| 1.1. Prerequisites for Bank Reconciliation |

Users MUST have full rights to the "Bank Reconcilliation" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access.

The Bank Account must be setup in the Bank Setup module

|

| 1.2. Fields & Descriptions for Bank Reconciliation |

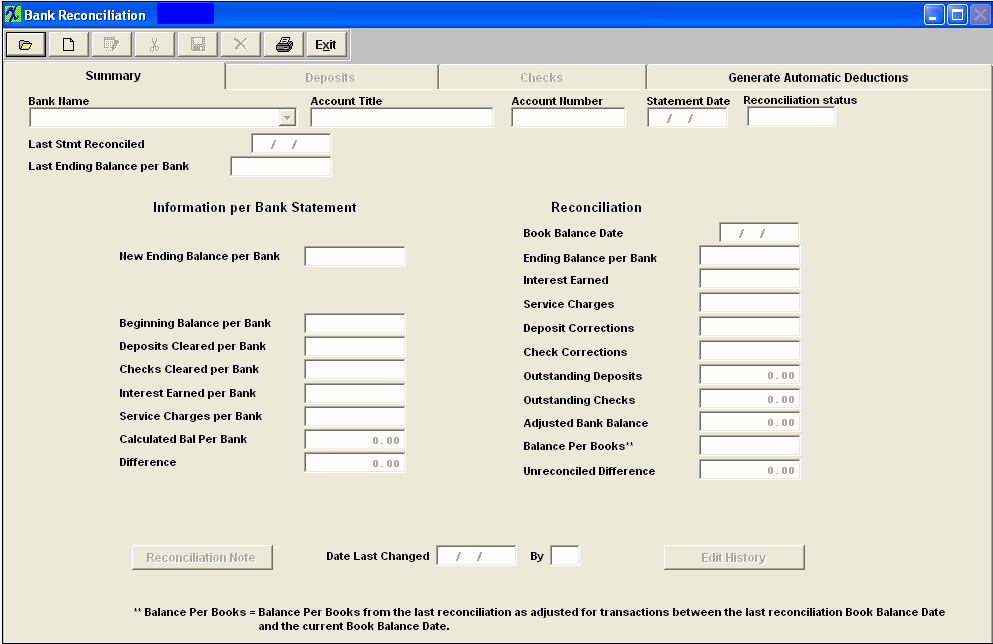

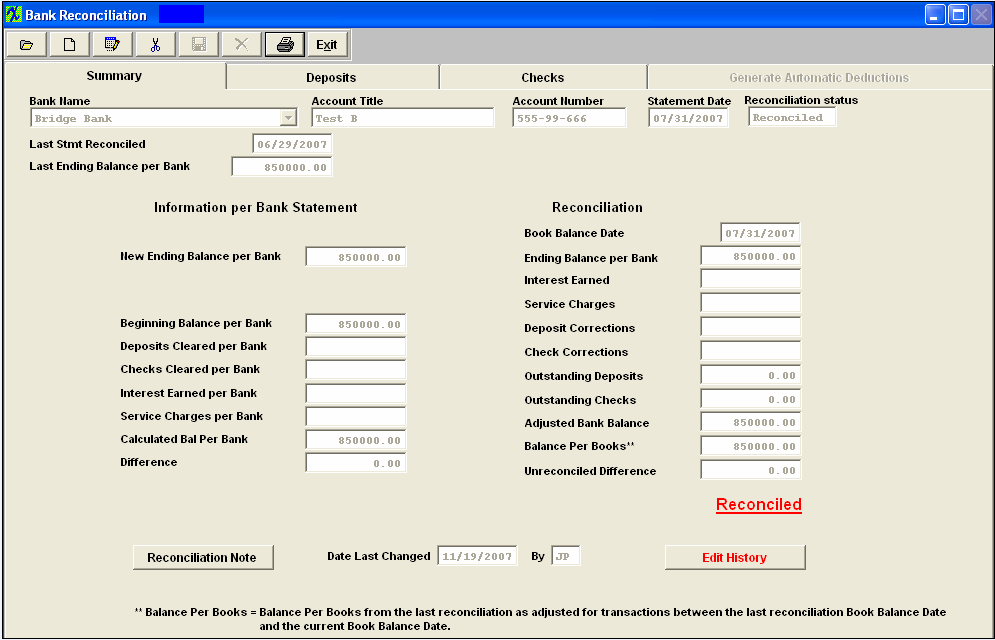

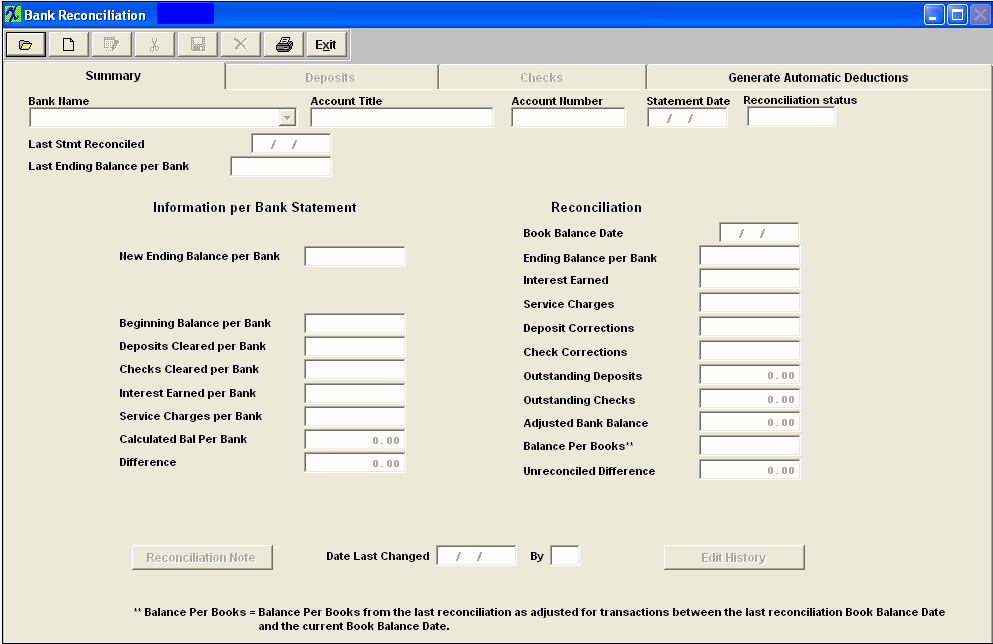

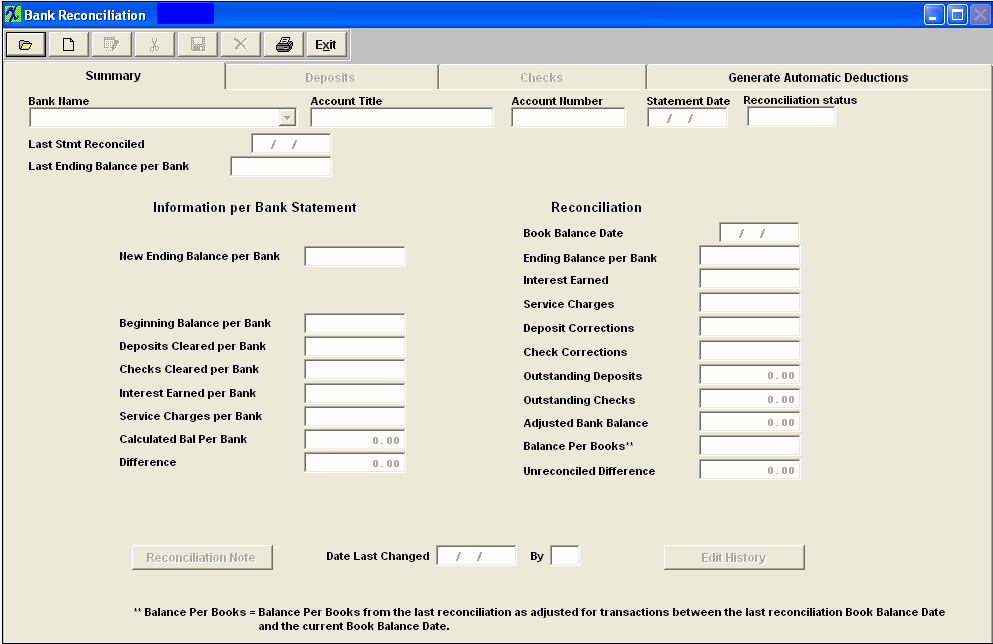

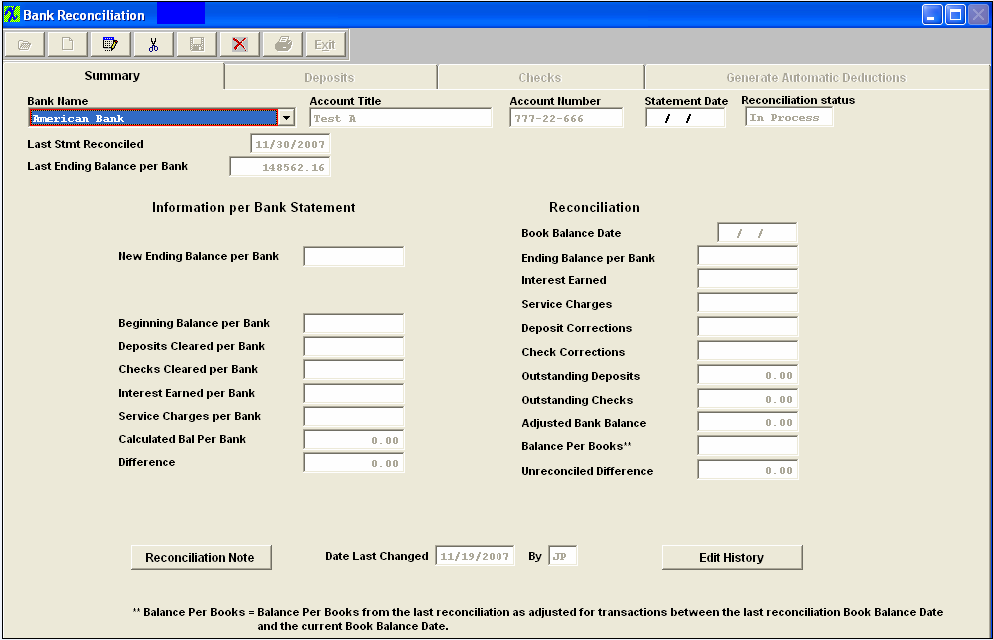

| 1.2.1. Summary Tab |

Bank Reconciliation Summary tab Field and Definitions:

| Bank Name |

The name of the bank which was reconciled |

| Account Title |

The G/L title for this bank |

| Account Number |

The number that the bank has for this account |

| Statement Date |

The date of the bank statement |

| Reconciliation Status |

The status of this reconciliation – In Process, Reconciled |

