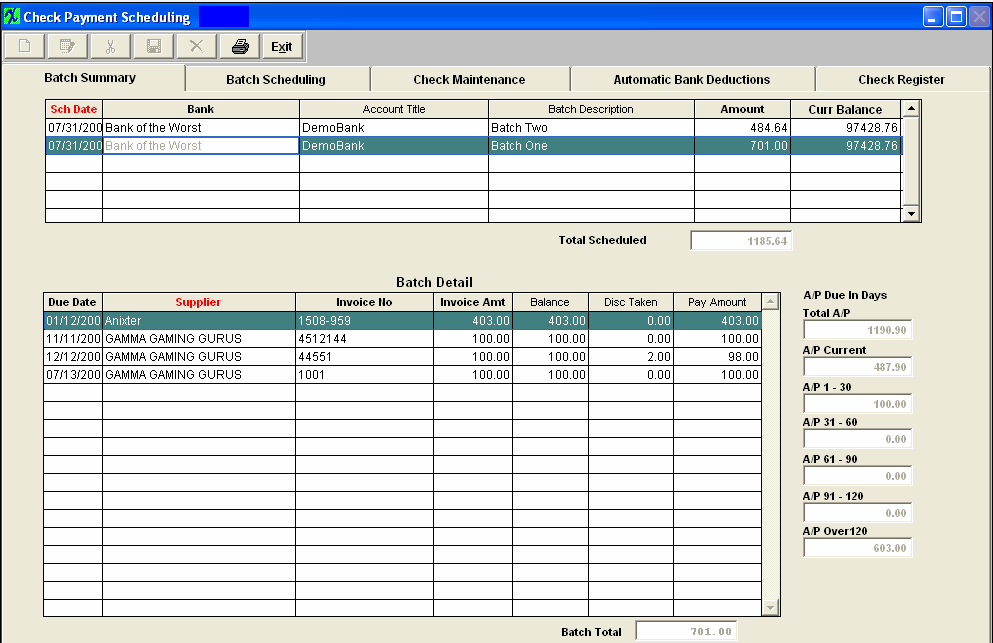

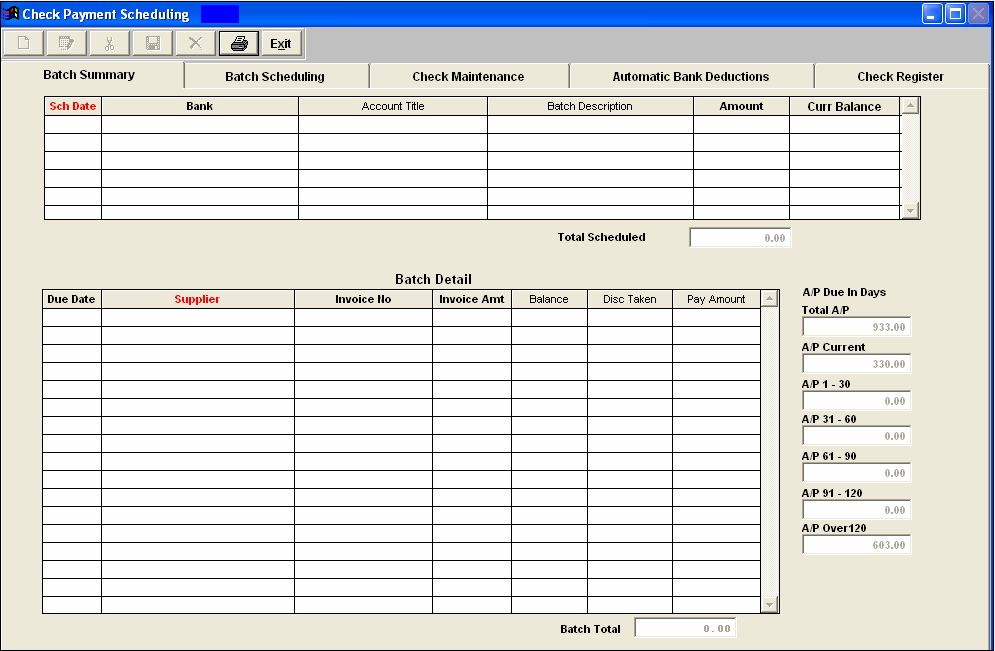

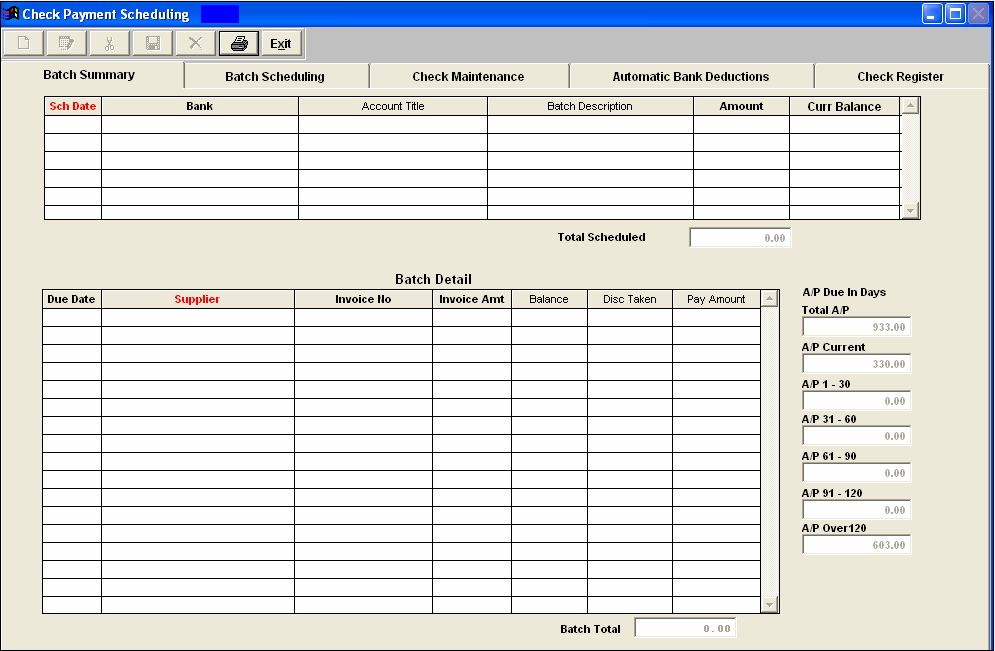

| 1.6.3.1. Batch Summary Tab | ||||||||||||||||||||||||||||||||||||||||||

Batch Summary Field Definitions

This is the date that the user has selected for this batch to be paid. The name of the bank from which the checks will be written. The G/L title for this bank. The user assigned description pertaining to this batch. The current balance in bank account Batch Detail Section:

The name of the supplier which is being paid. The Suppliers number assigned to the invoice. The total amount of the individual invoice. The unpaid balance of the invoice. The applicable early payment discount amount. The amount of the check payment for this specified invoice. A/P Due in Days Section:

The grand total of all of the open Accounts Payable per the Accounts Payable Aging module. The total of all invoices due today and later per the Accounts Payable Aging module. The total of all invoices due yesterday and out 30 days per the Accounts Payable Aging module. The total of all invoices due 31 days to 60 days ago per the Accounts Payable Aging module. The total of all invoices due 61 days to 90 days ago per the Accounts Payable Aging module. The total of all invoices due 91 days to 120 days ago per the Accounts Payable Aging module. The total of all invoices due 120 days to infinity days ago per the Accounts Payable Aging module. |

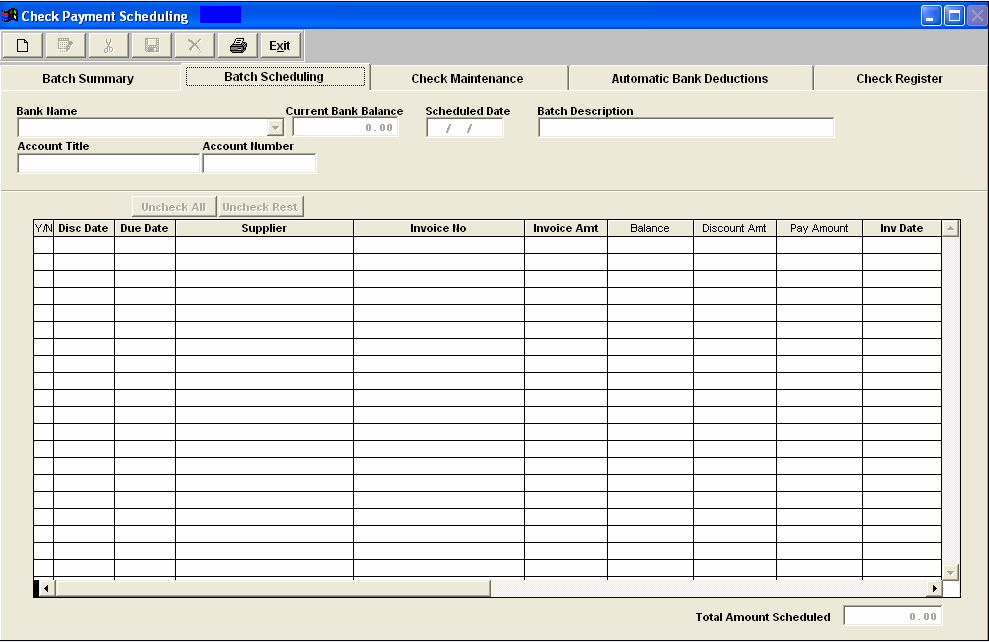

| 1.6.3.2. Batch Scheduling Tab | ||||||||||||||||||||||||||||||||||||||||||||||||

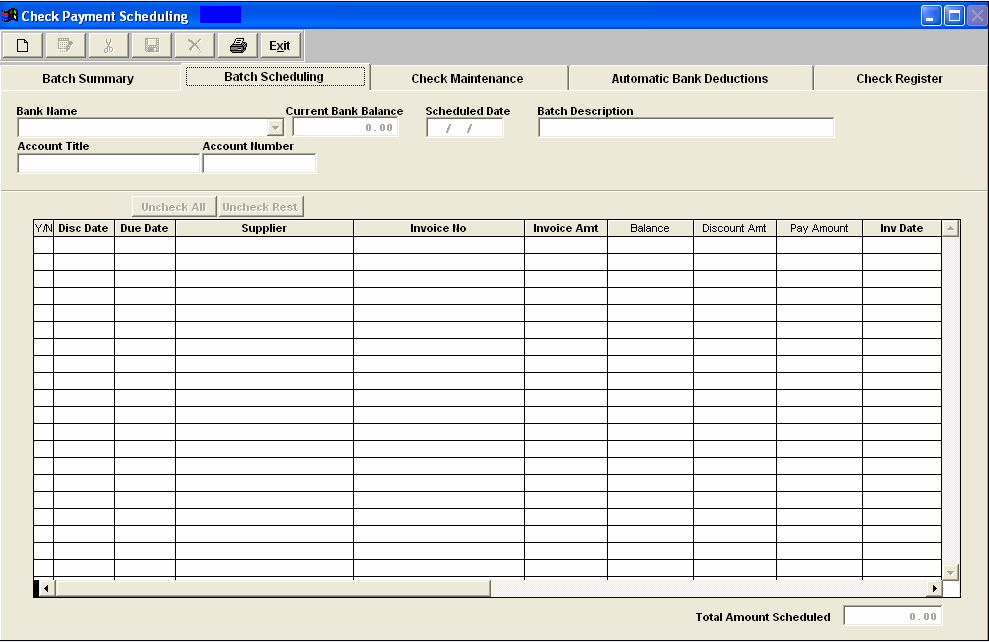

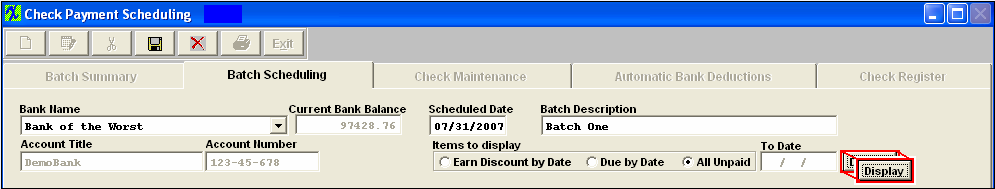

Clicking on the Batch Scheduling tab will bring up the following screen:

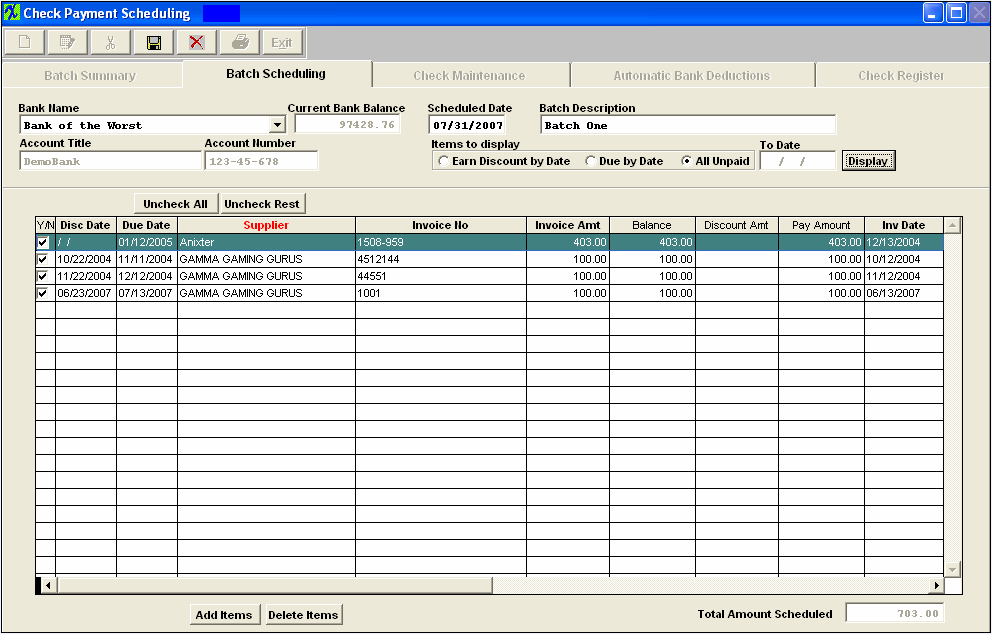

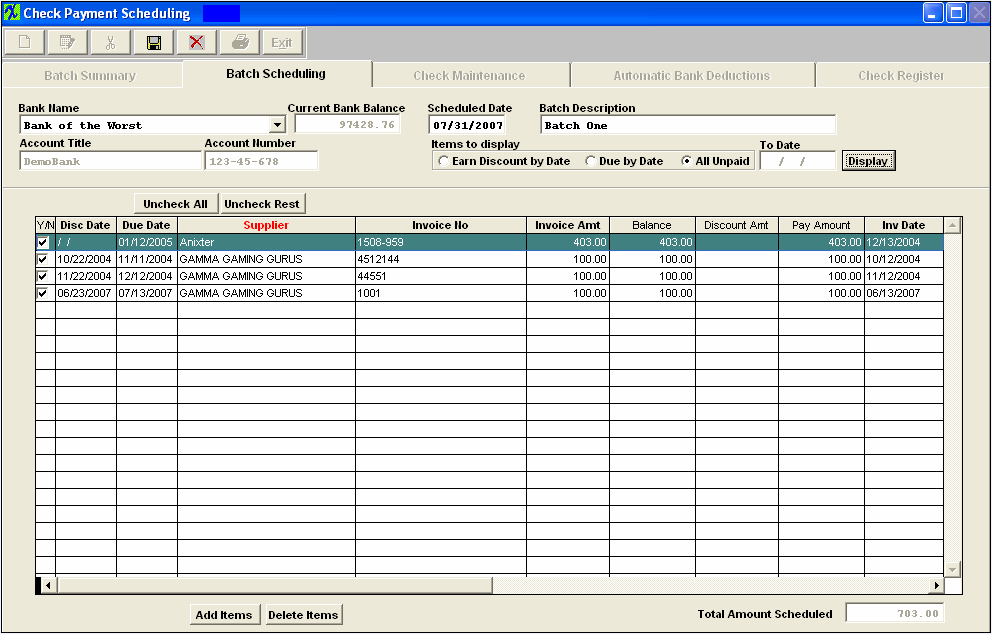

Once user selects the Add button, selects the Bank Name, Scheduled Date, Batach Description, Items to Display, and depresses the Display button all Unpaid Invoices will be displayed and the following screen will appear:  Field Definitions

The name of the bank from which the checks will be written. Only the Active Bank Accounts will be available in the pull down when processing new records. This is the date that the user has selected for this batch to be paid. The Batch description the user assigned to this batch. The G/L title for the bank being displayed in the Bank Name. The account number for the bank account selected. If this box is checked, the invoice is included in the batch for payment. The date on which the early payment discount expires for terms such as 2 % 10, net 30. Under the terms the supplier has for the user, the last possible payment date available before being considered delinquent.For example, if the terms are 2 % 10, net 30, the date appearing in this column would be 30 days from the invoice date without consideration for the early payment discount. The name of the supplier which is being paid. The Suppliers number assigned to the invoice. The total amount of the individual invoice. The unpaid balance of the invoice. The applicable early payment discount amount. The sum of all of the scheduled invoice payments for this batch. To view the Invoice Date, scroll to the right. If there are several invoices in the batch, the user may sort by invoice date by depressing the Invoice Date column header. |

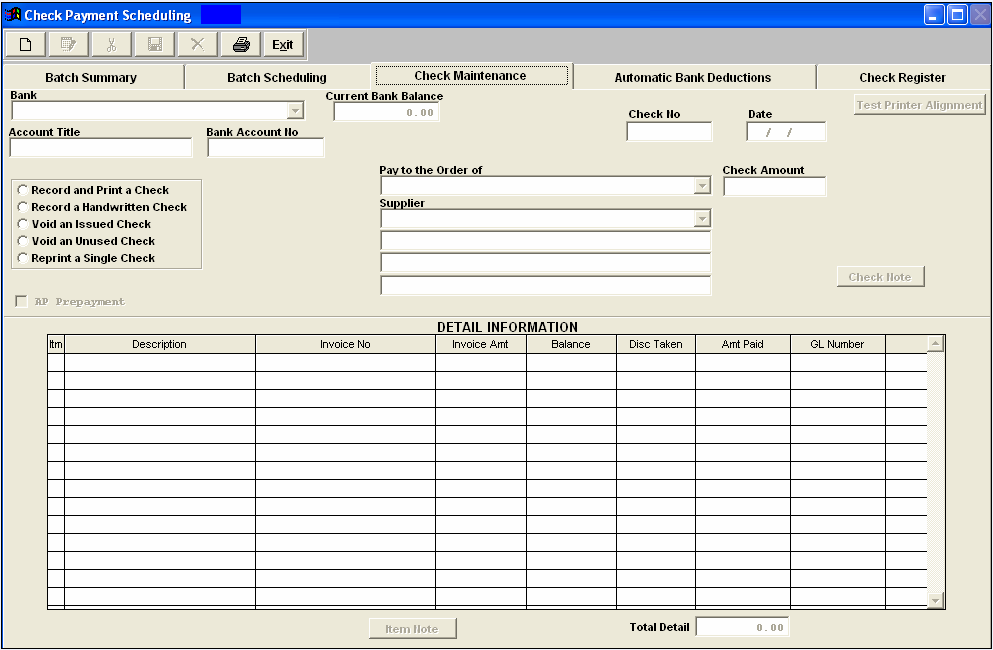

| 1.6.3.3. Check Maintenance Tab | ||||||||||||||||||||||||||||||||||||||||||||||

