| Overview Regarding Return Material Authorization Accounting |

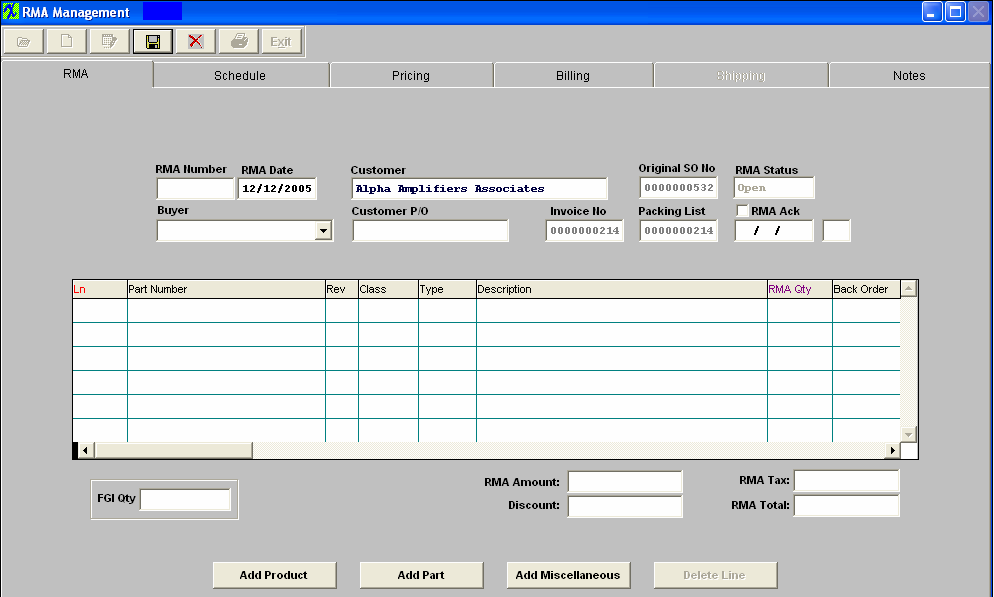

No Journal Entry is created in the RMA module, however the system was collecting the JE components from that module as follows: Assume that the original sale was for 10 units @ $100.00 each, with a standard cost of $80.00 each and freight charged the customer of $15.00. At the time the user selects the original Invoice number in the Return Material Authorization module, the system “remembers” the original accounting entry that was created at the time the original Invoice was printed, which was: Debit Accounts Receivable – Trade $1,015.00 Debit Cost of Goods Sold $800.00 Credit Sales $1,000.00 Credit Finished Goods Inventory $800.00 Credit Freight Income $15.00

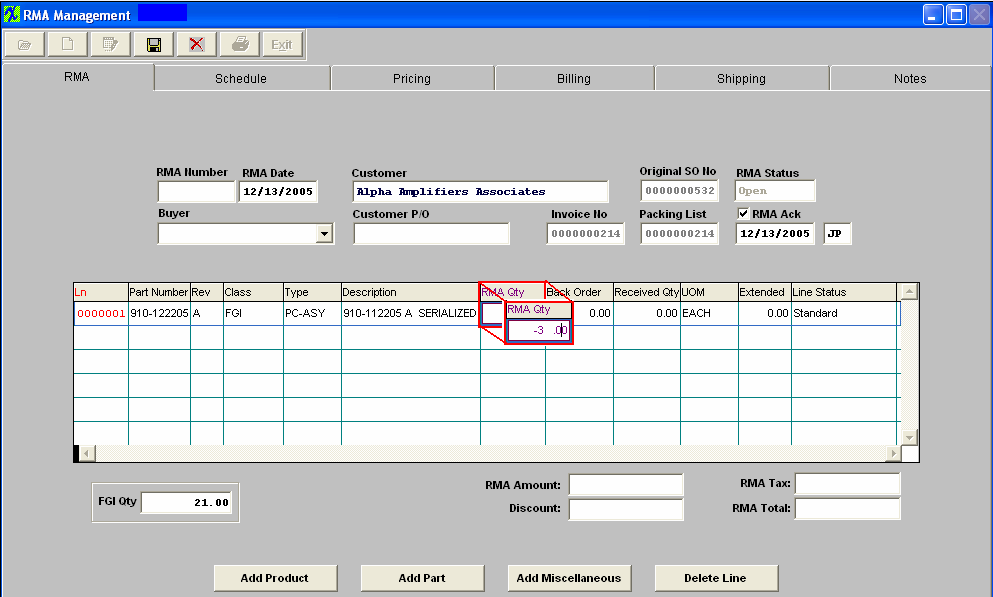

When the user enters the “return quantity” (the one entered as a negative quantity), the system will remember that the original cost of sales was $80.00 per unit.

