| 1. G/L Release/Posting/Closing |

| 1.1. Release and Post to GL |

| 1.1.1. Prerequisites for the Release and Post Module |

Prerequisites Required for General Ledger activity:

| GL Setup |

The account information for the General Ledger must be established in the G/L Account Setup .

|

| Accounting Security |

Users MUST have full rights to the "ALL Releases to GL" in Accounting Security to be able to release records. Users MUST have full rights to the "ALL Posting to GL" in Accounting Security to be able to post records. Users with “Accounting Security Supervisor” rights will automatically have access.

|

| Other Setups |

Please refer to the additional set ups required as discussed in the Introduction below.

|

In order for the ManEx General Ledger module to work correctly, all the modules in Accounting Setup must be setup properly, along with the following list of modules in System Setup :

Inventory Items

For Inventory Items, the Standard Cost must be entered: In Systems with ManEx Accounting installed, the amount entered in the Standard Cost field is used for Cost Accounting functions and is subject to strict change control. If ManEx Accounting is not being used, the field can show actual, target or user defined cost.

Important Note - If accounting is installed: For ALL buy parts, the Standard Cost field MUST have data entered. If this data is missing (or wrong), the Raw Materials Inventory and the Work In Process (WIP) will be incorrect for the accounting records.

Item Master tab – Buy part

·All make parts which are turnkey (not labor only), MUST have data entered in the Standard Cost field. Additionally, the data entered in the Standard Cost field for the make part should equal the sum of the Bill of Materials components. If the sum of the Bill of Materials components does not equal the Standard Cost per the MAKE PART Item Master, a CONFIGURATION VARIANCE will generate. A way to have the system upload these costs automatically is via the Standard Cost Adjustment module.

.

|

| 1.1.2. Introduction for the GL Release and Post Module | Release and Posting Information Overview

ManEx has revised and added new features to the Release and Posting to GL screen that will give the user much more detailed information on screen and flexibility. All transaction can be now released and posted from one screen. It also allows the users more control on how they wish to have the accounting records released/posted per transaction. Also, within the Release/Post Screen, where available user has the ability to drill back to the source in which the Transactions originated from. For Example: Within the Release/Post Sales screen the users will see a link back to the Sales Order and/or Invoice that the transaction originated from. If the user depresses this link the system will then bring them back to that module and record for further review.

Note: This screen is a single user screen, to prevent users from attempting to release/post the same record causing duplicated transactions to be posted to the GL.

There are three options for each of the 17 types of transactions to be released and posted.

1) The current method "Manual Release after Review & Manual Post after Review" This means that the transaction must first be released and then posted as two separate activities.

2) "Auto Release & Manual Post after Review" This means that when the transaction is saved or approved in the originating screen, the transaction is placed in the released tables and only has to go through the posting routine to be posted to the General Ledger.

3) "Immediate Auto Release & Post to G/L without Review" This means that when the transaction is saved or approved in the originating screen it is automatically posted to the General Ledger without having to go through any release or posting screen for review.

Postings To General Ledger are created automatically! For example, when a CUSTOMER INVOICE is printed, the system sets up the Underlying Journal Entry ready to post into the General Ledger.

Three Stage Posting Process:

As designed, the General Ledger presents a 3 stage reporting/posting process to the user.

The first stage updates the aging reports and happens automatically when a Sales Invoice is printed or a Vendor’s Invoice is reconciled or entered directly into the accounts payable system through the use of a Manual Invoice. In this way the current aging status of both A/R and A/P can be known immediately.

The second stage of the process occurs when the user activates the ‘RELEASE TO G/L’ selections. The process creates Underlying Journal Entries for the associated transactions. These Underlying Journals are in turn used in the actual General Ledger update procedure.

The third and final stage of the General Ledger posting procedure is the actual posting to the General Ledger from the Underlying Journals. The posting process updates the tables used to present Balance Sheet and Income Statement information to the user.

Posting means that the transaction is recorded in the GLTRANS table. This information is then used in the GL Reports.

The last process is CLOSING A PERIOD and moving the final closing balance information into the appropriate history files.

Real Time

All of the G/L interfaces are created in a Real Time mode and forward into the various release modules. For example, the instant that the Invoice is printed in the ManEx Administration module, the entry is created and forwards into the Release Sales to General Ledger.

The ManEx general ledger system is designed to give the user the widest range of possible entry options while maintaining compatibility with generally accepted accounting principals.

