| 1. How To ..... for General Journal Entries |

| 1.1. Find a Journal Entry | ||||||

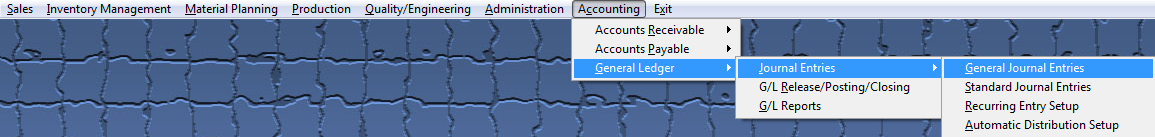

Enter the SQLMANEX.EXE (within the ManEx root directory) The following screen will be displayed:

When first entering the General Journal Entry area the ‘Find’, ‘Add’, ‘Generate RE/FY Closing’ and ‘Exit’ icons will be available for selection.

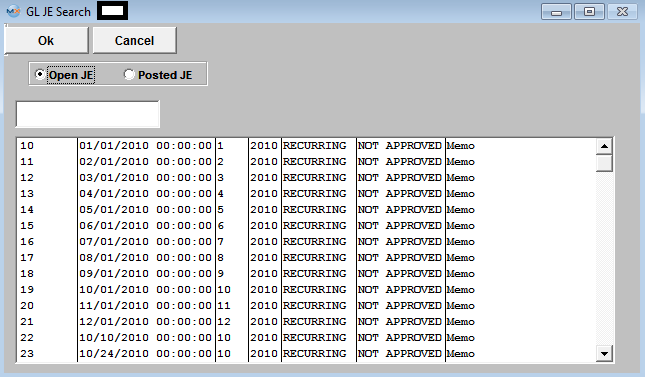

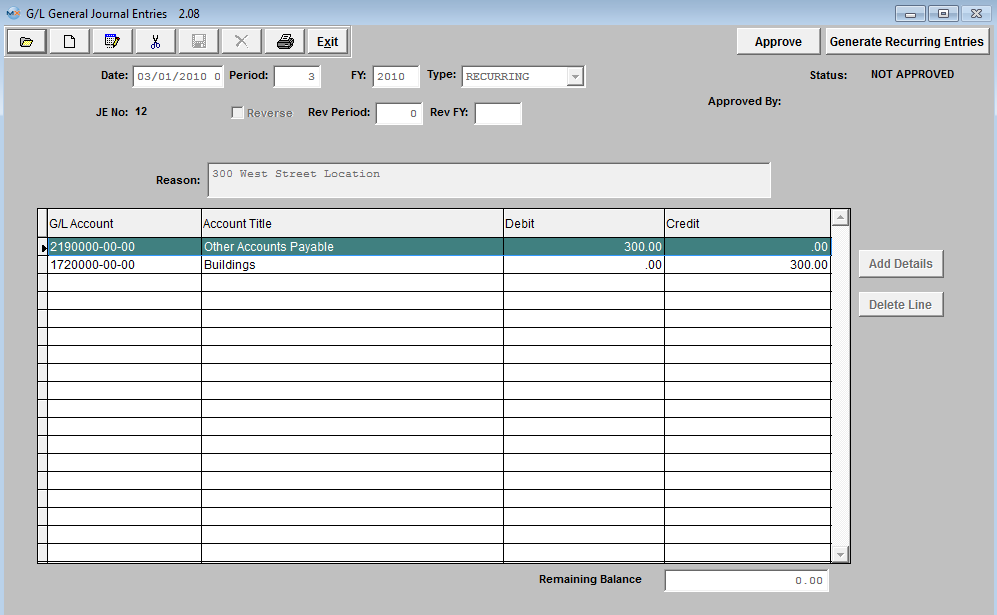

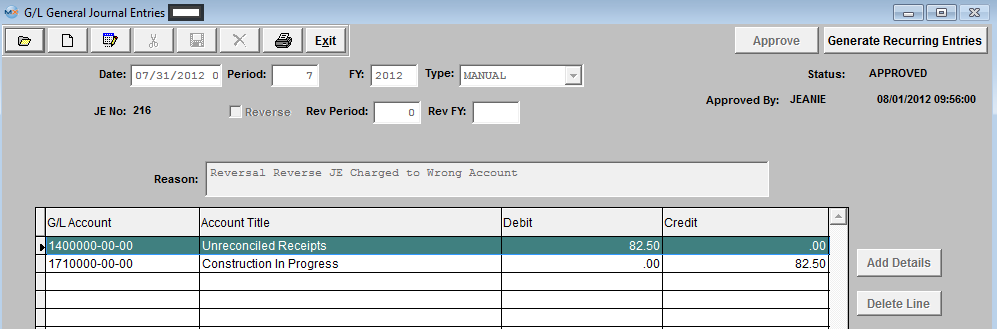

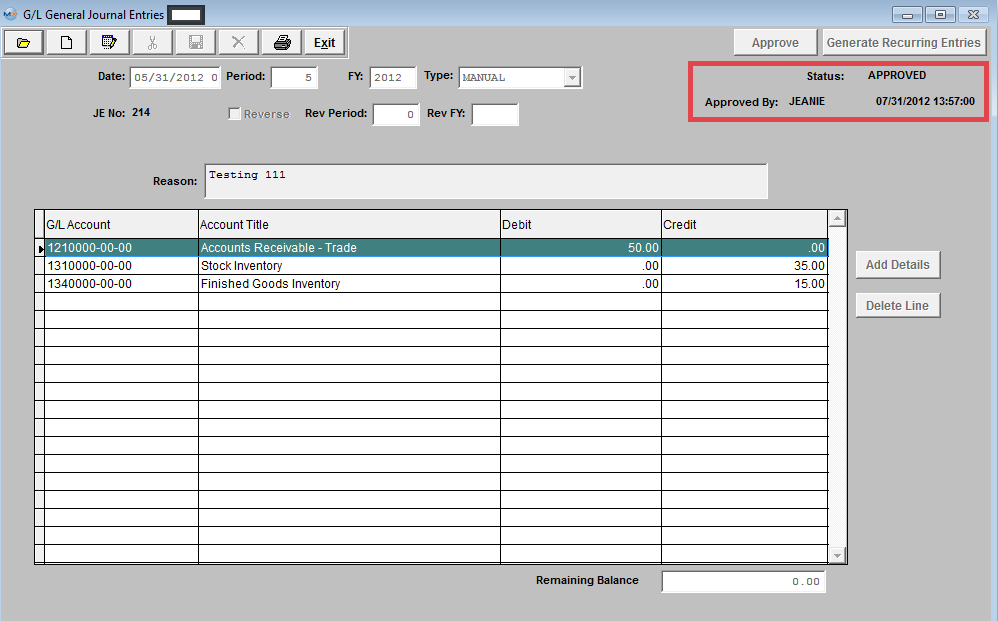

Selecting the desired entry will populate the screen as follows:

|

| 1.2. Add a Journal Entry | ||||||||

|

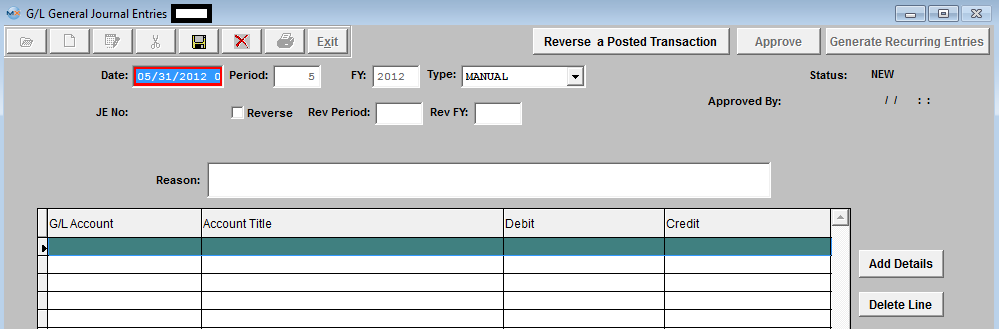

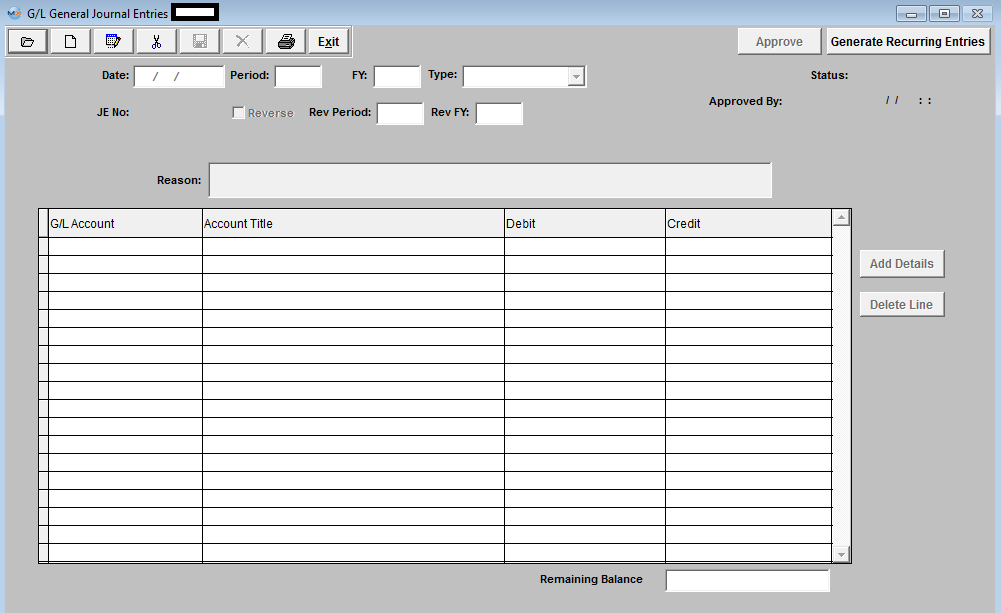

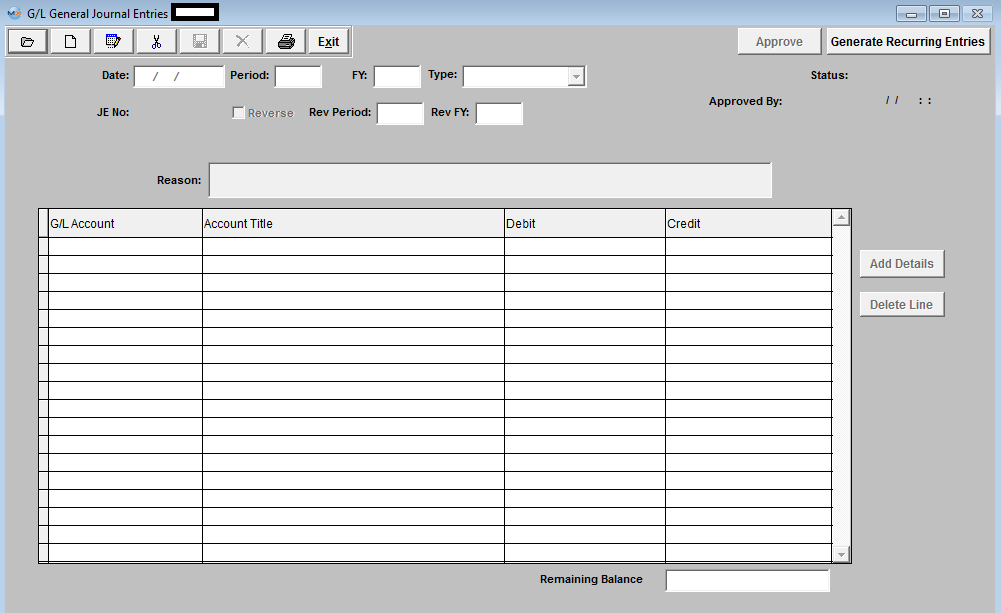

The following Screen will be displayed:

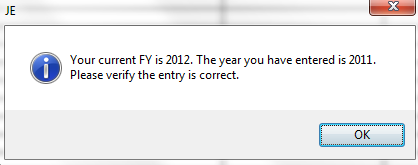

Depress the Add record action button. The first field (DATE) will default to the last day of the previous fiscal month, but can be changed to any date desired. The date as entered will be the Transaction Date of record so care must be taken to enter a date that lies within the Period you wish to affect with this Entry.

The ability to post a transaction outside of the current period is affected by the General Ledger Post Default setup, whether postings are allowed in previous periods and fiscal years and future periods.

The TYPE field is a pop up but will default properly to MANUAL when in Add mode. Other types such as STANDARD may be selected within display, if appropriate. STATUS will display ‘NEW’ when adding and will display the appropriate status when displaying a previously added but NOT APPROVED entry and well as an entry that has been POSTED. REVERSE refers to whether this is should be a Reversing Entry. A Reversing Entry is one that cancels itself out upon the Closing of the Period in which it is posted. The Reverse field will default as Unchecked and may be changed if the Transaction is of an appropriate type. REASON is a required field and some text must be entered to allow a successful save of a Journal Entry. Use the TAB key to exit the Reason Field.

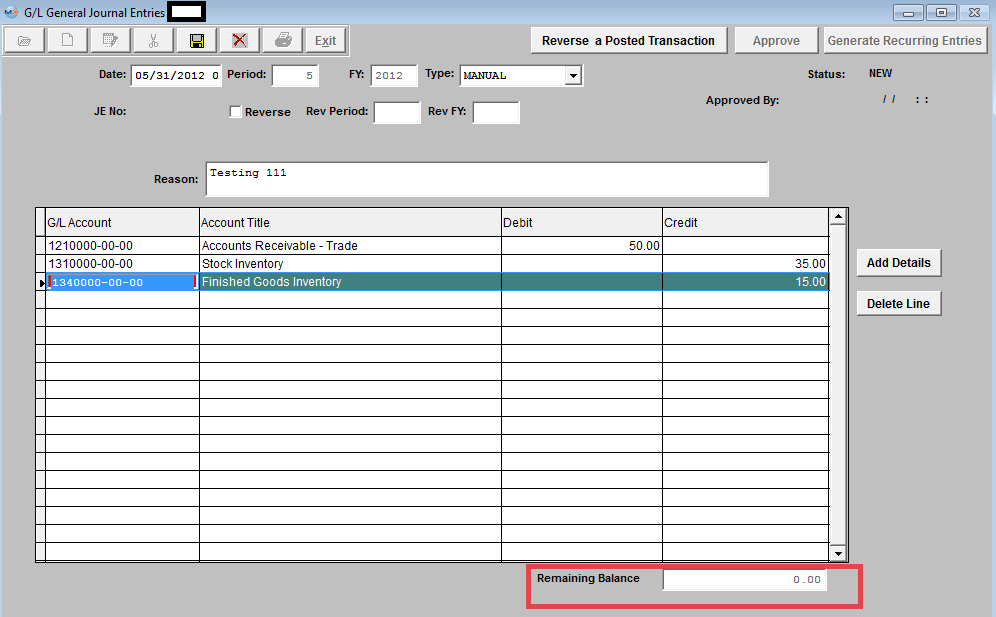

The actual data entry occurs in the middle section. Once you tab out of the Reason Field the system will default to the first GL Account Number to be entered. The user must enter a G/L Account directly by typing in the account number. The system will default to the nearest G/L Account match as you type. Then once you hit the Enter/Tab key the system will default in the Account Title Information. Then enter the Debit or Credit Amount.