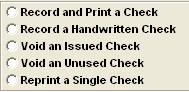

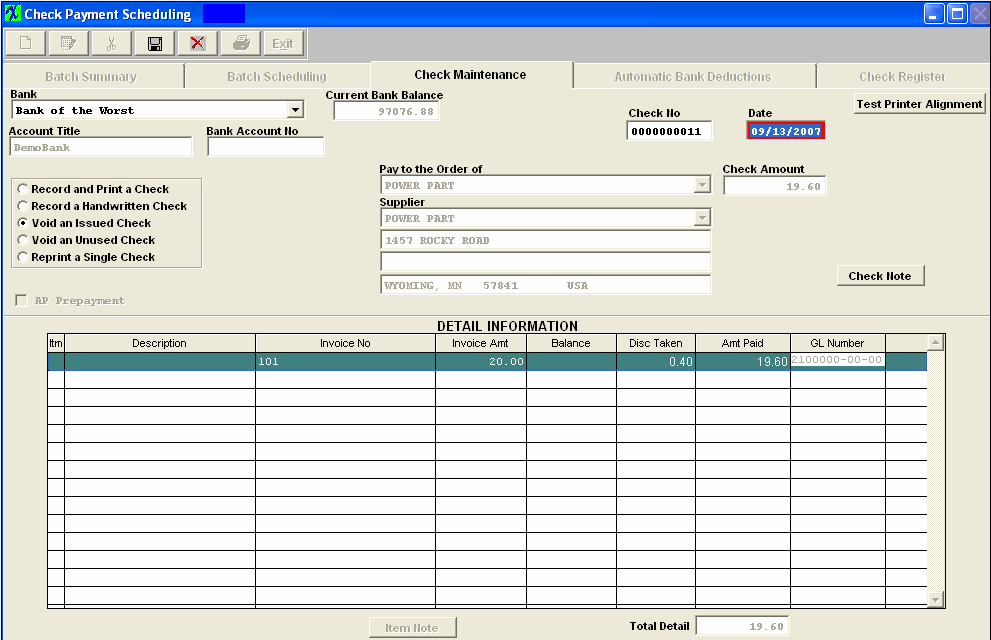

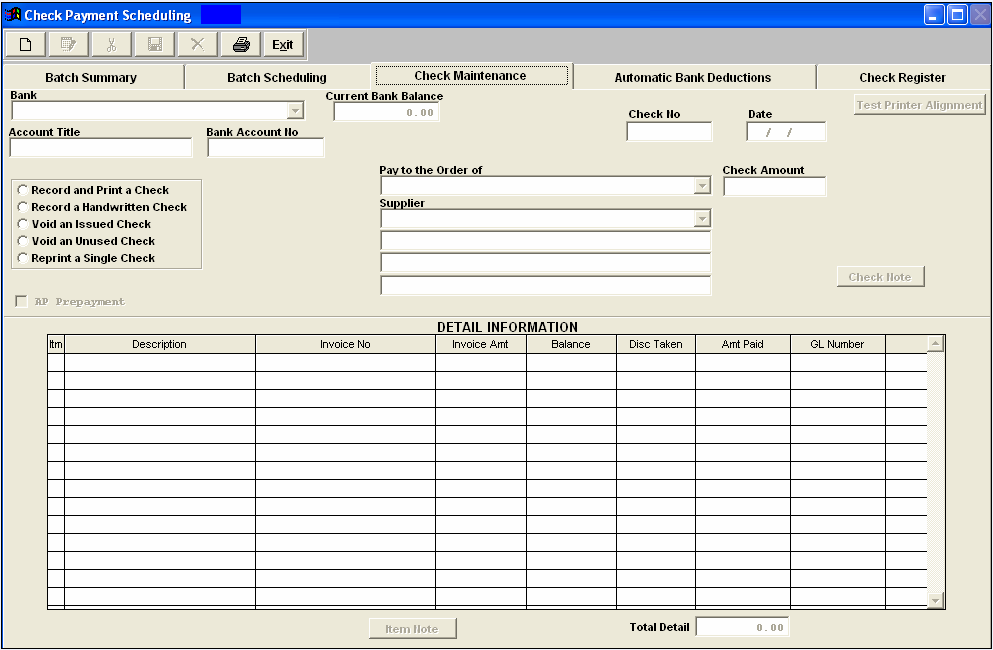

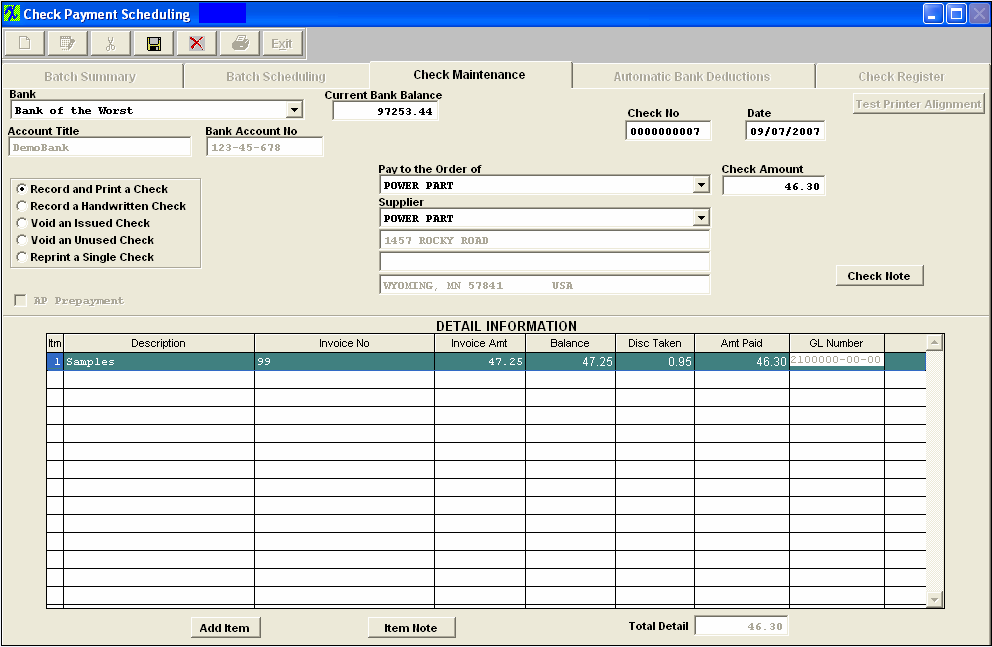

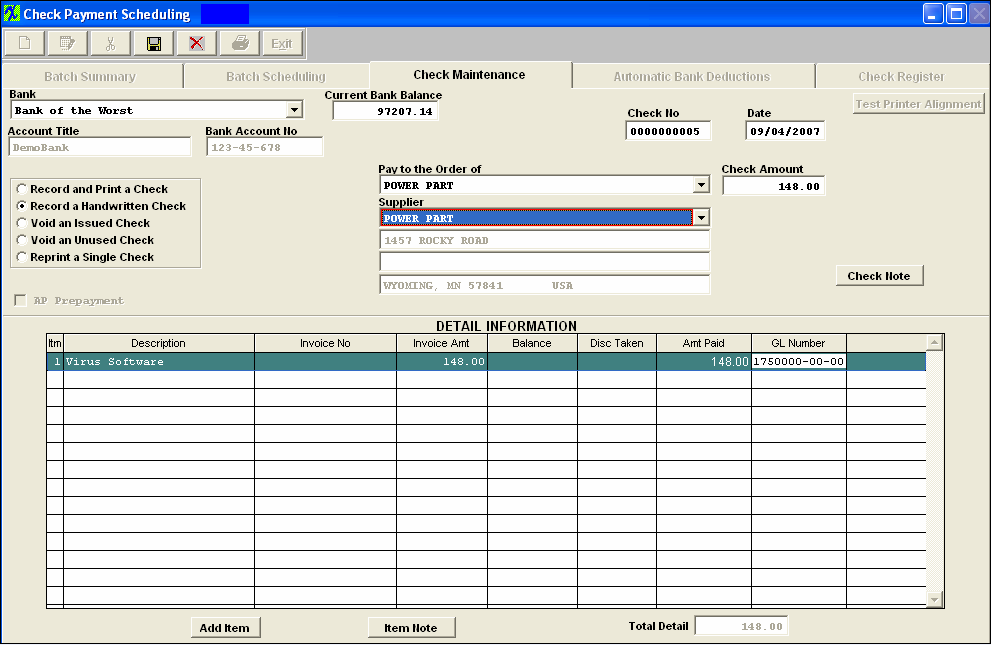

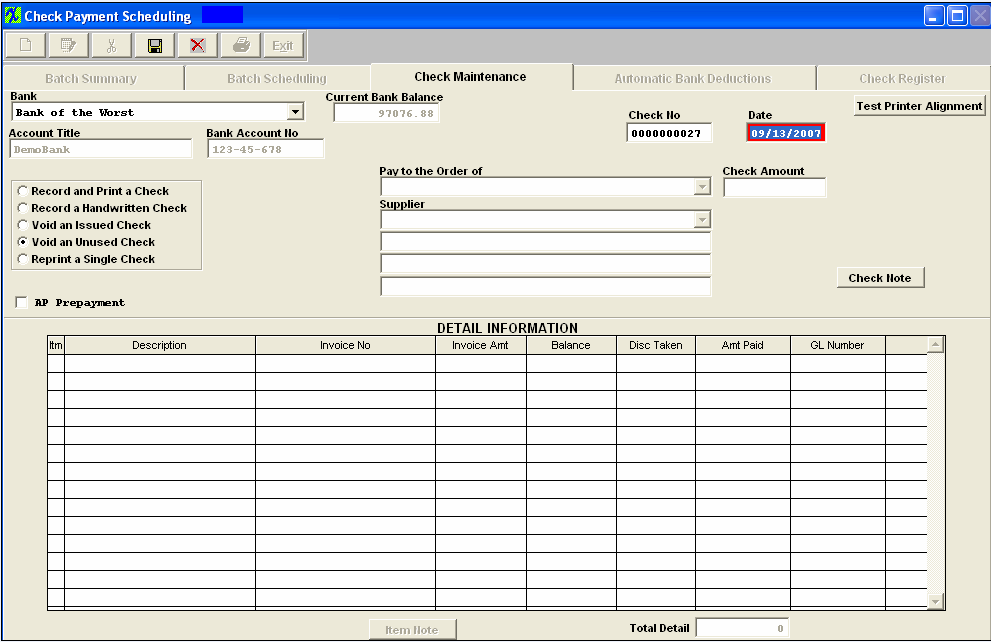

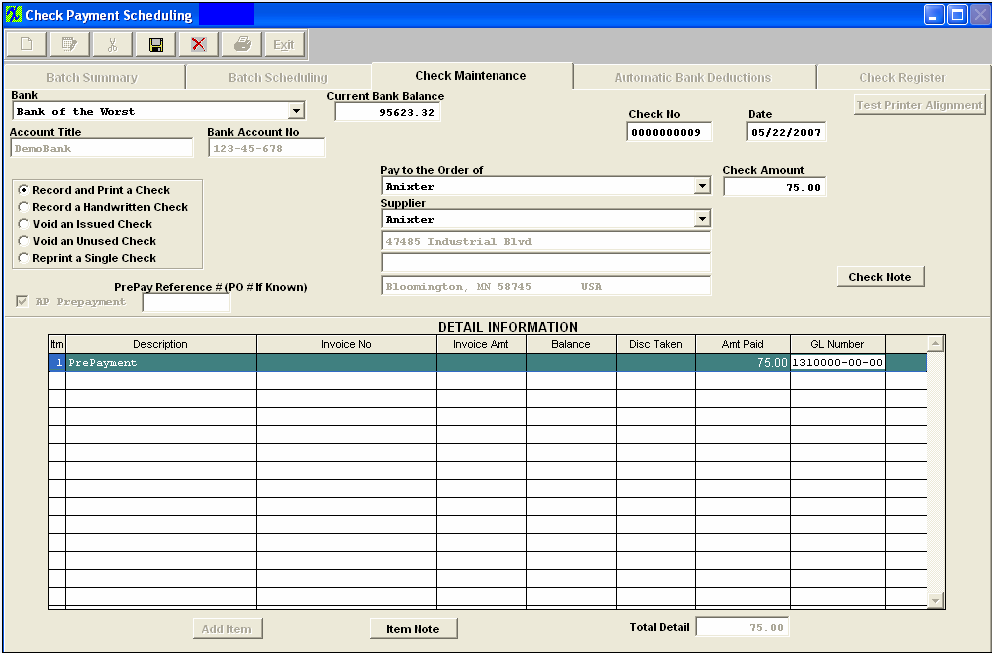

This tab is used to record and print a manual check, to void a check or to re-print a single check or make a Prepayment to a Supplier. Upon clicking on the tab, the followng screen appears:

Detail Information

|

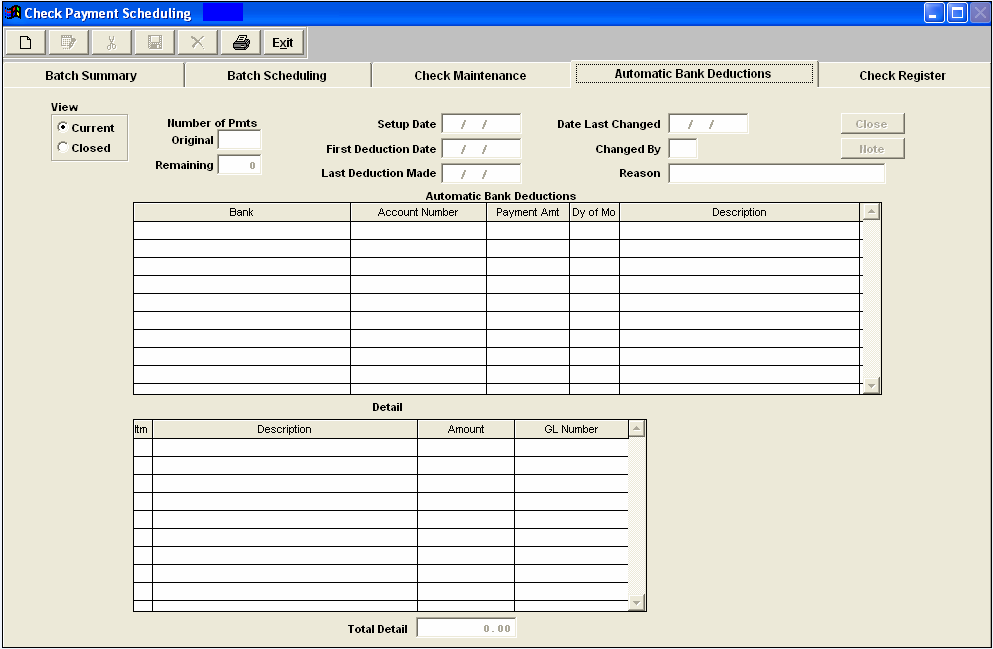

| 1.6.3.4. Automatic Bank Deduction Tab | ||||||||||||||||||||||||||||||||||||||||

|

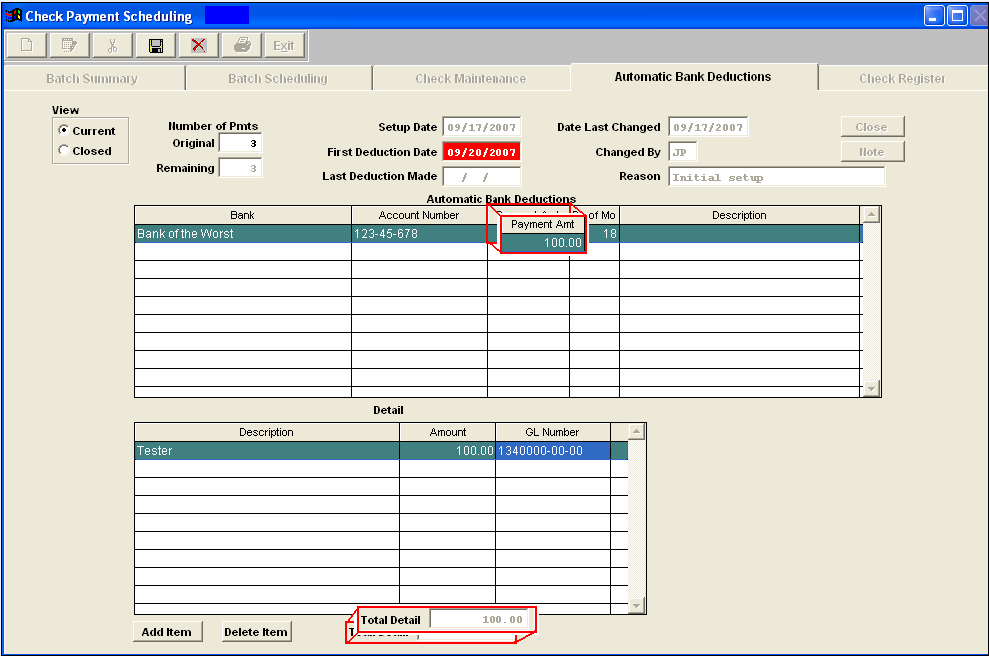

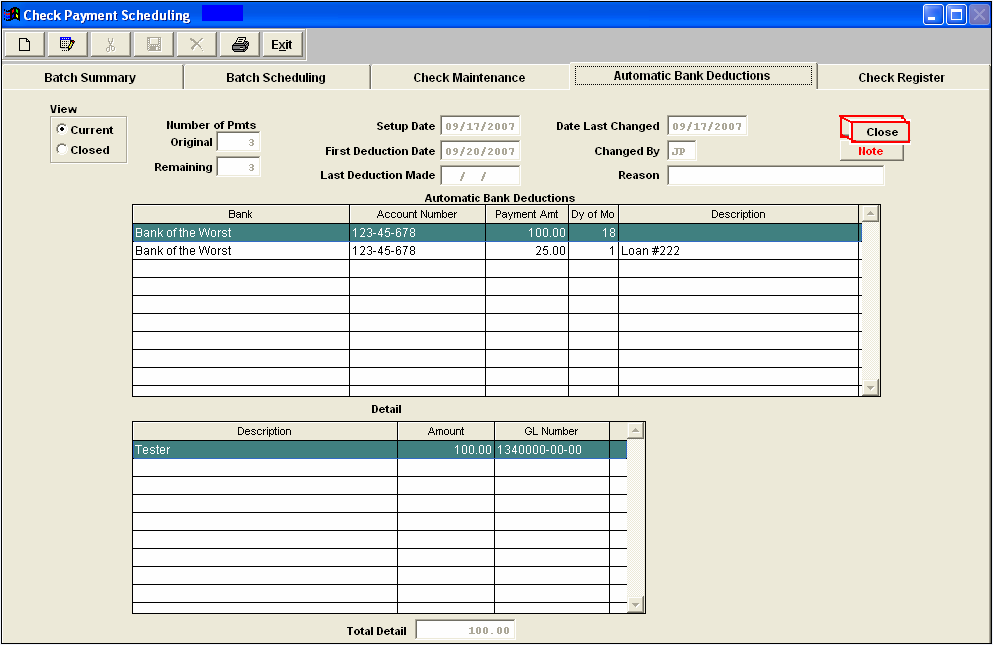

This is the companion screen to the Bank Reconciliation - Generate Automatic Deductions tab. In this screen, the automatic deductions are set up. Upon generation in the Bank Reconciliation module, the appropriate journal entry will generate and the outstanding check list will display the automatic deduction. To view the detail on a specific deduction, highlight it and the pertinent detail will display in the Detail section. Automatic Bank Deductions field definitions:

Automatic Bank Deductions Section:

Detail Section:

|

| 1.6.3.5. Check Register Tab | ||||||||||||||||||||||||||||||||||||

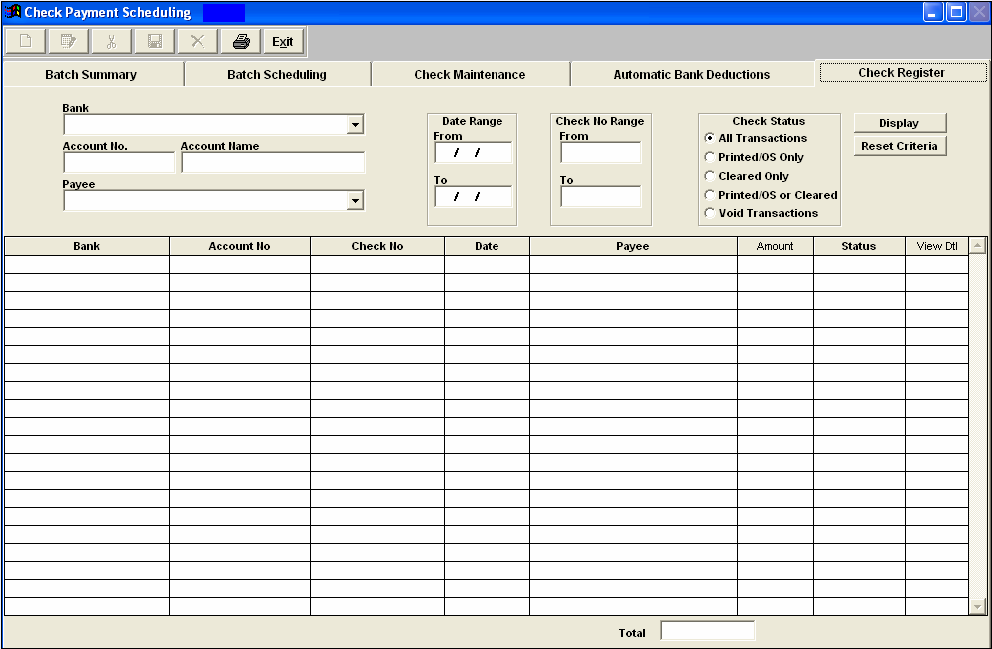

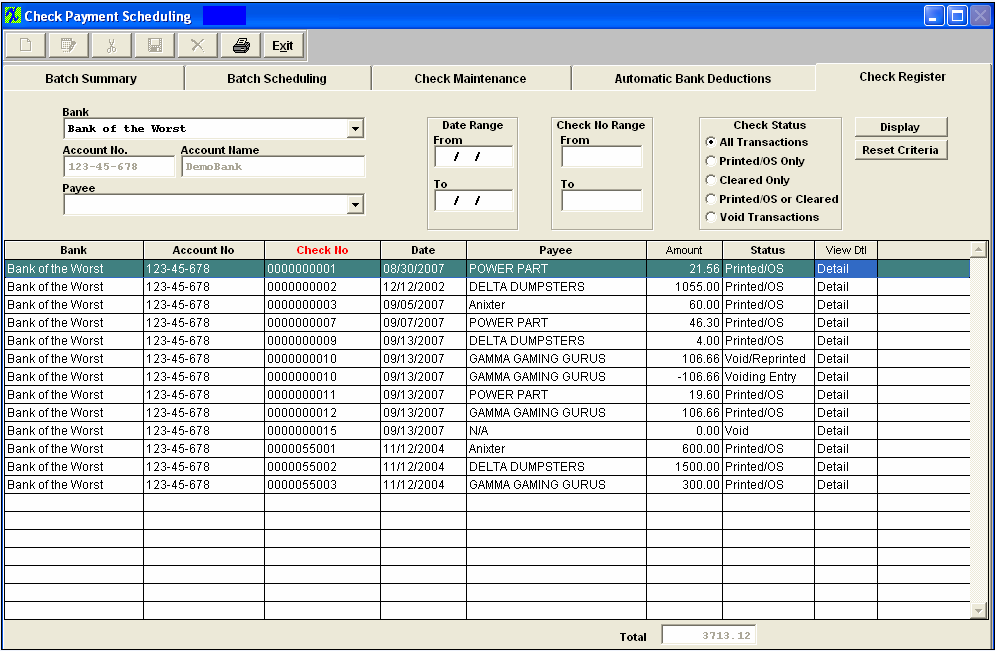

Depressing the Check Register tab will bring up the following screen:

|

| 1.6.4. How To ..... for Payment Scheduling |

| 1.6.4.1. Batch Scheduling |

| 1.6.4.1.1. Create a Scheduled Batch of Checks | ||

Adding a New Scheduled Batch

The following screen will appear:

Enter the Batch Scheduling screen:  Depress the Add record button. Enter your password. Select the Bank Name from the drop down display (Inactive Bank Accounts will not be listed). The Account Title and Number will appear automatically. Enter in the Scheduled Date. Enter in the Batch Description. Select the appropriate radial in the Items to Display section: Earn Discount by Date, Due By date or All Unpaid. If Earn Discount or Due By are selected then enter into the To Date field the date through which you want included in the scheduled batch. Then depress the Display button.

All unpaid Invoices will be displayed:

|

| 1.6.4.1.2. Edit a Scheduled Batch of Checks | ||

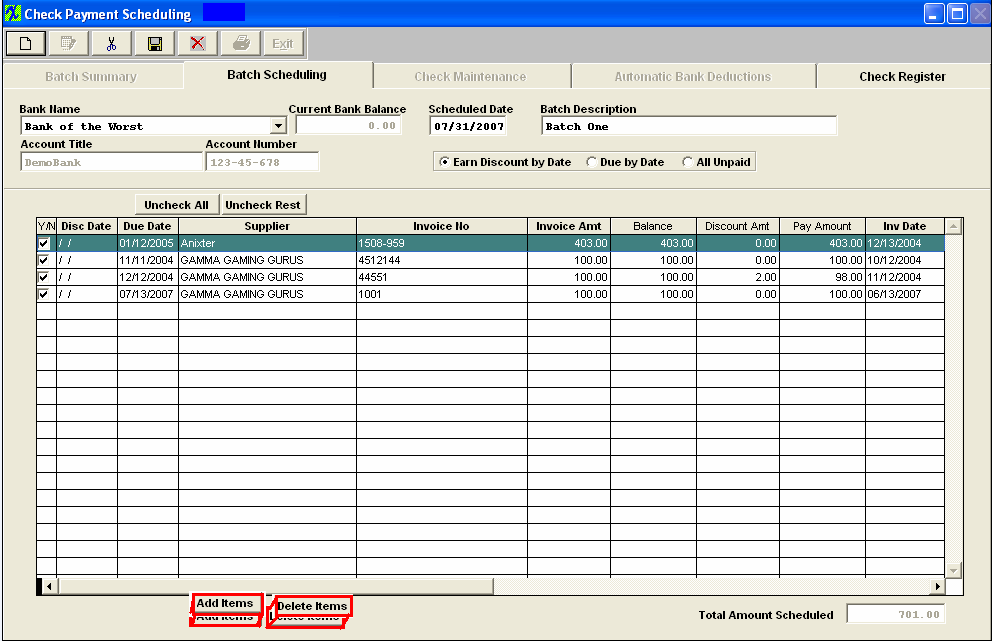

The following screen will appear: To edit a scheduled batch, highlight the batch you want to edit. Go to the Batch Scheduling screen.