|

| 1.1.3. Fields and Defintions for the Release and Post Module |

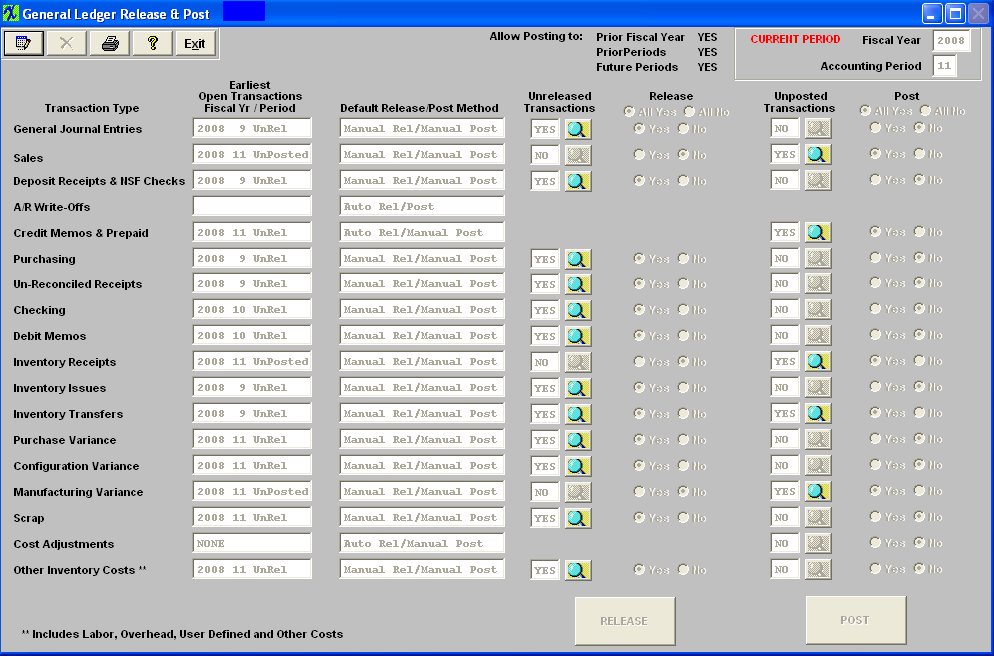

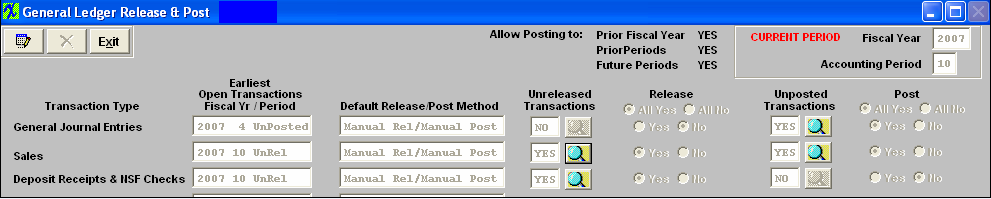

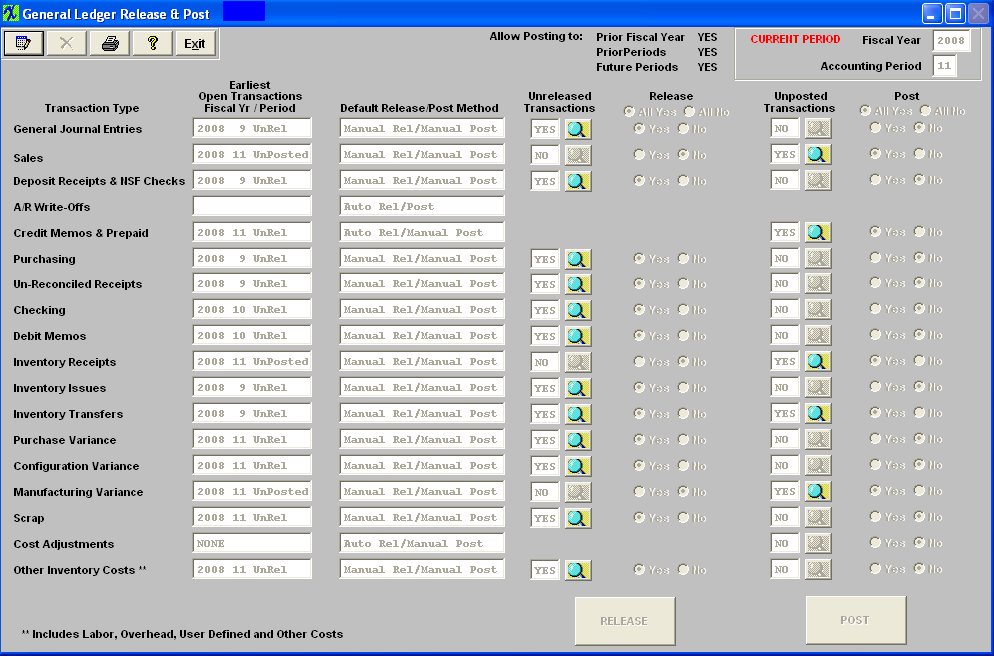

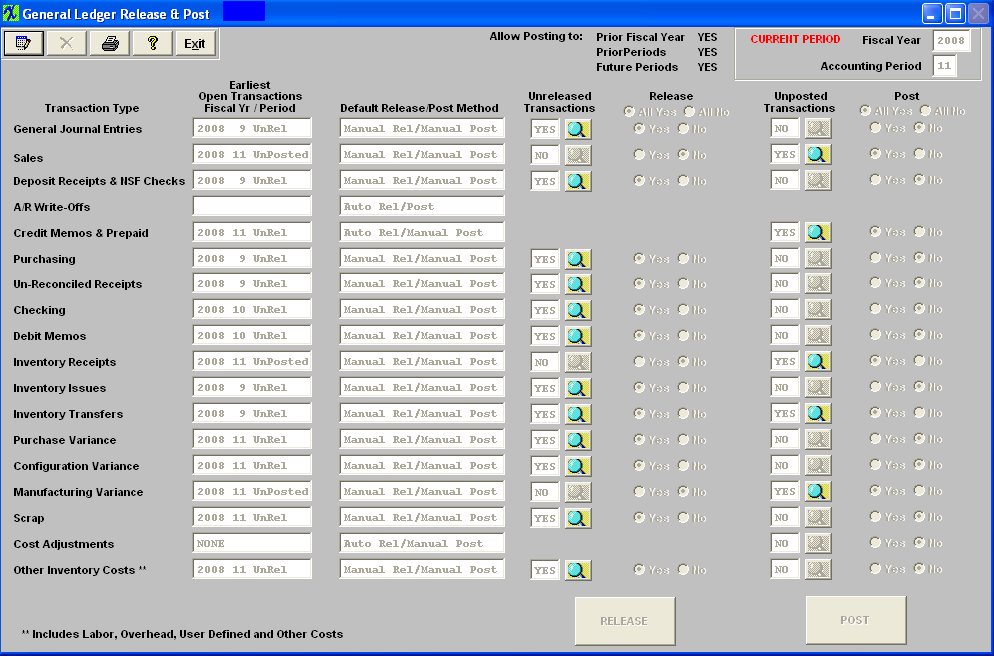

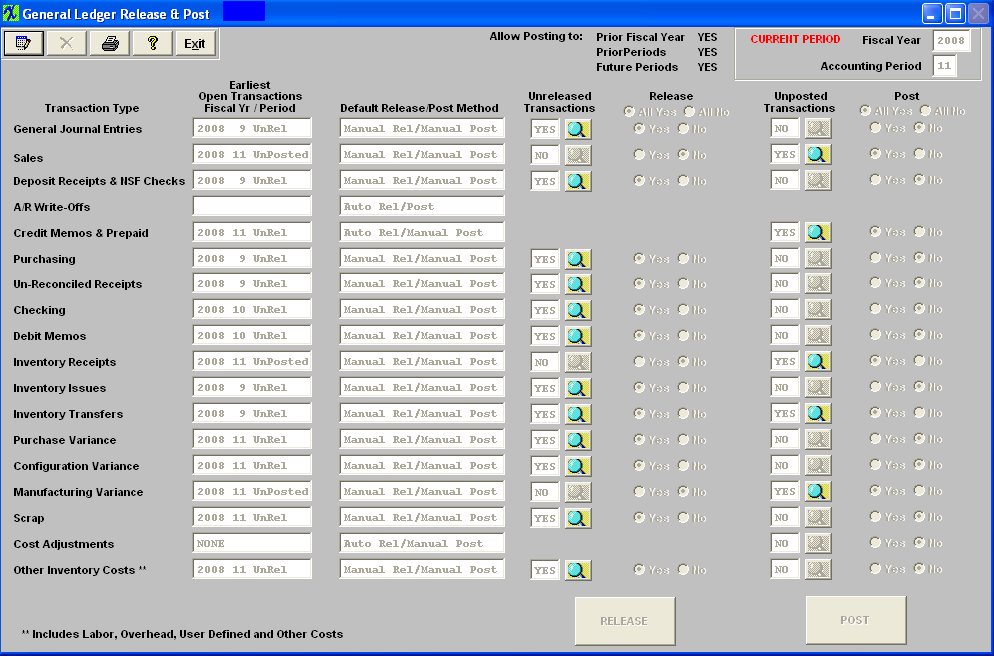

| 1.1.3.1. General Ledger Release & Post Screen |

| Allow Posting to: |

This field will display if posting is allowed to: Prior Fiscal Year; Prior Periods; Future Periods. This information will come from the G/L Post Defaults module. |

| Current Period |

This field will display the current Fiscal Year, and Accounting Period the system is at. |

| Transaction Type |

The types of Transactions contained in the ManEx System. |

| Earliest Open Transactions Fiscal Year/Period |

This field will display the earliest unreleased or unposted fiscal year and period for the type of transaction. |

| Default Release/Post Method |

This field will display the default method of posting the transaction type. This information will come from the G/L Post Defaults module: Manual Rel/Manual Post; Auto Rel/Manual Post; or Auto Rel/Auto Post. |

| Unrelease Transactions |

This field will display a “Yes” if there are unreleased transactions for the Fiscal Year and Period selected, otherwise it will display “No”. This field will only be displayed if the default method for the transaction type is "Manual Rel/Manual Post". |

| Release |

This field will only be editable in the "Edit" mode and the radio button will default to "Yes' if there are transactions to release for that type of transaction. User will be allowed to change the radio button to "No" if they do not want to release that type of transaction when depressing the "RELEASE" button at the bottom of the screen. This field will only be displayed for those transactions that are set for “Manual Rel/Manual Post”. The radio button will be set to ‘No” and disabled if there are no transactions to release for that type of transaction. |

| Unposted Transactions |

This field will display a “Yes” if there are unposted transactions for the Fiscal Year and Period selected, otherwise it will display “No”. This field will only be displayed if the default method for the transaction type is "Manual Rel/Manual Post" or AutoRel/Manual Post. |

| Post |

This field will only be editable in the "Edit" mode and the radio button will default to "Yes' if there are transactions to post for that type of transaction. User will be allowed to change the radio button to "No" if they do not want to post that type of transaction when depressing the "POST" button at the bottom of the screen. This field will only be displayed for those transactions that are set for “Manual Rel/Manual Post” or Auto Rel/Manual Post. The radio button will be set to ‘No” and disabled if there are no transactions to post for that type of transaction. |

|

Depress this button to Release ALL records that have the "Yes" radial selected. |

|

Depress this button to Post ALL records that have the "Yes" radial selected. |

Transaction Types:

| General Journal Entries |

|

| Sales |

The Journal Entry is created once the Customer Invoice is printed. Accounts Receivable is increased by the total amount of the invoice. Sales are increased by the sales price of the items sold. If freight is charged to the customer, that value is recorded. If sales taxes are charged to the customer, the appropriate entry is created. Also, Finished Goods inventory is relieved and the accompanying entry to Cost of Goods Sold is created.

If the user has created a Credit Memo, the entry to record same is created automatically, pro-rata relieving Accounts Receivable, Sales, etc. AND also Reinstating Inventory for any usable inventory returned by their customer. Any Unusable Inventory returned can be directed to the Scrap Account. The system also accepts General Credit Memos, and creates the entry after prompting the user for the appropriate General Ledger Account Number.

|

| Deposit Receipts & NSF Checks |

Once any Bank Deposit is recorded in the ManEx Accounts Receivable module, the Underlying Journal Entry is created, increasing the bank balance and offsetting Accounts Receivable. If the Cash Receipt is for a Customer Prepayment or Deposit, the Journal Entry records the information according to the default set up by the user. Also, any Miscellaneous Receipt prompts the user for the General Ledger Account Number at the time of data entry, then the ManEx system creates the entire entry.

If checks previously deposited are returned, the entry to reinstate any Accounts Receivable balance and to lower the appropriate bank account is created automatically when the user records a returned check.

|

| A/R Write-Offs |

The user elects to Write Off any portion of the Customer Invoice, the ManEx system creates the appropriate Journal Entry, reversing pro-rata the entry to Accounts Receivable and sets up the offset to Reserve For Bad Debts.

|

| Credit Memos & Prepaid |

If the user has created a Credit Memo, the entry to record same is created automatically, pro-rata relieving Accounts Receivable, Sales, etc. AND also Reinstating Inventory for any usable inventory returned by their customer. Any Unusable Inventory returned can be directed to the Scrap Account. The system also accepts General Credit Memos, and creates the entry after prompting the user for the appropriate General Ledger Account Number. |

| Purchasing |

ManEx handles payables created via the Purchase Order module, any Miscellaneous Payables entered via the Manual A/P Entry, or a Recurring Payable in the same fashion. Once the PAYABLE is recorded in the A/P Aging area, the entries to record the payables are set up. The entry increases inventory, expenses, assets and accounts payable.

|

| Un-Reconciled Receipts |

When an inventory item is received into stock a transaction is created within the un-reconciled receipts (according to its standard cost) (this is a place holder to account for received material) until the receipts are reconciled. |

| Checking |

Once Account Payable Checks have been printed, the ManEx system automatically records the appropriate Journal Entry relieving the bank and the Accounts Payable account.ManEx provides the same type of Journal Entry if a Manual Check is recorded.The entry relieves the bank and increases the appropriate General Ledger Account Number entered by the user at the time of recording.

If the user has voided any previously printed or Manual Checks, the ManEx system automatically reverses the original entry

|

| Debit Memos |

If the user has created a Debit Memo against any Active A/P Balances, the entry to reverse the payable is created automatically, pro-rata reversing the original payable.Additionally, when the user creates a Discrepant Material Return from Inventory, a Debit Memo will forward to Accounts Payable. The applicable entry will be created debiting Accounts Payable and crediting Raw Materials Inventory.

|

| Inventory Receipts |

An entry is created at the time the user Records a Receipt via the Inventory handling function. Raw Materials Inventory is increased with the offset as defined by the user.

The other way these entries are created is when the assembled product is moved to the Finished Goods work center in the Shop Floor Tracking module. The entry created by the system is to increase Finished Goods Inventory, with the offset to Work In Process. If there was a Configuration Variance (see below) this entry is also created.

|

| Inventory Issues |

There are four types of inventory issues:

An entry is created at the time the user records an Issue via the Inventory Handling function. Raw Materials Inventory is decreased with the offset as defined by the user.

The other way these entries are created is when the raw material components are pulled for a Work Order. The Entry created by the system is to increase Work In Process Inventory, with the offset to Raw Materials Inventory.

When a Physical Inventory is reconciled, the user may update the Inventory Master for the Inventory On Hand. Note that this action requires a supervisor’s password or specific Post Inventory Adjustments authorization in the Security Utility tab. All of the Reconciled Count Numbers will update the Quantity On Hand in the Inventory Master.Additionally, the requisite Journal Entires for any variances will forward into the accounting module.

Note that Journal Entries will not be created in the following circumstances:

Consigned stock

In Store additions

|

| Inventory Transfers |

If, when a Cycle Count is reconciled with the Inventory Records, the count is different than the record, then the user is prompted whether to accept the difference or to recount and re-enter. Count Adjustments are logged to the GL Adjustment Account, if accounting is used.

|

| Purchase Variance |

When parts are procured, the purchase order may have a price different than the standard cost. To balance the accounts payable values with the increases in inventory, the difference between the standard cost and the purchase price (based on the PO Reconciliation done in Accounting with the actual invoice) is charged to PPV, or Purchase Priced Variance. E.G., if a parts standard cost is $1.00, and the INVOICE is $1.15, then $1.00 is credited to inventory, $0.15 is credited to PPV, and $1.15 is debited to AP. There are FIVE reports available that detail out the source of the transactions.

