| 1. Fields & Definitions for Payment Scheduling |

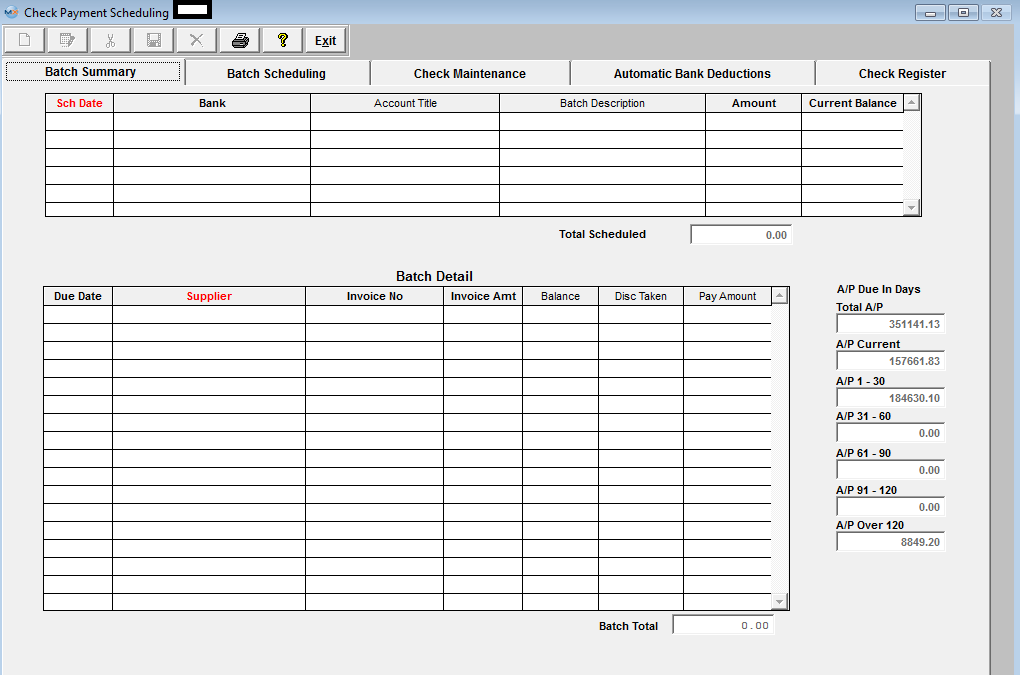

| 1.1. Batch Summary Tab | ||||||||||||||||||||||||||||||||||||||||||

Batch Summary Field Definitions

This is the date that the user has selected for this batch to be paid. The name of the bank from which the checks will be written. The G/L title for this bank. The user assigned description pertaining to this batch. The current balance in bank account Batch Detail Section:

The name of the supplier which is being paid. The Suppliers number assigned to the invoice. The total amount of the individual invoice. The unpaid balance of the invoice. The applicable early payment discount amount. The amount of the check payment for this specified invoice. A/P Due in Days Section:

The grand total of all of the open Accounts Payable per the Accounts Payable Aging module. The total of all invoices due today and later per the Accounts Payable Aging module. The total of all invoices due yesterday and out 30 days per the Accounts Payable Aging module. The total of all invoices due 31 days to 60 days ago per the Accounts Payable Aging module. The total of all invoices due 61 days to 90 days ago per the Accounts Payable Aging module. The total of all invoices due 91 days to 120 days ago per the Accounts Payable Aging module. The total of all invoices due 120 days to infinity days ago per the Accounts Payable Aging module. |