Depress the Edit button. Enter your password. If you want to add to this batch, depress the Add items button at the botton of the screen. Enter the EXACT invoice number as is entered in the Accounts Payable Aging. Depress the Enter Key and the rest of the information regarding that invoice will fill in automatically.  To delete an already scheduled line item, highlight the item. Depress the Delete Items button. You will receive the following message: Depress the Yes button to continue, depress the No button to abondon deletion.

Depress the Save button to save the changes, depress the Abandon changes button to abandon the changes.

|

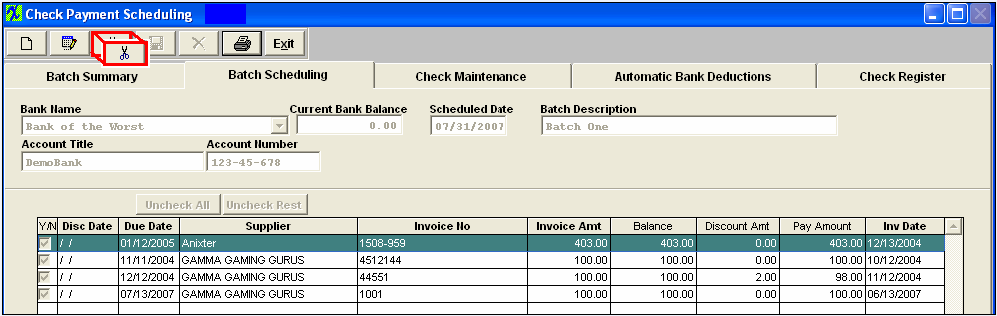

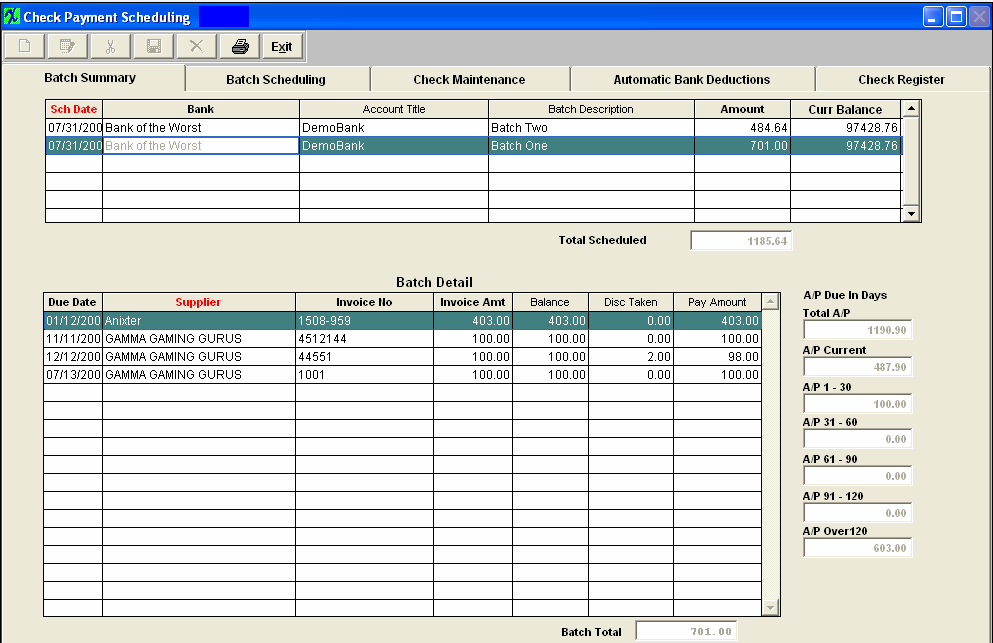

| 1.6.4.1.3. Delete a Scheduled Batch of Checks | ||

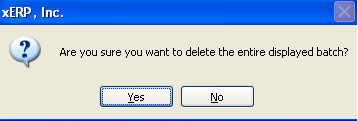

The following screen will appear: Highlight the batch you want to delete.  Enter the Batch Scheduling screen. Depress the Delete Batch record button.

Enter in your password. The following message will appear:

Depress the Yes button to continue. The batch will be deleted. Enter the No button to abandon the deletion. |

| 1.6.4.1.4. Printing Batch Checks | ||||||||||||||||||||||||||||||||||||||||||||||||||||

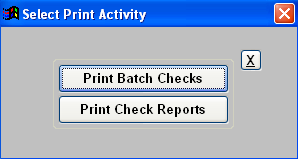

The following screen will appear: Highlight the batch you want to print.

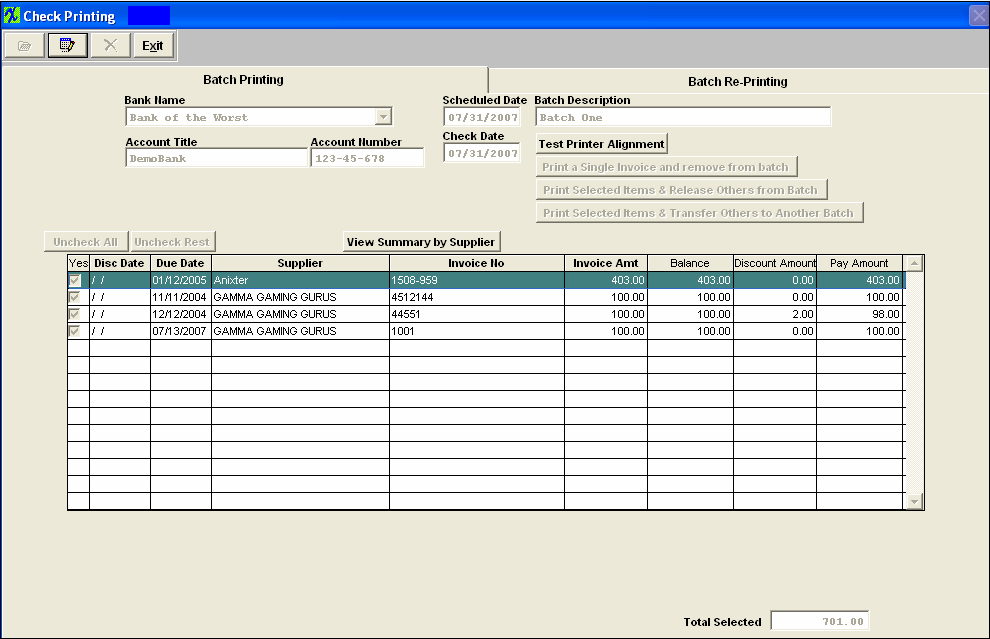

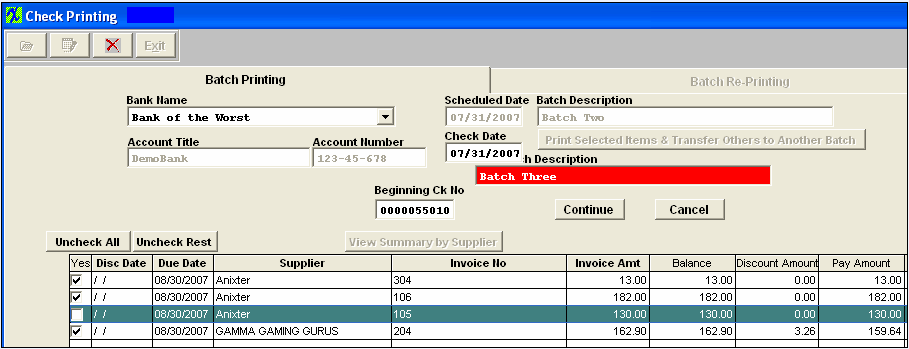

If the user selects the "Print Batch Checks", the following screen will appear: (Note: The Bank name field could be blank if the Bank is Inactive)  Check Printing Screen field definitions -- Batch Printing tab:

This is the date that the user has selected for this batch to be paid. The user assigned description pertaining to this batch. The G/L title for this bank. The number that the bank has for this account. The button will uncheck all of the checkmarks in the Yes column. Highlight the last item you want to include in this payment, then clicking on this button will uncheck the rest of the checkmarks in the Yes column. Depressing this button selection will bring up the following screen:

View Batch Detail field definitions: Summary of Selected Items By Supplier

The name of the supplier to which payment will be made. The name of the institution or business which will appear on the check. The first address line per the Supplier Information setup. The applicable early payment discount amount. The sum of all of the scheduled invoice payments for this batch. Selecting this will return you to the prior screen view. Print Checks

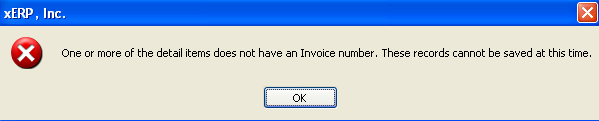

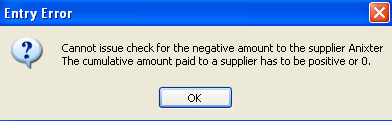

If user receives the following message after depressing the Print Check button:

This message is displayed when the check that the system is attempting to print would end up being for a negative value. One possible reason would be that the Remit To information between the Invoice and Debit Memo's selected on the Check Batch are different, or blank. Due to this the system would want to create two separate checks, and that could place the Debit Memo on a check by itself. We can not allow checks for negative value. So we suggest that you make sure that all of your Remit To information is properly populated within the Supplier Information module. However, there is a work around if you need to create a check for an Invoice and Debit Memo that have different or Blank Remit To Information, you may process the records through the Check Maintenance module, Record & Print a Check . If the "Remit to Address" printing on the check is different then expected or balnk refer to Article #3342 for further detail.

.

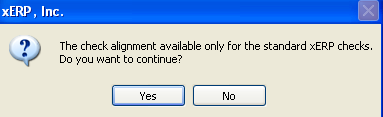

Test Printer Alignment

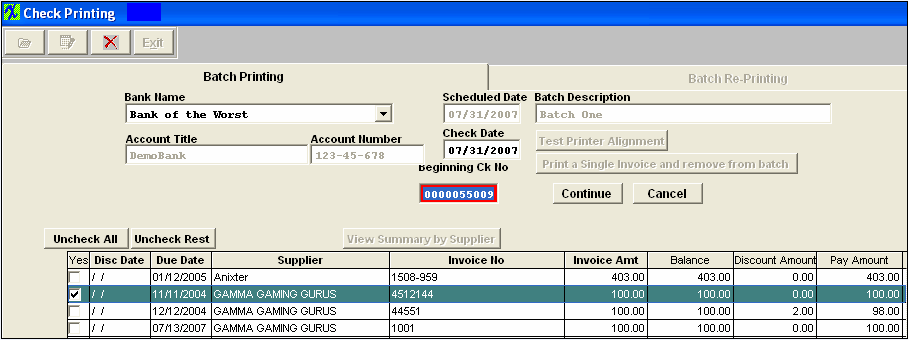

Print a Single Invoice and remove from batch Choosing this option will allow the user to select just one invoice from a batch and print a check for it. Uncheck any boxes in the Yes column which you DO NOT want to pay. Depress the Print a Single Invoice and remove from batch button. The following will display:

You may enter a different check number than the default if you choose. Depress the Continue button to print the check.

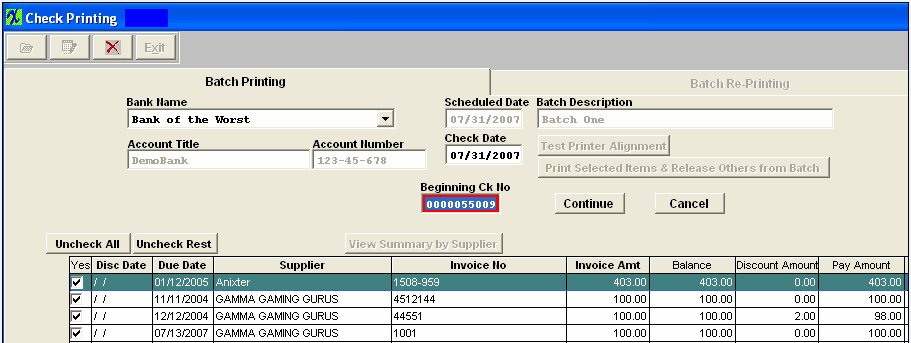

Print Selected items and release others from Batch

Choosing this option will allow the user to select some invoices from a batch and print checks for them. All invoices NOT checked in the Yes box will be released from all scheduling. Uncheck any boxes in the Yes column which you DO NOT want to pay. Depress the Print Selected items and release others from batch button.

You may enter a different check number than the default if you choose. Depress the Continue button to print the check. Print Selected Items and Transfer Others to Another Batch Choosing this option will allow the user to select some of the invoices from a batch and print checks for them. Additionally, items not selected will be transferred to a newly created batch. After depressing the “Print selected Items and Transfer Others to Another Batch”, the screen below will appear. You will need to enter in the New Batch Description.  You may enter a different check number than the one displayed if you choose. Depress the Continue button to print the checks.

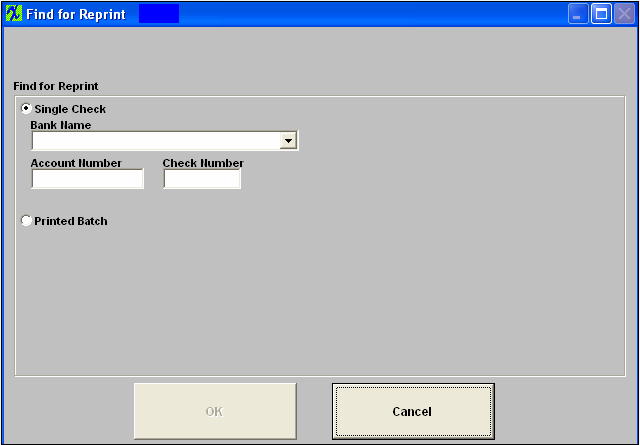

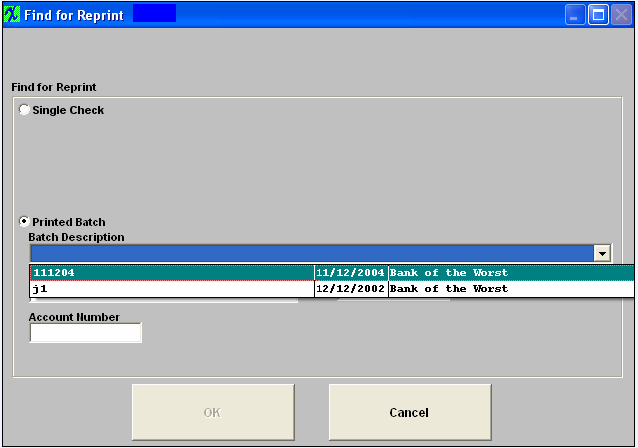

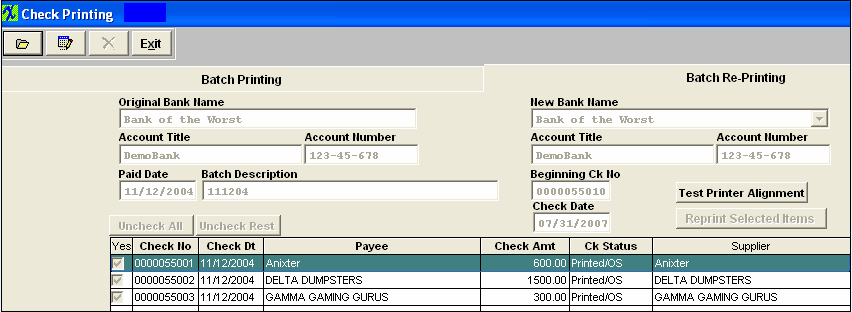

Next, click on the OK button. Note: that an entirely new batch has been created for the invoices not checked. Reprint ChecksThe Batch Re-Printing tab is used to re-print checks that got mangled in the printer.

The following screen will be displayed.  Depress the Edit button. Enter in your password. Check the Yes column at the far left for the checks you wish reprinted. You have the option to change the Check number at this point in time if needed. Depress the Reprint Selected Items button. The new check will go to the printer. The old check number will be voided and will be replaced by the new check number on the Check Register.

|

| 1.6.4.1.4.1. Check Forms |

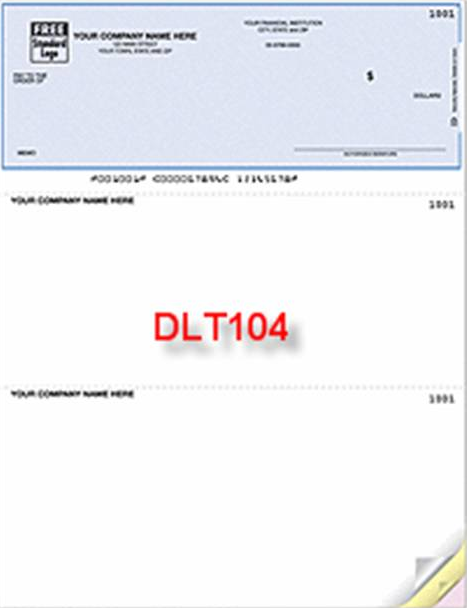

STANDARD ManEx CHECK LAYOUT - This layout would be used with blank checks.

DELUXE FORM DLT104 - This form would be used with Checks purchased from Deluxe Business Checks & Forms. NOTE: When you switch over to using a new Deluxe Form, please contact ManEx for new layout.

CANADIAN CHECK LAYOUT - This form would be used with Checks purchased from Litho-Quebec JGB Inc. See information below.

Litho-Quebec JGB Inc. Pointe-Claire, QC

H9R 4A7

514.694.9595

|

| 1.6.4.2. Check Maintenance |

| 1.6.4.2.1. Record & Print Check | ||||||

This tab is used to record a manual check, to void a check or to re-print a single check. Upon clicking on the tab, this screen appears:

Note: To reprint batches of checks, see the Batch Re-Printing procedures. To get started, depress the Add button. Type in your password. Depress the down arrow next to the Bank field. Select the appropriate bank.

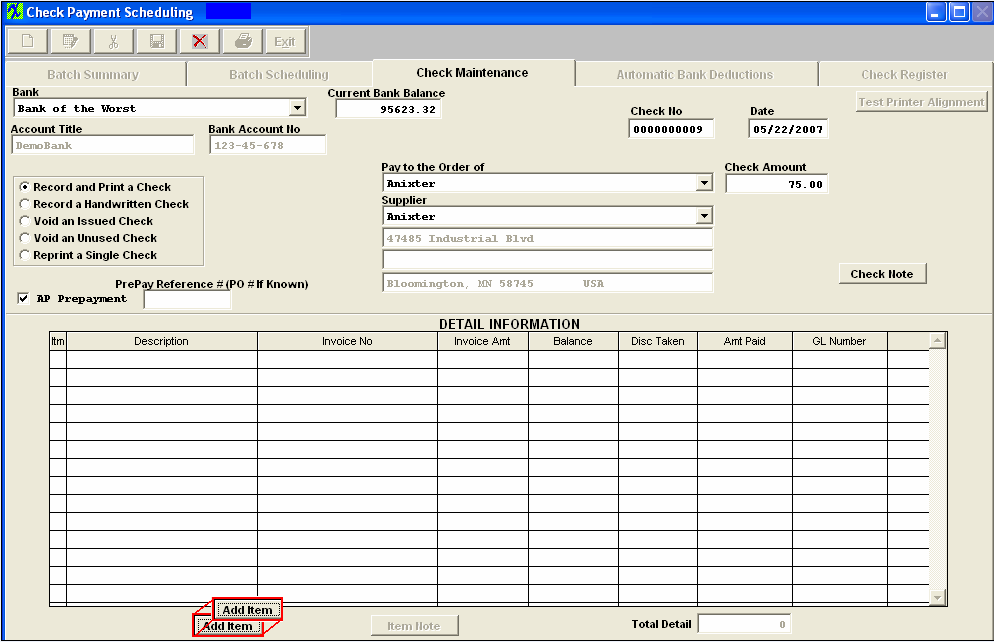

If the "Record and Print a Check" radial is selected, the user will be able to issue a check via the printer and at the same time, record it. This is especially useful for COD non-inventory orders.

Note: For COD orders involving inventory, please refer to the Pre-Pay Supplier procedures.

Enter in the amount of the check. If you wish to add a Check Note, depress that button. Depress the Edit button. Type in your note. Depress the Save button. Depress the Exit button. Depress the Add Item button located at the bottom of the screen. Enter in the Item Number, Description. Enter an Invoice number that exists in the AP Aging. When the Invoice number is entered the Invoice Amount, Balance, and General Ledger Number will fill in automatically and user can make the needed changes to the Disc Taken and Amt Paid.

Once the Check amount and the detail total are the same, the Save button will enable. You may enter a different check number than the one displayed if you choose.

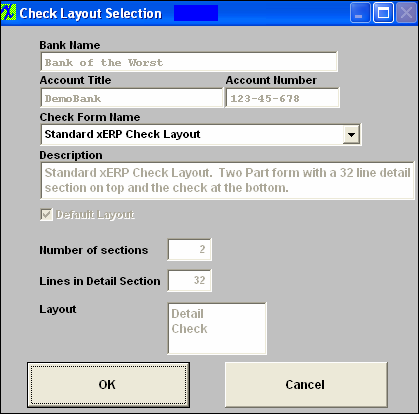

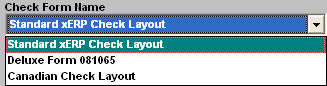

Depress the Save button and the following check format selection will appear:  Click on the down arrow to select the desired layout; There are three types of Check Forms to select from: Standard xERP Check Layout; Deluxe Form DLT104; or Canadian Check Layout. See Article #4657 for further information on the check forms.  Once the selection has been made, depress the "OK" button and the check will go to the printer and will also record. NOTE: If Invoice is in a check batch it will automatically removed from the batch when paid within the check maintenance screen.

|

| 1.6.4.2.2. Record a Hand Written Check | ||||

This tab is used to record a manual check, to void a check or to re-print a single check. Upon clicking on the tab, this screen appears:

To get started, depress the Add record button. Type in your password. Depress the down arrow next to the Bank field. Select the appropriate bank.

If the "Record a Handwritten Check" radial is selected, the user will have already manually hand written a check. This function will only record the record the check, it will not print out a check.

Enter in the Amount. The system will prompt for the next check number. The user may highlight the check number field and type in another number if needed. Depress the Add Item button. Enter in the Item and Description. If the invoice is applicable to an existing invoice already in the Accounts Payable Aging, enter in the Invoice number exactly as it exists in the AP Aging. Then the remaining fields will automatically update.