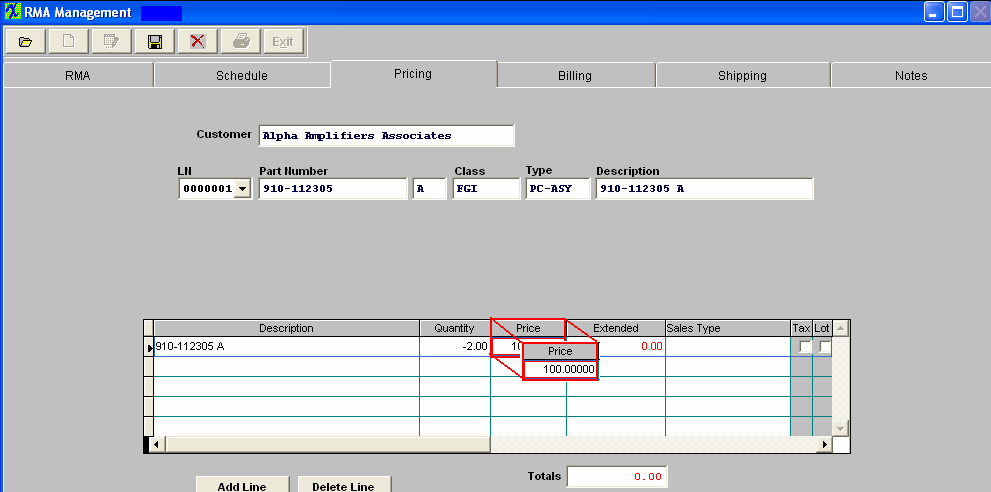

The user then enters the pricing on the item to be returned on the Pricing page of the RMA module.

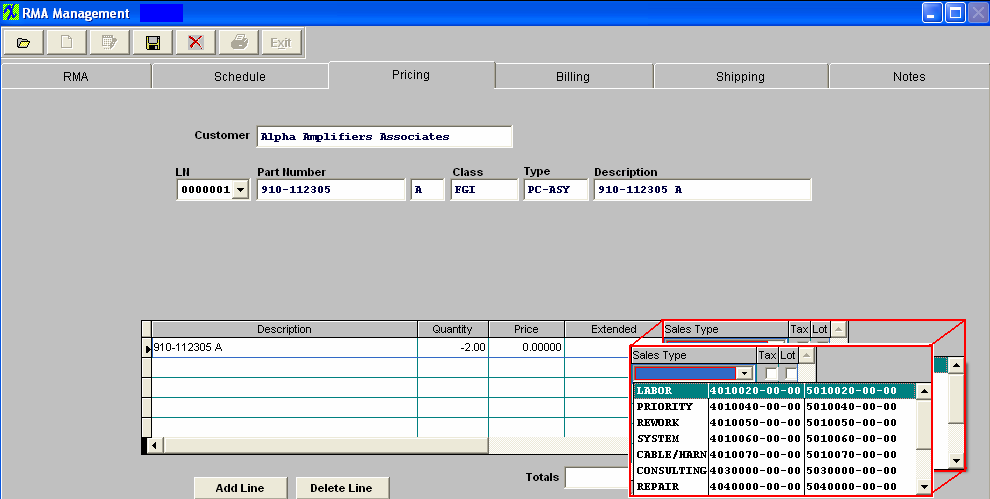

The pricing entered can be any amount up to the amount of the original pricing of $100.00 per unit. And so the journal entry component for the debit to the sales account is 2X $100.00 = $200.00, in this example. The user selects the sales and cost of goods general ledger accounts to be used per the Sales Type column:

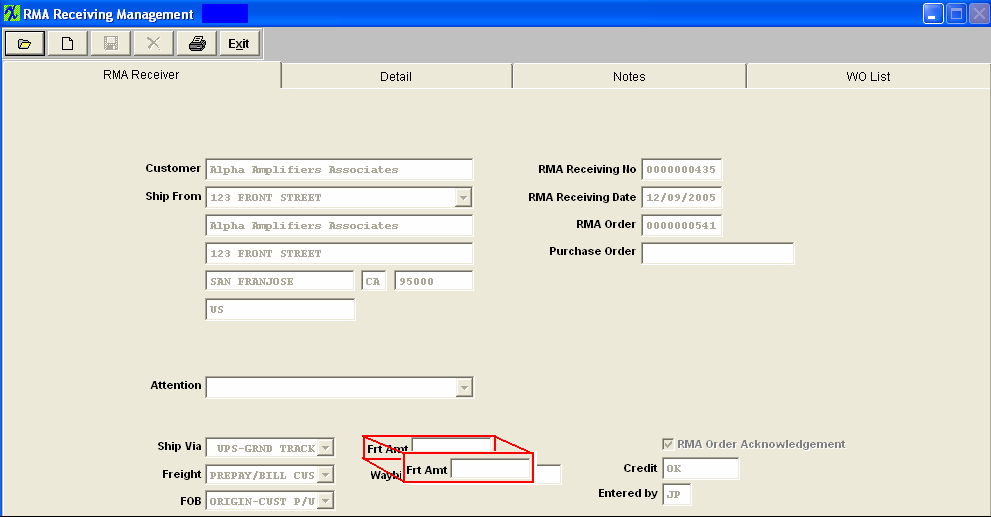

And so, the sales account number selected will be debited for $200.00 once the journal entry is created, upon the actual receipt of the returned item.And the related Cost of Goods sold account will be credited for the $160.00. If the return is to be reworked and then returned back to the customer, the user creates a second line item on the RMA using a positive quantity which is in actuality creating the RMA Sales Order and an eventual invoice upon shipment. The journal entry and the applicable Credit Memo for the returnis created in this Return Material Authorization Receiving module.On this screen, the user indicates the amount of freight to be credited, such as a pro rata 2/10 of $15.00, or $3.00, for example:

After the user types in the quantity received on the Detail page and depresses the Save button, several things happen all at once: The Journal Entry is created as follows and forwards to the Release to General Ledger module: Debit Sales $200.00 Debit WIP $160.00 Debit Freight $3.00 Credit Accounts Receivable $203.00 Credit COGS $160.00

Once the Rework Work order is released, the user may opt to go into kitting and add line shortages which will be included in the Material Variance once the Kit is closed.Please refer to the Kitting and Shortage Management manual. From this point forward, the accounting is the same as for a regular order. |