| 1. General Ledger Reports |

| 1.1. Prerequisites for the GL Reports | ||||

Prerequisites Required GENERAL LEDGER activity:

The account information for the General Ledger must be established in the Accounting Setup . Users MUST have full rights to the "View GL Activity/Reports" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. |

| 1.2. Introduction for GL Reports |

OVERVIEW

General Ledger reports are defined in 4 main categories: 1) Static Informational Reports 2) Account Inquiry Reports 3) Summary Reports 4) Posting Reports STATIC INFORMATIONAL REPORTS Static Informational Reports are reports allowing the user to review information entered during the setup phase of the general ledger. Currently the only static informational report is the Chart of Accounts.

|

| 1.3. How To .... for the GL Reports |

| 1.3.1. Chart of Accounts | ||||||

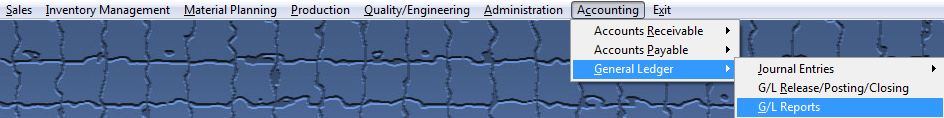

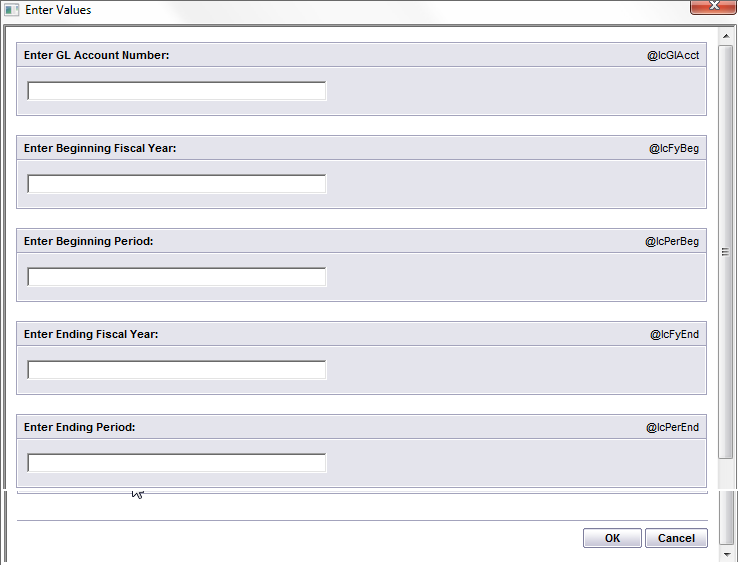

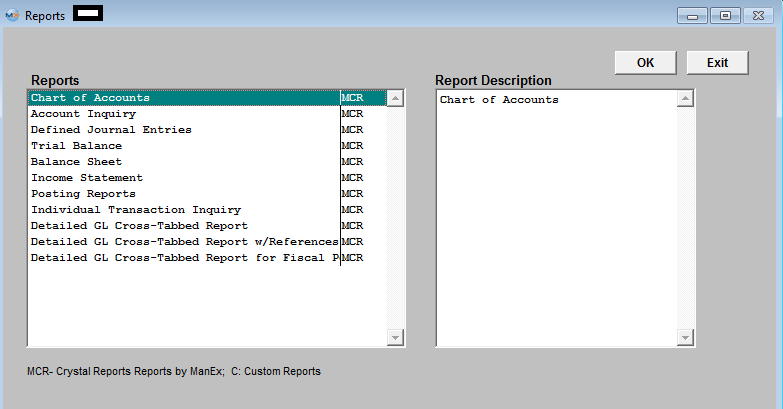

Enter the SQLMANEX.EXE (within the ManEx root directory) The following screen will be displayed, enter the Accounting/General Ledger/G/L Reports The following screen will appear:

Select the Chart of Accounts report. Then depress the OK button, the following report will be displayed.