Type in the Amt Paid and depress the Save Record button. The AP Aging will update and the check will be recorded. If the check you are attempting to record does not apply to an existing record in the AP Aging. Then you need to follow the above procedure to the point of Adding Item. Once you depress the Add Item button, enter in the Item and Description. This time do not tab or enter into the Invoice No field, you must click directly into the Invoice Amt field. Enter in the Invoice Amt, Balance, Disc Taken, Amt Paid and GL Number. Once the Total Detail equals the Amount field, the system will allow you to save the record.  NOTE: If Invoice is in a check batch it will automatically removed from the batch when paid within the check maintenance screen.

|

| 1.6.4.2.3. Void an Issued Check | ||

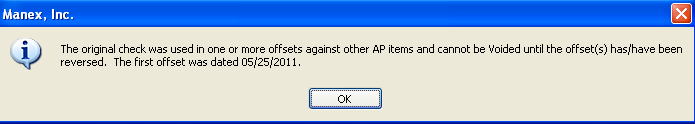

This tab is used to record a manual check, to void a check or to re-print a single check. Upon clicking on the tab, this screen appears:

To get started, depress the Add button. Type in your password. Depress the down arrow next to the Bank field. Select the appropriate bank.

If the "Void an Issued Check" radial is selected, the user may void any un-cleared outstanding check. Type in the check number you wish to void. All of the associated data will appear, as detailed below.

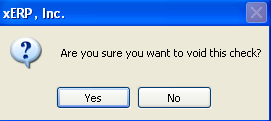

Depress the Save button. You will receive the following message to confirm that you want to void the check:

Depress the Yes button. The check will void.

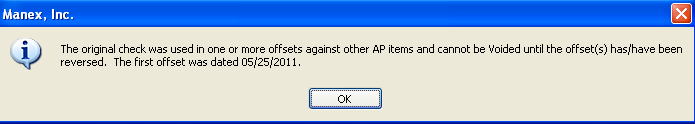

If the original check has been applied to Invoice(s) within the AP Offset module the check cannot be voided or reprinted and user will receive the following message:

|

| 1.6.4.2.4. Void an Unused Check | ||

|

This tab is used to record a manual check, to void a check or to re-print a single check. Upon clicking on the tab, this screen appears:

To get started, depress the Add button. Type in your password. Depress the down arrow next to the Bank field. Select the appropriate bank.

If the "Void an Unused Check" radial is selected, the user may void a check which had never been paid through or entered in the system as a manual check recording. Enter the check number you wish to void.

Depress the Save button. You will receive the following message to confirm that you want to void the check:

Depress the Yes button. The check will be recorded as Void in the Check Register. |

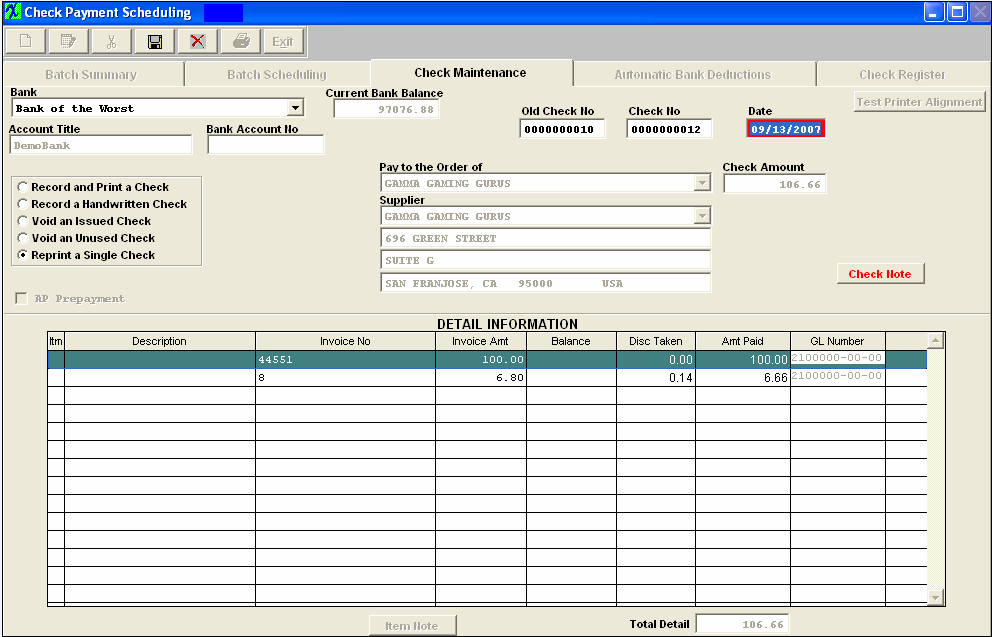

| 1.6.4.2.5. Reprint a Single Check | ||

|

This tab is used to record a manual check, to void a check or to re-print a single check. Upon clicking on the tab, this screen appears:

Note: To reprint batches of checks, see the Batch Re-Printing procedures. To get started, depress the Add button. Type in your password. Depress the down arrow next to the Bank field. Select the appropriate bank.

If the "Reprint a Single Check" radial is selected, the user will be able to void out and reprint a single check. Enter the old check number into the field, the system will automatically fill in all of the rest of the information. The system will prompt for the next check number. The user may highlight the check number field and type in another number if needed. Once the Check amount and the detail total are the same, the Save button will enable.

Depress the Save button. The check will go to the printer and will also record. If the original check has been applied to Invoice(s) within the AP Offset module the check cannot be voided or reprinted and user will receive the following message:

|

| 1.6.4.3. Automatic Bank Deduction |

| 1.6.4.3.1. Add a New Automatic Bank Deduction |

Adding a new Automatic Deduction

Depress the Add button. Type in your password. Enter the original number of payments, the date of the first deduction then select the bank. Enter the payment amount, the day of the month for the deduction and a description of the deduction.

Depress the Add Item button. Type in the Item Number, a description of the line item, the line item amount and the General Ledger number. Note: if you don’t know the G/L number, place the cursor in the G/L field and hit the Enter key twice. This will bring up the following:  Depress the arrow next to the Find By field.

Scroll up or down until the appropriate G/L range is found. Then depress the down arrow next to the Account Numbers field. The following selection for the posting account will appear:

Select the account. Depress the OK button.

Note that the Payment Amt and the Total Detail must be equal before the save button will be available.

Depress the Save button to save changes, depress the Abandon Changes button to abandon changes. NOTE: Once this record is saved it will not be editable, if changes are needed to the record you will be required to close the existing record and create a new one accordingly. For further explanations see Article #2328.

|

| 1.6.4.3.2. Edit an Automatic Bank Deduction |

Editing a Automatic Bank Deduction

You may only make a change to an un-saved Automated Bank Deduction. If it’s been saved, you are able to edit the Note information only. The reason for this is that these records are the source for the automatic deductions frm the bank account and if we did allow any of the items to be changed user would have no audit trail. (For example if you have an automatic deduction from bank account for payment of an auto loan of $500 on the 2nd of each month and system allowed you to change the amount from $500 to $400 for an office equipment loan in July, you would have no audit trail back for the $500 auto loan). So instead of editing a record, the user may change the status to Closed and then add a new automatic bank deduction with the desired features. For further information see Article #2328.

|

| 1.6.4.3.3. Close an Automatic Bank Deduction |

To close out an automatic bank deduction. Highlight the pertinent deduction and depress the Close button.

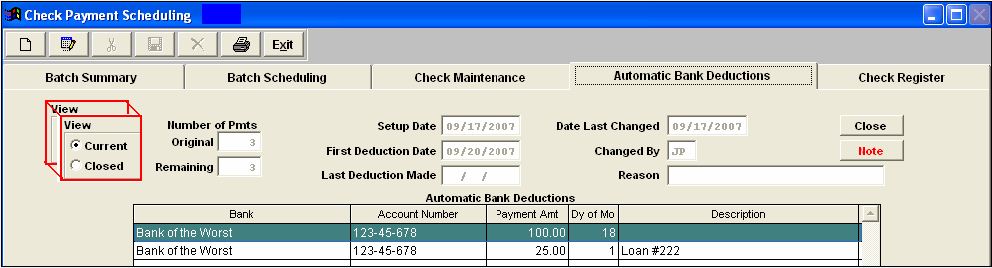

Type in your password. Depress the Save button to save the changes, depress the Abandon Changes button to abandon the changes. To view the deduction you’ve closed, click on the Closed radial and the screen view will update.

|

| 1.6.4.4. Check Register |

| 1.6.4.4.1. Create a Check Register | ||||||||||

Depressing the Check Register tab will bring up the following screen:

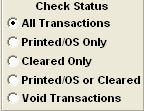

To design the check register display and the applicable print out, depress the down arrow next to the Bank field. Select the pertinent bank. The account number and account name will automatically fill in .If you are interested in only one specific payee, depress the down arrow next to the Payee filed and select the desired payee. If you want to view a specific date range, type in the Date Range From and To. If you are interested in a range of check numbers, type in the first and the last check number into the Check Number Range fields. Determine the Check status you desire by click on the appropriate radial:

All transaction status types will display in the detail. Only checks marked off as Cleared in the Bank Reconciliation module will display. Both un-cleared and cleared checks will display. Once you have all of the criteria selected, hit the Display button:

Once the display is showing on the screen, you may sort by Bank, Account Number, Check Number, Date, Payee or Status by clicking on the column header: To view the detail of any line item, click on the Detail column on the far right hand side.The following screen will display:

To further view any notes pertaining to the Check, depress the Check Note button. To view any note specific to the individual line item, depress the Item Note button. Hit Exit to return to the main screen. To reset the selection criteria, depress the Reset Criteria button. Then re-design the display. |

| 1.6.4.5. How To Pre-Pay A Supplier | ||

The following screen will appear:

Depress the Check Maintenance tab. User can enter all of the information for a manual check on this screen.

Select the Add button, then select the Bank from the Pulldown, then check the "Record and Print a Check", then check the "AP Prepayment" box.  Once the AP Prepayment box is check, an additional box will appear for user to enter a Prepay Reference number (if applicable). NOTE: A Prepay GL number must be setup in the GL Acct Setup screen and the Purchase AP Setup in order to use this option.

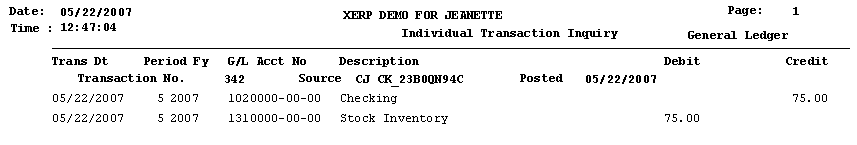

Check number and date will default in, but may be edited: Select the Supplier (payee) from the pulldown and enter the Check amount. The "Add Item" button at the bottom of the detail info screen will become available:  Depress this button and the detail information will default in, enter a GL number:  Save Record and print check. The entry will record as follows:  To apply this Prepayment against an Invoice use the AP Offset module.

|

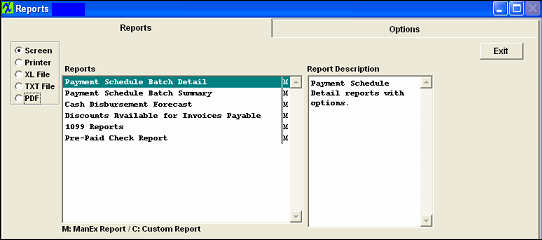

| 1.6.5. Reports for Payment Scheduling |

| 1.6.5.1. Check Reports | ||||||||||||||||||||

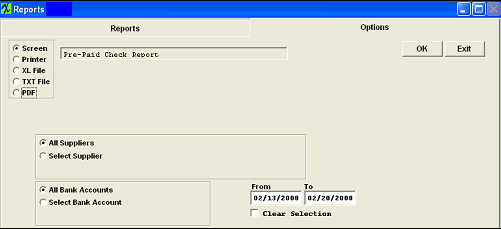

Print Check Reports

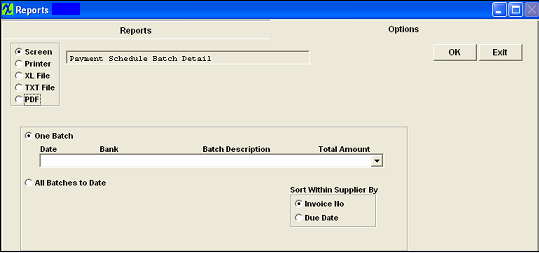

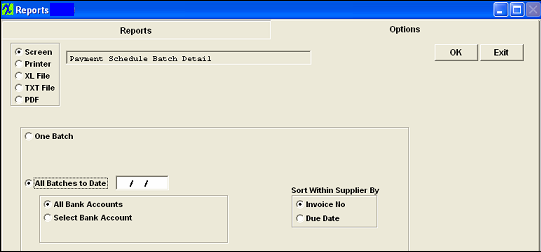

The following screen will appear:

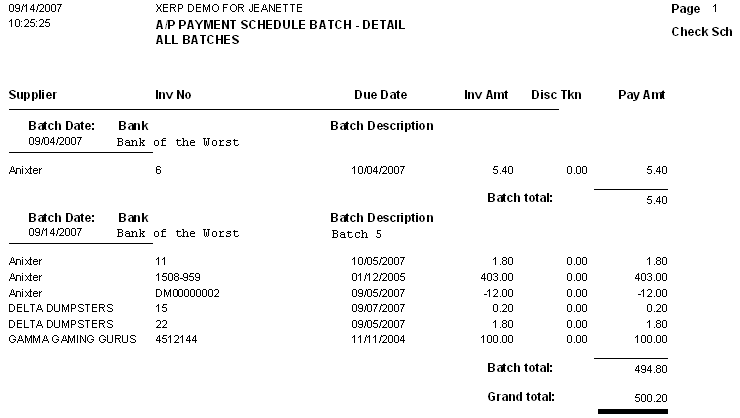

Payment Schedule Batch Detail

The following report will be displayed.

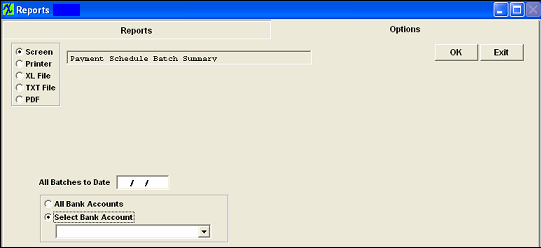

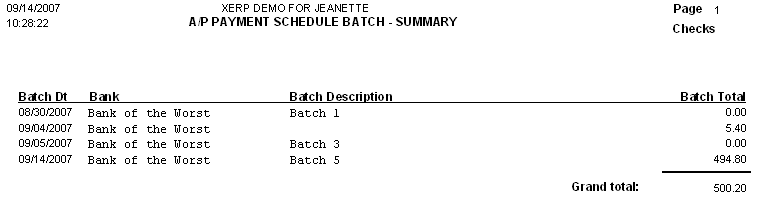

Payment Schedule Batch Summary

The following repot will be displayed.

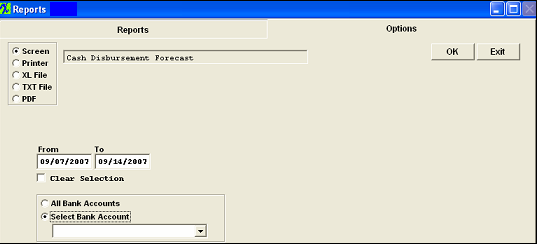

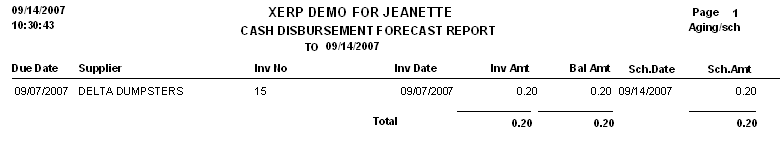

Cash Disbursement Forecast Report

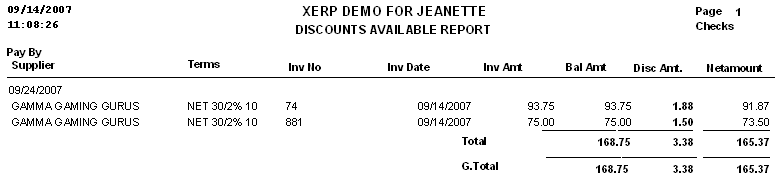

The following report will be displayed. Discounts Available for Invoices Payable Highlight the report in the listing. Then depress the OK button. The following report will be displayed.

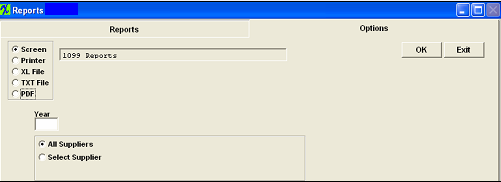

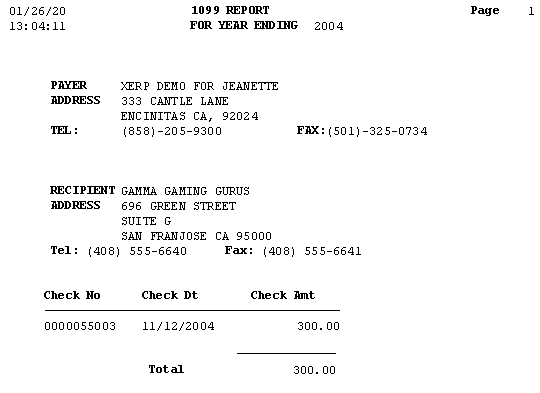

1099 Reports

The following reports are available: "1099 Report for Year Ending ...." and "1099 Report Summary for Year Ending ...."

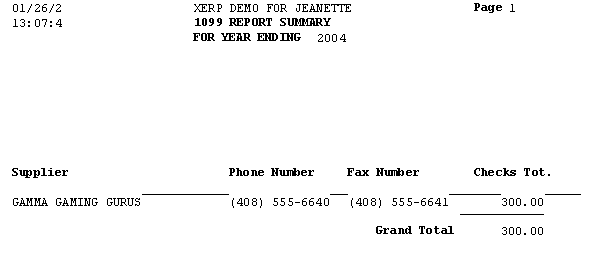

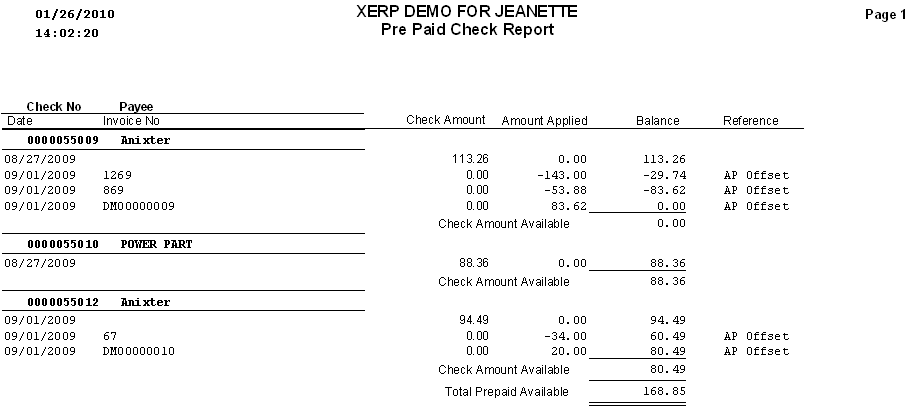

Pre-Paid Check Report

The following report will print:

|

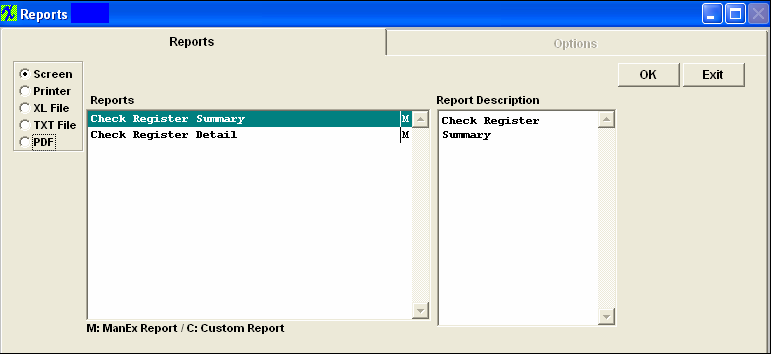

| 1.6.5.2. Check Register Reports |

Print Check Register Reports

The information will be based on the criteria selected in the Check Register screen

Once the display is as desired, if you want a hard copy printout, depress the Printer Icon and the following reports will be available.

Highlight the desired report, Select one of the radio buttons for the output you desire; Screen, Printer, XL File, TXT File, or PDF, and depress the OK button.

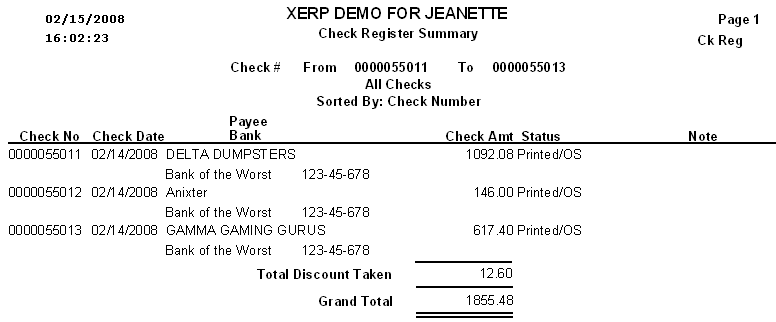

Check Register Summary Report

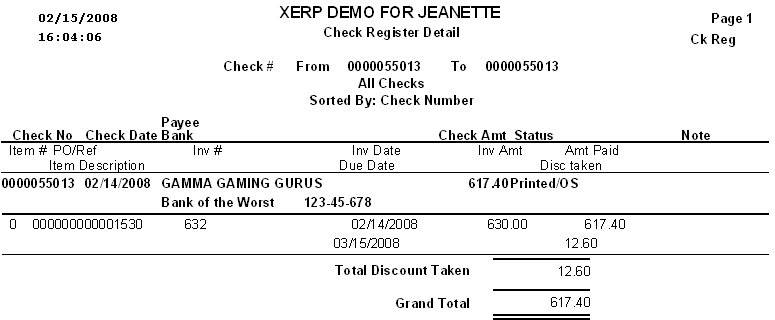

Check Register Detail Report

|

| 1.7. Accounts Payable Offset |

| 1.7.1. Prerequisites for A/P Offset |

|

Users MUST have full rights to the "AP Offsets and Debit Memos" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. Only the items currently existing in the A/P Aging with a status other than "Editable" and "Deleted" will appear. AP Invoices MUST be released before they will be displayed in the AP Offset. AP Invoice records that have a status of "Deleted" or "Editable" will NOT be brought forward into the AP Offset module.

|

| 1.7.2. Introduction for A/P Offset |

|

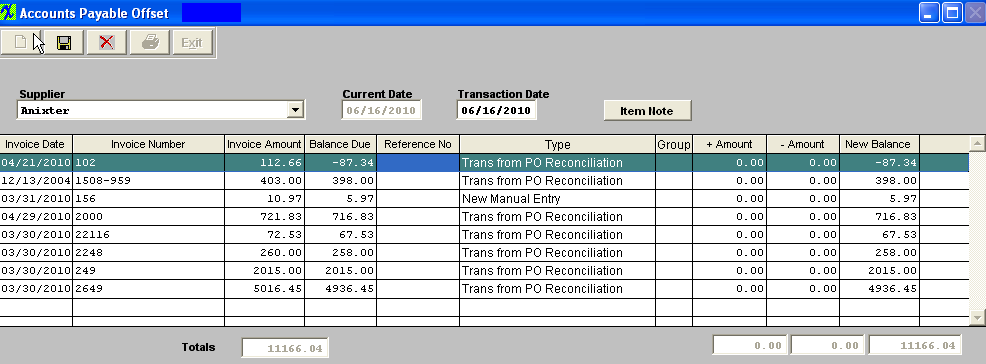

The Accounts Payable Offset section allows the user to apply an open debit memo and/or prepayments against an invoice, or to debit and credit several invoices to change the amounts due per invoice. |

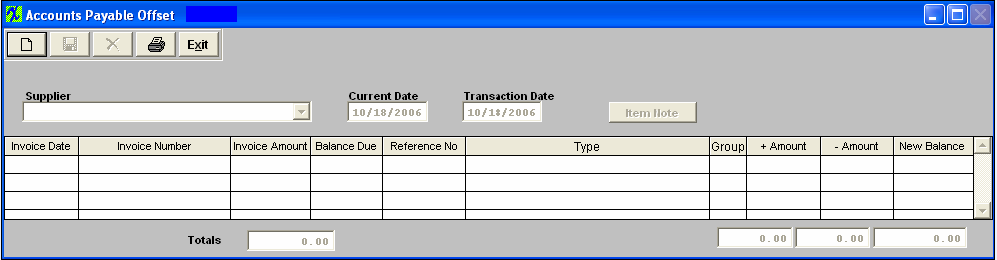

| 1.7.3. Fields & Definitions for A/P Offset | ||||||||||||||||||||||||||||||

|

| 1.7.4. How To .... for A/P Offset |

| 1.7.4.1. Add an AP Offset | ||

|

The following screen will appear:

NOTE: Only the items currently existing in the A/P Aging with a status other than "Editable" and "Deleted" will appear. AP Invoices MUST be released before they will be displayed in the AP Offset. AP Invoice records that have a status of "Deleted" or "Editable" will NOT be brought forward into the AP Offset module.

