| 1. Add an A/R Credit Memo |

| 1.1. Invoice Credit Memo | ||||||||

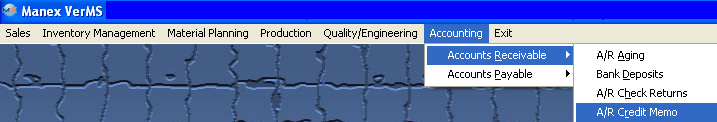

Enter the SQLMANEX.EXE (within the ManEx root directory) The following screen will be displayed, select Accounting/Accounts Receivable/A/R Credit Memo

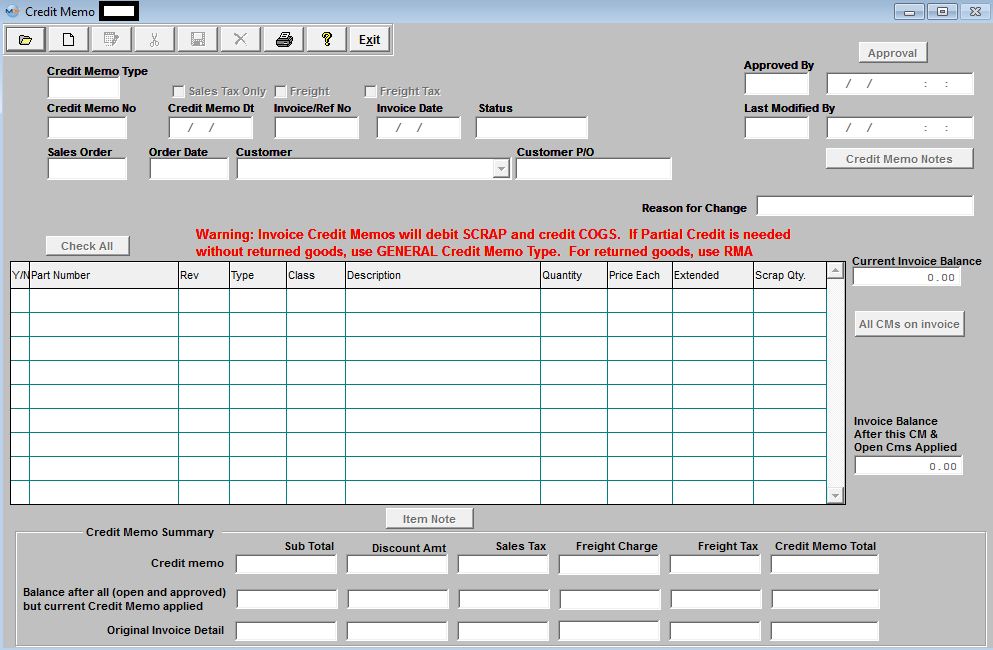

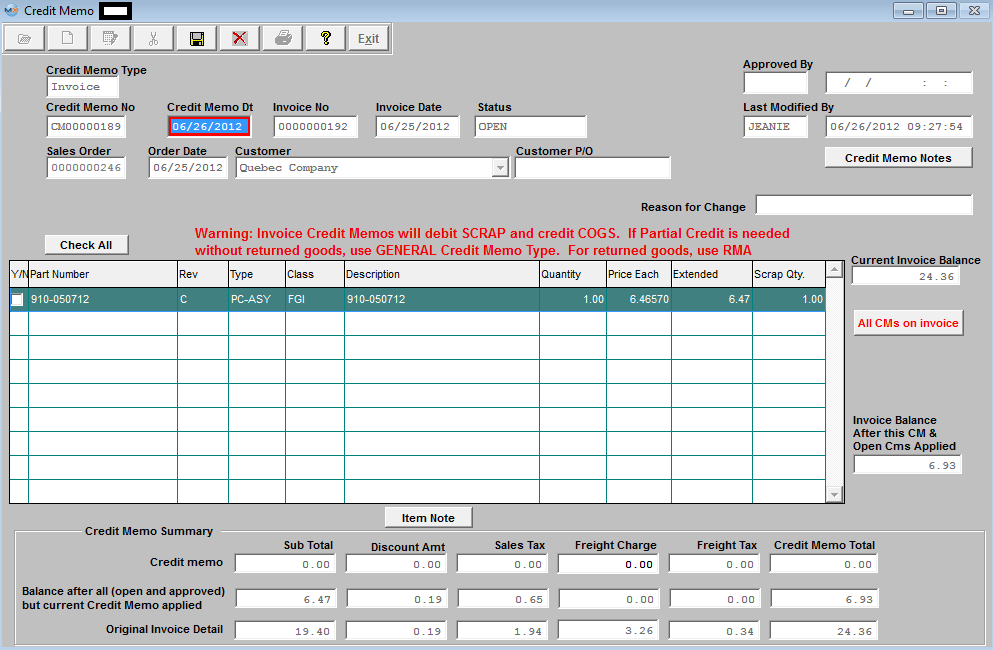

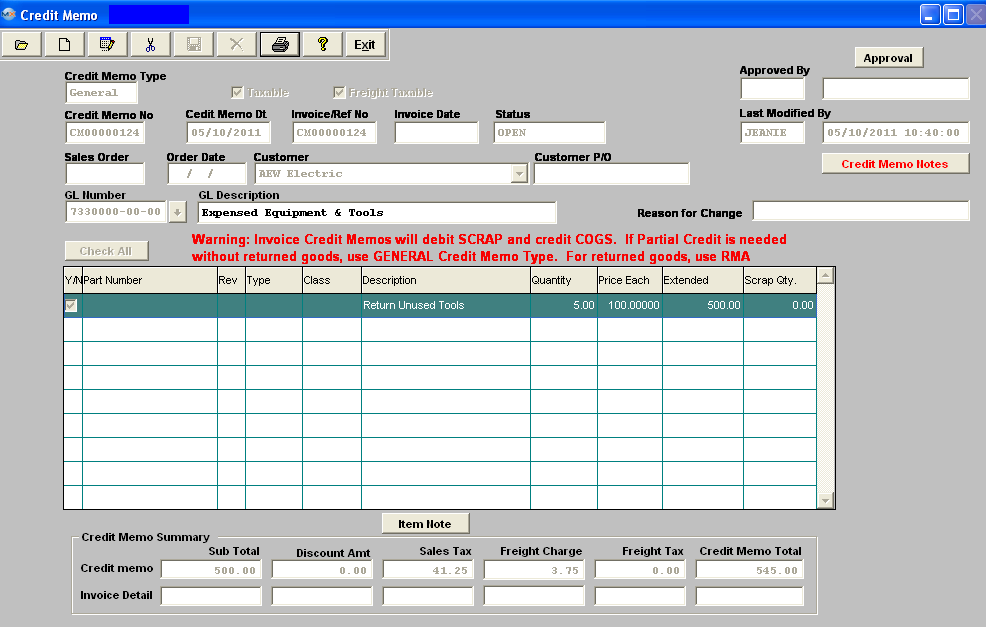

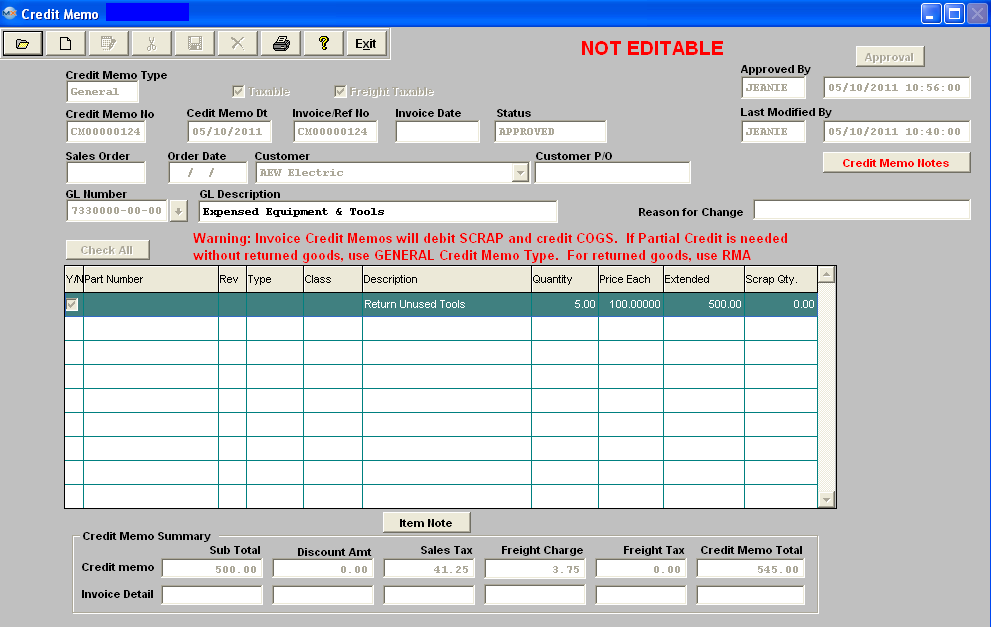

The following screen will be displayed:

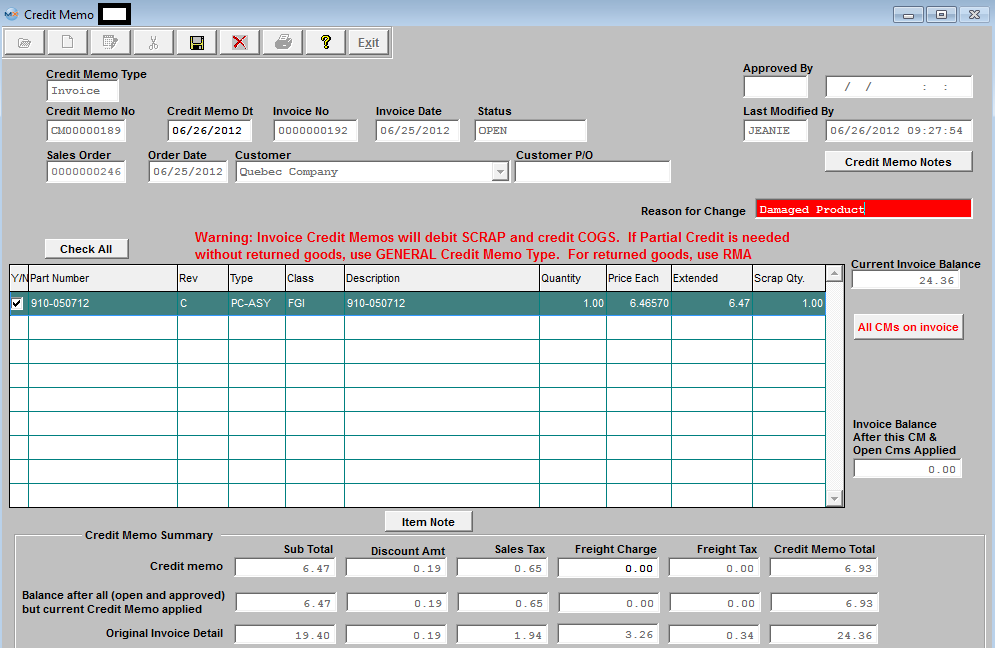

The CM fields are populated with the data from the invoice selected. The qty will default into the Scrap Qty field (this field is read only). This is the qty that will hit the scrap account.

The following information will default into the fields to the right:

"Current Invoice Balance" is pulled from the AR record and reflects any Cash Payments, AR Offsets & "Approved" Credit Memos, but will NOT include "Open" Credit Memos.

"All CMs on invoice" - this button will display in Red, if there are any prior credit memos (open or approved) for the same invoice. "Invoice Balance after this CM & Open CMs Applied" is pulled from the AR record and reflects any Cash Payments, AR Offsets, "Approved" and "Open" Credit Memos, including the current one being added/edited. NOTE: If the amount in this field is within 1% of the Invoice, a button will appear "Adjust Invoice Balance to 0" (If user is creating a Credit Memo for a price adjustment to a Customer Invoice and is not returning the goods and does not want the amount to hit the scrap account then we suggest that user creates a General Credit Memo).

User can choose to issue a Credit Memo for the Sales Tax only or Freight only, by selecting the boxes at the top of the screen. The Sales Tax, Freight and Freight Tax to be credited will appear in the Credit Memo Summary section. NOTE: Users will only be allowed to use these three “only” check boxes at the time when the 1st CM for an invoice is created or if the prior credit memo did not use any amount of the tax/freight yet.

The user may select one or more lines from the invoice against which the credit is to be taken. The selection is accomplished by clicking on the left box on the desired line. As the boxes are checked, the amount of the Credit Memo at the bottom of the screen in the Credit Memo Summary is changed to reflect the lines selected. After selecting the lines to be credited, the user may edit both the quantity and the price of each line. Changing either of these changes the totals for the Credit Memo at the bottom of the screen in the Credit Memo Summary. In addition to selecting and\or modifying the line items, the sales tax, freight charges and freight taxes will also be modified pro-rata by the system. The values will be calculated pro-rata based on the credit being issued for each line. For the line items checked at the left, the qty entered in the Quantity field will default into the Scrap Qty column. The system will automatically debit SCRAP and credit COGS. (If you do not want the GL Transaction to hit the scrap account the user should create a General Credit Memo).

