| 1. Automatic Bank Deduction |

| 1.1. Add a New Automatic Bank Deduction |

|

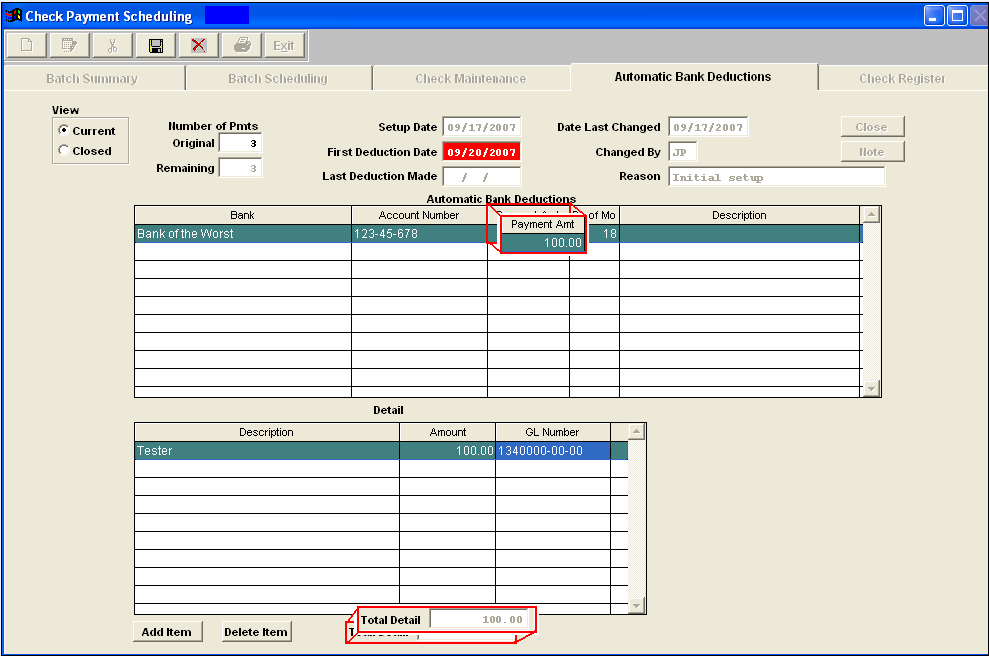

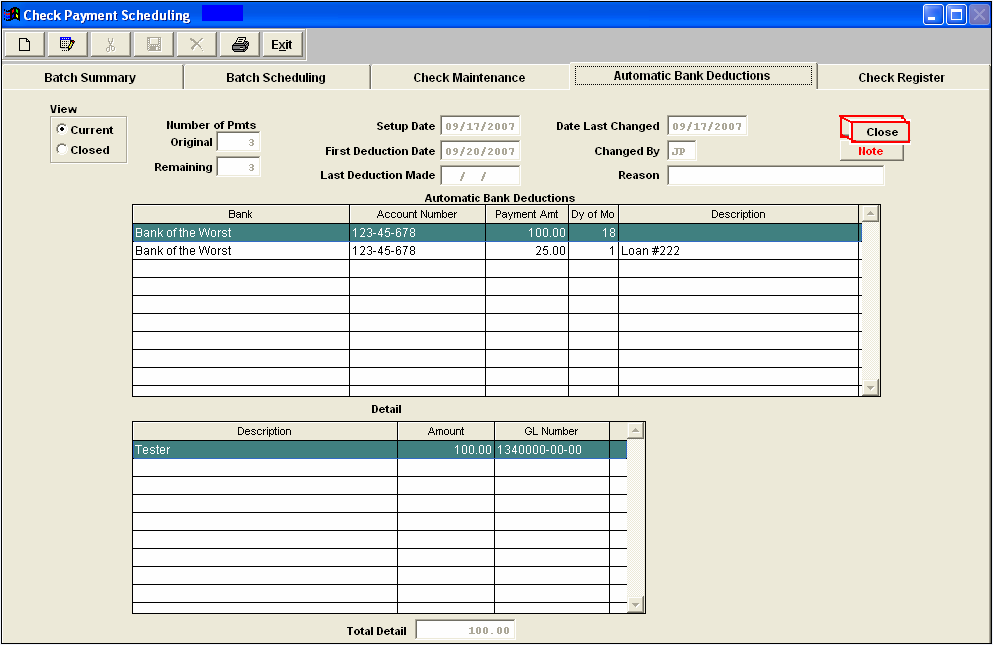

Select the "Automatic Bank Deductions" tab and the following screen will be displayed. This tab is used to record a manual check, to void a check or to re-print a single check.  Depress the Add button. Enter in your password. Enter the original number of payments, the date of the first deduction then select the bank. Enter the payment amount, the day of the month for the deduction and a description of the deduction.

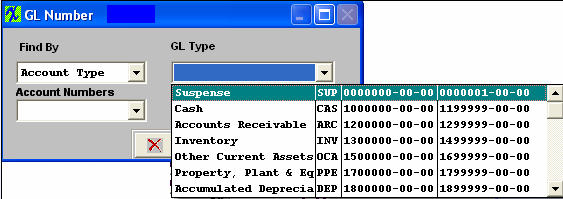

Depress the Add Item button. Type in the Item Number, a description of the line item, the line item amount and the General Ledger number. Note: if you don’t know the G/L number, place the cursor in the G/L field and hit the Enter key twice. This will bring up the following:  Depress the arrow next to the Find By field.

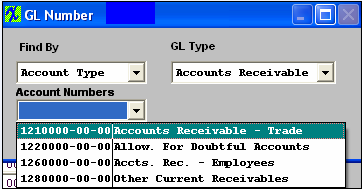

Scroll up or down until the appropriate G/L range is found. Then depress the down arrow next to the Account Numbers field. The following selection for the posting account will appear:

Select the account. Depress the OK button.

Note that the Payment Amt and the Total Detail must be equal before the save button will be available.