For more information on the three Variances see Article #3053 |

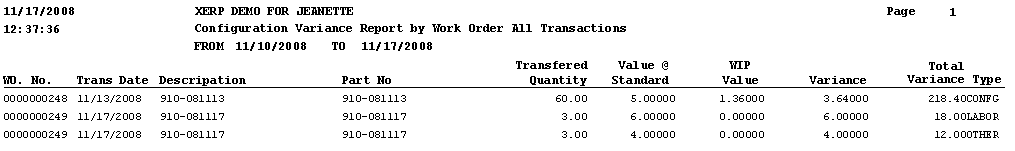

| Configuration Variance |

When the standard cost of an assembly is different from the sum of the standard costs of its components, the difference must also be addressed in WIP. E.G., if the standard cost of an assembly is $10.00, and the sum of the standard cost of the BOM components is $11.00, then upon moving the assembly from WIP to FGI, WIP is credited with $11.00, Configuration Variance is Debited $1.00 and Inventory is debited $10.00. There are FOUR reports available that detail out the source of the transactions.

For more information on the three Variances see Article #3053 |

| Manufacturing Variance |

When the work order has had material kitted to it in addition to that called out by the BOM, or the kit is finished with missing parts (maybe freebies that didn’t get to inventory), the difference between the total issued to the work order and the total value of the BOM parts becomes the Manufacturing Variance. E.G. one batch of parts got lost even though they were kitted to the work order, and a second batch of parts was issued to the work order, the second batch would be a manufacturing variance, since they were lost in the manufacturing process. There are FOUR reports available that detail out the source of the transactions.

For more information on the three Variances see Article #3053 |

| Scrap |

At the end of the production process, items transferring into the Scrap Work Center create an accounting entry increasing the scrap default account and decreasing WIP for the value of the number of units of the assembly at the assembly’s Standard Cost.

Additionally, when an Engineering Change Order deletes a line item and that line item is defined as “SCRAP”, an entry increasing scrap and decreasing Raw Materials Inventory is generated.

Within Inventory Handling, the Entry created is to record the movement of Inventory from one warehouse location to another increasing or decreasing General Ledger accounts as defined by the user.

|

| Cost Adjustments |

This entry is created in the Standard Cost Adjustment Module. Once the rollup is completed, any adjustments to General Ledger forward to Accounting. The user is allowed to Post Changes to Standard Cost and to generate the General Ledger Entries. Note: This requires a high level accounting password.

|

| Other Inventory Costs" |

Includes Labor, Overhead, User Defined, and Other Costs |

|

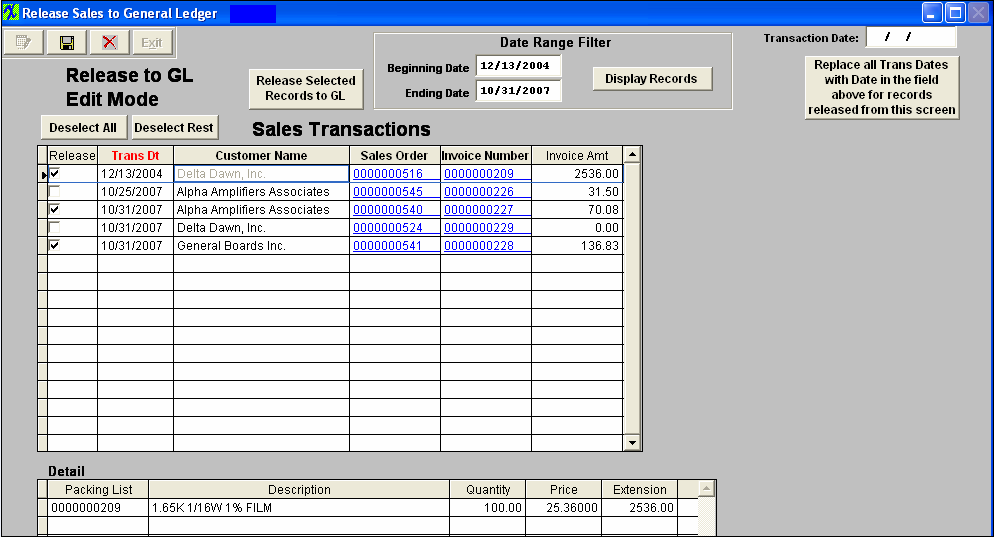

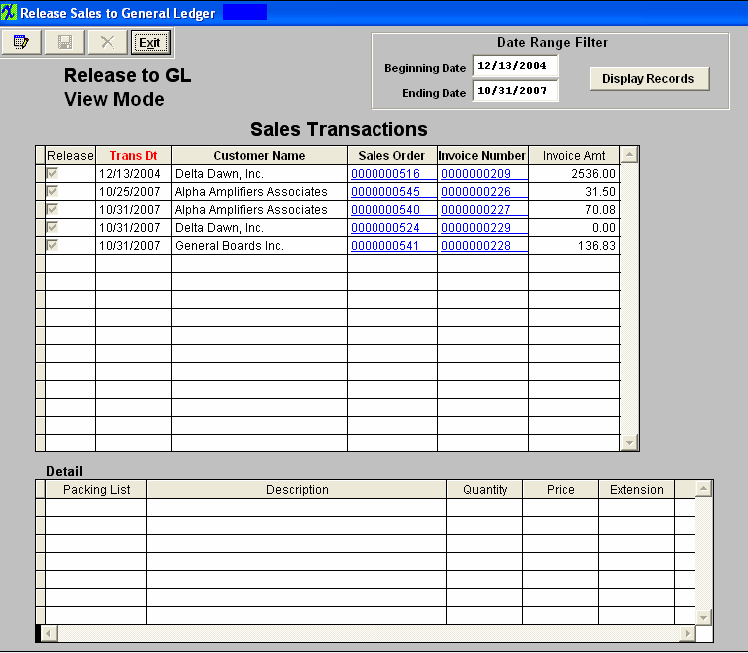

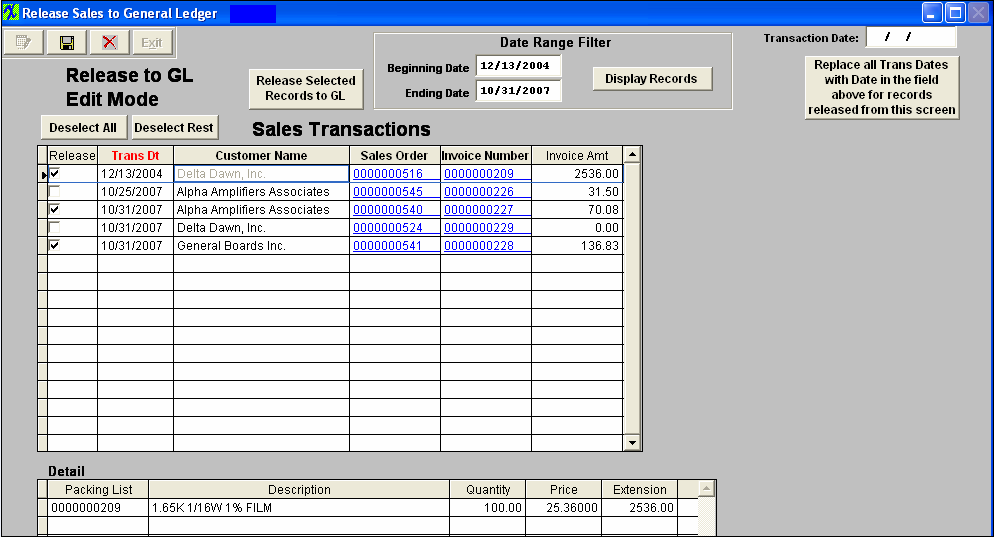

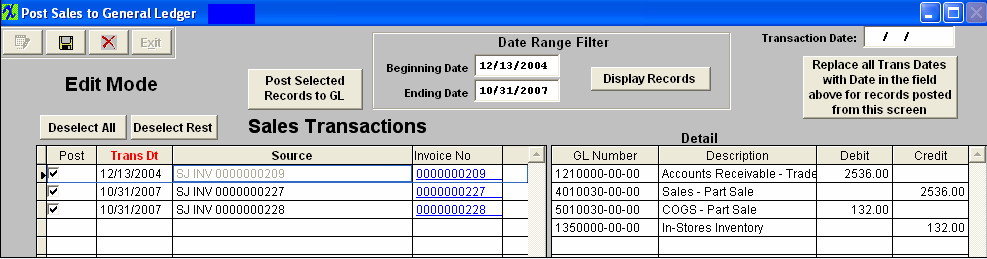

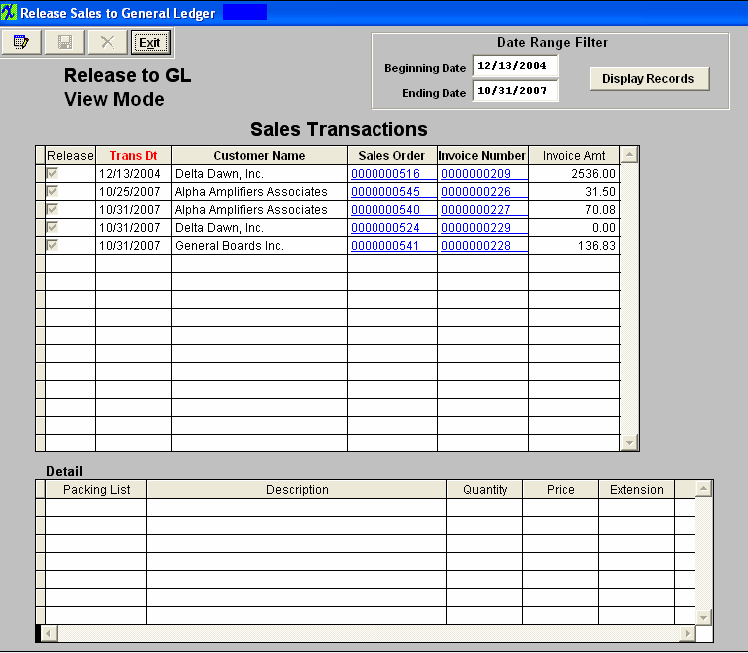

| 1.1.3.2. Release Screen | (Note: The screens may vary in appearance by the type of transaction but basically contain the same information). On some transaction types there will be one grid and on others there will be a second grid showing the details of the transactions. The data can be sorted in various ways by clicking on the column headers that are in bold font. Some types of transactions will allow users to drill back to the source in which the transactions originated from, such as Purchase Order, Sales Order, Work Order, etc. Those will be shown with an underline font.