Note: An invoice Credit Memo created in this module or one created in the RMA process against an OPEN invoice will offset the open A/R Trade invoice in the A/R Aging, and the amount displaying in A/R Trade Aging will be the NET. There will be a credit appearing in the A/R Aging only if the Customer invoice had already been paid down.

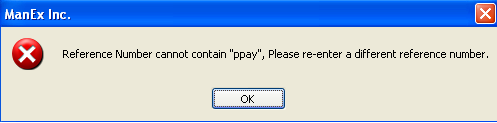

User MUST enter a reason for the Credit memo before saving. If the reason field is blank user will receive the folowing message:

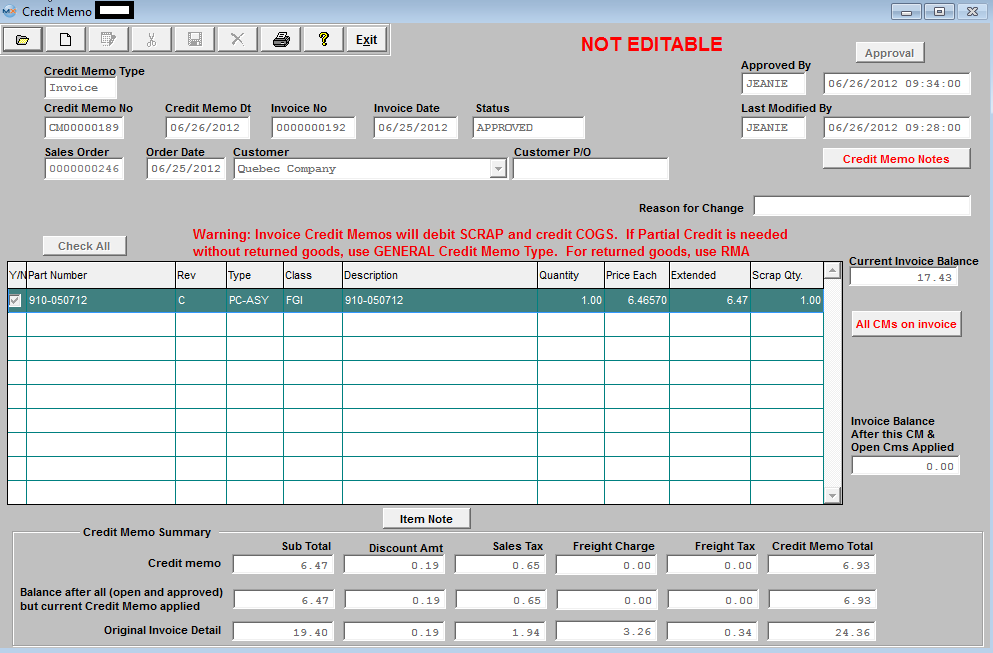

Once a reason has been entered user may Approve the Credit Memo. When user depresses the Approval button the following message will appear:  Once the Credit Memo has been approved the Status will change from Open to Approved and the CM will be forwarded to the AR Aging Module. If desired it may be Offset using the AR Offset module.