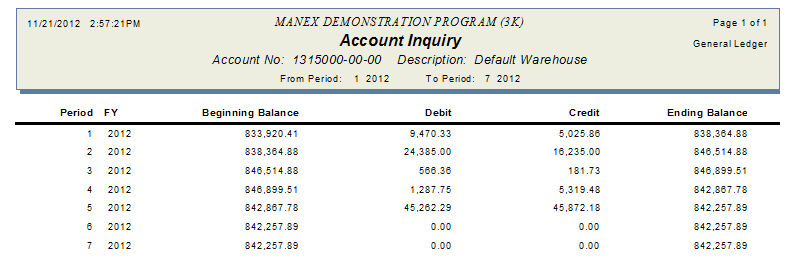

ACCOUNT INQUIRY REPORTS - Account inquiry reports are on-screen reports allowing transaction viewing from summary for a particular account through detail as posted in the associated journal.

The following report will be displayed.

|

| 1.3.2. Journal Entries | ||||||

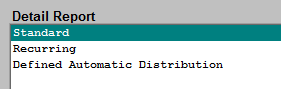

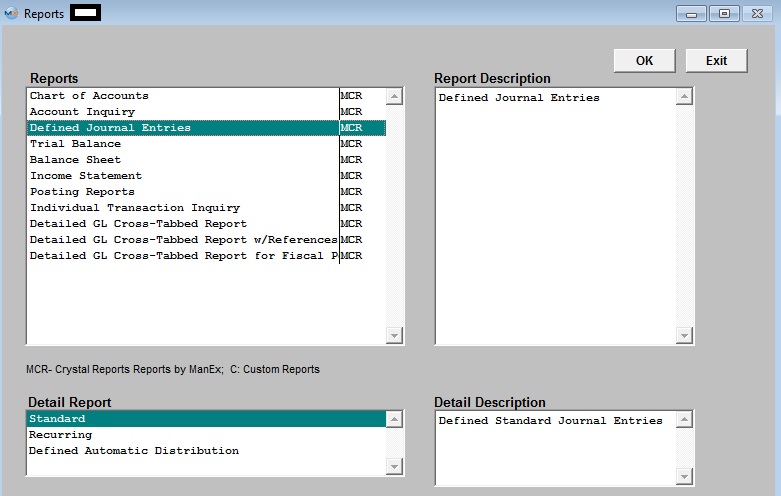

The following screen will appear:

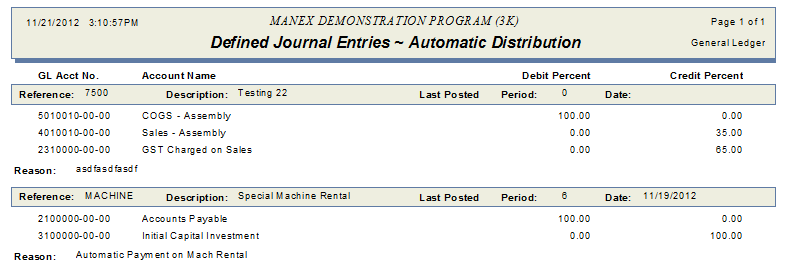

The following report will print:

|

| 1.3.3. Trial Balance | ||||||||

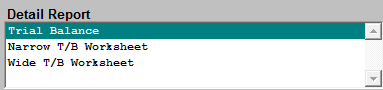

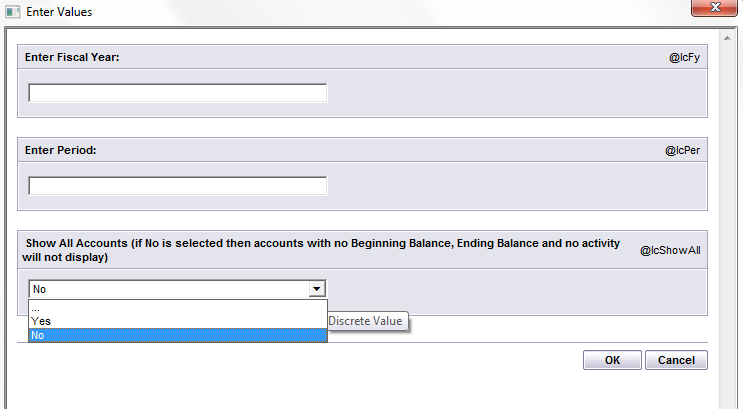

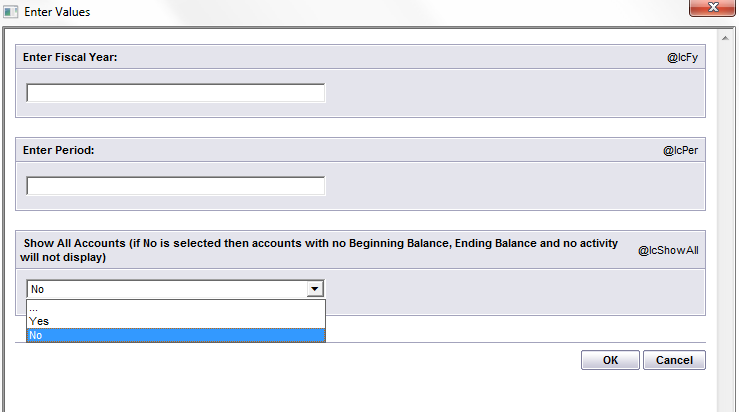

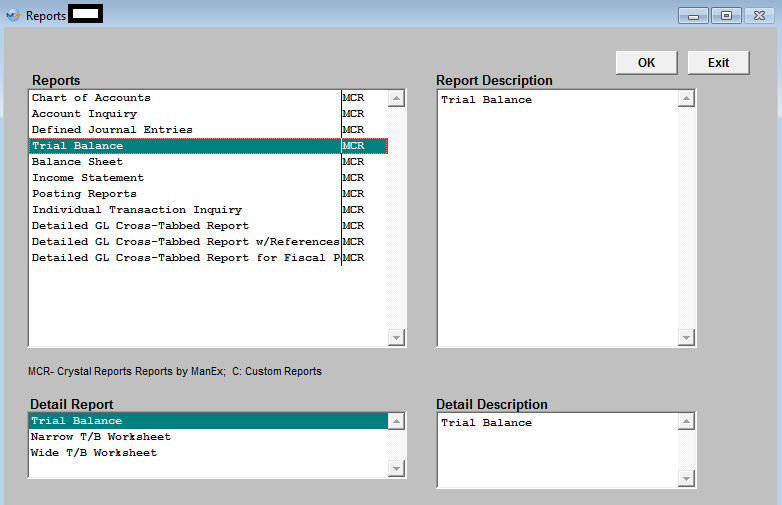

The following screen will be displayed:

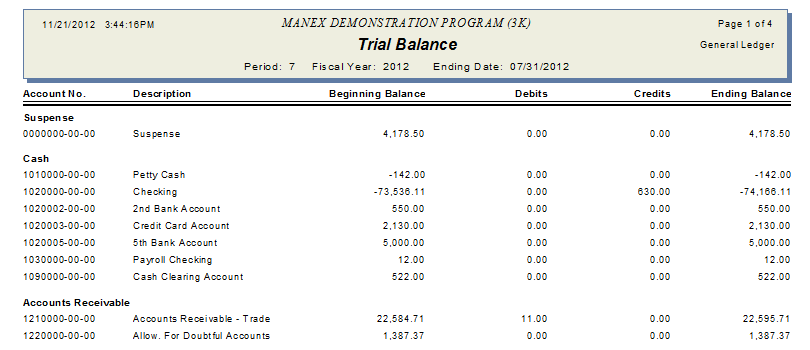

Depress the OK Button and the following report will be displayed (Basic Trial Balance Report)

|

| 1.3.4. Balance Sheets | ||||||||

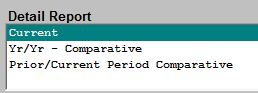

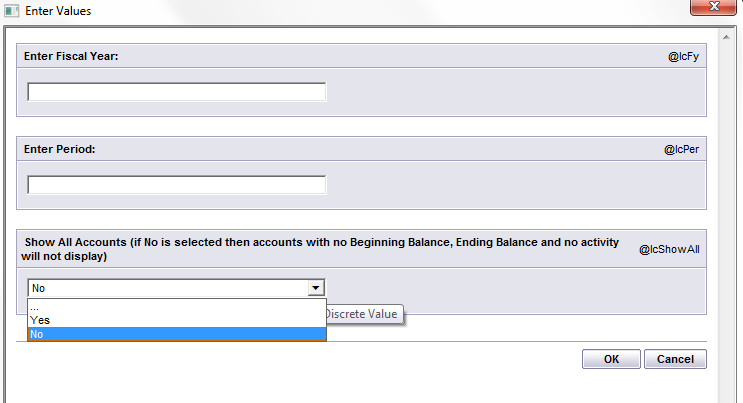

The following screen will be displayed:

OVERVIEW

Balance Sheet reporting provides for the printout of ending balance values in a standard format as defined by the user. The Account Type, Account setup and report default definition is defined in the setup modules for the General Ledger . Current period report provides a single column of output while the comparative reports provide for two columns of data to compare one set of data with another. For example, one may compare the current period with the prior period, current period with same period in the previous year, current period and year to date, etc. The three Consolidated reports available are for the users that have multiple divisions setup within the ManEx system. They are the same as the individual balance sheets, but these reports consolidate multiple division into one report.