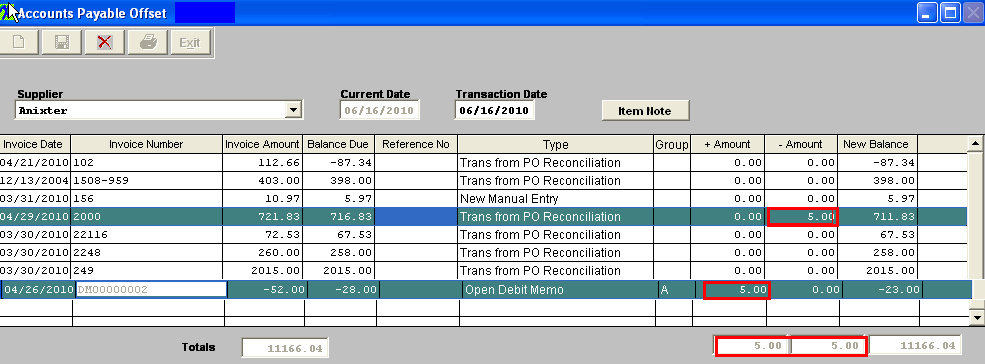

To offset, select the applicable invoice. Type in any amount you want subtracted to the invoice in the - Amount column. Type an equal amount in the + Amount column that you want subtracted from a Debit Memo. Continue this until the totals appearing at the bottom of the screen equal the same amounts for both the + and – Amounts columns, as illustrated below:

User can at this time add an Item Note and this note will only appear on the AP Offset Report.

|

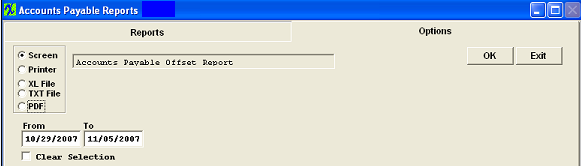

| 1.7.5. Reports for the A/P Offset | ||

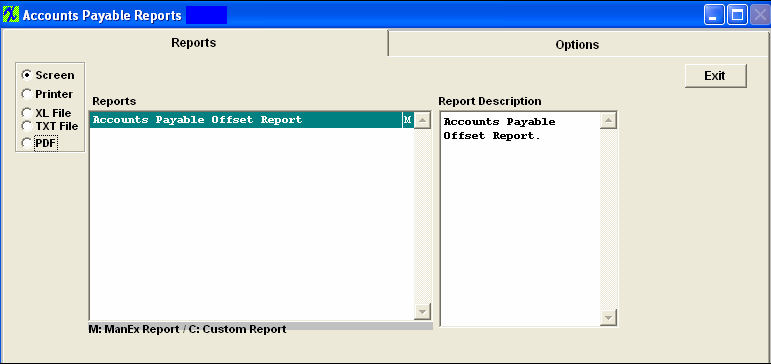

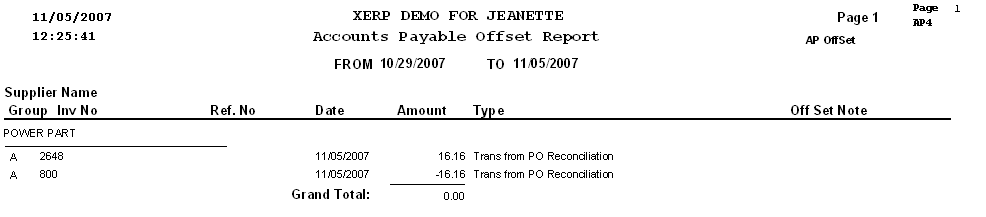

Accounts Payable Offset Report To obtain a printout, depress the Printer Button. The following report will be available.

The following report is available:

|

| 1.8. Debit Memo |

| 1.8.1. Prerequisites for Debit Memo | ||

Users MUST have full rights to the "AP Offsets and Debit Memos" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access.

|

| 1.8.2. Introduction for Debit Memo |

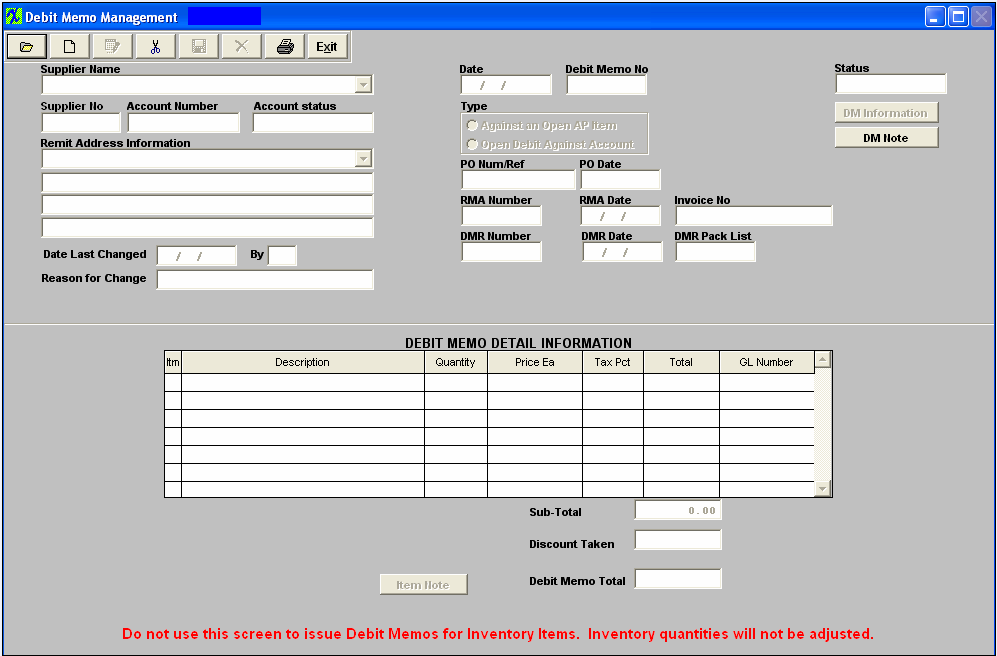

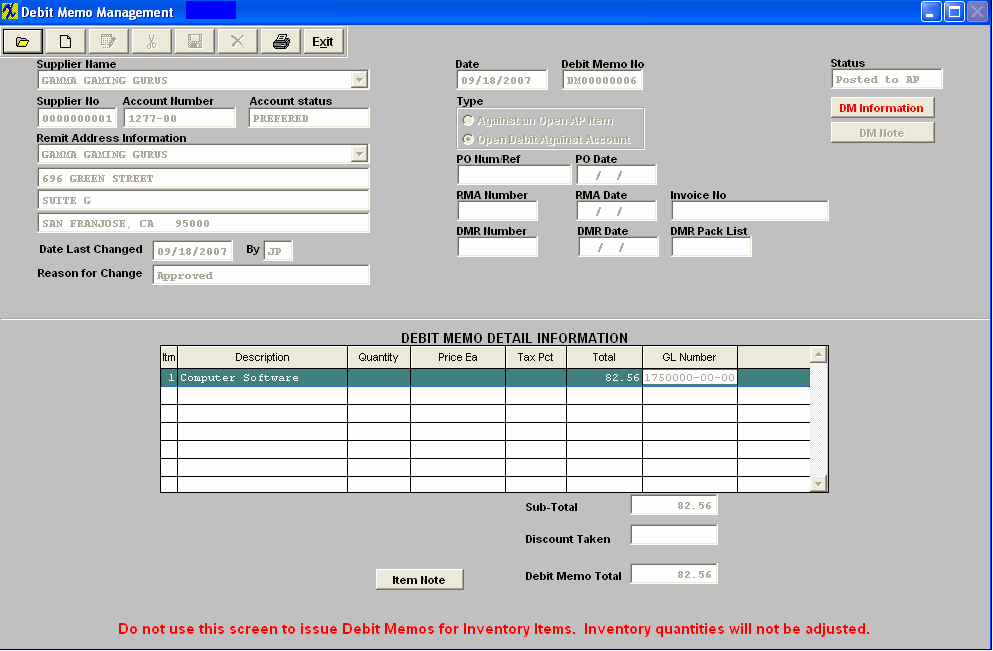

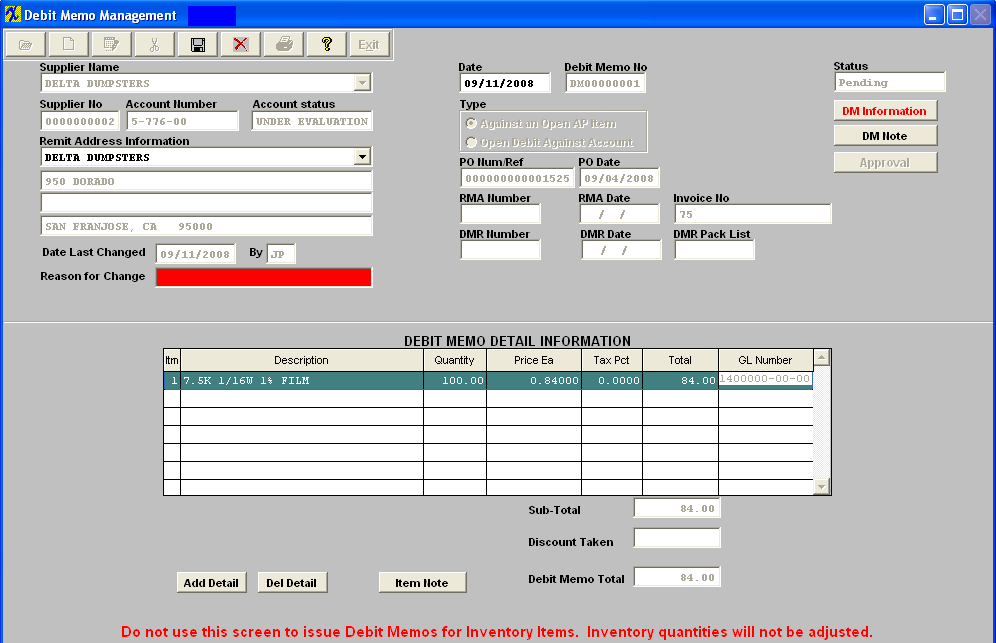

There are two types of Debit Memos: One created via the DMR process and the ones created directly via this entry screen.

Note: That if the Debit Memo concerns a return of inventory, the user should use the DMR process because any Debit Memo affecting the inventory general ledger numbers should be created via the DMR process. Note: A Debit Memo created against an open supplier invoice will automatically net against that invoice in the A/P Aging. In the case of a DMR Debit Memo, if the supplier invoice has already been paid, then a Debit Memo will forward to the A/P Aging. This open Debit Memo may be offset against other open invoices from that same supplier via the A/P offset module.

Additionally, please note that ONLY a "From Inventory DMR" will generate a Debit Memo (Only if the PO has been reconciled and transfered to AP). If a DMR was created "From a Purchase Order" then there will be no Debit Memo created – this is adjusted automatically within the ManEx system prior to the PO Reconciliation. Only what has been ACCEPTED will forward to the PO Reconciliation module. |

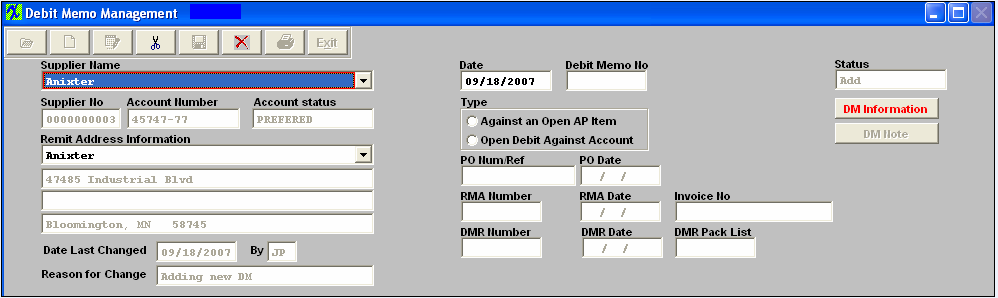

| 1.8.3. Fields & Definitions for Debit Memo | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Debit Memo field Definitions

|

Supplier Name

|

The name of the supplier for which the DM was created.

|

Date

|

The date of the DM.

|

Debit Memo Number

|

The unique number assigned to the DM.

|

Status

|

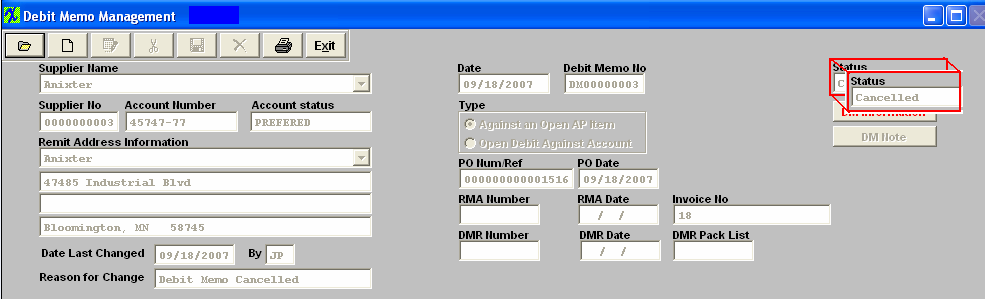

The Status of the Debit Memo - "ADD" "Pending" "Posted to AP" "Released to GL" or "Cancelled"

|

Supplier Number

|

The number assigned to the Supplier in the Supplier Information master.

|

Account Number

|

The number by which the supplier identifies the user.

|

Account Status

|

The status of the supplier, approved, pending, etc., per the Supplier Information master.

|

Type

|

The radial denotes the type of DM, either against an open A/P invoice or created as a general DM, just against the account without regard as to whether there was any open invoice.

|

|

If displayed in Red, depressing this button will bring up the information typed in when debit memo was created.

|

|

Depress this button to add any notes pertinent to this DM. If displayed in Red, depressing this button will display any pertinent notes re this DM.

|

Remit Address Information

|

This is the remit to address for this supplier per the supplier information master.

|

PO Num/Ref

|

The Purchase Order number that the original Invoice was applied against.

|

PO Date

|

The Order Date pulled forward from when the Purchase Order was originally created.

|

RMA Number

|

This would be the RMA number information that was entered within the DMR module. RMA Date |

|

This is the RMA Date information that was entered within the DMR Module. Invoice No |

|

The Original Invoice that the Debit Memo is being applied against. DMR Number |

|

The DMR number that was assigned within the DMR module. DMR Date |

The date that the associated DMR was processed |

DMR Pack List |

|

The Packing List Number that was assigned to the DMR within the DMR module. Date Last Changed |

|

This is the date of any changes made to the original DM. By |

|

The initials of the user who made the last change. Reason for Change |

|

The description of the reason for the last change. DEBIT MEMO DETAIL INFORMATION section:

This is the item number of the detail. The description pertaining to this specific line item. The quantity for the line item. The price each for this line item. The sales tax percentage applicable to this line item. The sum of the (quantity X price each) + tax % (quantity X price each) = Total. The general ledger number for this line item. The total of the DM, after discount and including any applicable sales tax. Depressing this button will display any notes pertaining to the line item highlighted. |

| 1.8.4. How To ..... for Debit Memo |

| 1.8.4.1. Find a Debit Memo | ||||||||||

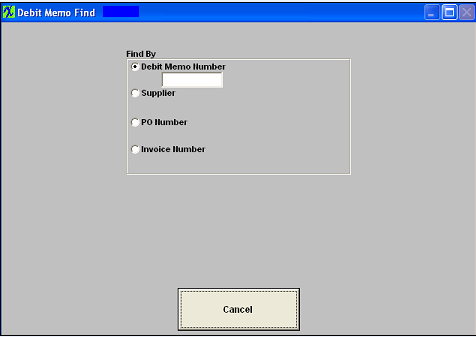

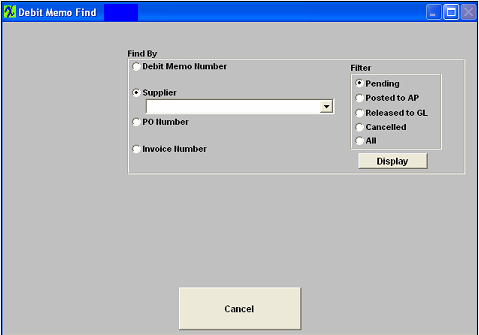

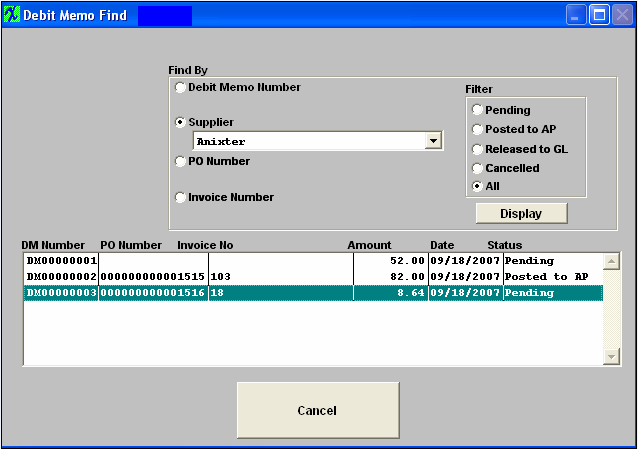

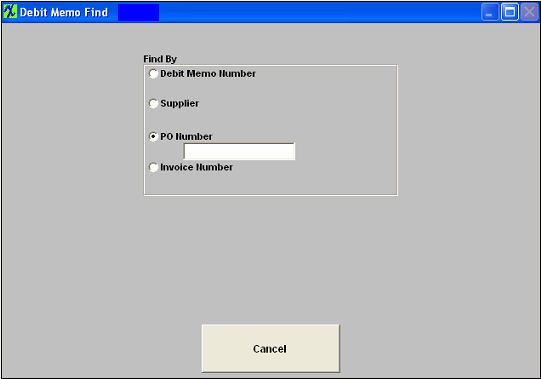

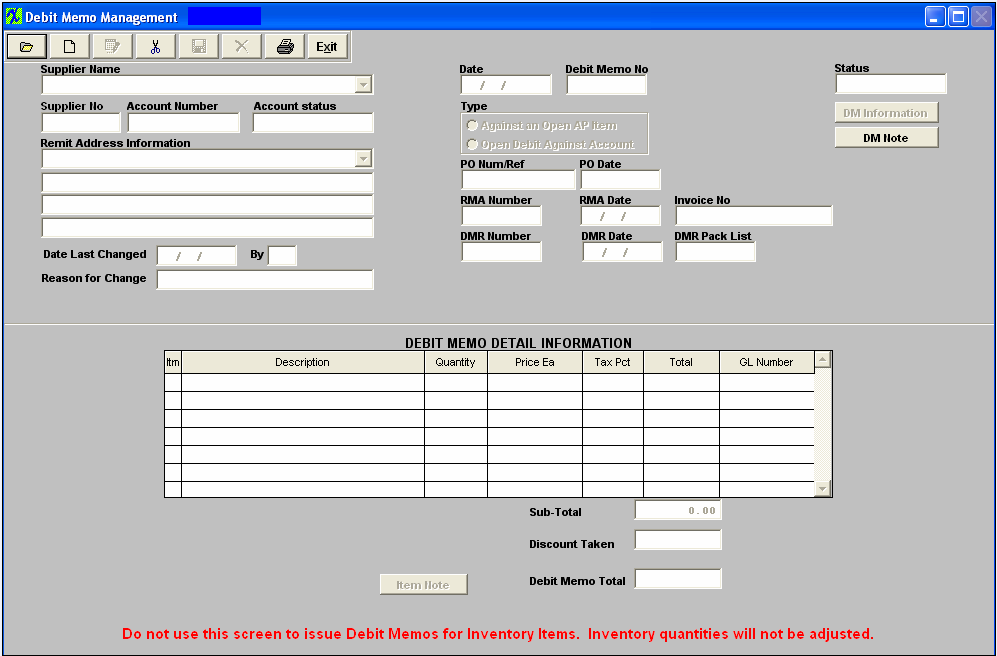

The following screen will appear:

Depress the Find Record button.