|

| 1.2. General Credit Memo | ||||||||||||

|

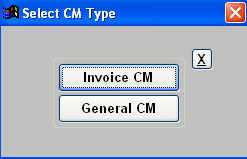

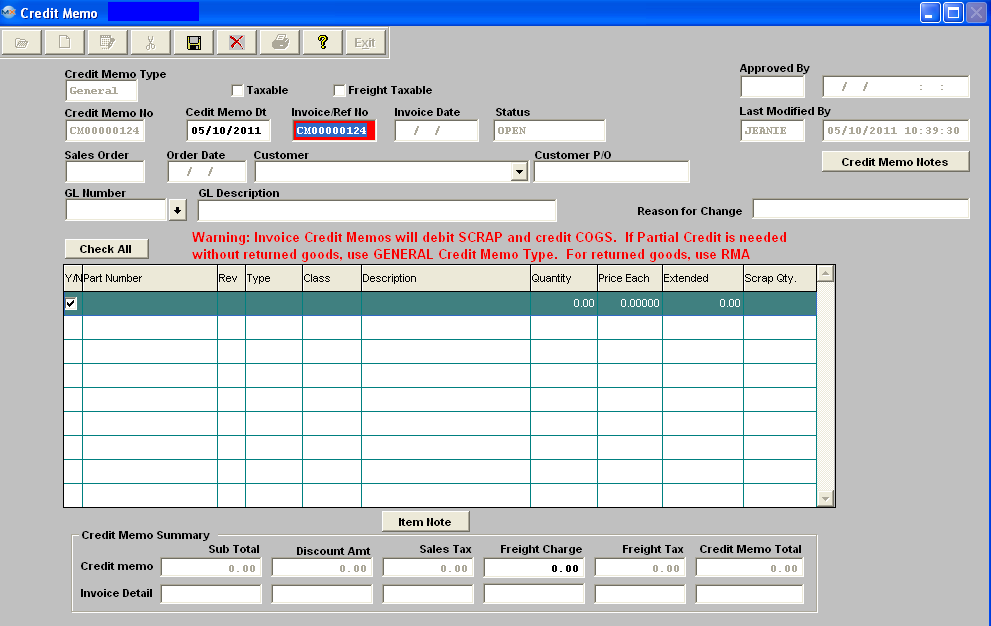

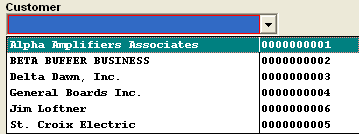

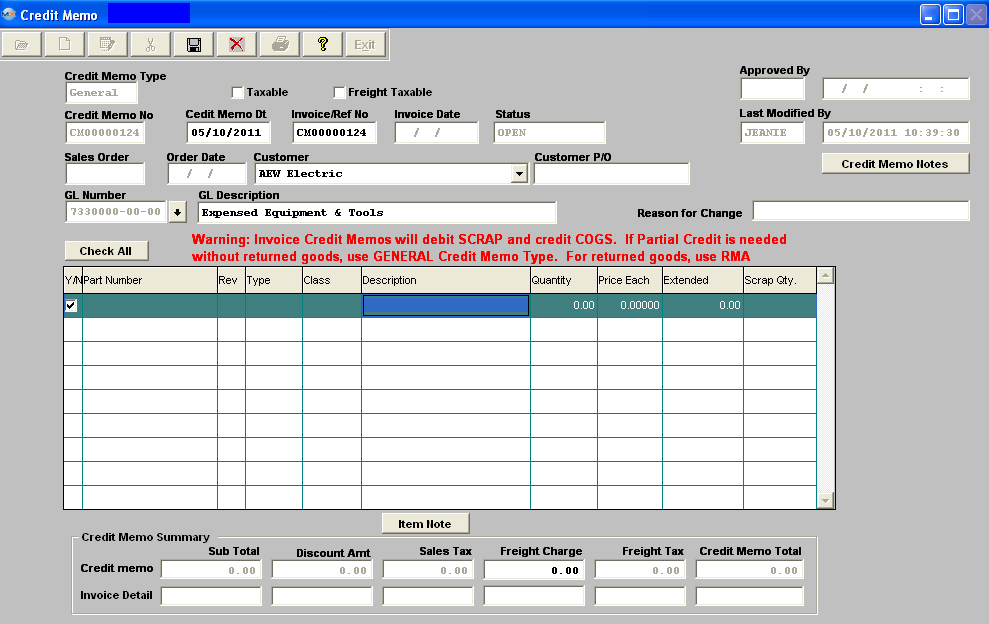

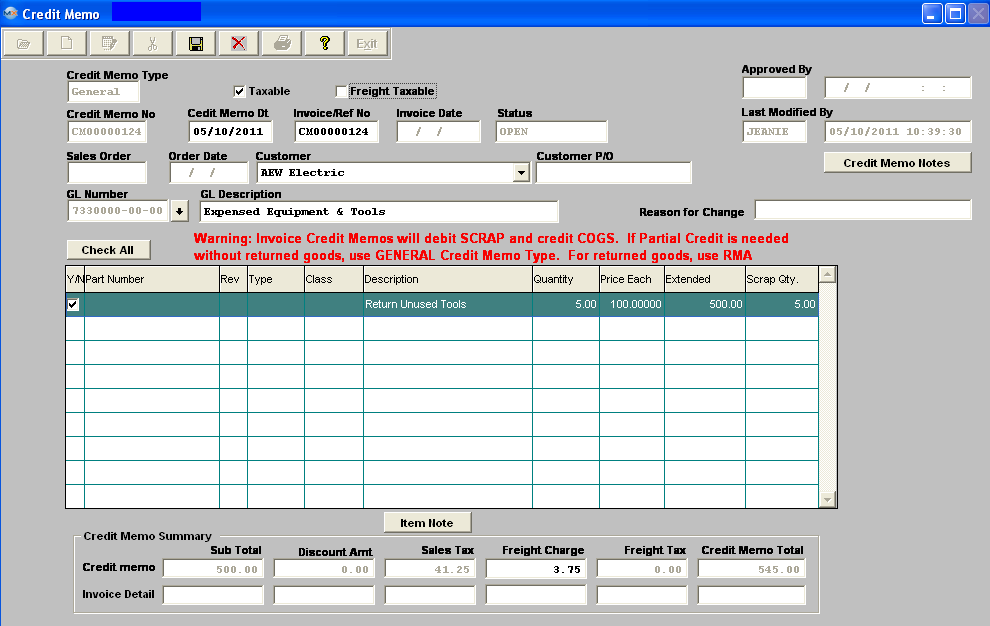

The following screen will be displayed:

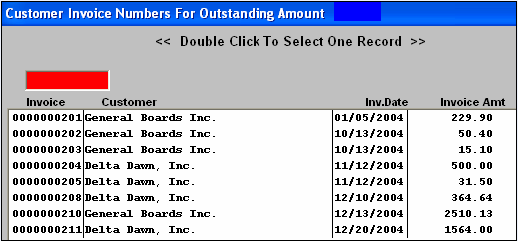

The following screen will appear:

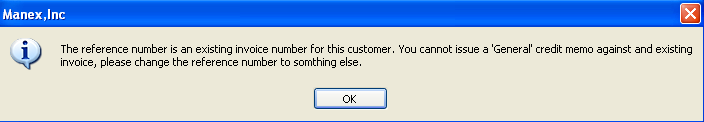

The Invoice Number field changes to a reference number, and the user enters a Reference Number for the Credit Memo.

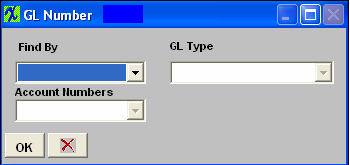

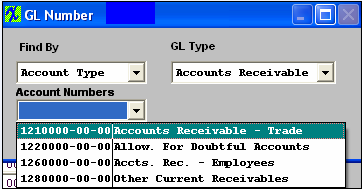

A General Ledger Account number must be supplied for a general Credit Memo. Note: When creating a General Credit Memo users should not select the same GL account number that is entered in the Actsetup for the Account Receivables. If you do, then the resulting transaction will debit and credit both the sane GL account number. The following GL screen will appear:

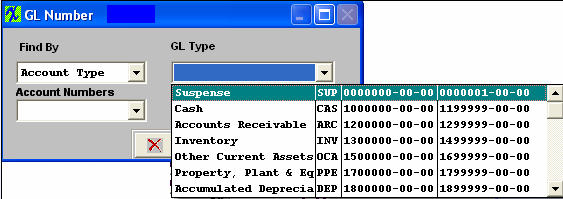

Select the method of finding the General Ledger Account number, by Account Type or Account Numbers. If you select Find By Account Type, depress the down arrow on the right hand side of the screen.

Select the desired Account Type, then select the Account Number.

Depress the OK button. If you select by account number, depress the down arrow next to the Account Numbers box and the accounts will appear. Highlight the Account Number you wish to use.

Then the user enters the description, quantity and price each to be credited. If the Taxable box is checked the Sales Tax will default in. If the Freight Taxable box is checked user must enter in the Freight Charge to be Credited as displayed below. The Credit Memo Total will calculate automatically.

User MUST enter a reason for the Credit Memo before saving. If Credit Memo Reason is blank user will receive the following message.

To enter the reason for the General Credit memo. Depress the Credit Memo Reason button. Depress the Edit button. Enter the Credit Memo Reason. Depress the Save button. Depress the Exit button. Then the Credit Memo may be saved and recorded by depressing the Save record action icon, or deleted by depressing the Abandon changes action icon.  Depress the Approval button, and receive the following message.

Once Credit Memo has been approved the CM Status will change from Pending to Approved, and the CM will forward to the A/R Aging module. If desired, it may be Offset via the A/R Offset module.

|