| Last Statement Reconciled |

The date of the last reconciliation for this bank will default into this field. This field is editable when the users process a Bank Statement for the first time, but will only allow you to enter a date that is earlier than the Statement Date that is being processed. This will prevent the user from accidentally entering in the exact same date or later than the Statement Date being processed. |

| Last Ending Balance per Bank |

The ending balance per the last bank reconciliation |

Information per Bank Statement

| New Ending Balance per Bank |

For the current statement, the ending balance per the bank statement. |

| Deposits Cleared per Bank |

This is the total of all of the cleared deposits per the bank statement |

| Checks Cleared per Bank |

This is the total of all of the cleared checks per the bank statement |

| Interest Earned per Bank |

This is the amount of any interest credited to the bank account by the bank. Upon the final save after the reconciliation is complete, the appropriate journal entry is created |

| Service Charges per Bank |

This is the amount of any charges debited to the bank account by the bank. Upon the final save after the reconciliation is complete, the appropriate journal entry is created. |

| Calculated Balance per Bank |

This amount is the opening balance + deposits cleared – checks cleared + interest earned – service charges and should equal the exact amount of the ending balance per the bank statement. |

| Difference |

This would be any difference between the New Ending Balance per Bank and the Calculated Balance per Bank. This amount should be zero. |

Reconciliation (There is no data entry required for this column. All of the line items are entered elsewhere and forwarded into this column.)

