| 1. FAQ-Accounts Payable |

| 1.1. How to Handle Invoices that have been Paid with a CC and has been Released to GL |

|

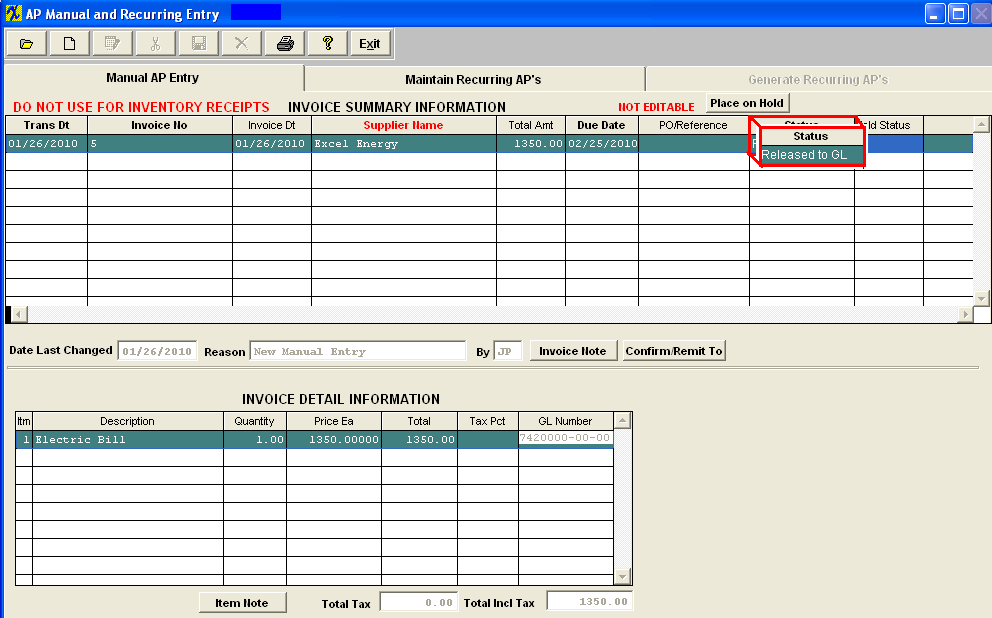

Q. How to Handle Invoices that have been Paid with a Credit Card and has been Released and Posted to GL If the Paid Invoice has been Posted to the General Ledger and the status in Manual AP Entry is "Released to GL":

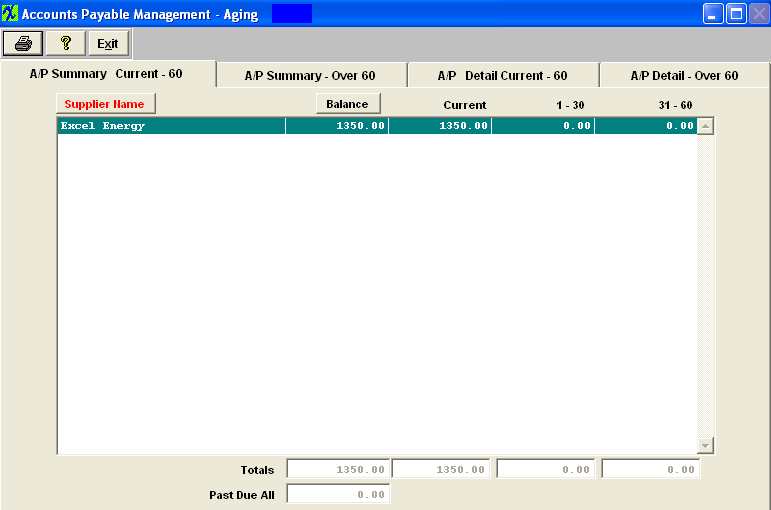

This record will remain on the AP Aging under Excel Energy until the check is created to the Credit Card Company.

