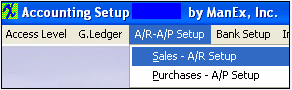

| 1. A/R-A/P Setup |

| 1.1. Sales - A/R Setup |

| 1.1.1. Prerequisites for the Sales - AR Setup |

| 1.1.2. Introduction for the Sales - AR Setup |

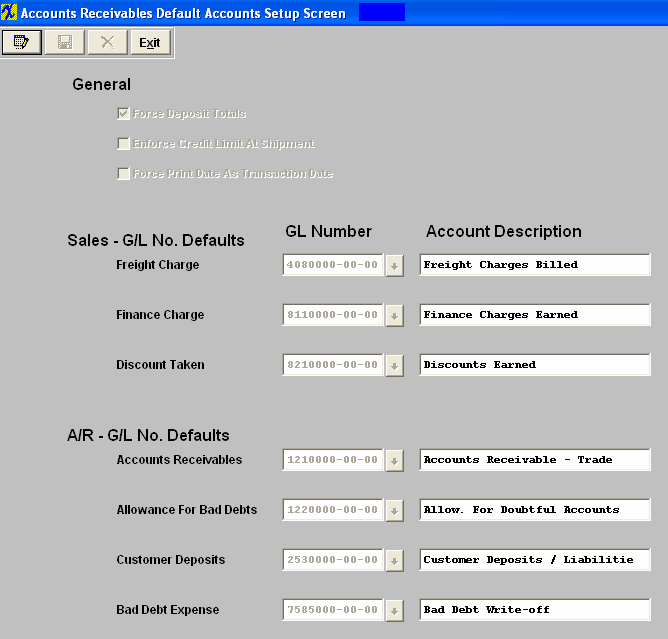

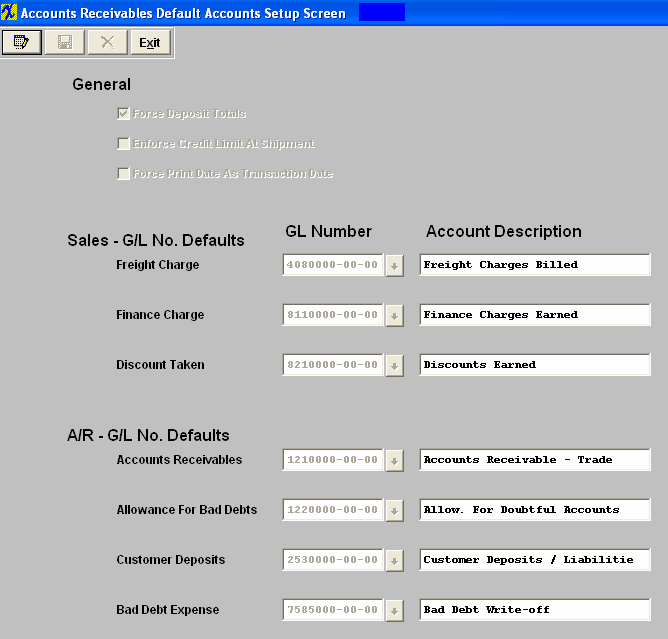

This is where user sets up the default Sales and A/R General Ledger numbers. By setting up default account numbers for Sales and A/R here, each time an entry is created for Sales or A/R, the accounts will already be assigned for posting.

Note: that the accounts selected as defaults must have the class of posting in the General Ledger Account Setup screen. If you have the Multi-Plant version of Manex, prepare defaults for each division set up previously in G/L Divisions /Departments screen. |

| 1.1.3. Fields & Definitions for the Sales AR Setup | ||||||||||||||||||||

General

Sales - G/L No. Defaults

A/R - G/L No. Defaults

|

| 1.1.4. How To ........... |

| 1.1.4.1. Sales/Accounts Receivable Setup | ||

The following screen will appear:  The user may Edit information on this screen. At the conclusion of any modifications, the user must Save or Cancel to leave the screen.

If you are a Multi-Plant user, select the Division at the top of the screen. Enter the defaults for that division. Save the data. Repeat this process until all divisions are entered. Where Used: This Setup is used in Sales Orders and Invoicing. After completing this section: «Mark as Completed in RoadMap in Section C Item 3-a» |

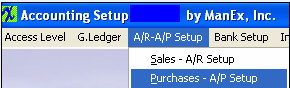

| 1.2. Purchases - A/P Setup |

| 1.2.1. Prerequisites for the Purchases - A/P Setup |

General Ledger Accounts must be completed before using this section.

|

| 1.2.2. Introduction for the Purchases - A/P Setup |

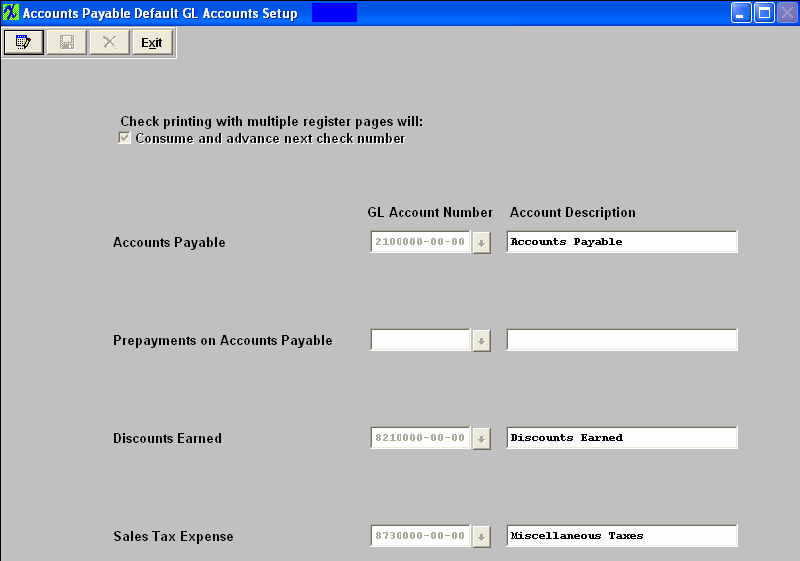

This is where user sets up the default associated with Accounts Payable General Ledger numbers. By setting up default account numbers for Purchases and A/P here, each time an entry is created for Purchases or A/P, the accounts will already be assigned for posting.

Note: that the accounts selected as defaults must have the class of posting in the General Ledger Account Setup screen. If you have the Multi-Plant version of Manex, prepare defaults for each division set up previously in G/L Divisions /Departments screen. |

| 1.2.3. Fields & Definitions for the Purchases - A/P Setup | ||||||||||

|

| 1.2.4. How To ........... |

| 1.2.4.1. Purchase-Accounts Payable Setup | ||

The following screen will appear:

The user may Edit information on this screen. At the conclusion of any modifications, the user must Save or Abandon Changes to leave the screen.

When in Edit Mode user can select different GL Account Numbers from the pull downs. The GL Account Numbers MUST be setup in the GL Account Setup module.

Where Used: This Setup is used in Purchase Orders and Accounts Payable. After completing this section: «Mark as Completed in RoadMap in Sect. C Item 3b» |