Depress the "Add Details" button to add another G/L Account.

Enter the Debits and Credits until the Remaining Balance at the bottom of the screen equals 0.00.

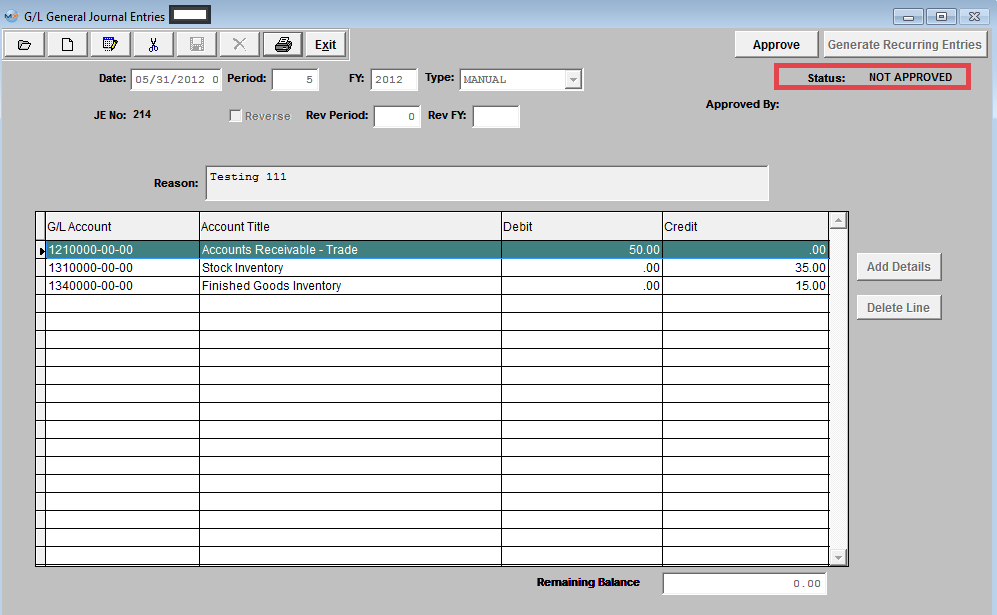

The Abandon changes action button is available at all times during an add operation. The Save record action button will also show as available but will not allow you to save the record until the entire General Journal Entry is in balance (debits = credits). Once the Entry is in Balance, the system will allow you to save the Journal Entry. A General Journal Number will then be assigned to the Transaction.  Journal Entry must be approved before it may be posted. After checking for accuracy, approve a Journal Entry by selecting the ‘Approve’ button and enter an authorized administrative password.

The JE Status will then be changed to Approved.  | ||||||||

| 1.3. Edit a Journal Entry |

|

Find a Journal Entry you want to Edit. NOTE: The user may edit a ‘NOT APPROVED’ Journal Entry. Once an entry has been ‘APPROVED’ however, another Journal Entry must be entered to clear or reverse it.

The JE will populate the screen: All fields are editable. When changes have been completed, depress the Save record action button to save changes or depress the Abandon changes action button to abondaon changes. In order to save the transaction, both DEBITS and CREDITS must equal. The user may generate two types of entries with the ‘Generate RE/FY Closing’ (Generate Recurring entries/ Fiscal Year Closing) button selection.

The first type, Recurring Entries, must be defined under the Recurring Entry Setup module prior to being available as a recurring type. The second type of entry is a special kind of Fiscal Year End Closing Entry, which may be generated after all adjustments have been made for a period but before the actual Period Close Closing Entries zero out the income and expense items for the period and transfer the balance to the Balance Sheet's Retained Earnings. It is important that an entry be created to Close the Income and Expense to the Balance Sheet at the end of each Fiscal Year Period Close. Without such an entry the Balance Sheet will be out of balance by the amount of profit (or loss) incurred, because such an entry was last posted to the Equity Accounts. Such a transfer and closing should not affect reprint of Income Statements for Prior Periods but a Posting to a Prior Period will affect the Balance Sheet / Income Statement for the affected period. A General Journal Entry must be generated to close those Prior Period income and expense items to Retained Earnings if the company chose to allow posting to prior periods. Journal Entry must be approved before it may be posted. After checking for accuracy, approve a Journal Entry by selecting the ‘Approve’ button and enter an authorized administrative password.