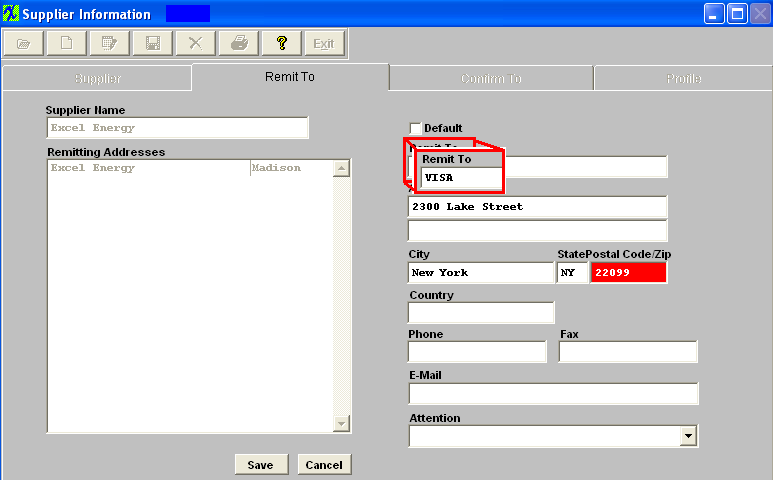

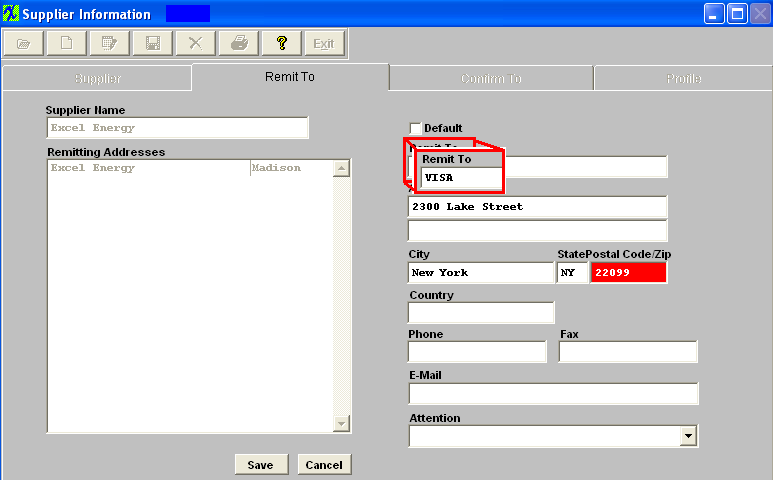

User will still need to add the Credit Card Information to the Supplier Remit To:

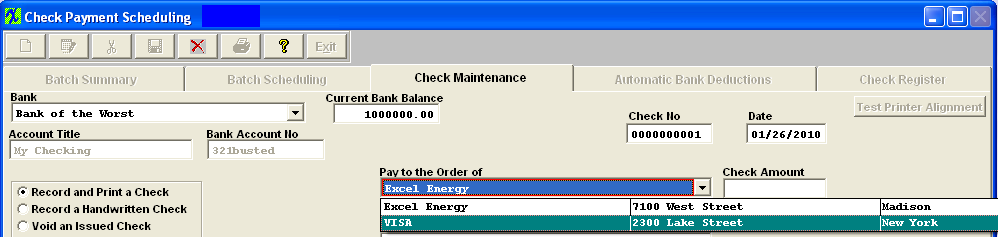

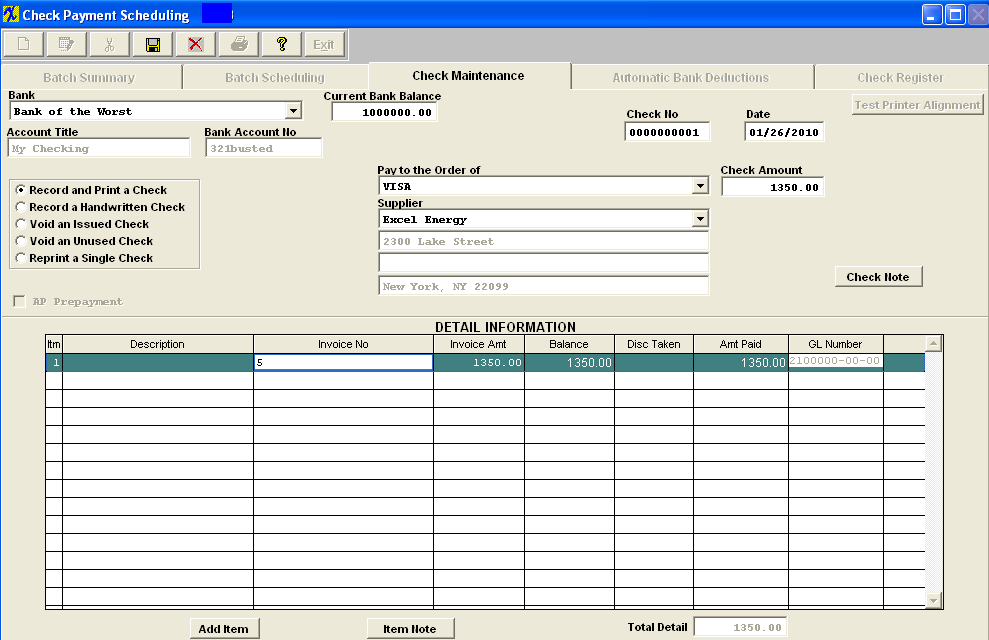

Then within Check Maintenance, the user can Record and Print a Check and select the Supplier, then within the "Pay to Order of":, they you have to select the Credit Card Remit To:

Then go through and add each individual invoice that they would like to pay to the Credit Card Company:

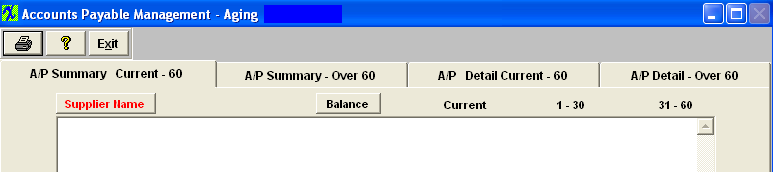

This will clear the Invoice from the AP Aging Screen.

|

| 1.2. How to Handle Invoices that have been Paid with a CC and has NOT been Released to GL |