Depress the Save button to save changes, depress the Abandon Changes button to abandon changes. NOTE: Once this record is saved it will not be editable, if changes are needed to the record you will be required to close the existing record and create a new one accordingly. For further explanations see Article #2328.

|

| 1.2. Edit an Automatic Bank Deduction |

Editing a Automatic Bank Deduction

You may only make a change to an un-saved Automated Bank Deduction. If it’s been saved, you are able to edit the Note information only. The reason for this is that these records are the source for the automatic deductions frm the bank account and if we did allow any of the items to be changed user would have no audit trail. (For example if you have an automatic deduction from bank account for payment of an auto loan of $500 on the 2nd of each month and system allowed you to change the amount from $500 to $400 for an office equipment loan in July, you would have no audit trail back for the $500 auto loan). So instead of editing a record, the user may change the status to Closed and then add a new automatic bank deduction with the desired features. For further information see Article #2328.

|

| 1.3. Close an Automatic Bank Deduction |

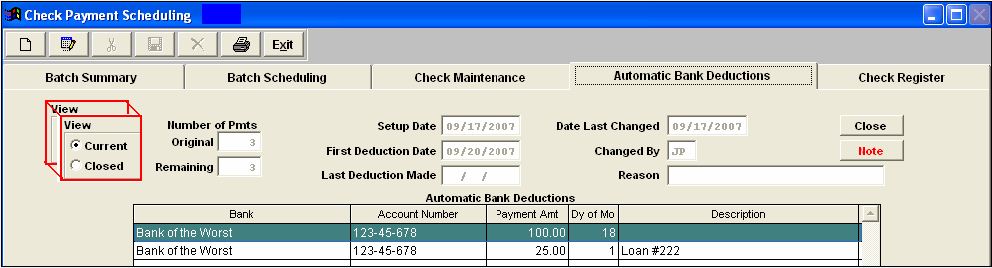

To close out an automatic bank deduction. Highlight the pertinent deduction and depress the Close button.

Type in your password. Depress the Save button to save the changes, depress the Abandon Changes button to abandon the changes. To view the deduction you’ve closed, click on the Closed radial and the screen view will update.

|