|

All transactions are checked to be released by default. Once you have selected the records to be released, Depress the "Release Selected Records to GL". The records selected to be released will be removed from the release screen and the records not selected to be released will stay on screen. This button is only available when this screen is in the "Edit" mode. |

Date Range Filter

| Beginning Date |

The Beginning Date is automatically set to the oldest transaction. Changing these dates filters the selection so that only those transactions within the date range are displayed.

|

| Ending Date |

The Ending Date is automatically set to the current date. Changing these dates filters the selection so that only those transactions within the date range are displayed.

|

|

User can select a date range filter to display only those transactions within a given period of time, by entering different Beginning Date and/or Ending Date and depressing the "Display Records" button.

|

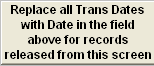

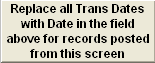

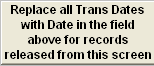

| Transaction Date |

This field gives you the ability to change the transaction dates for all of the transactions. This field is only available when this screen is in the "Edit" mode.

|

|

Depress this button to update the records with the new Transaction date. This button is only available when this screen is in the "Edit" mode. |

Transactions

Detail - This section is just intended to list out the individual items from the transaction and in some cases not actually breaking out the transaction that is going to be created. The Posting screen will display that information such as tax, freight, etc.

| Packing List |

This field display the detailed information for the current item selected in the top screen. Depending on the type of transaction being released. |

| Description |

This field display the description for the current item selected in the top screen. Depending on the type of transaction being released. |

| Quantity |

This field display the Quantity information for the current item selected in the top screen. Depending on the type of transaction being released. |

| Price |

This field display the unit price information for the current item selected in the top screen. Depending on the type of transaction being released. |

| Extension |

This field display the total priced information for the current item selected in the top screen. Depending on the type of transaction being released. |

|

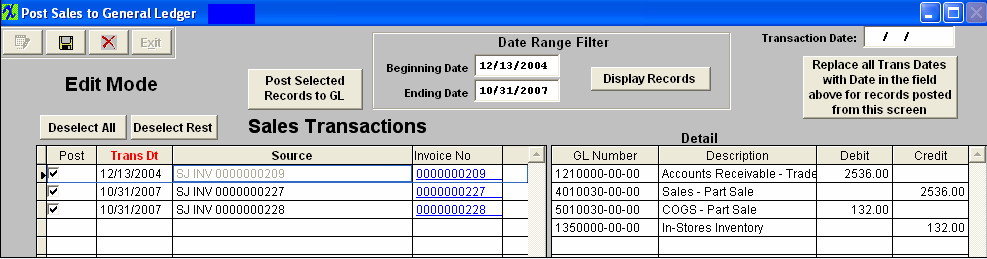

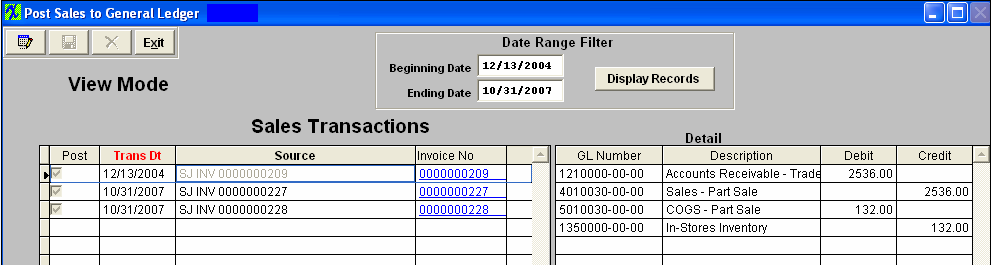

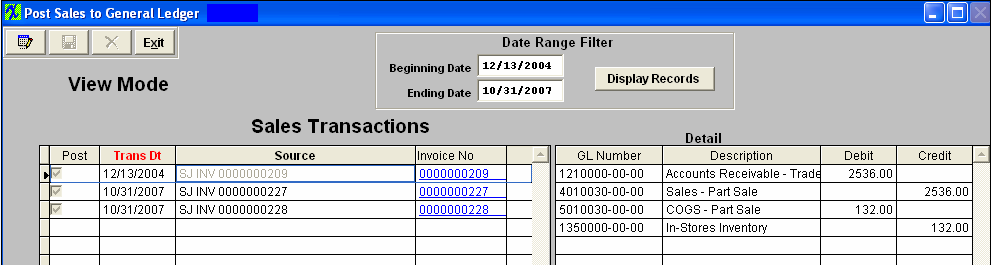

| 1.1.3.3. Post Screen | (Note: The screens may vary in appearance by the type of transaction but basically contain the same information). The transactions that have been released and waiting to be posted will appear in the first (left) grid. The data can be sorted in various ways by clicking on the column headers that are in bold font. Some types of transactions will allow users to drill back to the source in which the transactions originated from, such as Purchase Order, Sales Order, Work Order, etc. Those will be shown with an underline font in the last column. The detail of each transaction will be displayed in the second (right) grid with the GL number and the Debits and Credits.

|

Once you have selected the records to be posted, Depress the "Post Selected Records to GL". The records selected to be posted will be removed from the post screen and the records not selected to be posted will stay on screen. This button is only available when this screen is in the "Edit" mode. |

Date Range Filter

| Beginning Date |

The Beginning Date is automatically set to the oldest transaction. Changing these dates filters the selection so that only those transactions within the date range are displayed |

| Ending Date |

The Ending Date is automatically set to the current date. Changing these dates filters the selection so that only those transactions within the date range are displayed. |

|

User can select a date range filter to display only those transactions within a given period of time, by entering different Beginning Date and/or Ending Date and depressing the "Display Records" button. |

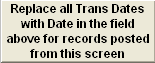

| Transaction Date |

This field gives you the ability to change the transaction dates for all of the transactions. This field is only available when this screen is in the "Edit" mode. |

|

Depress this button to update the records with the new Transaction date. This button is only available when this screen is in the "Edit" mode. |

Transactions

Detail

| GL Number |

This field display the GL number for the current item selected in the left screen. Depending on the type of transaction being posted. |

| Description |

This field display the GL description for the current item selected in the left screen. Depending on the type of transaction being posted. |

| Debit |

This field display the debit amount for the current item selected in the left screen. Depending on the type of transaction being posted. |

| Credit |

This field display the credit amount for the current item selected in the left screen. Depending on the type of transaction being posted. |

|

| 1.1.4. How To ...... for the Release and Post to GL |

| 1.1.4.1. Release & Post Information to G/L |

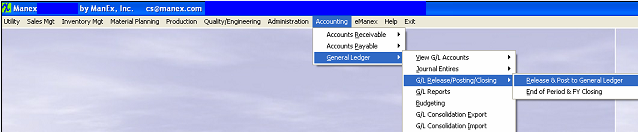

|

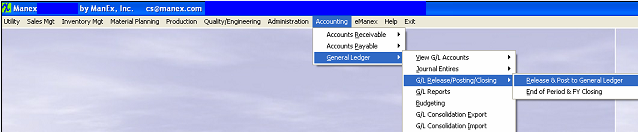

Enter Manex.exe

Accounting/General Ledger/G/L Release/Posting/Closing/Release & Post to General Ledger

|

|

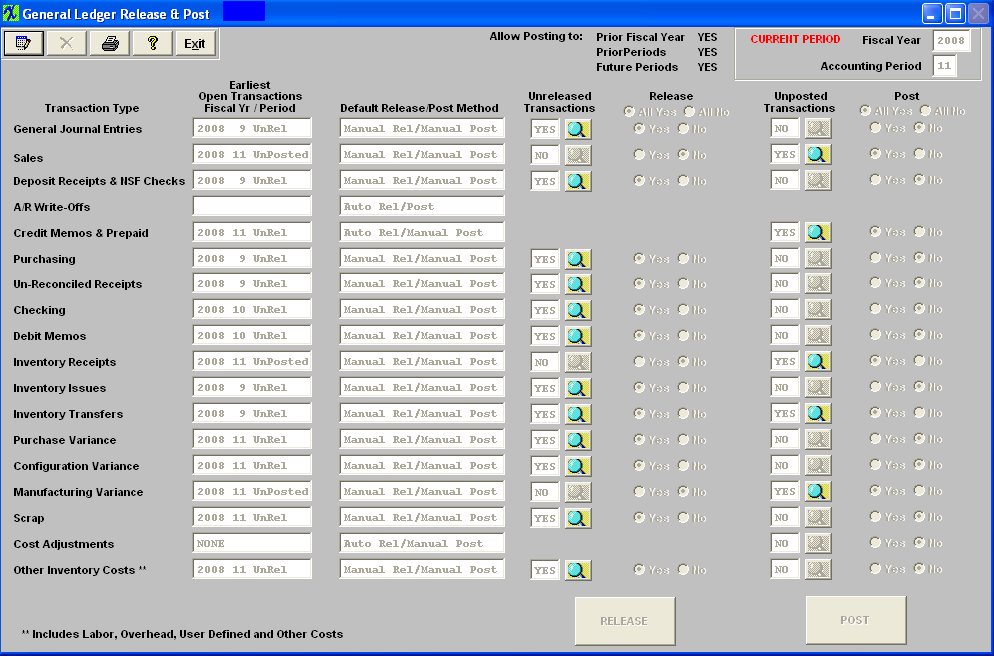

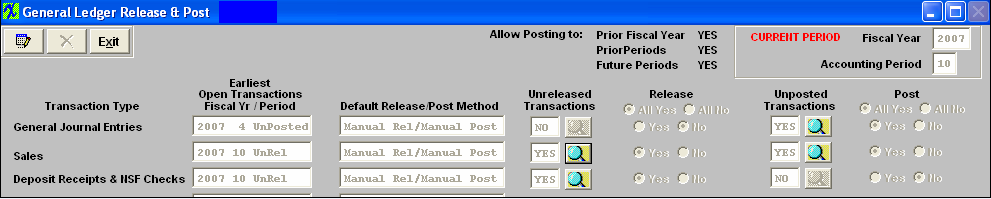

The General Ledger Release & Post screen will appear:

In the screen below, notice that for the Credit Memos & Prepaid type of transactions, the setup has the Release automatic, but Posting manual. The third column displays this condition, and the Release columns are not shown, but the Posting columns are shown. Likewise, for the A/R Write-offs type of transactions, both are automatic, and neither has the ability to view details nor elect whether or not to Release and Post.