|

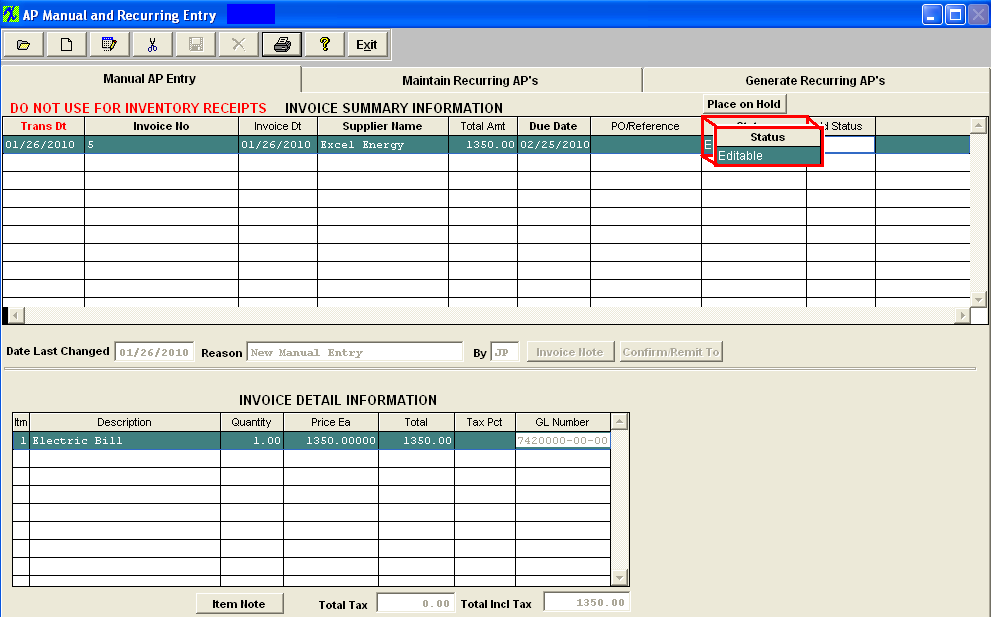

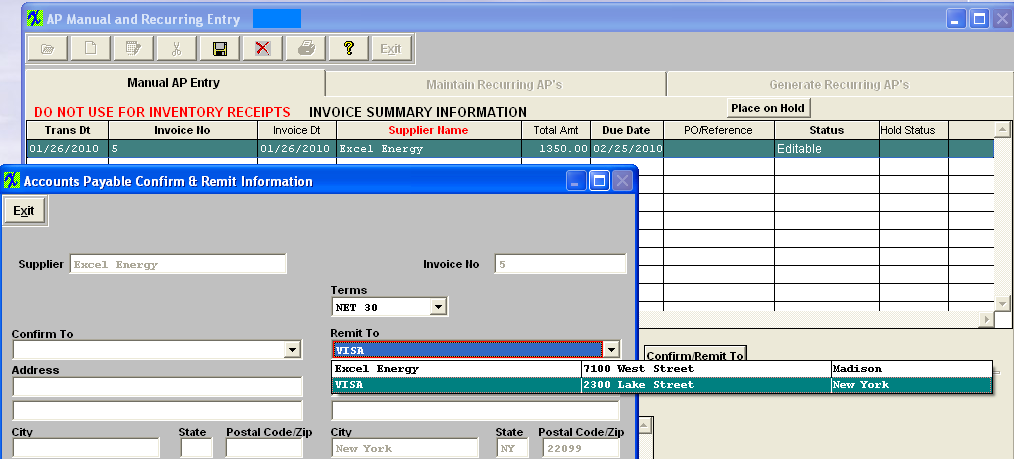

Q. How to Handle Invoices that have been Paid with a Credit Card and has NOT been Released or Posted to GL If the Paid Invoice has NOT been Posted to the General Ledger and the status in Manual AP Entry is "Editable"

User will need to add the Credit Card Company Information to the Supplier Remit To:

Then they will be able to Edit the Invoice through Manual AP Entry selecting the Credit Card remit to information:

This record will remain on the AP Aging under Excel Energy until the check is created to the Credit Card Company.

Once a Check is created and payable to the Credit Card Company it will then clear from the Excel Energy account from the AP Aging Screen.

|

| 1.3. If you have single or multiple invoices on AP aging that need to be removed. |

| Q. If you have Single or Multiple Invoices on A/P aging that need to be removed.

A. Use A/P Debit Memo "Open Debit Against Account" to cover single or multiple invoice balances. Make sure to pay attention to the GL accounts that were used on the original invoices if you want the Debit Memo values to offset the values against those GL accounts. As soon as the Debit Memo is approved a transaction is generated to be released/posted to the GL. Then the user will apply the General Debit Memo against the Invoice(s) in AP Offset . In this scenario this type of offset should NOT generate any transactions for posting to GL.

|

| 1.4. Is it Possible to Match two Receivers to One AP Invoice? |

Q. Is it Possible to Match two Receivers to One AP Invoice?

A. The receiver #’s are unique to each individual receipt against a PO so there is no way to match two PO receivers to one AP invoice. At this time each receiver would have to have their own invoice. We are aware about this type of request and feel it would be a good idea to add this ability as an enhancement. We have added this onto the list of enhancements requests.

|

| 1.5. Why doesn't the AP Aging Detail as of report match the GL account information? |

Q. Why doesn't the AP Aging Detail as of report match the GL account information?

A. You want to be sure that all invoices have been released and posted to the GL. The AP Aging Detail As Of report does NOT list invoices that have NOT been released/posted to the GL yet. This report is intended to match the GL account information not the AP Aging screen. Note: If this report is still not matching the GL account information after all transactions have been released and posted to the GL then it may be due to Posted Journal Entries against the AP GL account. These JE's will not be accounted for on the AS OF report yet will affect the GL Account balance and could explain why you are seeing a difference between the two. It may also be due to prepayments, all of the AP Aging reports account for prepayments but will not be accounted for on the AP Aging screen or the AP GL account information due to a different GL number being used for prepayments.

