| 1. FAQ-General Ledger |

| 1.1. Balance Sheet Not Sub-Totaling Correctly | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

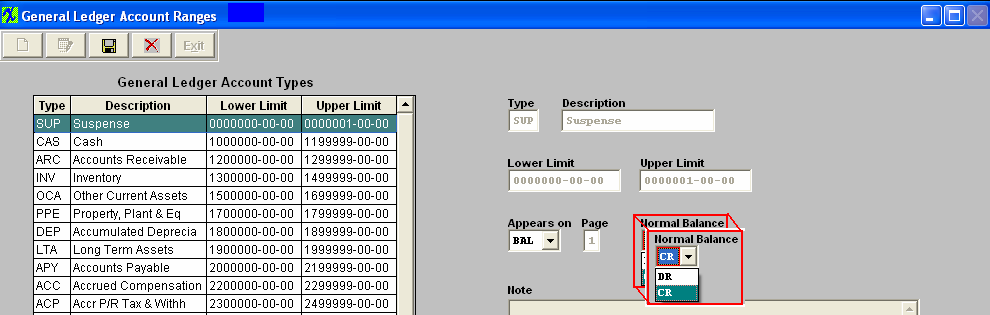

Q. The Balance Sheet is not sub-totaling Correctly The following is the way that the accounting normal balances are established within the ManEx General Ledger Account Ranges for the printing of the financial statements.

Users who have used the old “STANDARD” account setup, found the Depreciation listed as a Credit account instead of a Debit. Because this example was followed, the reports that total the information behave incorrectly. Remember, the system can’t distinguish between an asset or a liability/equity account and that’s why the contra accounts must have the same normal range assigned to them as their parent. For example, all depreciation accounts should be identified as a debit account, including the contra accounts of Accumulated Depreciation. When transactions are posted, these accounts are automatically (internally) identified as credit transactions. But when totaled, they would normally be totaled as a credit in a debit account or become a contra charge. There are two possible remedies for incorrect financial reports based on this issue: 1.(preferred) Go to the system setup, and change ASSET contra accounts to be normal balance DEBIT accounts and change Liability/Equity contra accounts to be normal balance CREDIT accounts . Or- 2.Use the print to Excel format for the financial reports, then individually sum up the subaccounts as desired, and perform subtotals as necessary. There are new applications which will be available soon to assist the user in this process. It needs to be emphasized that the data (all transactions and Journal Entries) in ManEx are correct. It is only the reporting that is affected by the contra accounts being set up improperly for the ManEx System. Below is the standard setup, and how it should be changed.

Note: No changes are required for the individual accounts, only the Normal balance in the following screen must be changed: |

| 1.2. Is there a report that will give you the Detail of a Kit Closure Variance? |

|

Q. Is there a report that will give you the Detail of a Kit Closure Variance?

A. For further detail See Article #3235

|

| 1.3. Why doesn't the Beginning Balance on the Trial Balance rpt doesn't match the GL Cross Tab Rpt? |

Q. Why doesn't the Beginning Balance on the Trial Balance rpt doesn't match the GL Cross Tab Rpt?

A. The Detailed GL Cross Tabbed Report for Fiscal Year is the ONLY Cross Tabbed report where the beginning balance will match the Trial Balance report beginning balance. The other Detailed GL Cross Tabbed reports are calculated a bit differently then the Trial Balance report, so they will more than likely never match the Trial Balance rpt.

|

| 1.4. Why isn’t a General Ledger number appearing on the Trial Balance Report? |

|

Why isn’t a General Ledger number appearing on the Trial Balance Report?

Make sure you have the record released and posted to the transaction and if that did not update the trial balance, then you can run the “Rebuild the Accounts Table” utility to rebuild all accounts and update the trial balance. Be sure you have all users logged off when running the utility. |

| 1.5. Why the Posted Sales GL Reports Slow Down in 9.0? |

Users will experience a longer report compile time for the Posted Sales report in 9.0 or later. The reason this report will now take a longer time to compile is due to the changes we made in the routine to pickup the COGS at the time to the Inventory Issue instead of the time of posting. In these changes to make the transactions correct we now have to analyze 5 tables to get the information instead of only looking at one table. |

| 1.6. Why is the Unreconciled Receipt considered as an Asset? |

Question: Why is the Unreconciled Receipt considered as an Asset?

Answer: This item represents inventory that has been received but the purchase order has not been reconciled with the purchase order, so we don’t want to put it into inventory until it has been reconciled so this is basically a holding account until it has been reconciled and transferred over to inventory. We set it up this way to recognize that we have received the items and recognize both the asset and the liability we owe the supplier. |

| 1.7. 200th Journal Line |

Q. How do I continue once I've reached the 200th line item in a General Journal Enty? A. There is currently a two hundred (200) line edit limit within the Journal entry window.You may overcome this limit by saving then editing the same journal entry as displayed below. To overcome 200 line limit: IN GENERAL JOURNAL ENTRY SCREEN, TYPE IN THE FIRST 199 ACCOUNTS: LOOK AT THE REMAINING BALANCE: TYPE THIS AMOUNT INTO SUSPENSE ACCOUNT:

NOTE THAT THE REMAINING BALANCE FIELD IS NOW 0.00 SAVE THE ENTRY. EDIT THE ENTRY. HIGHLIGHT THE SUSPENSE LINE. DEPRESS THE DELETE LINE BUTTON. TYPE IN THE SUSPENSE ACCOUNT NUMBER. 0000000-00-00, at the prompt. APPROVE THE REMOVAL WHEN THE CONFIRM MESSAGE DISPLAYS BY DEPRESSING THE YES BUTTON. THE OUT OF BALANCE CONDITION WILL RETURN.

Continue typing in the opening entry. |