There are two different ways to Release records.

There are two different ways to Release records.

User can Release several transactions at once by depressing the Edit button and select or de-select the transactions to be released by depressing the radio next to "Yes" or "No" and depress the "RELEASE" button at the bottom of the screen and this will release all the transactions selected "Yes".

Or User can release transactions individually by clicking on one of the magnifying glass buttons under the Unreleased Transactions and the following Release screen will appear: (Note: The screens may vary in appearance by the type of transaction but basically contain the same information). On some transaction types there will be one grid and on others there will be a second grid showing the details of the transactions. The data can be sorted in various ways by clicking on the column headers that are in bold font. Some types of transactions allow drill down to the originial form such as Purchase Order, Sales Order, Work Order, etc. Those will be shown with an underline font. User can select a date range filter to display only those transactions within a given period of time, by entering different Beginning Date and/or Ending Date and depressing the "Display Records" button.

To release transactions, depress the Edit button, the user is notified they are in the "Edit" mode, the Save and Cancel buttons are available, along with the toggle buttons to "Select l/Deselect the transactions to release. Also in the edit mode you have the ability to change the transaction dates for all of the transactions.

One you have selected the records to be released, Depress the "Release Selected Records to GL". The records selected to be released will be removed from the release screen and the records not selected to be released will stay on screen. Then the magnifying glass for Unposted Transactions will display transactions to be posted.

Click on one of the magnifying glass buttons under the Unposted Transactions and the following Posting screen will appear: (Note: The screens may vary in appearance by the type of transaction but basically contain the same information). The transactions that have been released and waiting to be posted to the general ledger will appear in the first (left) grid. The data can be sorted in various ways by clicking on the column headers that are in bold font. Some types of transactions allow drill down to the originial form such as Invoice No, Purchase Order, Sales Order, Work Order, etc. Those will be shown with an underline font in the last column. The detail of each transaction will be displayed in the second (right) grid with the GL number and the Debits and Credits. User can select a date range filter to display only those transactions within a given period of time, by entering different Beginning Date and/or Ending Date and depressing the "Display Records" button. Transactions that cannot be posted because of restrictions for past or future period posting will be shaded in RED and the "YesNo" column in the grid is unchecked for those items.

Depress the Edit button, the user is notified they are in the "Edit" mode, the Save and Cancel buttons are available, along with the toggle buttons to Select/Deselect transactions to be posted. Also in the edit mode you have the ability to change the transaction dates for all of the transactions.

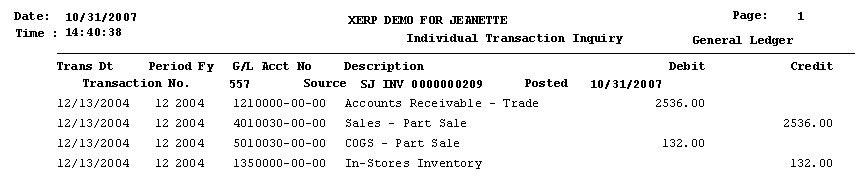

One you have selected the records to be posted, Depress the "Post Selected Records to GL". The records not selected to be posted will stay on screen, the records selected to be posted will be removed from the post screen and will create a Transaction record as the one displayed below:

|

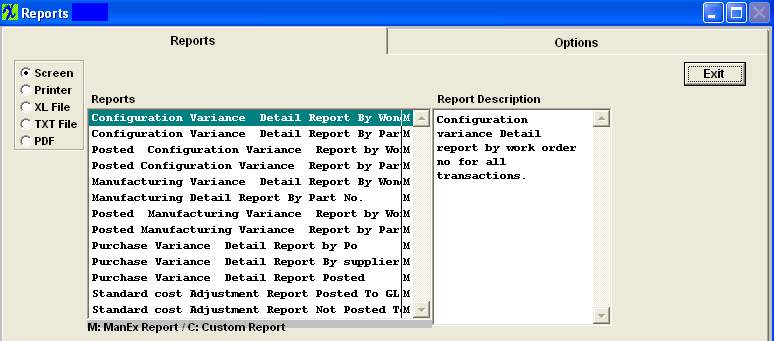

| 1.1.5. Reports-Variance |

|

Accounting/General Ledger/G/L Releas/Posting/Closing/Release & Post to General Ledger

For more information on the three Variances see Article #3053 |

|

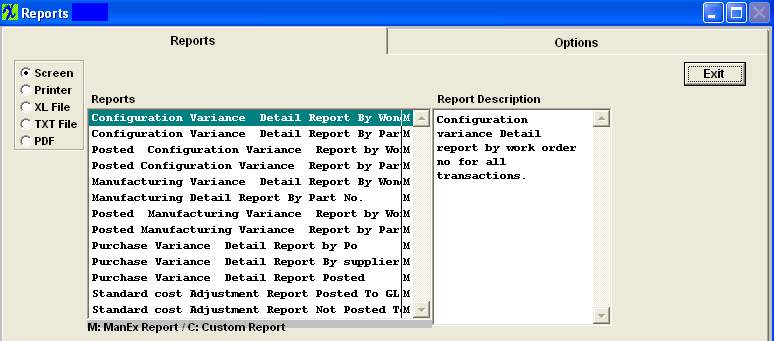

The following screen will appear:

To obtain the Variance Reports depress the Print button and a List of Variance Reports will appear:

Select the output you desire by clicking on the radial.Choose from Screen, Printer, XL File, TXT File, or PDF.

Highlight the report of interest.

Depress the option tab.

|

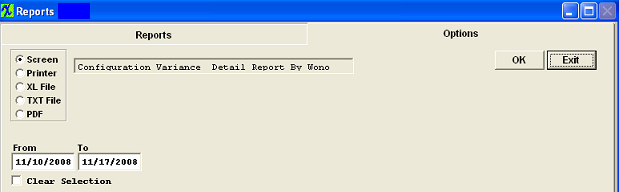

|

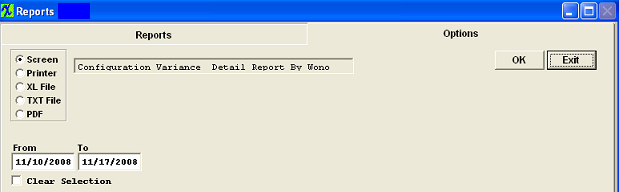

Configuration Variance Detail Report by Work Order No for all Transactions or Configuration Variance Detail Report by Part No for all Transactions

To clear the dates, check the Clear Selection box. Enter the desired date range From and To.

Depress the OK button.

|

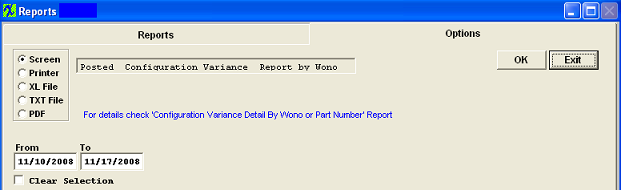

|

The following report will print: (Note: Report may view differently, depending on Report Selection):

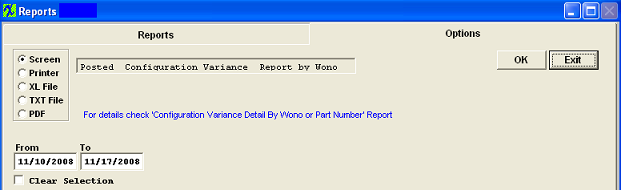

Posted Configuration Variance Detail Report by Work Order No or Posted Configuration Variance Detail Report by Part No

To clear the dates, check the Clear Selection box. Enter the desired date range From and To.

Depress the OK button.

|

|

The following report will print: (Note: Report may view differently, depending on Report Selection):

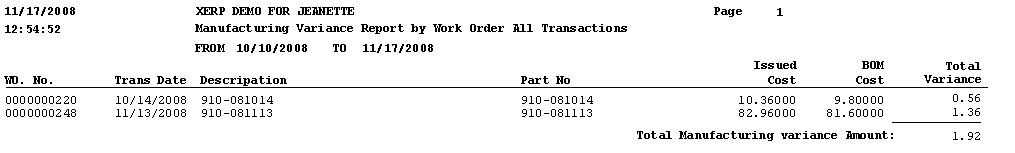

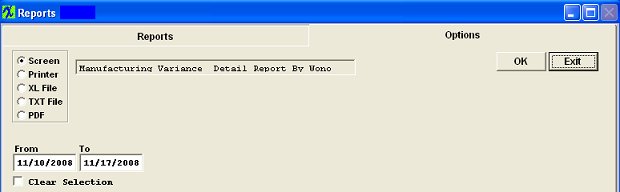

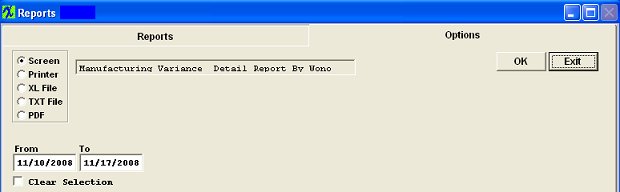

Manufacturing Variance Detail Report by Work Order No for all Transactions or Manufacturing Variance Detail Report by Part No for all Transactions

To clear the dates, check the Clear Selection box. Enter the desired date range From and To.

Depress the OK button.

|

|

The following report will print: (Note: Report may view differently, depending on Report Selection):

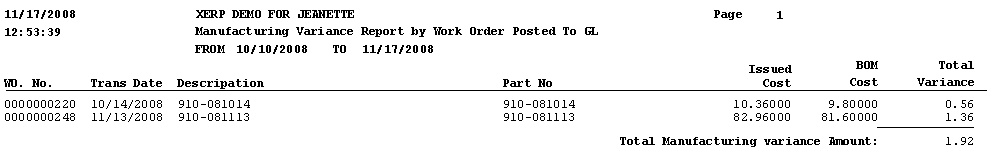

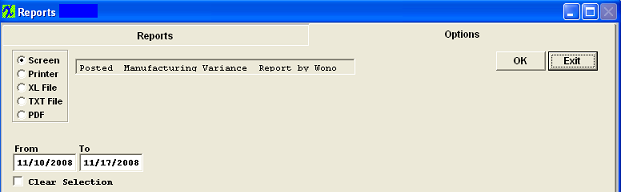

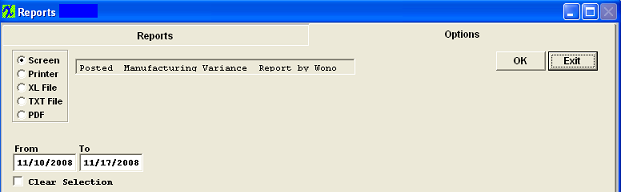

Posted Manufacturing Variance Report by Work Order No or Posted Manufacturing Variance Report by Part No

To clear the dates, check the Clear Selection box. Enter the desired date range From and To.