|

| 1.6. Why doesn't ManEx allow the Automatic Bank Deduction Records Editable? |

| The reason ManEx does not allow users to edit or make changes to saved Automatic Bank Deduction records is: Say user has a deduction for $100 a month, and then after a few months users wants to change it to $150 a month. If we allowed edits, then after the edits any reports and other references to the first few months would report the amount to be $150 a month when in fact they were $100. So ManEx provides a "Close" button on the form, to close out an automatic deduction ($100 a month) but maintain the original information. Then user would create a new Automatic Bank Dedduction for the $150 a month. |

| 1.7. Why isn't the New Remit to Address Printing on the Checks? |

Q. Why isn't the New Remit to Address Printing on the Checks?

A. The AP check module prints the checks per the Remit To information that is associated with each PO.

The system will keep the address information (on existing PO's) that was actually selected at the time the PO was created. If you add a new Supplier Remit To address and mark the new address as the Default. The previously created PO's will still carry the original Remit to (ManEx cannot assume that the user wants to change all Remit To's across the board for already created and approved PO's). The user will be required to edit each PO that the change affects and update the Remit to with the new default (any new PO's created will properly take the new default).

The Invoices created through the PO Reconciliation module also carry the original Remit to Address information. Any invoice that already was created and remains on your AP Aging will need to be edited through the Manual AP Entry screen. IF it was already released to the GL at that time, I don’t think that the Edit feature would be available. If you are unable to edit the Remit to information via the Manual AP Entry, then you can control the Remit to information that will print on the AP Check, by creating a Manual check through the Check Maintenance screen. If you completely delete a Remit To address any previously created PO's will no longer have a Remit to address to refer to, therefore the remit to information on existing PO's will be blank. The AP check module prints the checks per the Remit To information that is associated with each PO, so the address printed on the check will also be blank. So, each PO that still has invoices residing within the AP Aging, will have to be edited and the Remit To information will have to be updated with the new address, if a Remit To address is deleted. We would suggest that the person making changes to the Remit To Address information is careful before deleting one from the system. You have to make sure that any record that has already been associated with that record has been processed through the system, and/or updated with the new address information. |

| 1.8. What Check Forms can be Used in ManEx? |

Question: What Check Forms can be Used in ManEx? Answer: There are three types of Check Forms to select from: Standard ManEx Check Layout; Deluxe Form DLT104; or Canadian Check Layout. See Article #3014 for further information on the check forms. |

| 1.9. What is the best way to Handle a Wire Transfer to a Supplier Using the ManEx System? |

Q. What is the best way to Handle a Wire Transfer to a Supplier Using the ManEx System?

A. The Best Approach would be to:

Then everything should be accurate from a cost standpoint.

|

| 1.10. What is the difference between the "Un-Reconciled PO All Suppliers" Rpt and the "Un-Reconciled Receipt Account Value" Rpt |

Q. What is the difference between the "Un-Reconciled PO All Suppliers" Report and the "Un-Reconciled Receipt Account Value" Report?

A. The "Un-Reconciled PO All Supplier" report will only list receipts that are waiting to be reconciled within AP. The "Un-Reconciled Receipt Account Value" report will display ALL records that affect the GL Account. Including Receipts waiting to be reconciled and items that were rejected at receiving and are waiting for a DMR to be processed through the system.

|

| 1.11. Where does the AP Aging Detail Report Pull the Terms From? |

The AP Aging Detail report pull the terms from the Payment Terms. These terms are recorded when the Supplier information is setup. Then if a supplier changes the terms for future invoices, the terms on the existing invoices will not change. For example: If user creates an Invoice and the existing terms are 2-10, net 30 and after the invoice has been created, but before the invoice has been paid the supplier's terms change to COD, the original invoice that was created with the terms of 2-10, net 30 will not change, so the user can still get the 2% discount if they pay that invoice within 30 days.

The system allows the supplier to change the terms in the Purchase Setup module. The purpose of that is to give them the flexibility to setup whatever they want to with customers and suppliers per invoice. But the AP Aging Report needs to have one term to determine the Aging colmuns. If we had each invoice list its own terms on the report and attempt to calculate the aging based on each invoice it would cause additional problems within the reporting,etc. . .

|