| 1. Fields & Definitions for Sales Tax Authority Table |

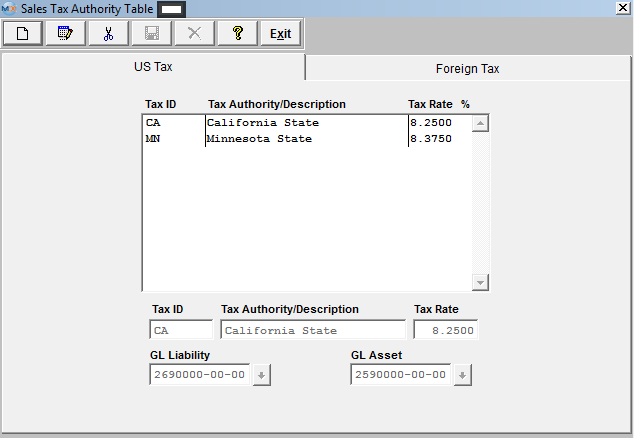

| 1.1. US Sales Tax |

| Tax ID |

City, County, State, Province, etc. ID |

| Tax Authority Description |

City, County, State, Province, etc. Description |

| Tax Rate % |

City, County, State, Province, etc. Tax Rate |

| GL Liability |

Assign GL Liability Number (if accounting module is active) (Liability is Accts Payable - something you owe to someone else) |

| GL Asset |

Assign GL Asset Number (if accounting module is active) (Asset is Accts Receivable - something of value owned by you) |

|

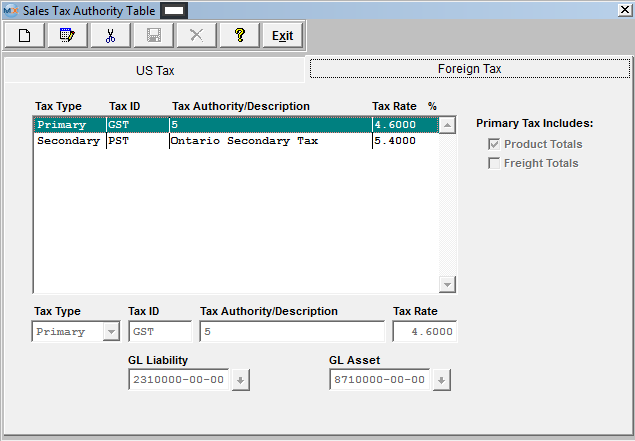

| 1.2. Foreign Tax | |

| Tax Type |

Primary or Secondary |

| Tax ID |

City, County, State, Province, etc. ID |

| Tax Authority Description |

City, County, State, Province, etc. Description |

| Tax Rate % |

City, County, State, Province, etc. Tax Rate |

| GL Liability |

Assign GL Liability Number (if accounting module is active) (Liability is Accts Payable - something you owe to someone else) |

| GL Asset |

Assign GL Asset Number (if accounting module is active) (Asset is Accts Receivable - something of value owned by you) |

| Primary Tax Includes |

Primary (tax to be calculated first) on the Product, Freight or both |

| Secondary Tax Includes |

Secondary (tax to be calculated after primary tax) on the Product, Freight, both or Primary |

|

|