Depress the OK button.

|

|

The following report will print: (Note: Report may view differently, depending on Report Selection):

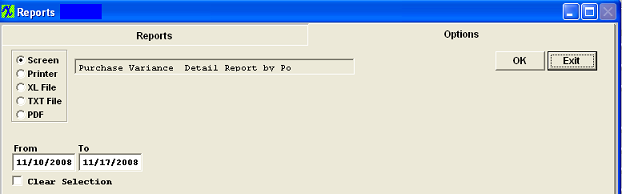

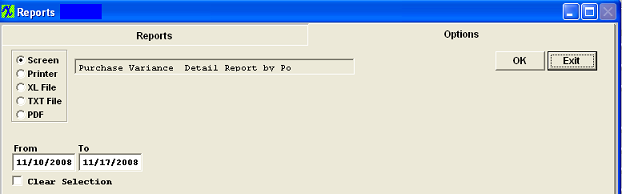

Purchase Variance Detail Report by PO or Purchase Variance Detail Report by Supplier for Variance Transactions Only or Purchase Variance Detail Report Posted

To clear the dates, check the Clear Selection box. Enter the desired date range From and To.

Depress the OK button.

|

|

The following report will print: (Note: Report may view differently, depending on Report Selection):

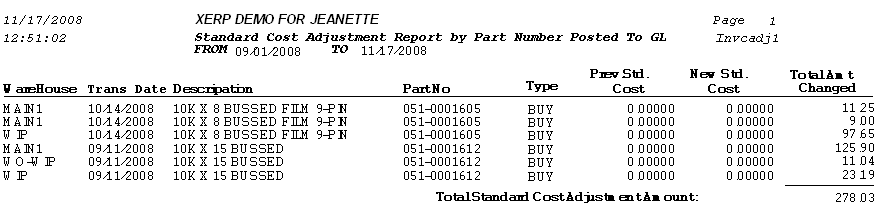

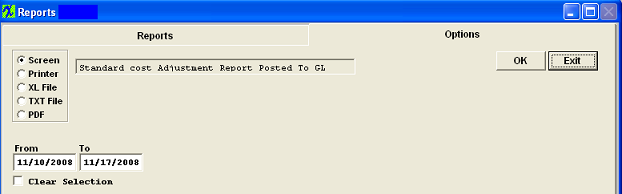

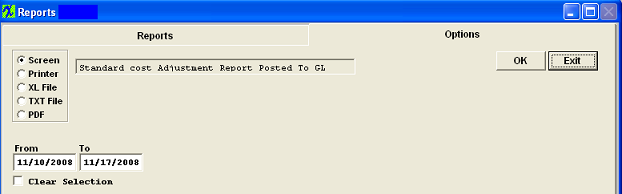

Standard Cost Adjustment Report Posted to GL by Part No or Standard Cost Adjustment Report Not Posted to GL by Part No

To clear the dates, check the Clear Selection box. Enter the desired date range From and To.

Depress the OK button.

|

|

The following report will print: (Note: Report may view differently, depending on Report Selection):

|

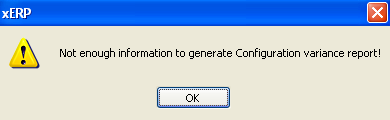

After depressing the OK button, if there is not enough information to generate the report you selected to print the following message will appear:

|

|

|

| 1.2. End of Period & F/Y Closing |

| 1.2.1. Prerequisites for the End of Period & FY Closing | All transactions MUST be released and posted before the "Close Period/Fiscal Year" button will be enabled.

Users MUST have full rights to the "End of Period and FY" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access.

Fiscal year end closing is a multi step process. First go through all of the normal Period End Closing routines. Print off all of the desired GL Reports , including a Year End Trial Balance Report.

|

| 1.2.2. Introduction for the End of Period & F/Y Closing |

The closing of the final period of a fiscal year serves to close the fiscal year itself and to reset the current balance entries. All of the Income Statement Accounts will zero out and post into the Retained Earnings Account.

|

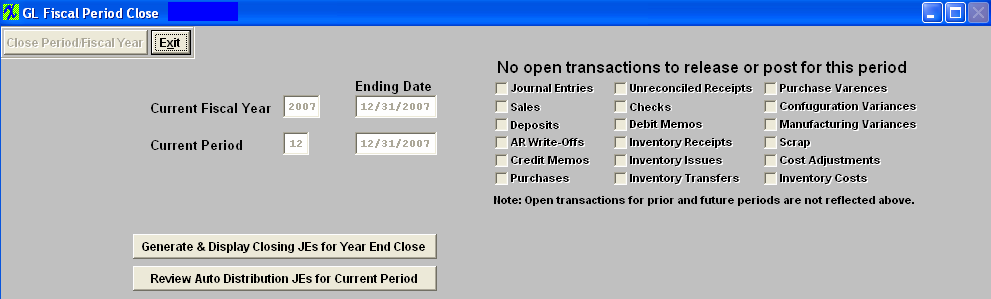

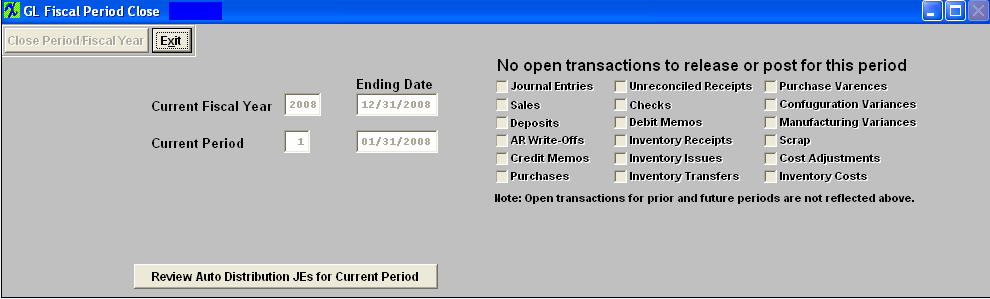

| 1.2.3. Fields & Definitions for the End of Period & FY Closing |

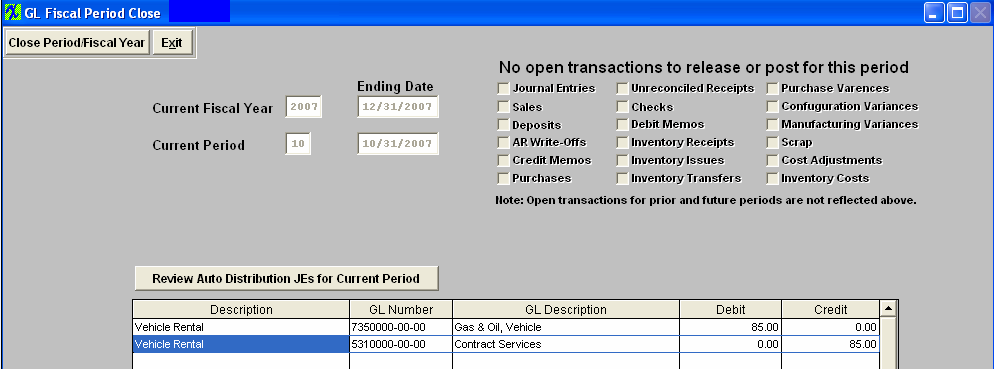

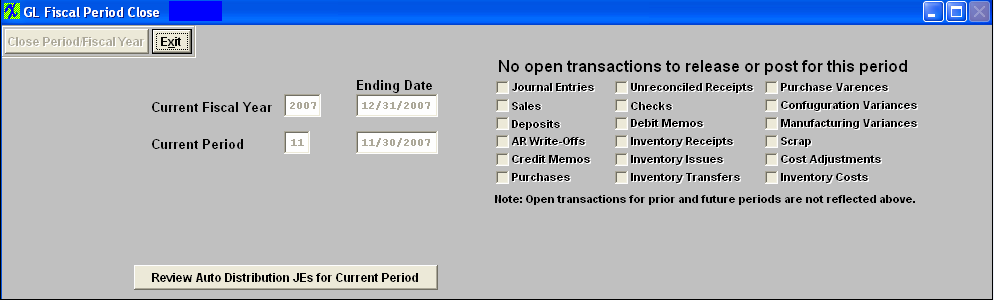

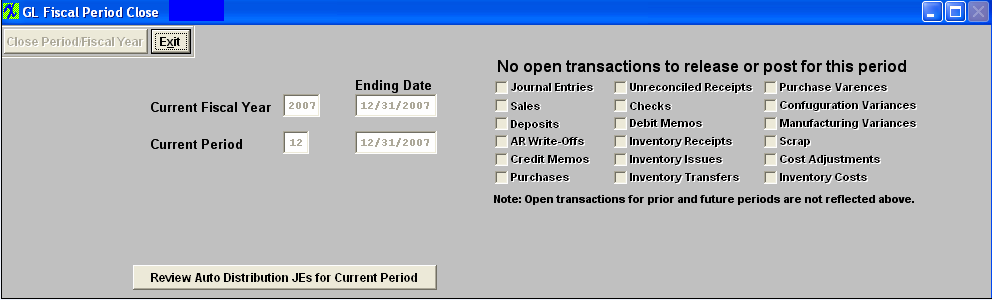

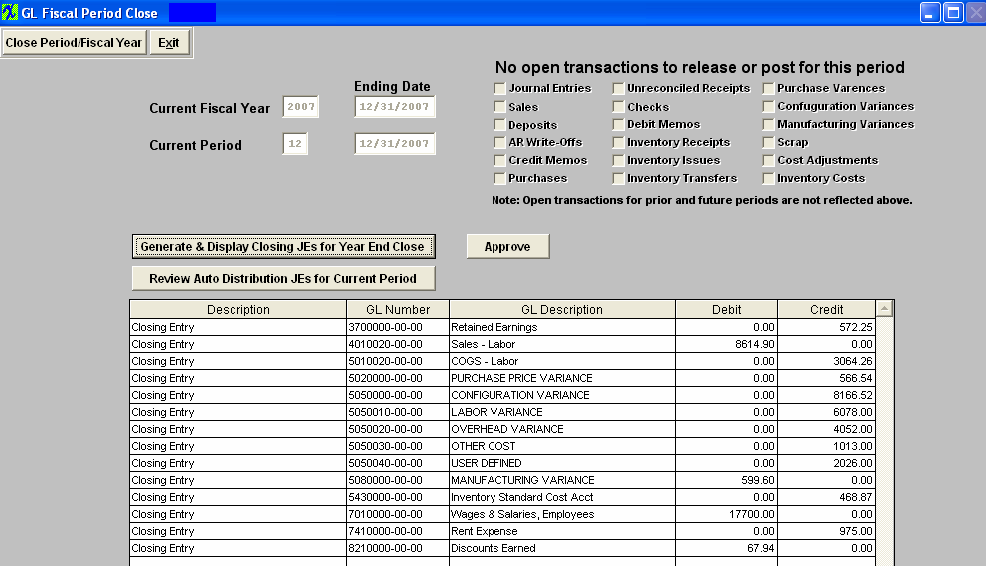

| 1.2.3.1. GL Fiscal Period Close | |

| Current Fiscal Year |

This field will display the Current Fiscal Year the system is set at along with the Ending Date of the Current Fiscal Year |

| Current Period |

This field will display the Current Fiscal Period the system is in along with the Ending Date of the Current Fiscal Period |