The Debit Memo will appear:

|

| 1.8.4.2. Add a Debit Memo | ||||

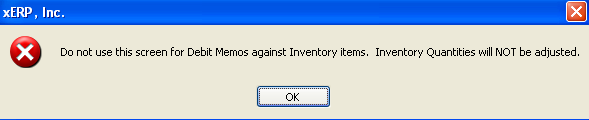

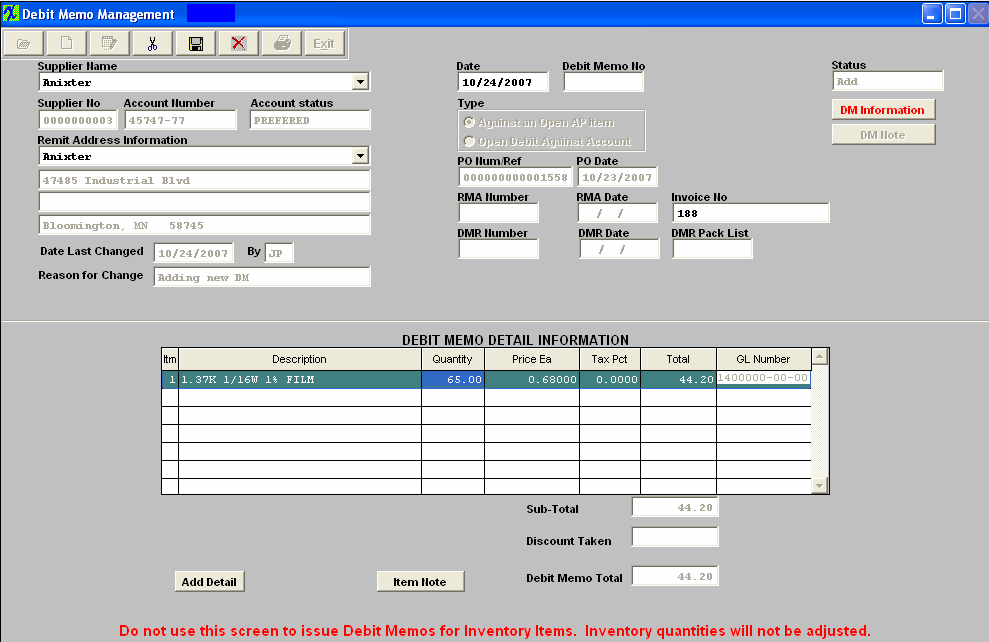

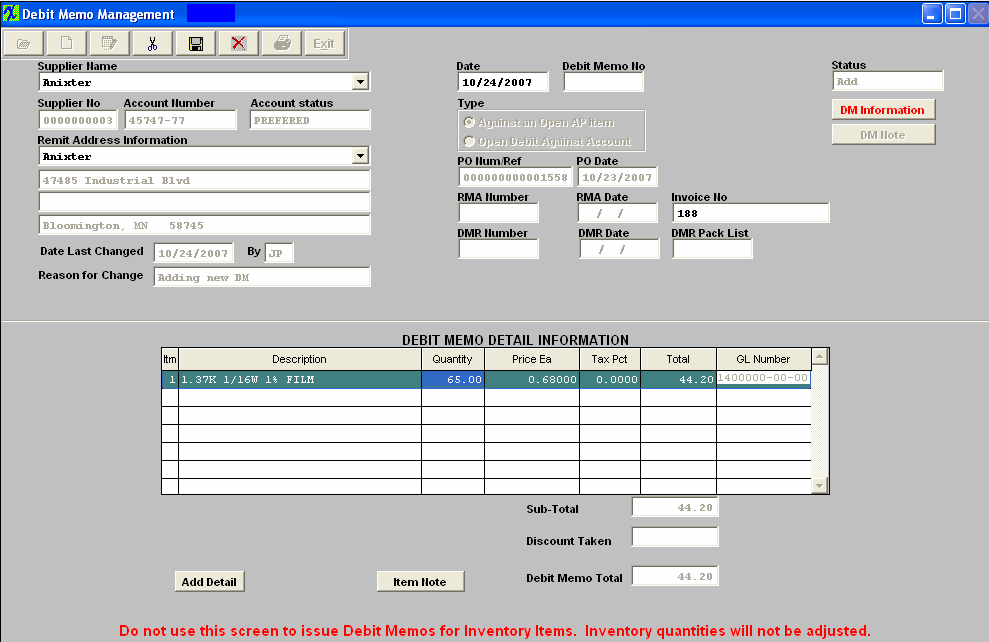

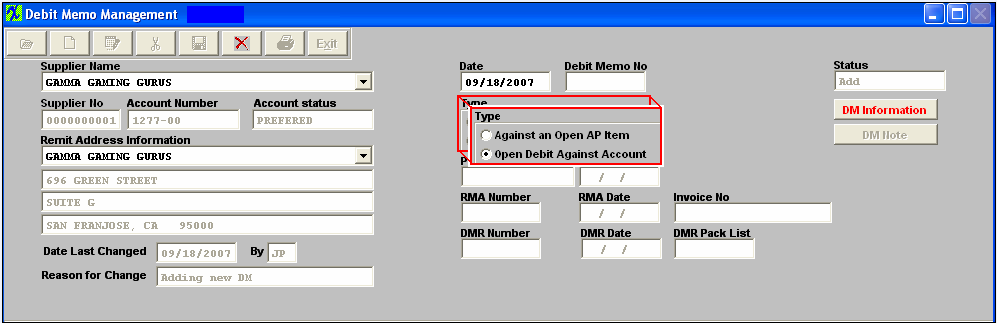

The following screen will appear:  Against an Open AP Item To add a Debit memo against an open A/P invoice, depress the Add button. Type in your accounting password.

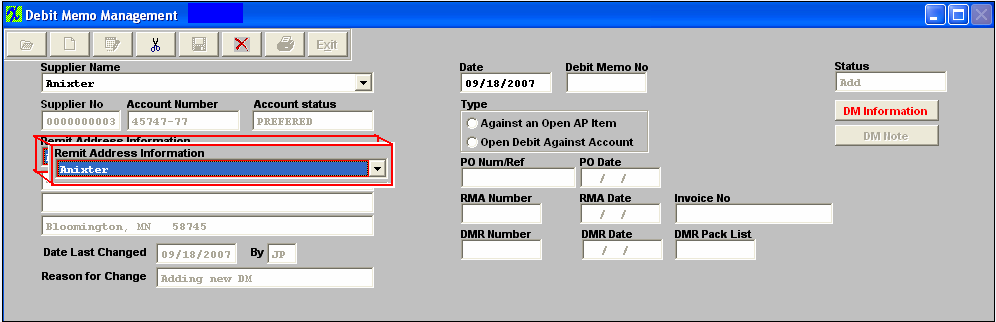

Once the supplier is selected, pertinent information will appear in the screen:

If you need to change the Remit Address Information, depress the down arrow next to the Remit Address Information field. Other address options will appear:

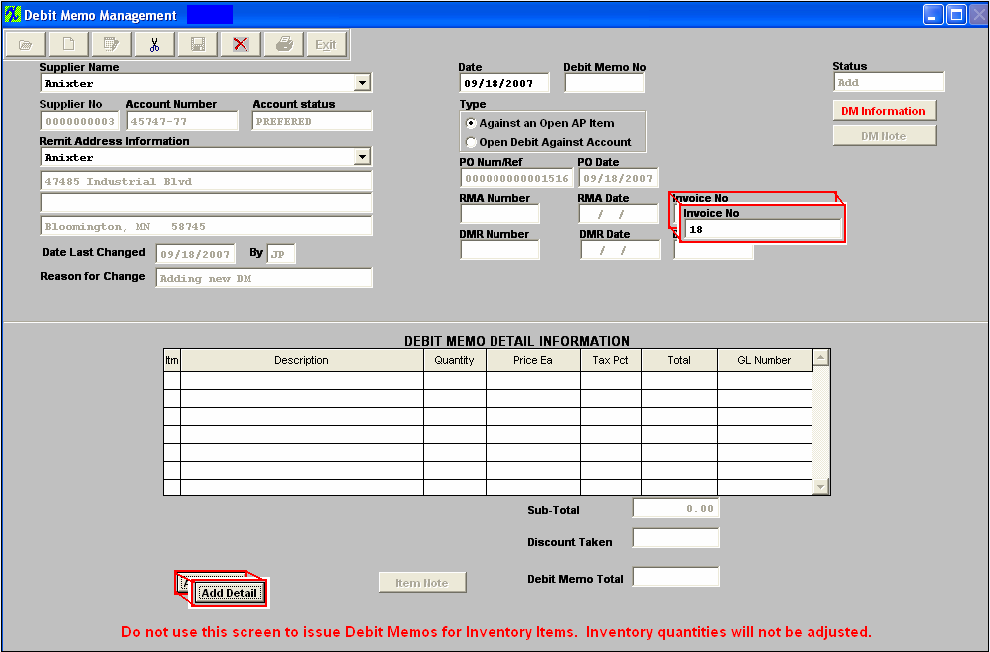

Select the address that pertains to this DM. Click on the Radial for Type as Against an Open AP Item.You will receive the following warning:

Depress the Ok button.

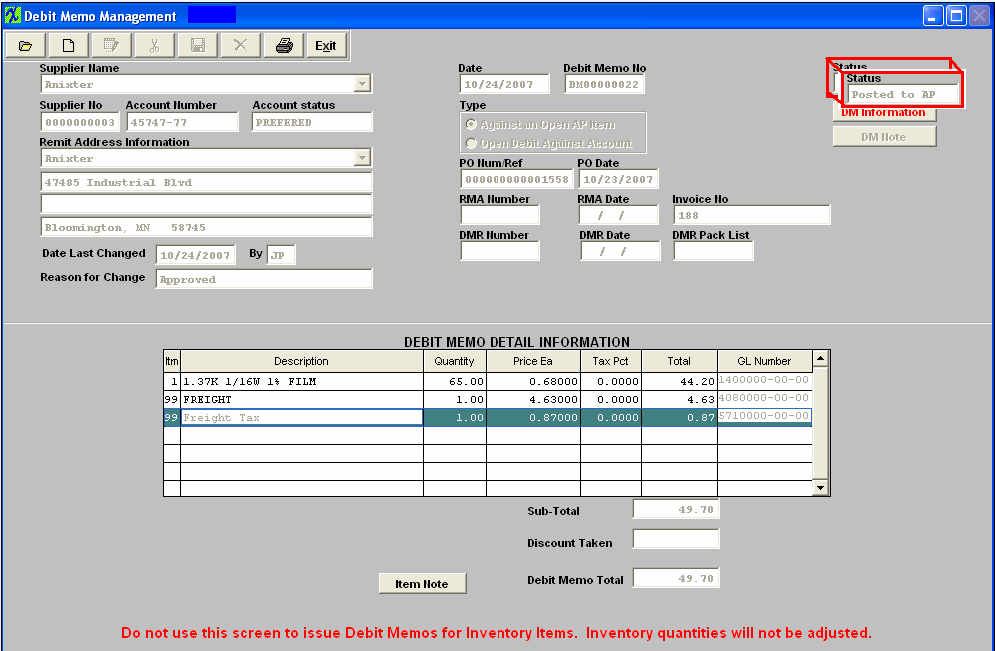

If you want to add a DM Note, depress the DM Note button, depress the Edit button, type in your note, and depress the Save button. Depress the Exit button when complete. Enter the EXACT invoice number. The PO Number or Reference will update automatically.  Depress the Add Detail Button. Type in the Item Number. The rest of the information pertaining to that Item Number will automatically update. Type in the quantity for this line item. The extension for the Total will update. (If you want to add an Item Note, depress the Item Note button, depress the Edit button, type in the note, and depress the Save button, depress the Exit button when finished). The Item Note button will then be displayed in Red.

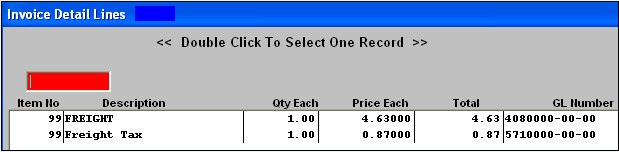

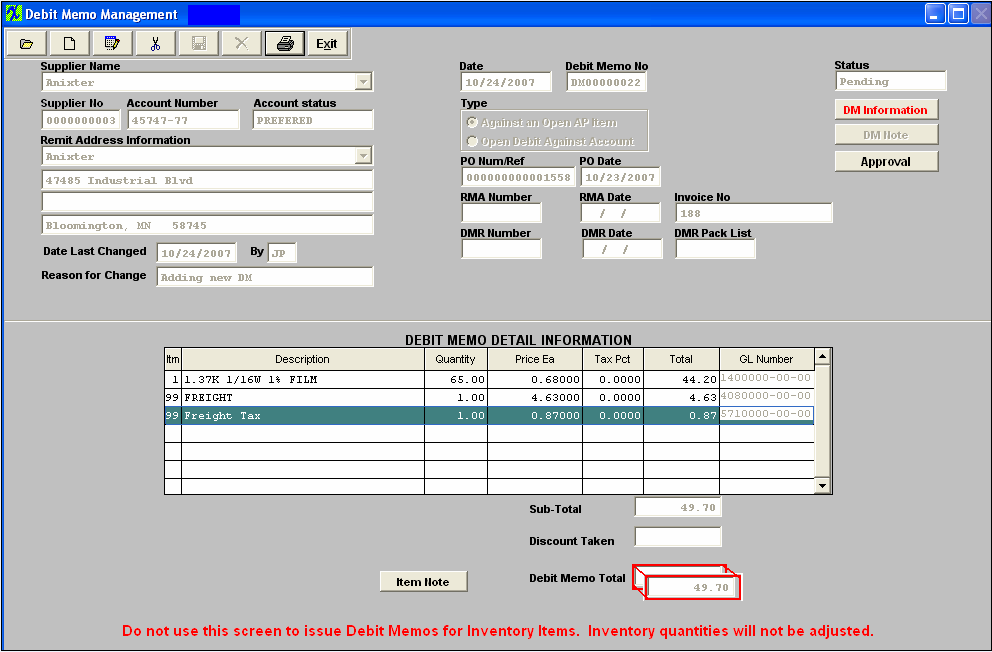

To add freight charges or freight tax to Debit Memo, depress the "Add Detail" button, enter "99" in the item field and the following selection screen will appear that will list the freight and freight tax that was associated with the original Invoice.

Highlight and double click on the freight and/or freight tax to have it included on the AP Debit Memo. The debit memo total will update including the freight and freight tax.

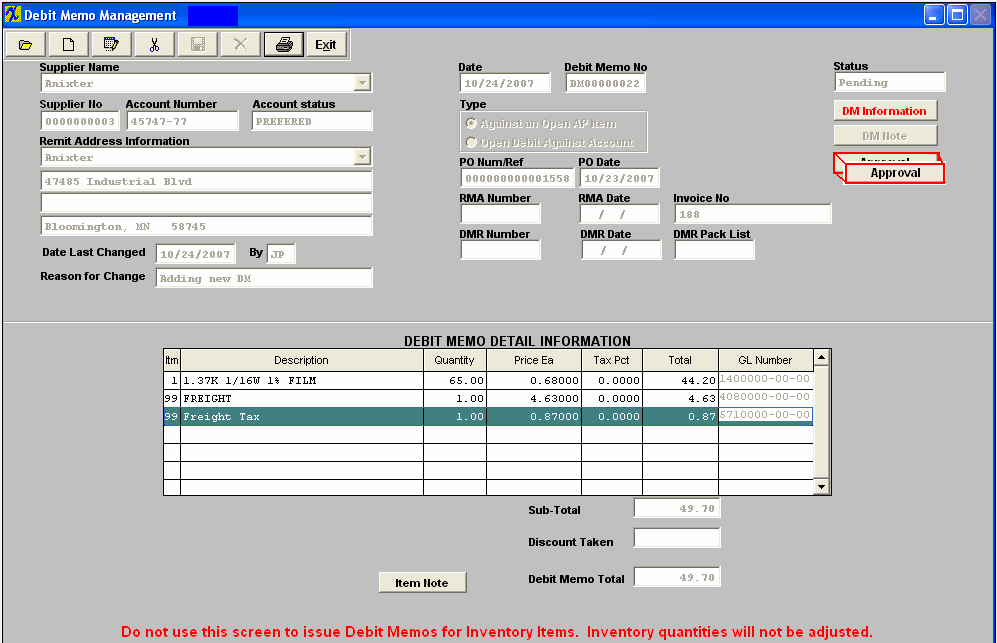

When the DM is completed, depress the Save button to save changes, depress the Abandon Changes button to abandon changes. Once the DM is saved, the Approval button will appear.

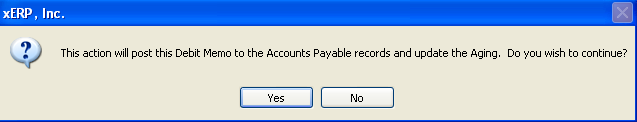

Depress the Approval button.  The following Message will appear:  Depress the Yes button. Enter in your password. The invoice amount in the A/P Aging will be adjusted downward by the amount of the DM.

The Status of the Debit Memo will be updated to “Posted to AP”, and the appropriate journal entry will be created for posting into the General Ledger.  Add an Open Debit Against Account

Follow the steps above, with the following exceptions: For Type, click the radial for Open Debit Against Account.

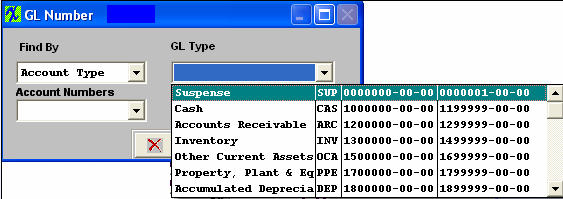

In the Debit Memo Detail Information section, depress the Add Item Button. Type in Item number, Description, Total and the General Ledger Number. Note: if you don’t know the G/L number, place the cursor in the G/L field and hit the Enter key twice. This will bring up the following:

Depress the arrow next to the Find By field. Select either Find By Account Type or Account Numbers. If you selected by Account Type, the following listing will appear, once you’ve depressed the down arrow next to the GL Type field:  Scroll up or down until the appropriate G/L range is found.Then depress the down arrow next to the Account Numbers field. The following selection for the posting account will appear:  Select the account. Depress the OK button. The completed screen will look like this:

|

| 1.8.4.3. Edit a Debit Memo |

The user may edit a Debit Memo up to the time it’s approved and transferred to General Ledger. After Approval (status = “Posted to AP”) the DM can’t be changed. To Edit, find the DM using the procedures in Article #2225 Depress the Edit button and enter your password, the Remit Address Information, Date, and detail information is editable.

Make the desired changes. Depress the Save button to save the changes, depress the Abandon Changes button to abandon the changes. Depress the Approval Button to Post the Debit memo to the AP. |

| 1.8.4.4. Cancel a Debit Memo |

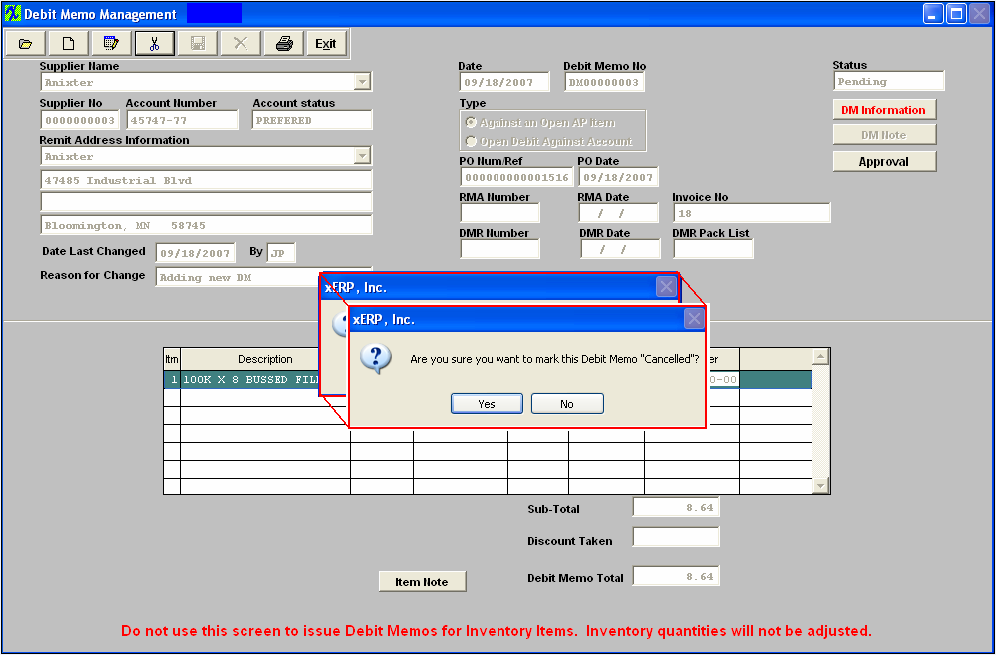

Cancel a Debit Memo The user may cancel a Debit Memo up to the time it’s approved and transferred to General Ledger. After Approval and Transfer, the DM can’t be canceled. To delete, find the Pending DM using the procedures in Article #2225 . Depress the Cancel button. Enter your password. The following Message will appear: Depress the Yes button. Enter your password. The status will then be changed to “Cancelled.”

|

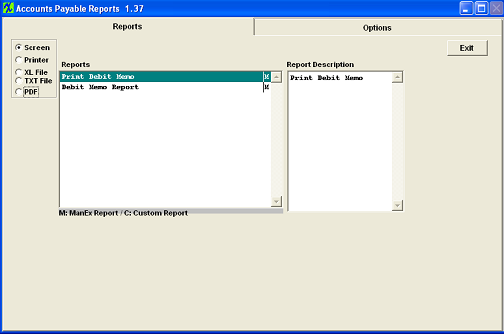

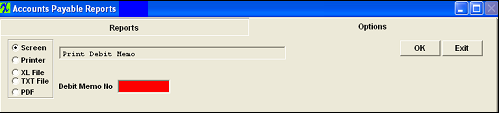

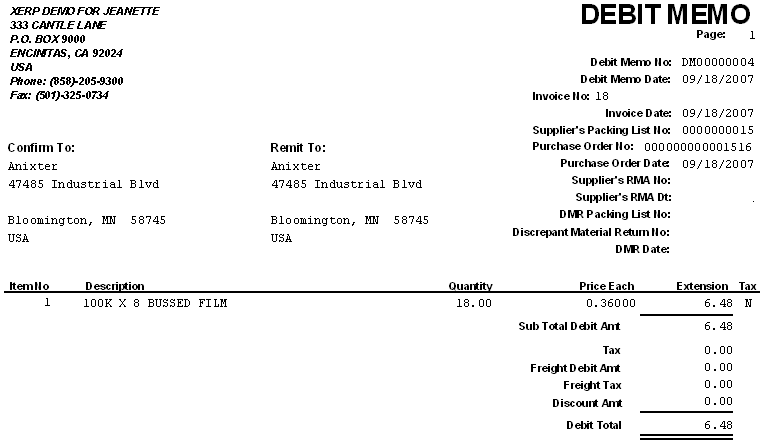

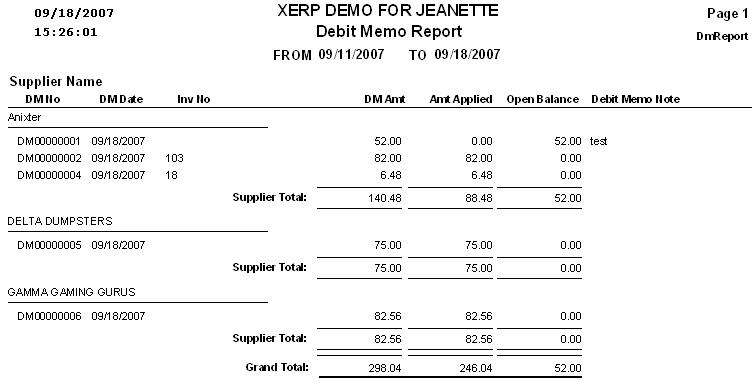

| 1.8.5. Reports for Debit Memo | ||||||

The following report will print:

Debit Memo Report

The following report will print:

|

| 1.9. Bank Reconciliation |

| 1.9.1. Prerequisites for Bank Reconciliation |

|

Users MUST have full rights to the "Bank Reconcilliation" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. |

| 1.9.2. Fields & Descriptions for Bank Reconciliation |

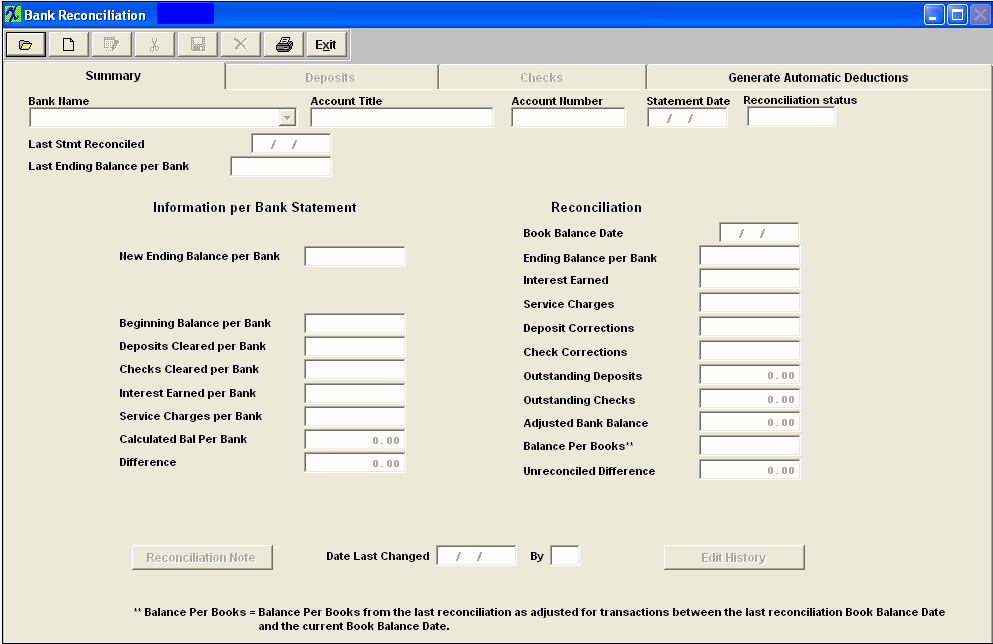

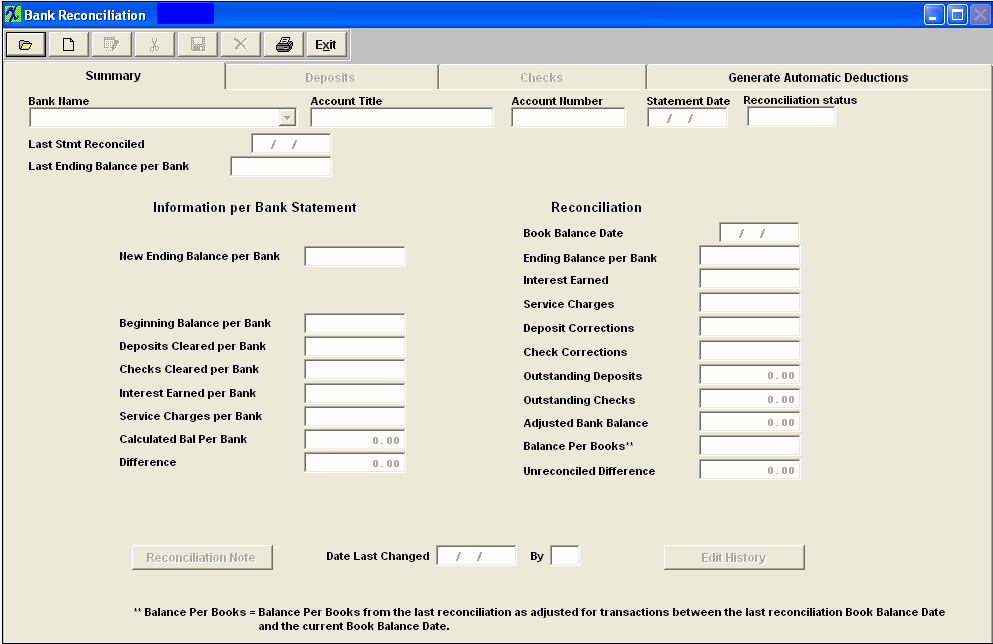

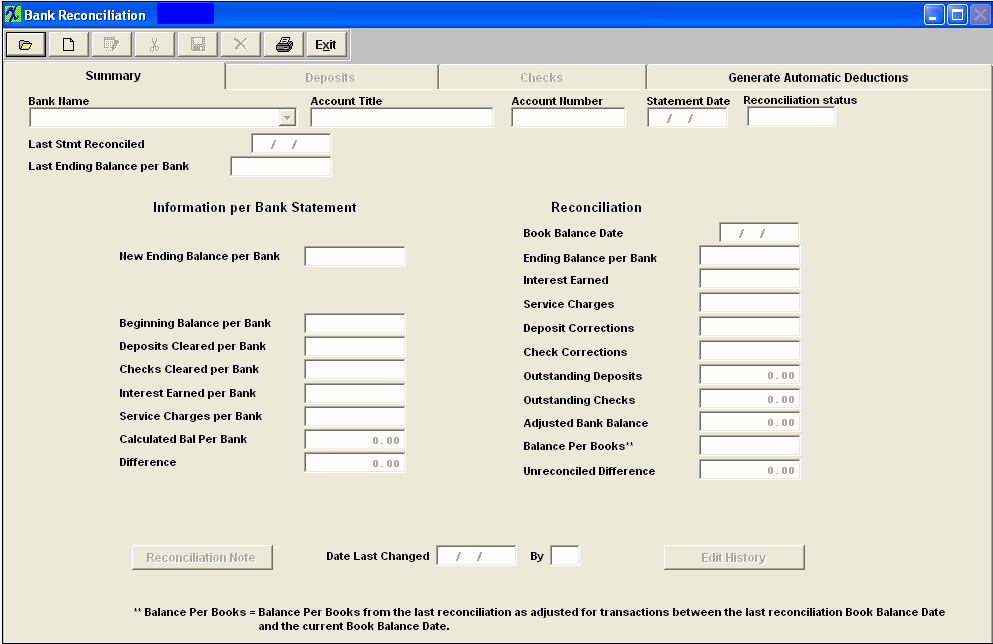

| 1.9.2.1. Summary Tab | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

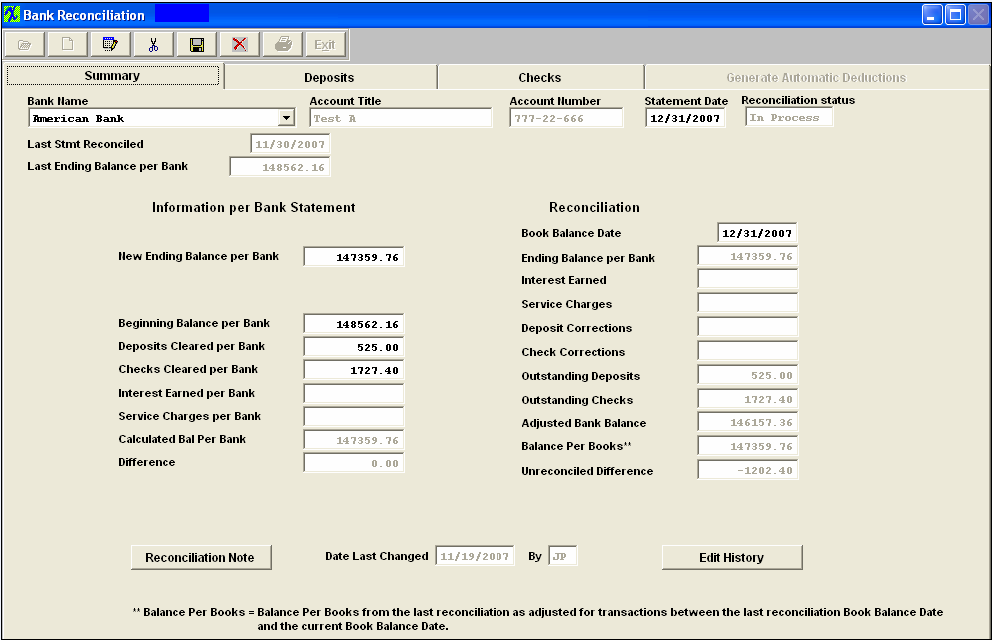

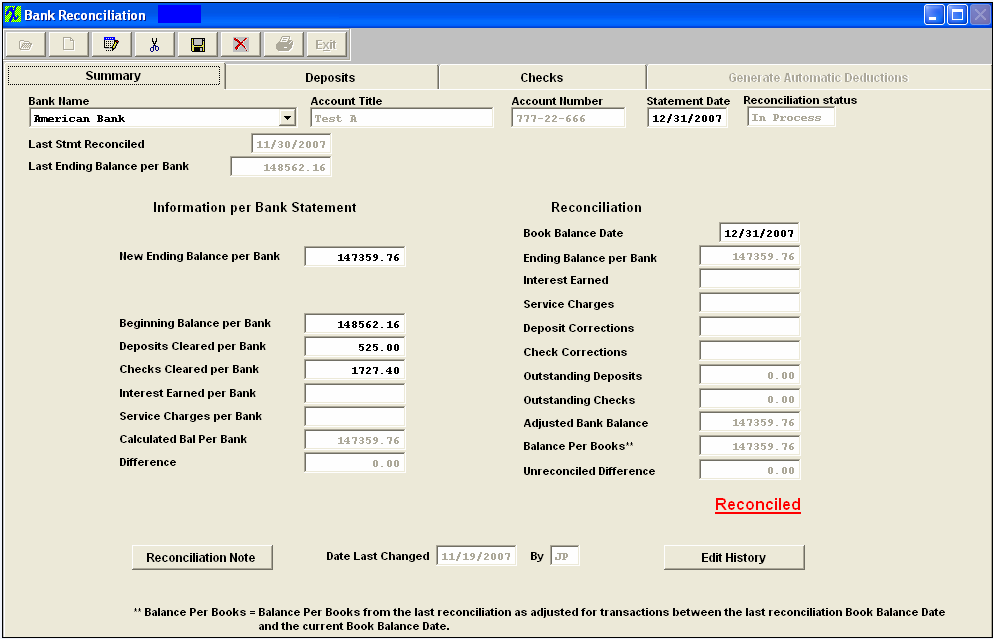

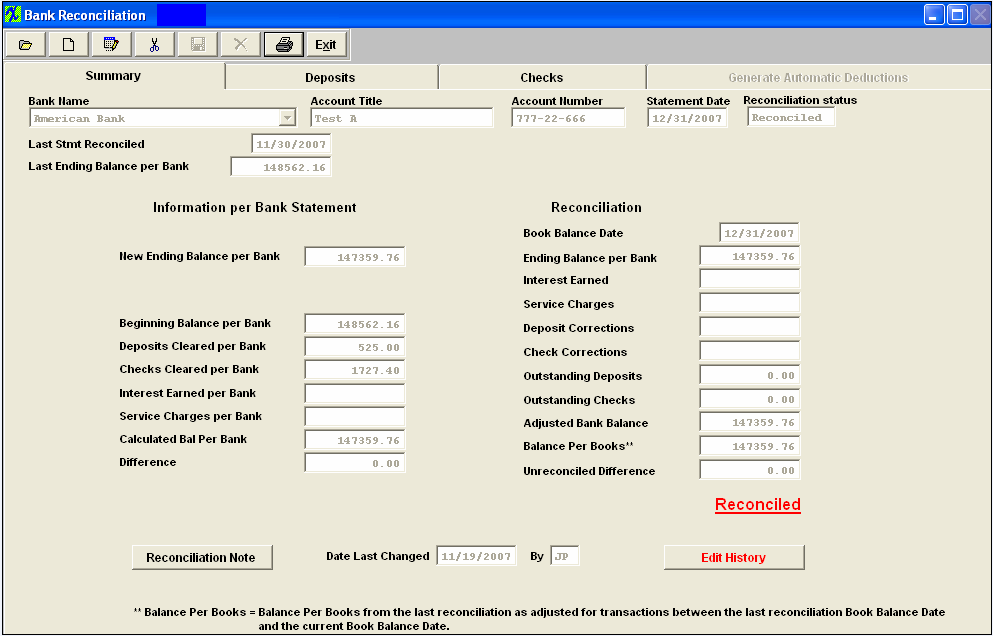

Bank Reconciliation Summary tab Field and Definitions:

Reconciliation (There is no data entry required for this column. All of the line items are entered elsewhere and forwarded into this column.)

|

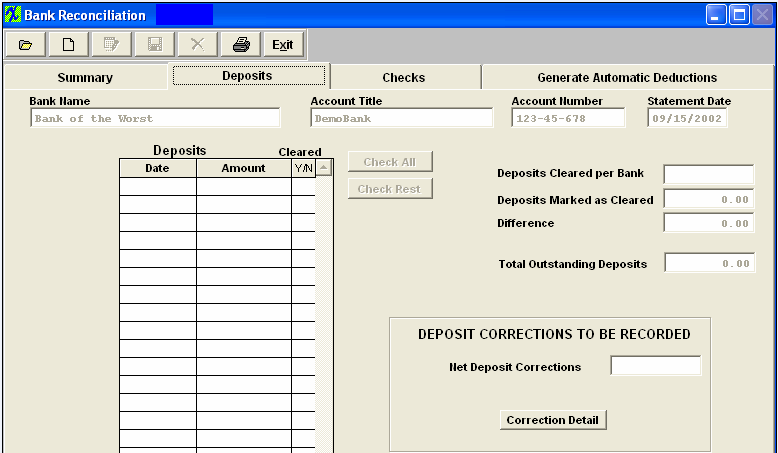

| 1.9.2.2. Deposits Tab | ||||||||||||||||||||||

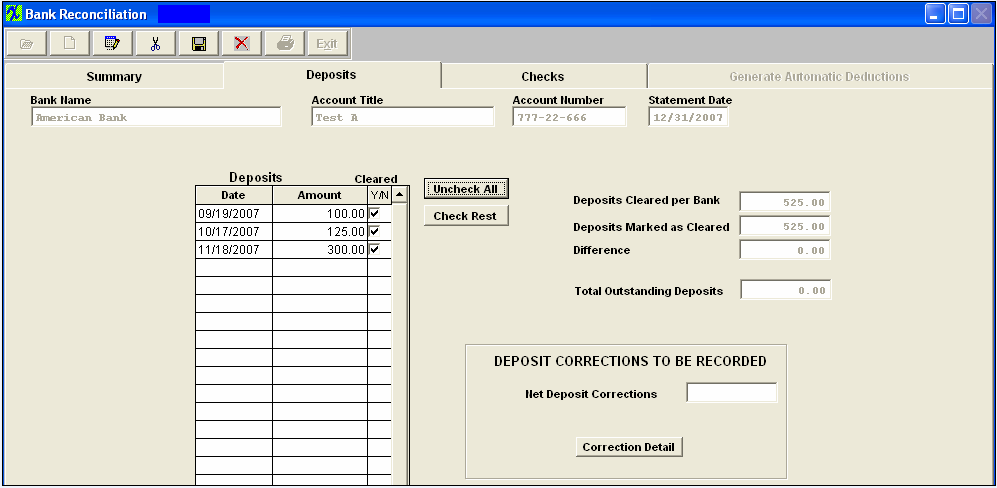

Field Defintions - Bank Reconciliation Deposits tab:

|

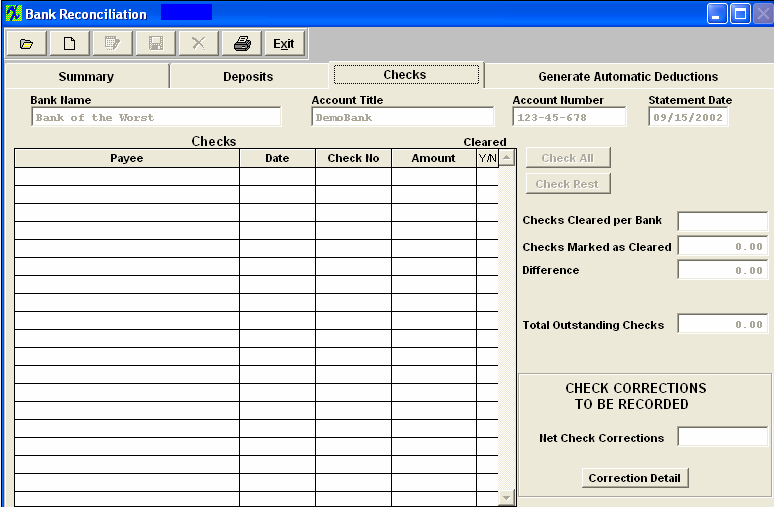

| 1.9.2.3. Checks Tab | ||||||||||||||||||||||

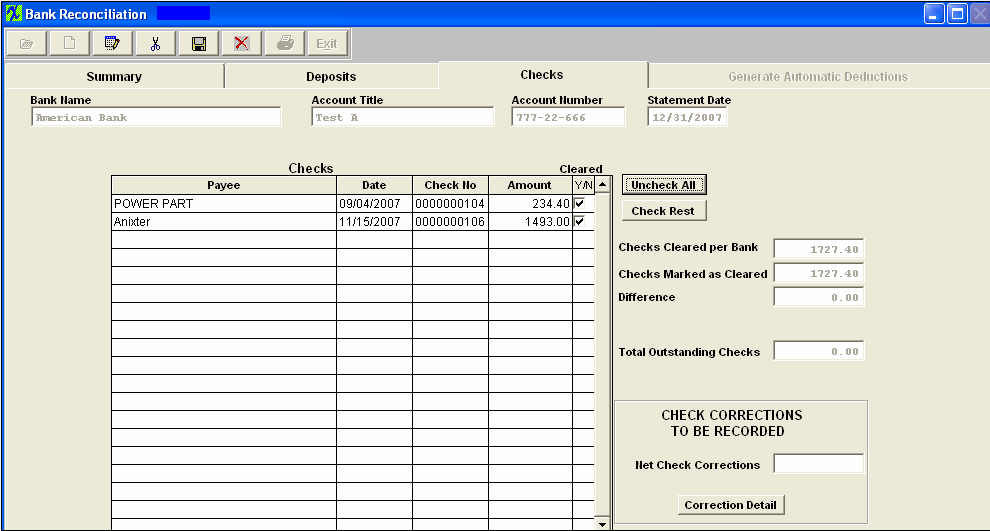

|

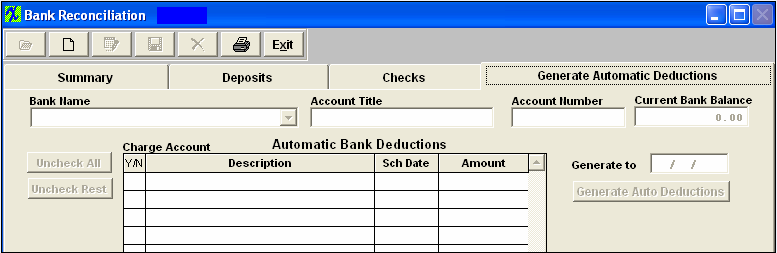

| 1.9.2.4. Generate Automatic Deductions Tab | ||||||||||||||||||||

|

| 1.9.3. How To .... for Bank Reconciliation |

| 1.9.3.1. Generate Automatic Deductions | ||

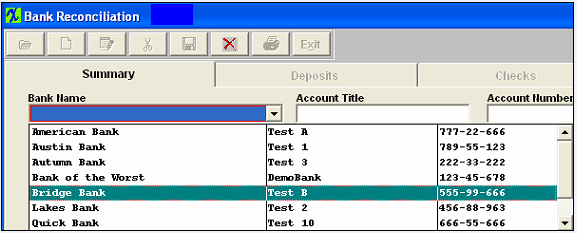

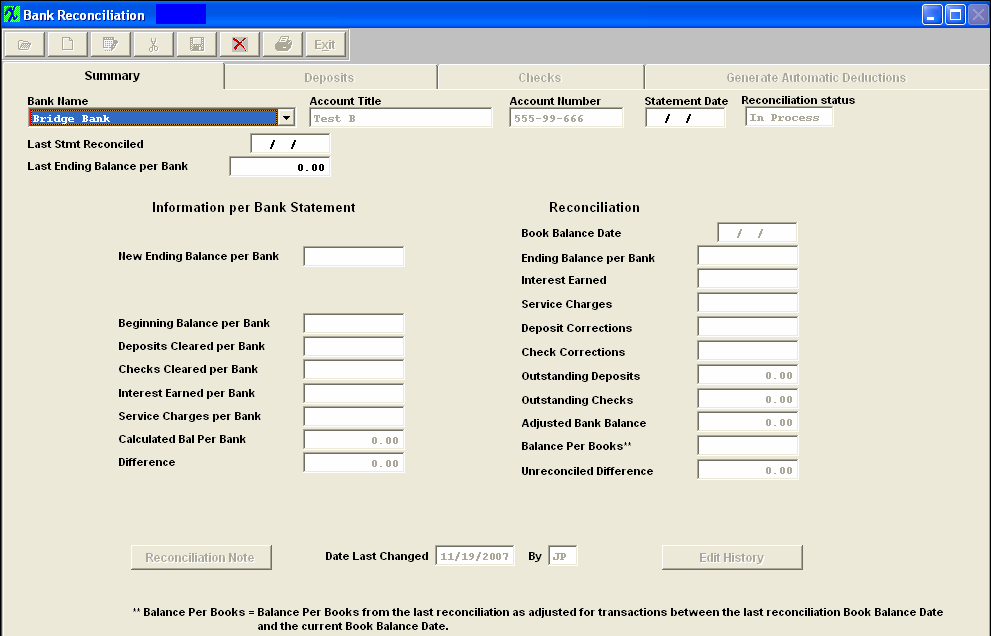

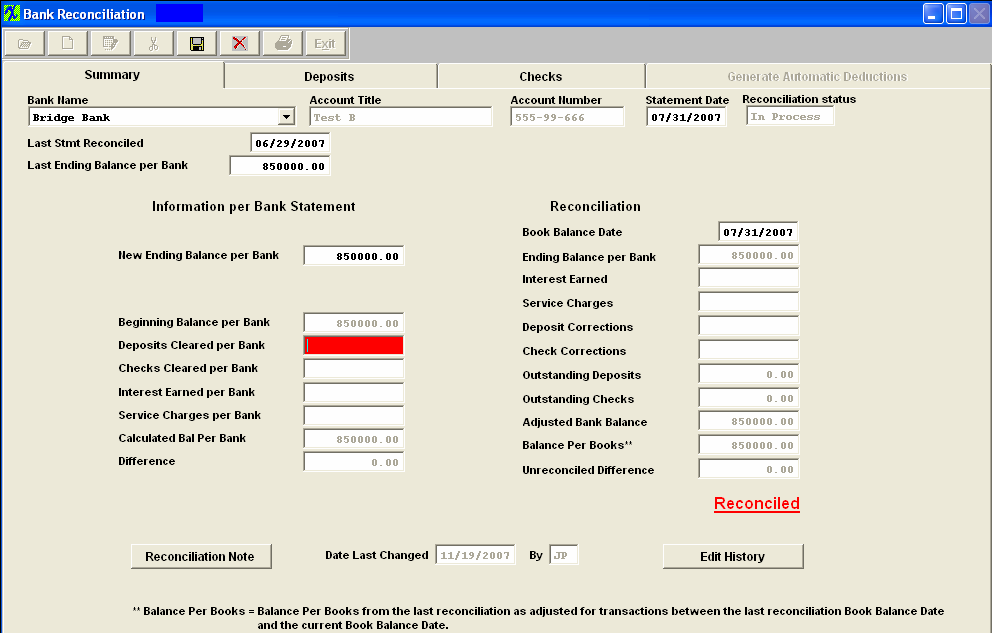

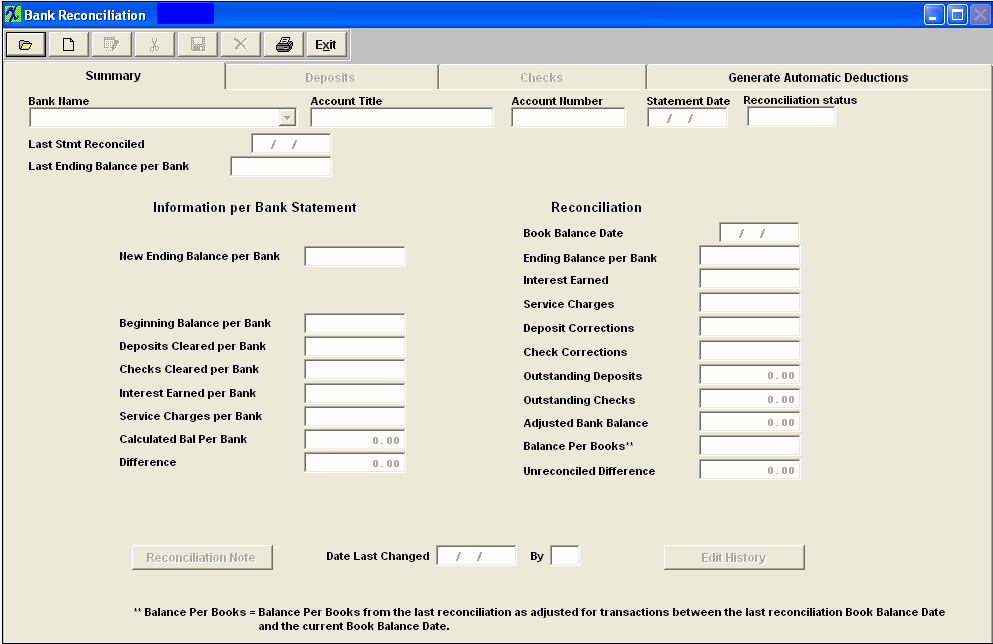

Upon entering the Bank Reconciliation module, the following screen will display:  Note that the Generate Automatic Deductions tab is enabled.

Click on the Generate Automatic Deductions tab and the following screen will appear:

To generate an automatic deduction, depress the Add button and enter your password. Depress the down arrow next to the Bank Name field. Select the appropriate bank. The Account Title and the Account Number will fill in automatically. Type in the date you want to generate to and depress the Generate Automatic Deductions bar. The list of all of the automatic bank deduction will appear:

In the Y/N field, check the ones you want to be generated. Depress the Save button. |

| 1.9.3.2. Adding a Bank Reconciliation |

| 1.9.3.2.1. Initial Bank Reconciliation | ||||||||||||

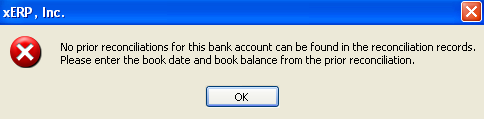

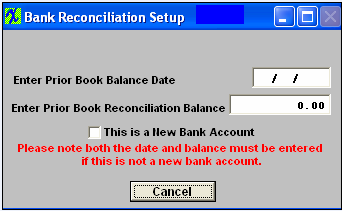

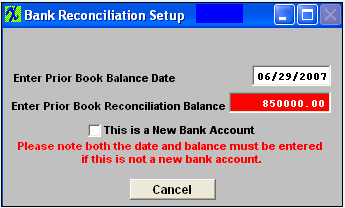

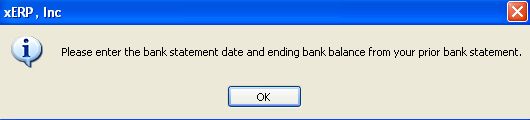

Initial Bank Reconciliation

The following screen will appear:

The screen will populate with the following information:

Enter the Last Stmt Reconciled date, the Last Ending Balance per Bank amount, the Statement Date and the New Ending Balance per bank al the rest of the information will default in and account will be reconciled.

Save Reconciliation

|

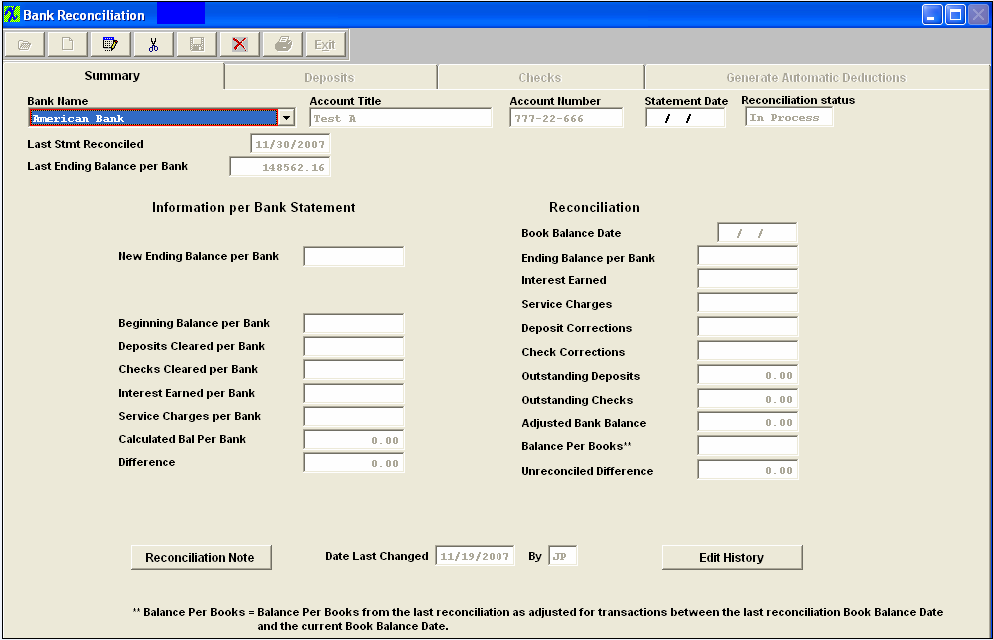

| 1.9.3.2.2. Subsequent Bank Reconciliation | ||||

Subsequent Bank Reconcilliations

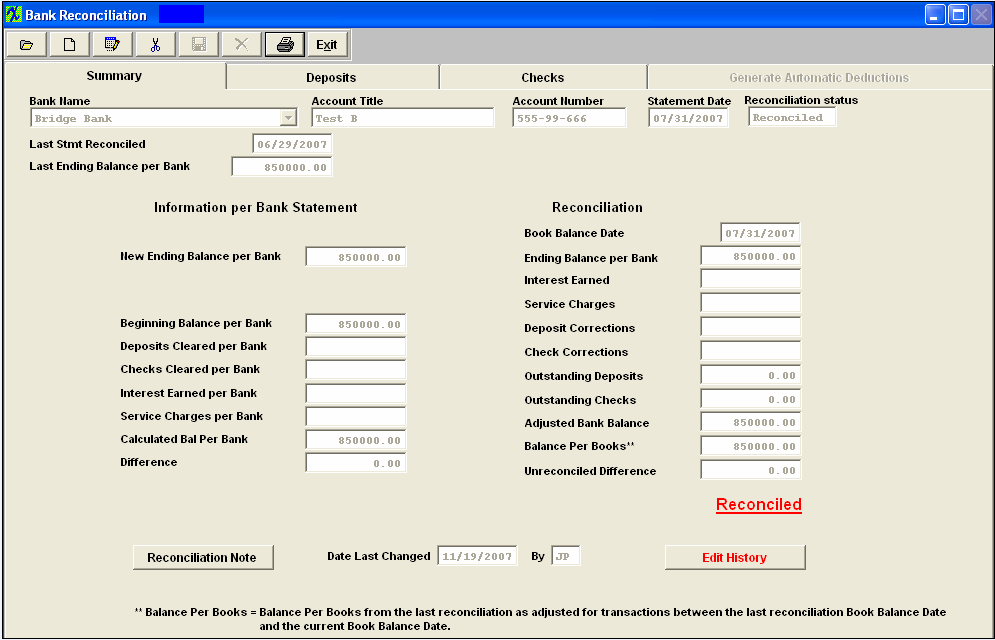

The following screen will appear:

All of the pertinent header information will automatically load, along with the Last Stmt Reconciled date and the Last Ending Balance per Bank amount which will also appear in the appropriate fields:  From your bank statement you are currently reconciling, enter the bank Statement Date, the Book Balance Date and the New Ending Balance per Bank. Enter the total deposits cleared per the bank statement and enter the Checks cleared per the Bank Statement. If applicable, enter the Interest earned per the bank statement. If applicable, enter the bank service charge per the bank statement.  Depress the Deposits tab. Check on the Cleared Y/N box if the deposit has cleared the bank per the bank statement. (NSF records will display as a negative entry and will allow users to check them off the same way as a regular depost once they have cleared the bank). If there are any corrections to the bank statement (most unusual), type in the net correction and then enter a complete explanation into the Correction Detail screen. Note: No general ledger entry is created for this amount.

Depress the Checks screen. Check on the Cleared Y/N box if the deposit has cleared the bank per the bank statement. If there are any corrections to the bank statement (most unusual), type in the net correction and then enter a complete explanation into the Correction Detail screen. Note: No general ledger entry is created for this amount.

Return to the Summary Screen. Bank Reconciliation after the Checks and Deposits had been cleared Note: The Balance Per Books field goes off the Posted Date for JEs and NOT the Transaction Date. See the Word attachment <<PS_for_JE_071114.docx>> for an example.

Save Reconciliation

|

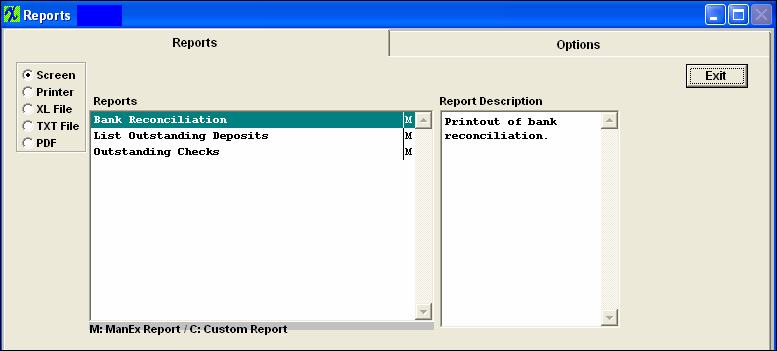

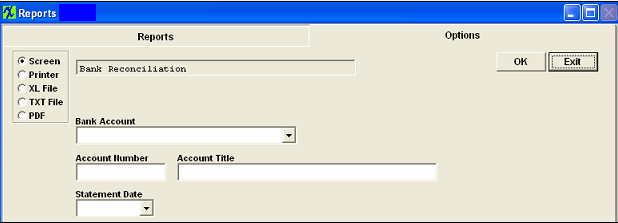

| 1.9.4. Reports for Bank Reconciliation | ||||||

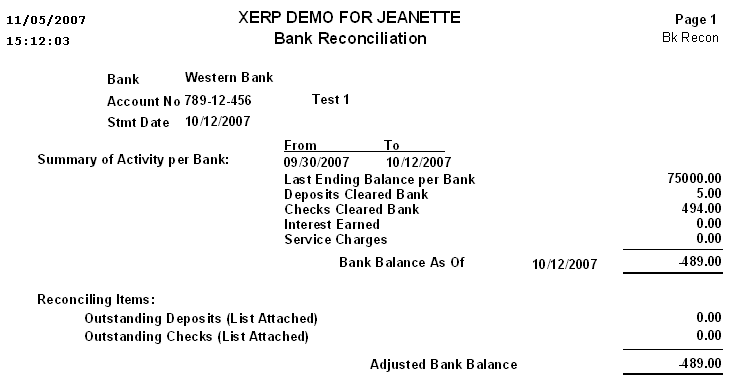

Depress the Reports icon and the following listing will appear:

Bank Reconciliation report

The following reports will be displayed:

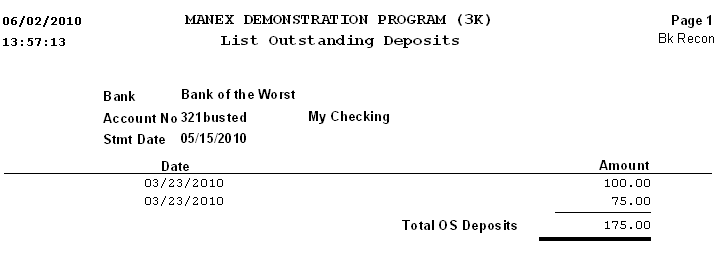

List Outstanding Deposits Report

The following report will be displayed:

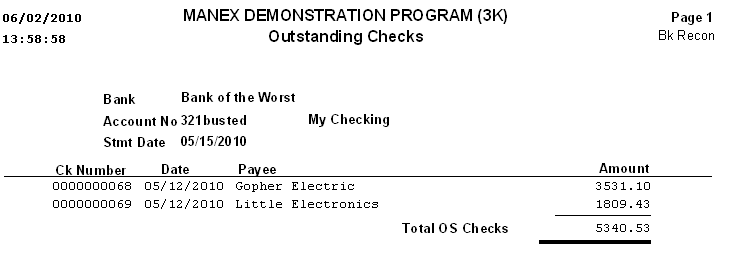

Outstanding Checks Report

The following report will be displayed:

|

| 1.10.1. Creating the PO with the CC Company as the Remit TO: then Paying the CC via ONLINE |

Supplier is created with multiple Remit To. One of them would be the Credit Card When creating the Purchase Order the Buyer will change the Remit To address to reflect the Credit Card Remit To address. In the below example I have two purchase orders created against to different Suppliers that have the same Credit Card Remit to information.

Product arrives at your Dock and Receiving will process the PO Receiving as normal. Resulting Transactions will hit Stock and Unreconciled receipts In this example the Dock processed two receipts on 8/27/2019 and one on 08/29/2019

I am assuming since these were credit card charges, you more than likely already received the invoice via email or with the shipment that was processed in the above three receipts. User would then proceed to PO Reconciliation and enter in the invoice information. You can see that the invoices will remain associated with the original Suppliers aging.

Approx. 1 month later you receive in the Credit Card statement from Visa. User would go through the Batch Scheduling and select to process ACH or Wire Transfer, etc . . . (just don’t select “check”) because in this example you are paying the Credit Card company online either through the CC website or your Bank Bill Pay feature.

The Check batch will actually generate an CSV for your records. Within this information you can see that the Rcv Company is Visa Credit Card

Resulting transactions that hit would like something like the below.

|

| 1.10.2. Creating the Purchase Order with the Credit Card Company as the Remit to:, then Paying the Credit Card via CHECK per Supplier |

This article will explain how to setup the credit card information wtihin the remit to;, create the Purchas Order with the Credit Card Company as the Remit to:, then issuing a check to the Credit Card Company for each supplier. Using this scenario you will have multiple checks being issued to the Credit Card Company per month. **Note: this process would be recommended if you are paying your Credit Card Company online. Either using the Credit Card Company website or your Bank Bill Pay. Upon processing the payment to the Credit Card Company you would want to make sure to not select Payment type as "Check" as that would result in individual Checks cut out to the Credit Card company if you select across multiple Suppliers. It is recommended that you select ACH or Wire transfer that will result in a CSV for your records. See Article #3477 for other options within ManEx.

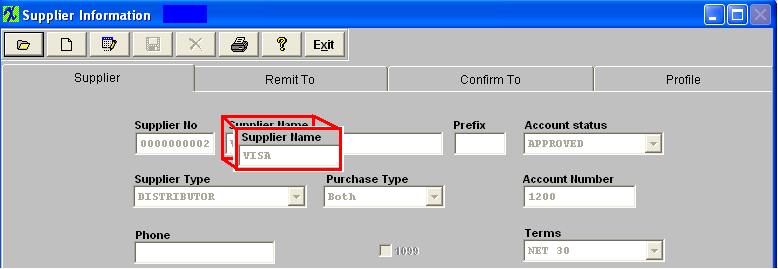

Depress the Edit action button and edit or add the remit to: with the credit card name first the the supplier name. (This will keep all VISTA payments due together).  Create the PO When the Buyer is placing an order with that (those) supplier(s), presumably it will be on the phone. It is strongly advised that the buyer obtains a credit card receipt, or at least the transaction number of the event.

Depress the Confirm/Remit to button and confirm that the Remit To is the credit card company:  When the product for the purchase order is received, (or at any time after the transaction) the buyer needs to forward a copy of the PO and the transaction number to accounting, so they can match it up with the <st1:place w:st="on">PO receipts.  When the <st1:place w:st="on">PO reconciliation is ready and done, the accountant may enter the transaction number (or the rightmost number of digits that will fit) into the invoice number for the reconciliation, and process it normally.  When it is time to pay the credit card, each transaction line in their statement can be checked against the transaction numbers recorded for the PO’s received, as well as verify the price. When it is time to schedule the check, all of the transactions for the supplier can be added and the transaction number (invoice number) will be printed on the check stubs. There may be many receipts in a period, from the same supplier, but there only needs to be one check written for all receipts.

It is true that if there is more than one supplier using the same credit card, the user will have to create checks for each supplier, but the transaction numbers on the checks should allow the credit card company to settle the account, even if there are multiple checks. Sometimes you may find credit card companies that will issue multiple cards under the same account, and they can then use a different card for each supplier. See Article #3477 for other options within ManEx.  Save and Print Check. Check #1275 Remited To: Credit Card Company (VISTA)

|

| 1.10.3. Changing the Supplier Associated to the PO/Invoice after PO Reconciliation to Pay the Credit Card Company |

If the user selects this scenario the user will create the PO, PO Receiver, and Reconcile the PO (for orders that have been paid with a credit card) as normal, but has NOT Posted Purchases to GL. Setting up the Credit Card Company as a Supplier. Then within the Manual AP Entry screen change the Supplier associated to the Invoice's/PO's to the Credit Card Company (as the Supplier) so they will be abe to create one check to the credit card company for all suppliers per month.

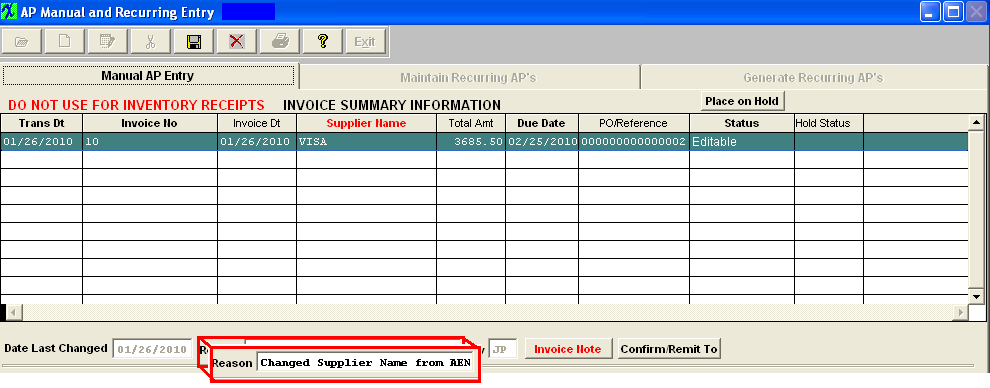

As long as the Purchase records have NOT been Posted to GL users may following the following steps:  I have three Invoices being displayed in AP Aging for three different Suppliers, which have all been paid for by Credit Card.  Set up the Credit Card Company as a Supplier within the Suppler Information:  Find the Invoice's that have been paid with a Credit Card within the AP Manual Entry screen, depress the Edit button and Change the Supplier Name selecting the Credit Card Company (VISA)

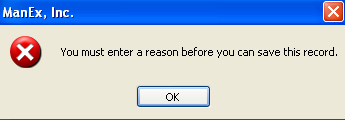

Depress the Save button and the following message appears:

Enter a Note stating that the Supplier Name (AEN) has been changed.

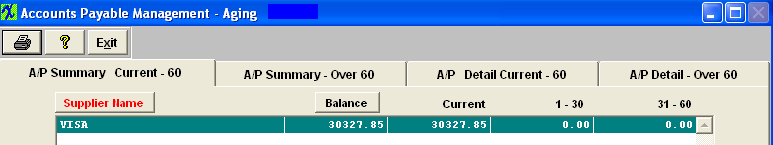

Once this step has been completed on all the invoices paid by the credit card, all these Invoices will be listed under the Credit Card Supplier Name (VISA) in the AP Aging.

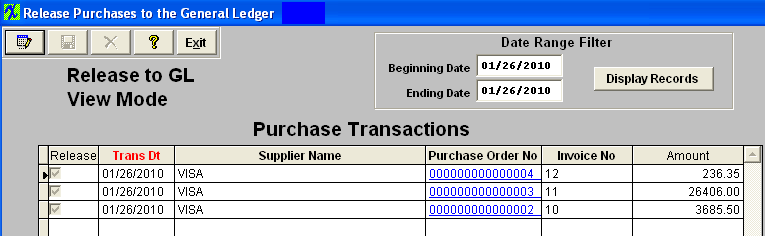

And all the Purchasing record waiting to be released and posted to GL have been updated with the credit card supplier name.

User can now create one check to the Credit Card Company (VISA)

|

| 1.11. FAQs |

| Facts and Questions for the Accounts Payable Modules |