|

| 1.4. Reverse a Journal Entry | ||||

|

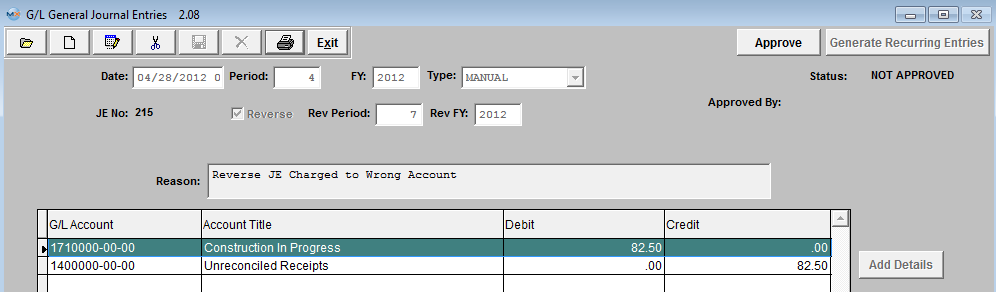

The following Screen will be displayed:

Depress the Add button and Create a JE Transaction in Period (4), but user would like this JE reversed in a future period. So, they will need to check the "Reverse" box and have it set to reverse in period (7) of 2012. A Reversing Entry is one that cancels itself out upon the Closing of the Period in which it is posted.

Approve the Entry and it will forward to the GL Release and Posting Screen.

The JE #20 was properly released and posted in Period (4) of 2012.

Current Accounting Period 7 of 2012

Upon entering the JE Find screen you can see that the system automatically created the reversing JE waiting for approval.

Approve the Entry and it will forward to the GL Release and Posting Screen.

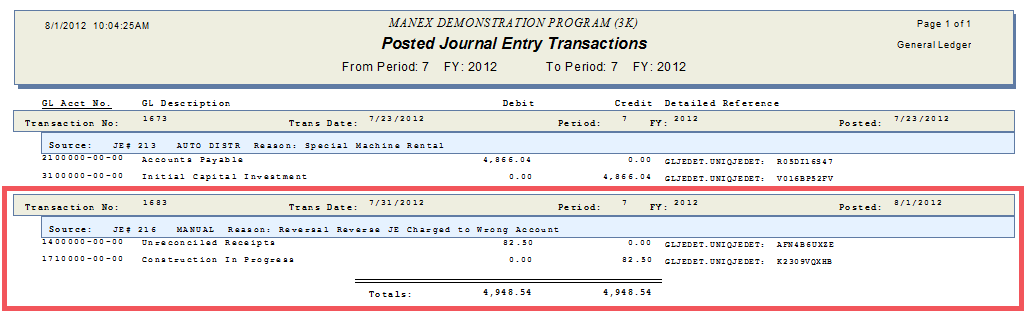

Print out the Posted Journal Entry Report, as displayed:

|

| 1.5. Reverse a Posted Transaction | ||||

|

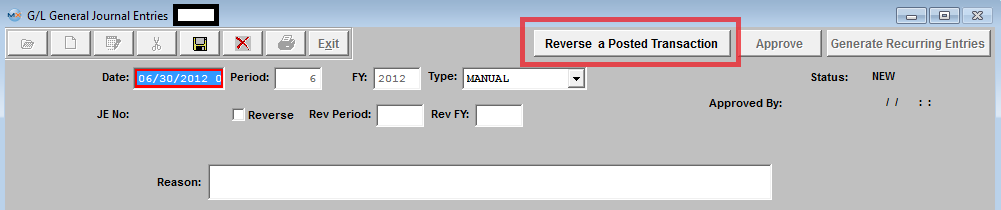

The following Screen will be displayed:  Depress the Add record action button, enter your password and the "Reverse a Posted Transaction" button becomes available:  Depress the "Reverse a Posted Transaction" button and the following warning will appear:

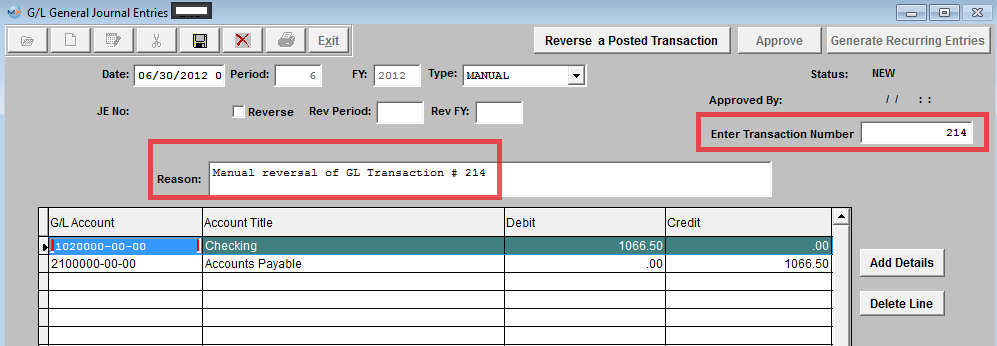

Depress OK. Enter the number of the transaction you want to reverse into the field shown below and the info will poplulate the screen, the Reason will default in as a "Manual reversal of GL Transaction ___": Note: User can reverse any posted Transaction from any Prior Period or FY. The Same Transaction can be reversed more than once also.

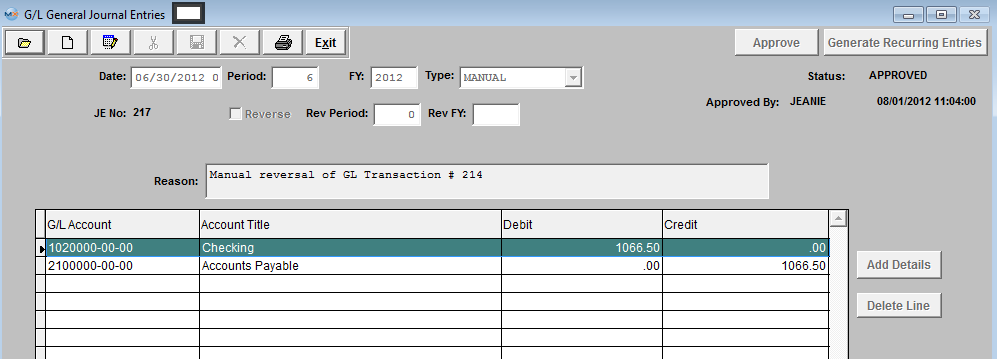

Once the Entry is Approved, it will forward to the GL Posting Screen.  Release and Post within the GL Release and Post screen. Print out the Posted Journal Entry Report, as displayed: The reason displayed will display as a Manual reversal and reference the Transaction number reversed.  |

| 1.6. Generate RE/FY Closing |

| 1.6.1. Introduction for Generate RE/FY Closing |

The user may generate two types of entries with the ‘Generate RE/FY Closing’ (Generate Recurring entries/ Fiscal Year Closing) button selection. The first type, Recurring Entries, must be defined under the Recurring Entry Setup module prior to being available as a recurring type. The second type of entry is a special kind of FISCAL YEAR END CLOSING ENTRY, which may be generated after all adjustments have been made for a period but before the actual Period Close Closing Entries zero out the income and expense items for the period and transfer the balance to the Balance Sheet's Retained Earnings. It is important that an entry be created to Close the Income and Expense to the Balance Sheet at the end of each Fiscal Year Period Close. Without such an entry the Balance Sheet will be out of balance by the amount of profit (or loss) incurred, because such an entry was last posted to the Equity Accounts. Such a transfer and closing should not affect reprint of Income Statements for Prior Periods but a Posting to a Prior Period will affect the Balance Sheet / Income Statement for the affected period. A General Journal Entry must be generated to close those Prior Period income and expense items to Retained Earnings if the company chose to allow posting to prior periods. User may Generate the RE/FY Closing in the G/L General Journal Entry module, or in the End of FY Closing module. |