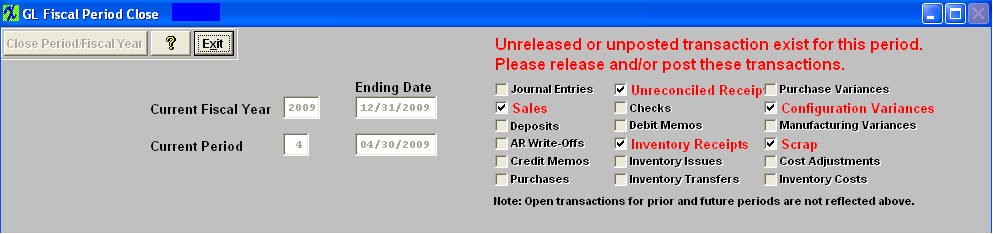

| No Open Transactions to release or post for this period |

If any of these boxes are checked this means that there are open transactions waiting to be released or posted for the current period, and will not allow you to close the current period until these transactions have been cleared. |

|

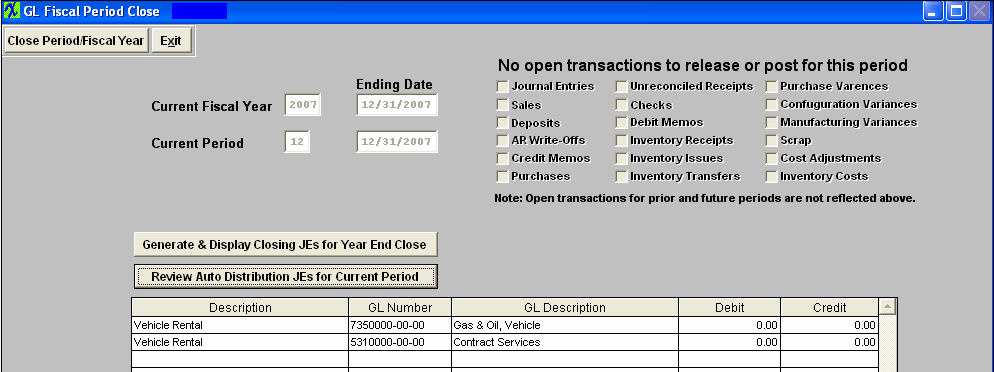

This will allow user to Generate & Display CLosing JEs for Year End Closing. This button will only be displayed when closing a Fiscal Year. |

|

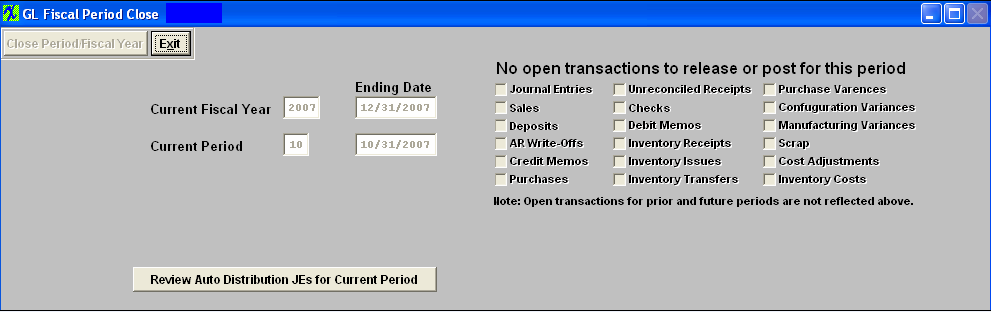

This will allow user to Review AUto Distribution JEs for Current Period. |

|

| 1.2.4. How To ...... for the End of Period & F/Y Closing |

| 1.2.4.1. Close End of Period | |

|

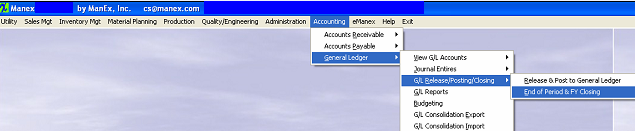

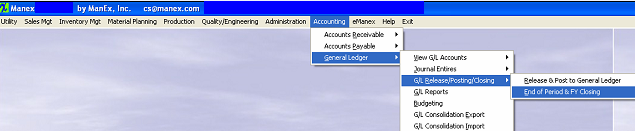

Enter Manex.exe

Accounting/General Ledger/G/L Release/Posting/Closing/End of Period & FY Closing

|

|

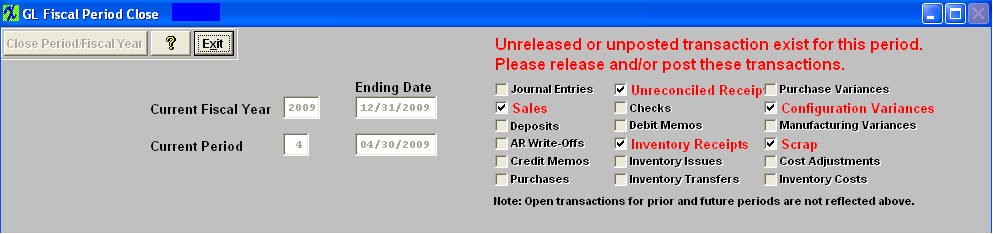

The following screen will appear displaying the unreleased or unposted transactions for this period and these transactions must be released and posted before the "Close Period/Fiscal Year" button will be available.

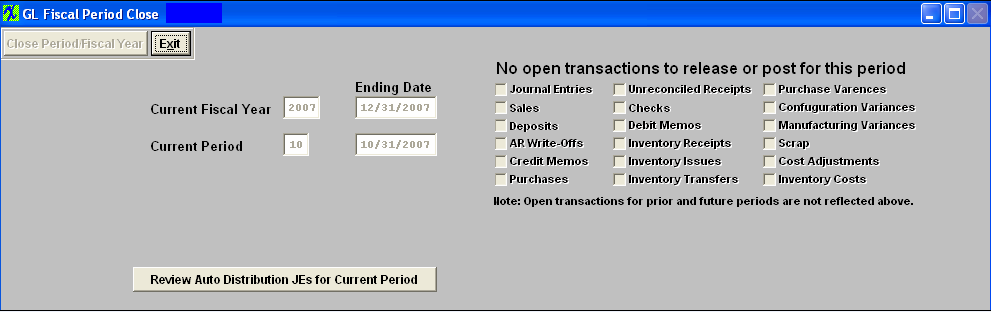

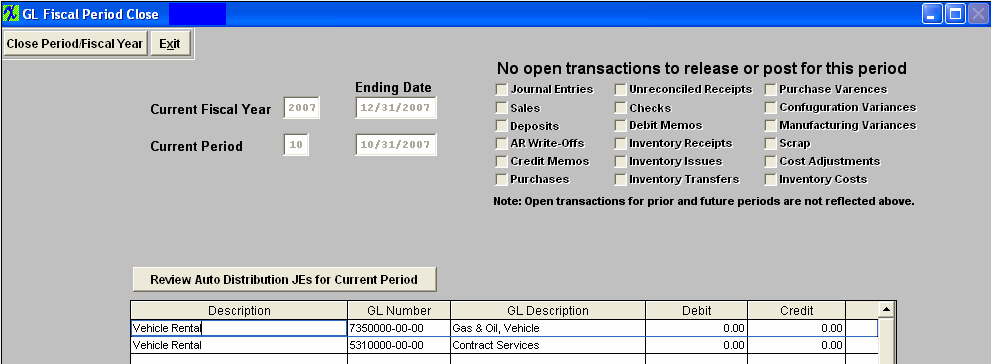

Once all transactions are released and posted the following screen will appear and the "Review Auto Distributions JEs for Current Period" button will be available.

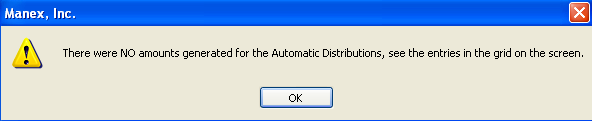

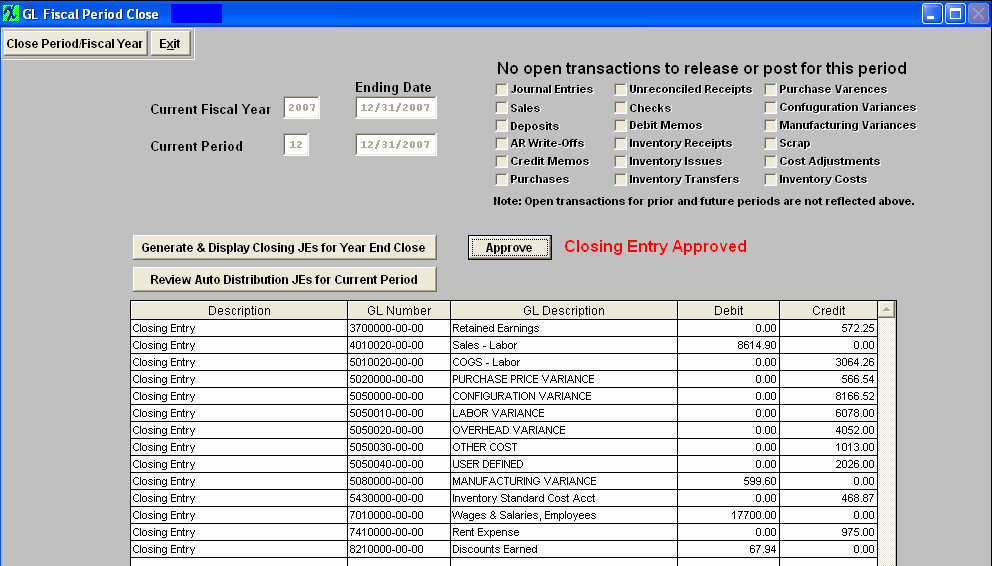

Depress the "Review Auto Distribution JEs for Current Period" button and a list of the calculated Automatice Distributions will be displayed in the grid that will appear. This list will also display any Automatic Distributions that are in the system but have no calculated entries. This can be used to alert the user that something might be wrong with one or more of the Automatic Distributions. If there are Automatic Distributions that need to be posted, the user must click on the "Approve" button that will appear. WHen the approvals are made, a message will appear on the screen and the "Close Period/Fiscal Year" button will be enabled.