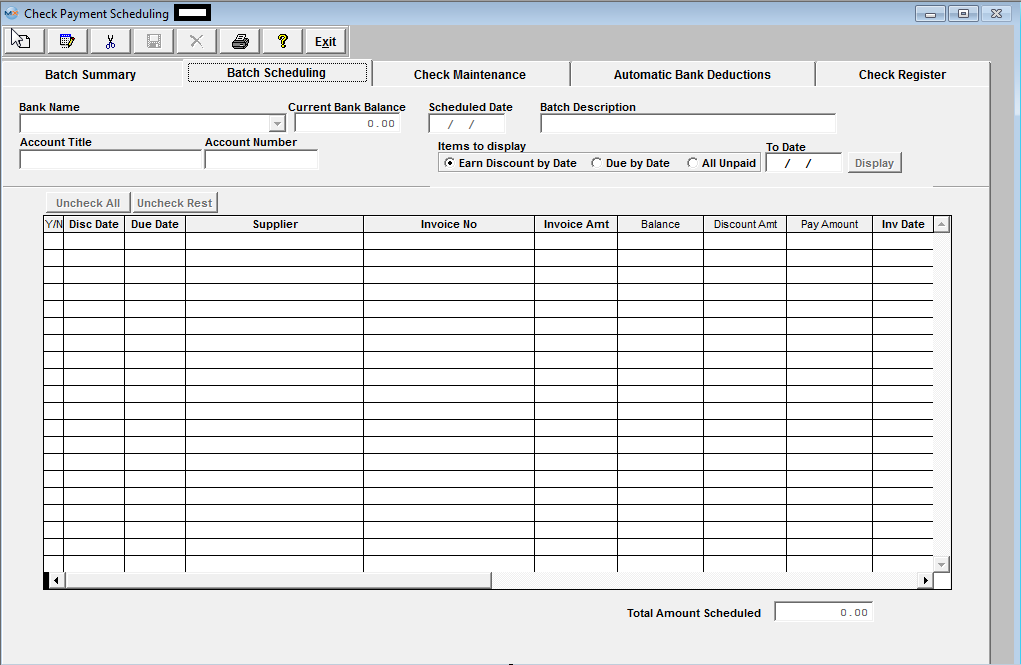

| 1.2. Batch Scheduling Tab | ||||||||||||||||||||||||||||||||||||||||||||||||

Clicking on the Batch Scheduling tab will bring up the following screen:

Field Definitions

The name of the bank from which the checks will be written. Only the Active Bank Accounts will be available in the pull down when processing new records. This is the date that the user has selected for this batch to be paid. The Batch description the user assigned to this batch. The G/L title for the bank being displayed in the Bank Name. The account number for the bank account selected. If this box is checked, the invoice is included in the batch for payment. The date on which the early payment discount expires for terms such as 2 % 10, net 30. Under the terms the supplier has for the user, the last possible payment date available before being considered delinquent.For example, if the terms are 2 % 10, net 30, the date appearing in this column would be 30 days from the invoice date without consideration for the early payment discount. The name of the supplier which is being paid. The Suppliers number assigned to the invoice. The total amount of the individual invoice. The unpaid balance of the invoice. The applicable early payment discount amount. The sum of all of the scheduled invoice payments for this batch. To view the Invoice Date, scroll to the right. If there are several invoices in the batch, the user may sort by invoice date by depressing the Invoice Date column header. |

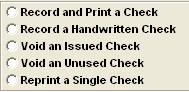

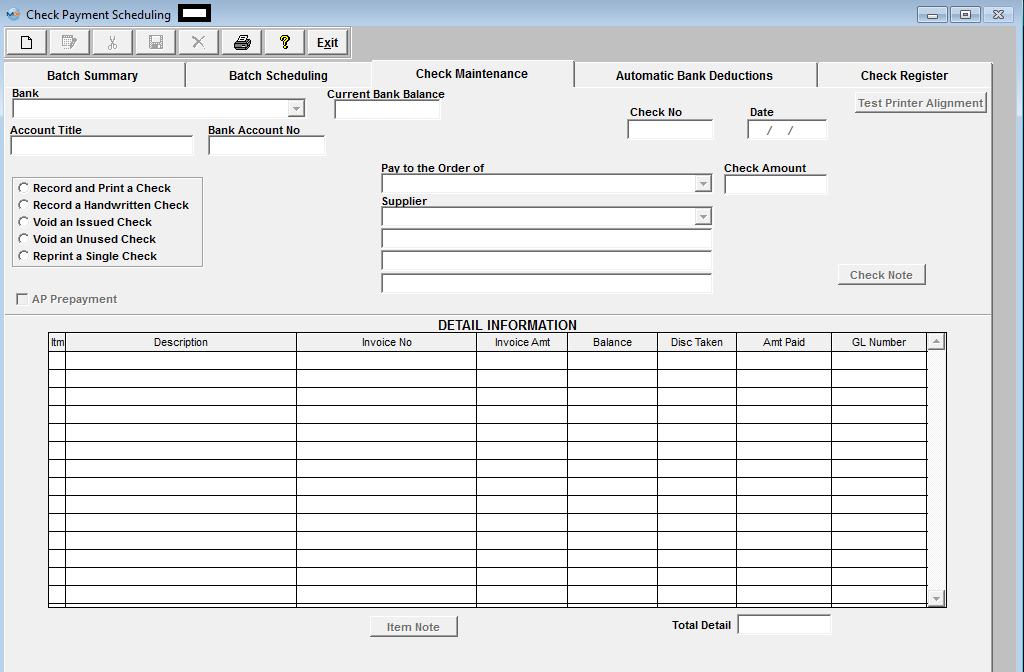

| 1.3. Check Maintenance Tab | ||||||||||||||||||||||||||||||||||||||||||||||

This tab is used to record and print a manual check, to void a check or to re-print a single check. Upon clicking on the tab, the followng screen appears:

Detail Information

|

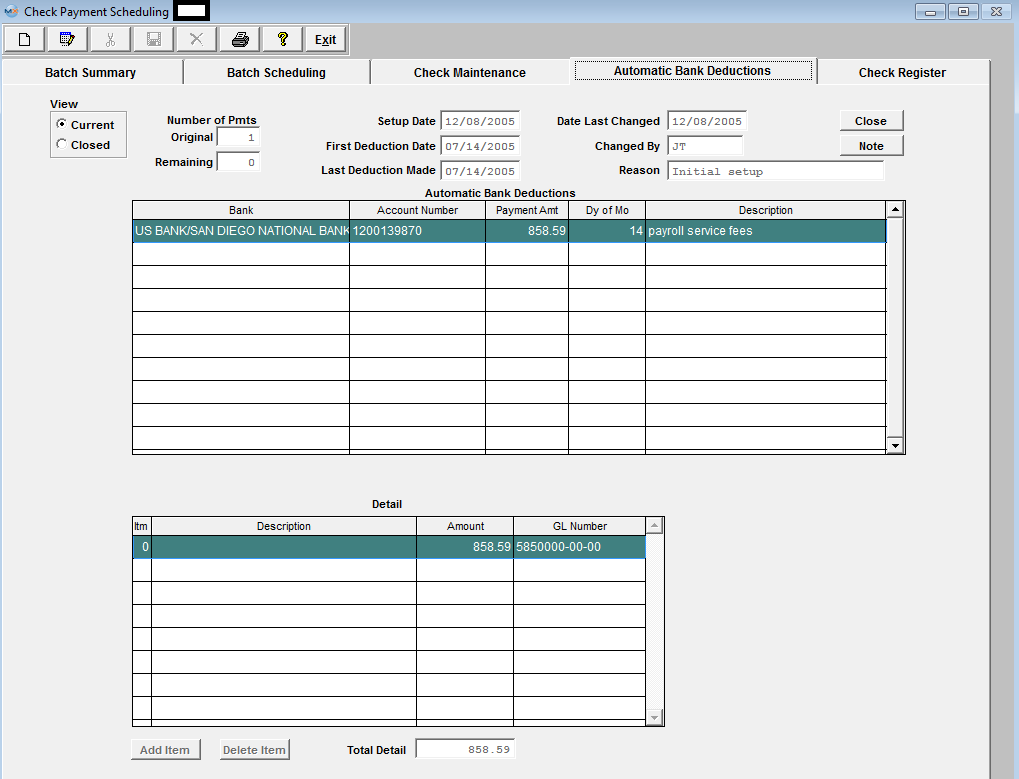

| 1.4. Automatic Bank Deduction Tab | ||||||||||||||||||||||||||||||||||||||||

|

This is the companion screen to the Bank Reconciliation - Generate Automatic Deductions tab. In this screen, the automatic deductions are set up. Upon generation in the Bank Reconciliation module, the appropriate journal entry will generate and the outstanding check list will display the automatic deduction. To view the detail on a specific deduction, highlight it and the pertinent detail will display in the Detail section. Automatic Bank Deductions field definitions:

Automatic Bank Deductions Section:

Detail Section:

|

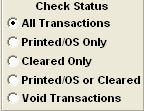

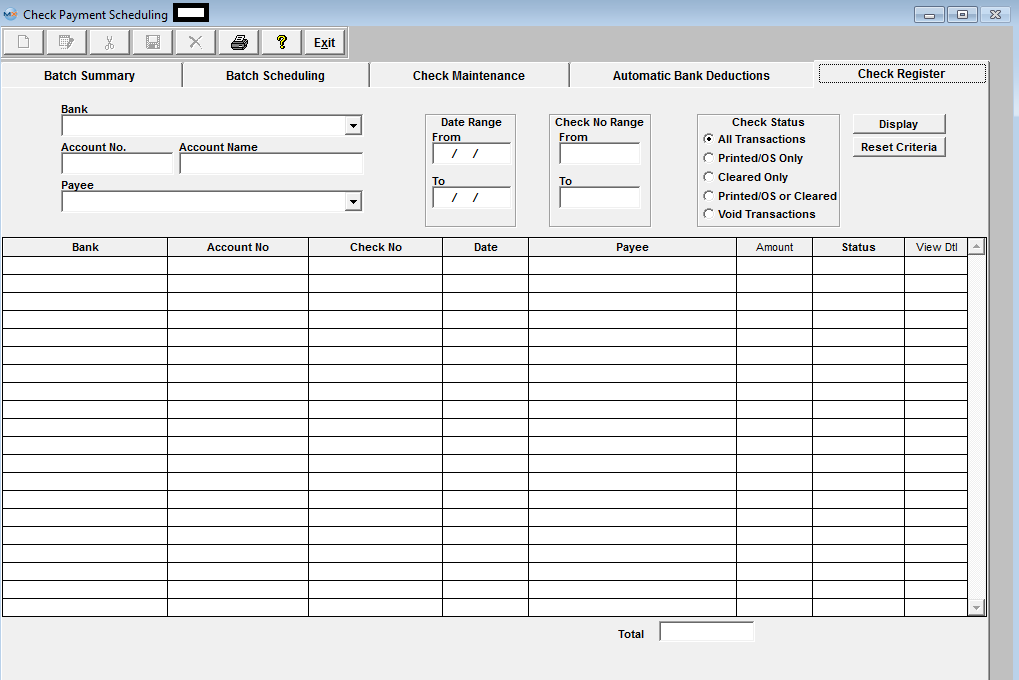

| 1.5. Check Register Tab | ||||||||||||||||||||||||||||||||||||

Depressing the Check Register tab will bring up the following screen:

|