| 1.6.2. Generate Recurring Entries | ||||

The following screen will be displayed:

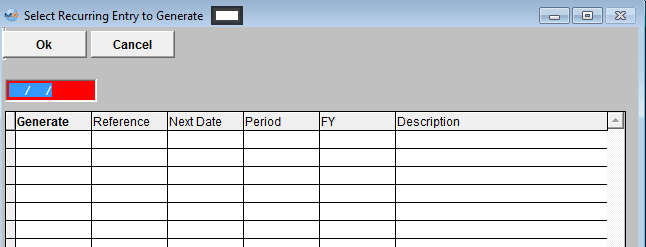

Depress the "Generate Recurring Entries" button and the following screen appears:

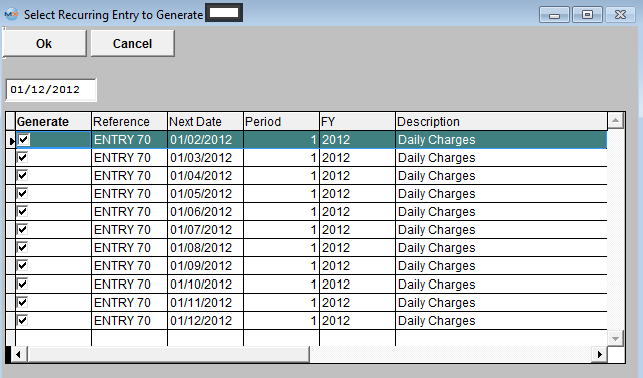

Enter in an Ending Date and all Recurring Entries due on or before this date will be listed:

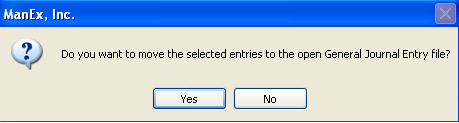

Depress OK and the following message will appear:

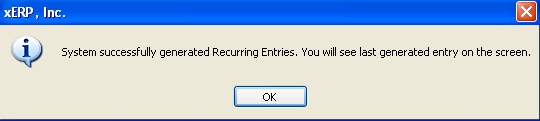

If user selects "Yes" to continue the following message will be displayed:

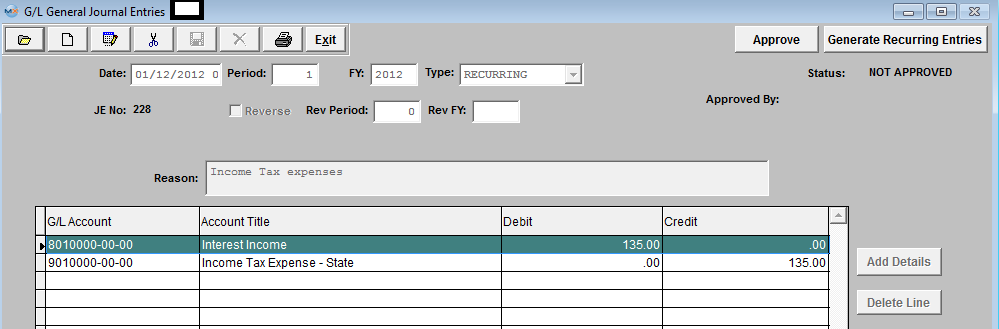

The last generated entry will be displayed on the General Journal Entry screen fro approval

The rest of the Recurring Entries that were generated will be listed in the Open JE screen with a status of NOT APPROVED

|