Note: If the user is having problems with the totaling within the Balance Sheet, the following is the way that the accounting normal balances are established within the ManEx General Ledger Account Ranges for the printing of the financial statements. All asset accounts must be set up with the normal balance value as DEBIT, including contra accounts.The system doesn’t distinguish between a liability and a contra asset on the balance sheet, therefore any contra asset must be identified with a normal balance of debit. This does not mean that the system will treat contra assets as normally having an accounting balance of debit. The debit in this field signifies only that it is part of the asset group and not a part of the liability group for the purpose of printing of the financial statements.

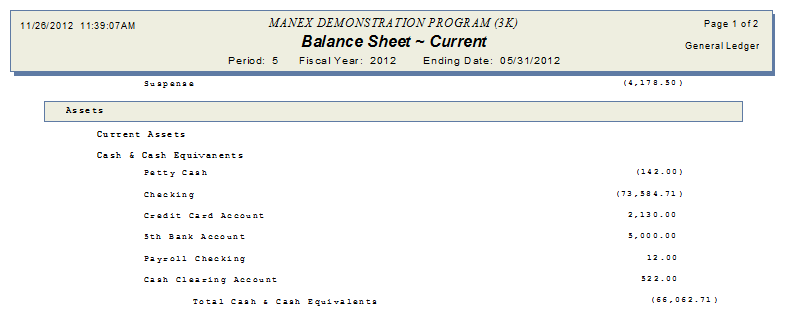

The following report will be displayed (Current BalanceSheet)

Note: Your Checking amount may not always match your Bank Balance. For more detail see Article #3262 .

|

| 1.3.5. Income Statements | ||||||||

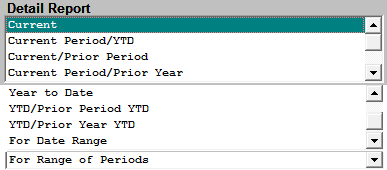

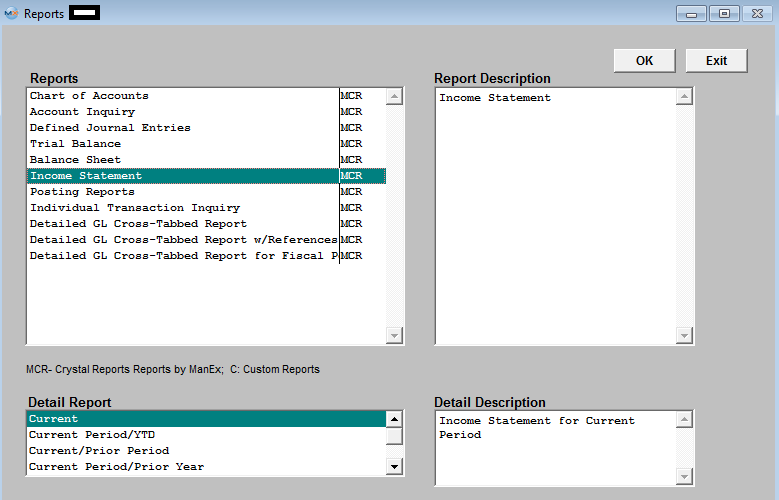

The following screen will appear:

OVERVIEW Income Statement reporting provides for the printing of a single period income statements as well as the more traditional period based reports. The Comparative reports provide for two columns of information, for comparative purposes.