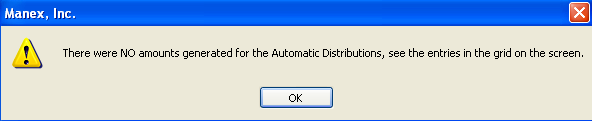

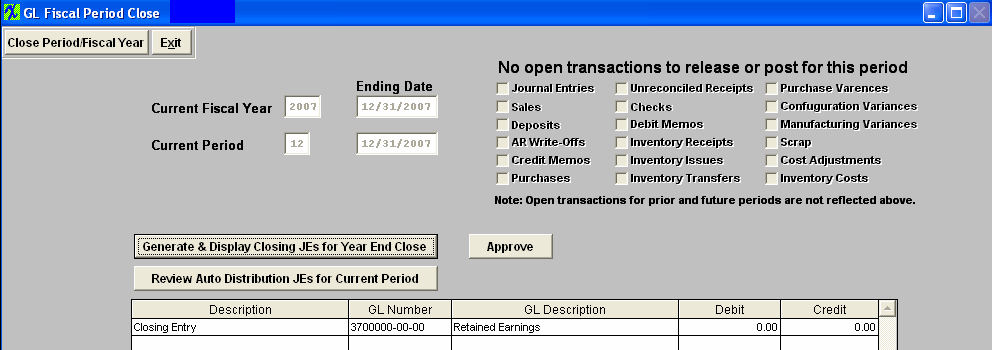

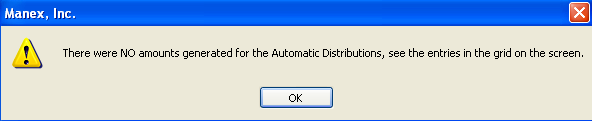

If there are NO Automatic Disctributions to be posted the following message appears:

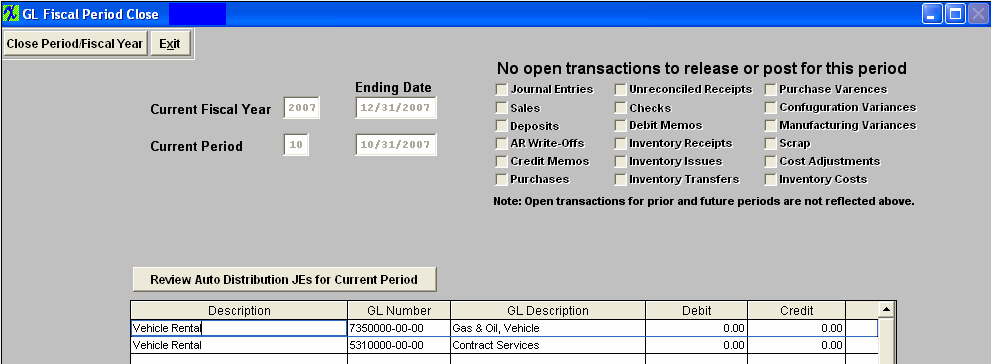

Depress OK - the "Close Period/FiscalYear" button becomes enabled and the "Approve" button will not appear:

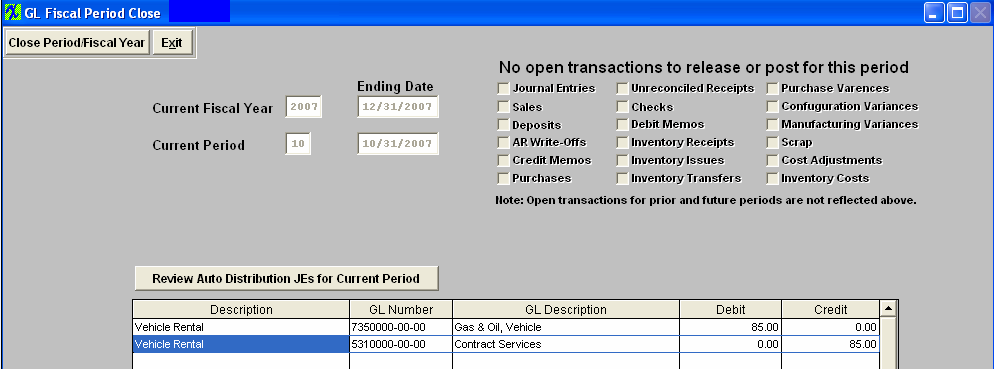

User can choose to enter in Amounts for the Auto Distributions if desired:

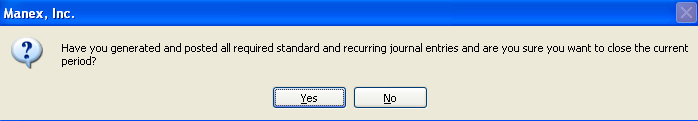

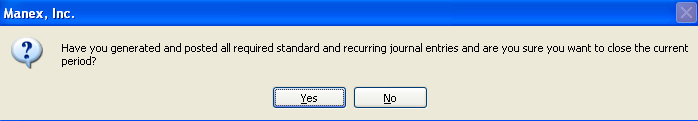

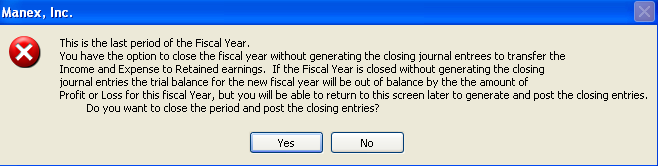

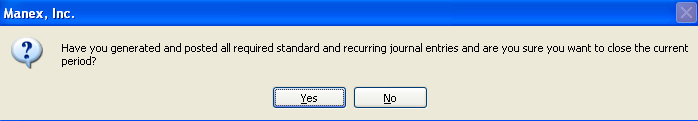

Depress the "Close Period/Fiscal Year" button. The following message will appear:

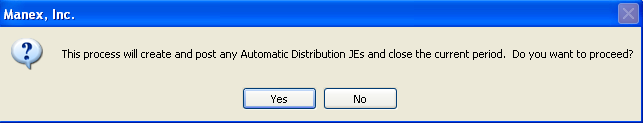

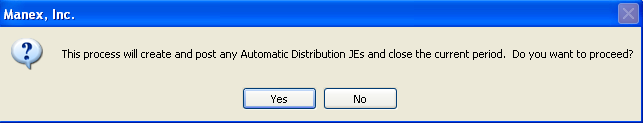

If you select "NO" you will be returned to the screen and nothing will be processed for the close (including Automatic Distributions). If you are certain that you want to close the Current Period, depress the "Yes" button. Enter your password. The following message will appear: If you do not want to continue the closing depress the "No" button to abandon the process.

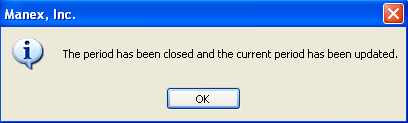

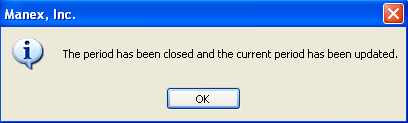

Depress the "Yes" button to continue, and the following message will appear confirming that the period has been closed and the current period has been updated. Depress the "No" button to abandon the process.

The screen will update to next period and the Exit button will be available.

|

| 1.2.4.2. Fiscal Year Closing | Fiscal Year End Closing

|

Enter Manex.exe

Accounting/General Ledger/G/L Release/Posting/Closing/End of Periods & FY Closing

|

|

The following screen will appear:

Depress the "Review Auto Distribution JEs for Current Period" and the following message will appear:

Depress OK - the following screen will appear so you may enter amount for the Auto Distribution if desired, or Select to Generate & Display Closing JEs for Year End Close:

Depress the "Generate & Display Closing JEs for Year End Close" button; the closing Entries waiting to be Approved will be displayed:

If the "Closing JEs have been already Generated & Approved in the G/L General Jornal Entry screen, the the following screen will appear allowing user to create a new transaction if needed:

Depress the "Approve" button and the status will update:

Depress the "Close Period/Fiscal Year" button and the following message will appear:

Depress "Yes" to continue the following message will appear:

Depress "Yes" to continue and the following message will appear:

Depress "Yes" to continue and the following message will appear:

Depress OK and the Fiscal Year and period will update

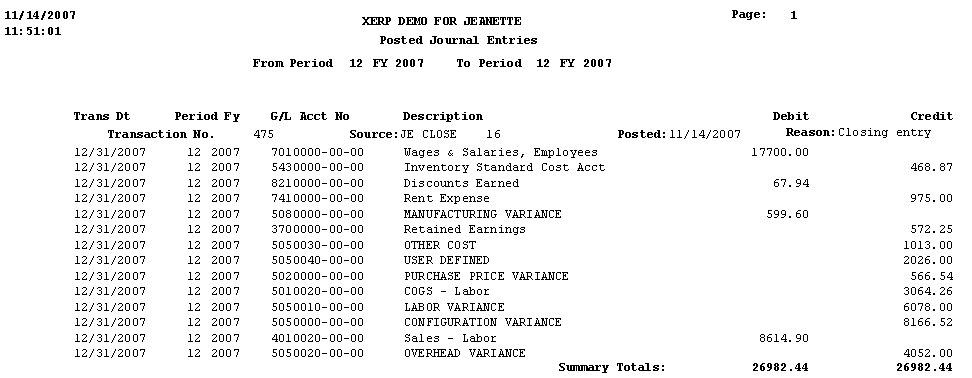

The Posted Closing Journal Entry

|

|