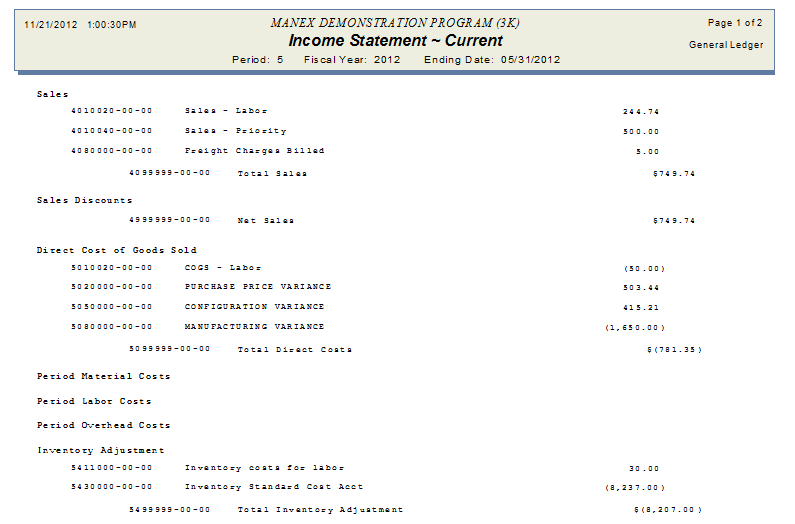

The following report will be displayed. (Current) (The numbers displayed in parenthesis are negative or Debits)

|

| 1.3.6. Posting Reports | ||||||||

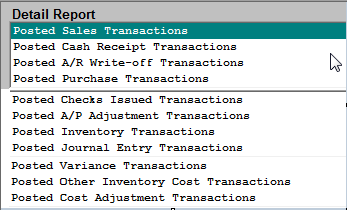

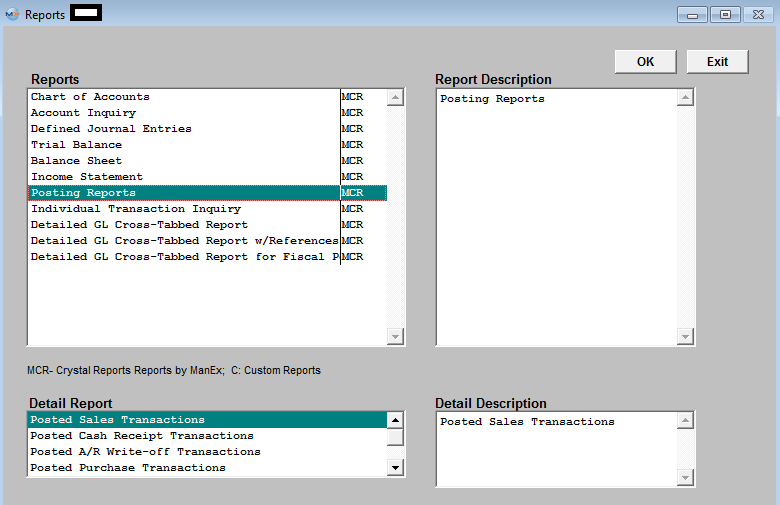

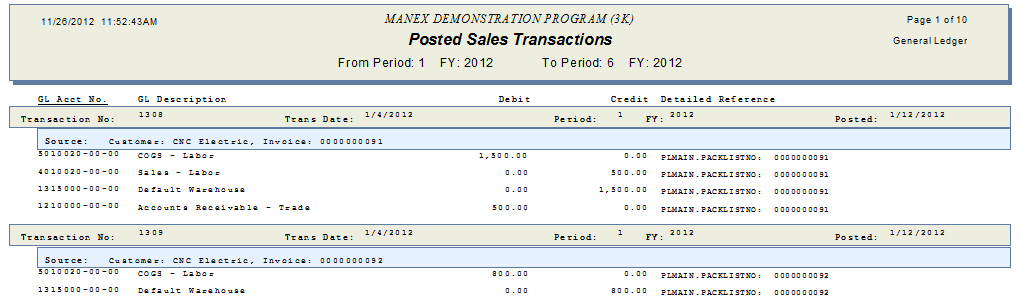

The following screen will be displayed:

The following report will be displayed:

|

| 1.3.7. Individual Transaction Inquiry | ||||||

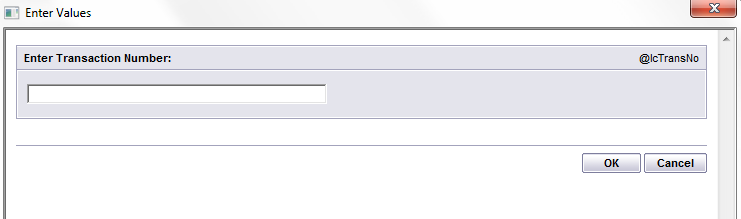

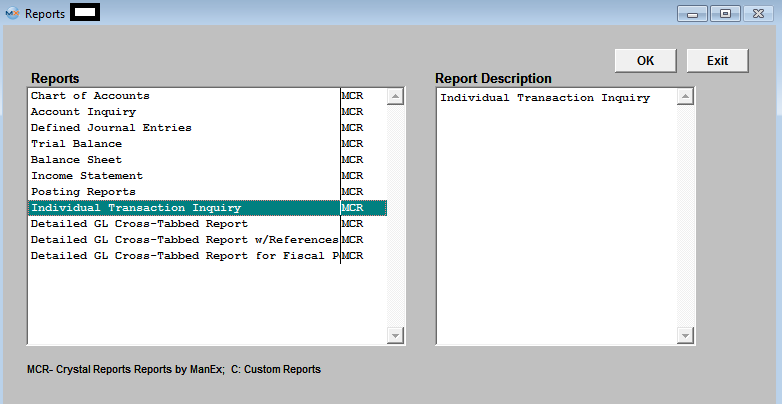

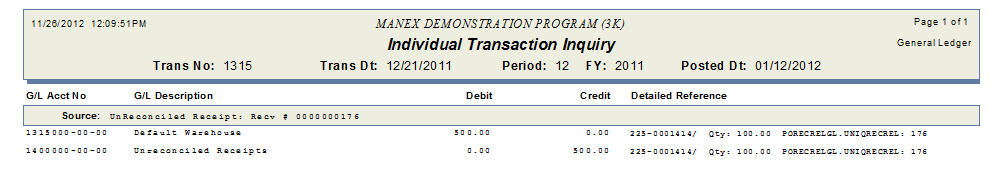

The following screen will be displayed:  The Individual Transaction Inquiry is a sister report to the Detailed GL Cross-Tabbed reports, it provides the full entry as referenced by the transaction number, which the user has obtained in the View G/L Activity or the Detailed GL Cross-Tabbed Reports.

The following report will be displayed:

|

| 1.3.8. Detailed GL Cross-Tabbed Reports | ||||||

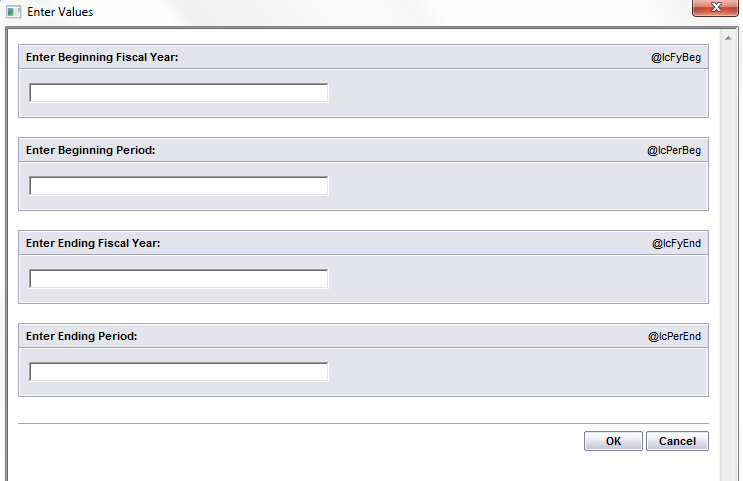

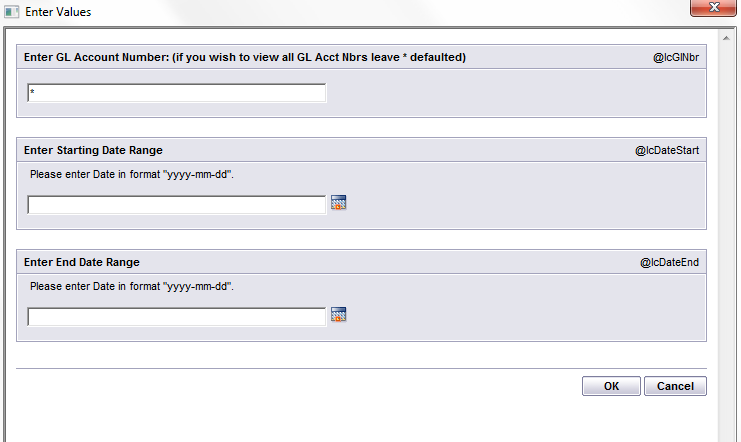

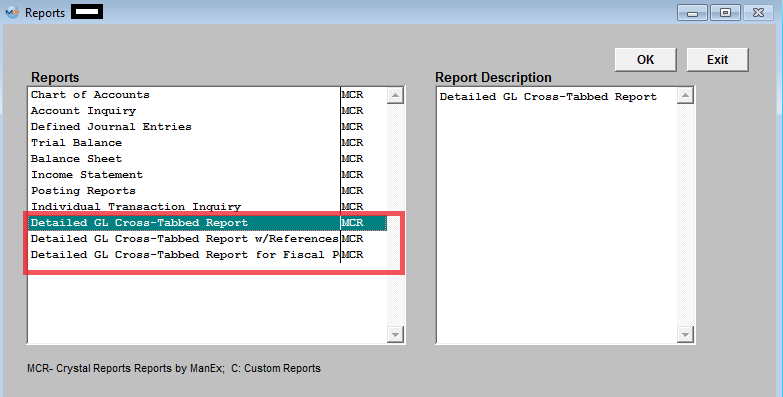

The following screen will be displayed:

The "Detailed GL Cross-Tabbed Reports" and "Individual Transaction Inquiry" are available for the user to drill down into the source of the transaction, which was posted to the General Ledger.

The Detailed GL Cross-Tabbed Reports provides a way to trace activity posted to all accounts during a given date range based on the Transaction date NOT the Posted Date.. The report is sorted by account number so you may see what amounts were posted to the account. A reference number is provided to assist in finding the balancing entries.

NOTE: If user happens to Transfer product back and forth (for example: if user transfers 5 into FGI, then transfers the same 5 back into Stag, then transfers the same 5 back into FGI again) the Total Qty transferred on the "GL X-Tabbed w/Reference" report will reflect 15 which is how many total qty's were transferred. The transaction value itself will be for the quantity of 5, but the reference info will be reflecting the quantity of 15. If users see this on the "GL X-Tabbed Report w/Reference" report, they may want to check the transfer history by highlighting the FGI work center and depressing the "Xfer History" button located in the Shop Floor Tracking module. This will display all the transactions that happen even though it was the for the same quantity.

Highlight one of the Detailed GL Cross-Tabbed Reports from the menu.

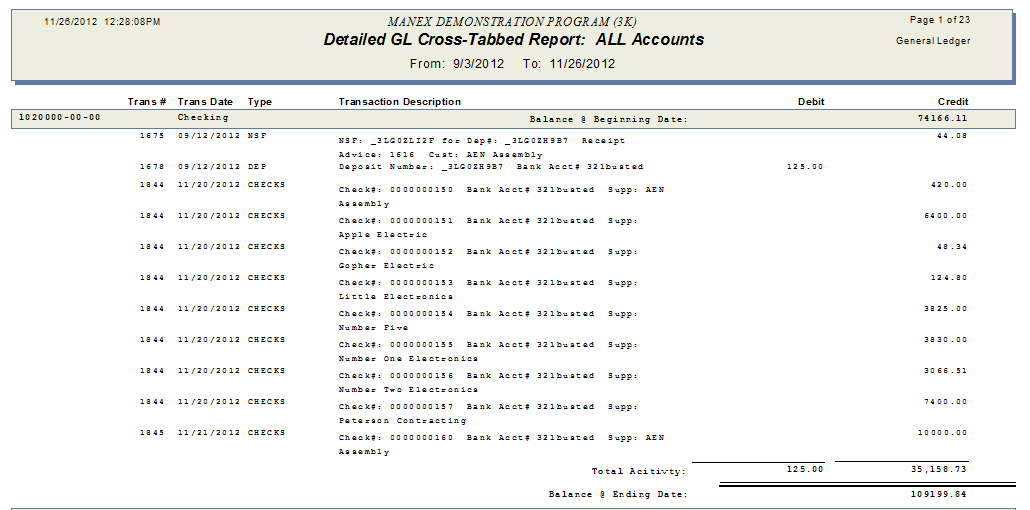

The following report will be displayed.

Note: "Missing Information" could mean that the inventory part number that was assoicated to this transaction has been deleted from the system.

|

| 1.3.9. Process for comparing Valuation reports against GL Acct balances |

Before attempting to compare the GL Account Values to any of the Valuation reports (example Inventory Valuation, Unreconciled Receipt, etc. . ) throughout the system you need to make sure that the following has been done.

|