| Book Balance Date |

The as of date for which the general ledger bank balance is being reconciled. Transaction recorded after that date will not be considered for this reconciliation. |

| Interest Earned |

Reversing the amount of interest income to be recorded into the general ledger, since it’s already been added in the Information per Bank Statement section. |

| Service Charges |

Reversing the amount of service charges to be recorded into the general ledger, since it’s already been added in the Information per Bank Statement section. |

| Deposit Corrections |

The net deposit correction forwarding from the Deposit tab. |

| Check Corrections |

The net check corrections forwarding from the Checks tab. |

| Outstanding Deposits |

The sum of all of the uncleared deposits forwarding from the Deposits tab |

| Outstanding Checks |

The sum of all of the uncleared checks forwarding from the Checks tab. |

| Adjusted Bank Balance |

This is Ending Balance per Bank - the Interest Earned, + the Service Charges, + or - the Deposit Corrections, + or – the Checks Corrections, + the Outstanding Deposits, less the Outstanding Checks. |

| Balance per Books |

The Balance per Books is the current balance after all transactions have been adjusted that are dated between the reconciliation started (Last Stmt date or last book balance date) and before the current Book Balance date. (If you take the Balance per Books from the last statement, add Deposits, subtract new checks, subtract NSF checks, and add or subtract new JE you should get the current Balance per Books). Note: The JEs are adjusted off the Posted Date and NOT the Transaction Date. ManEx recommends that you ONLY create a JE to make corrections to the bank balance if it CANNOT be accounted for through the bank reconciliation module. For an example see attachment <<ps_071114_a.doc>> |

| Unreconciled Difference |

This is any difference between the Adjusted Bank Balance and the Balance per Books. Note that this balance should be zero. |

|

If lit in RED, this is any notation entered by the user. |

| Date Last Changed |

The last date of the completed reconciliation or in process reconciliation |

| By |

The initials of the reconciler |

|

If lit in RED, the recordings of any edits. |

|

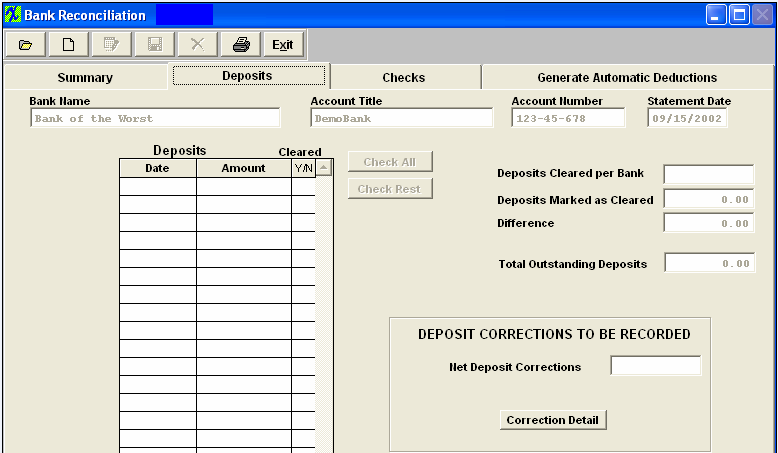

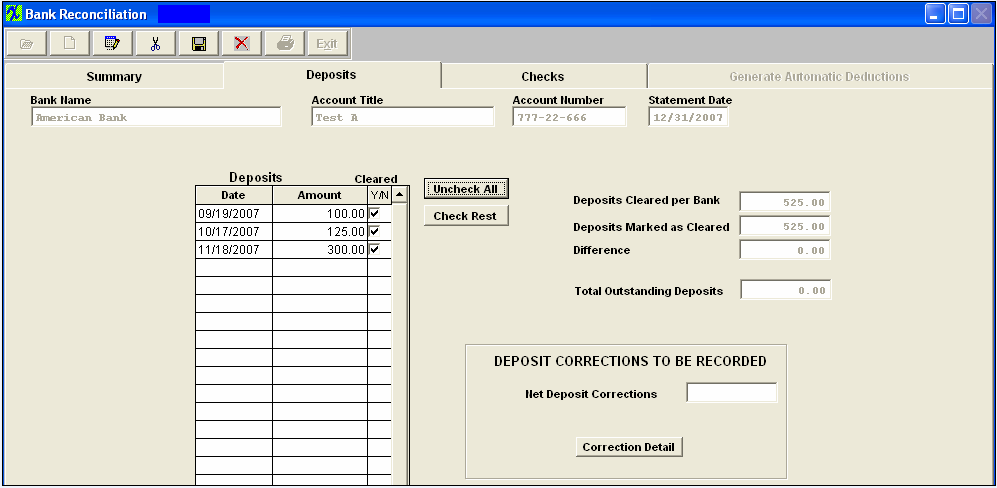

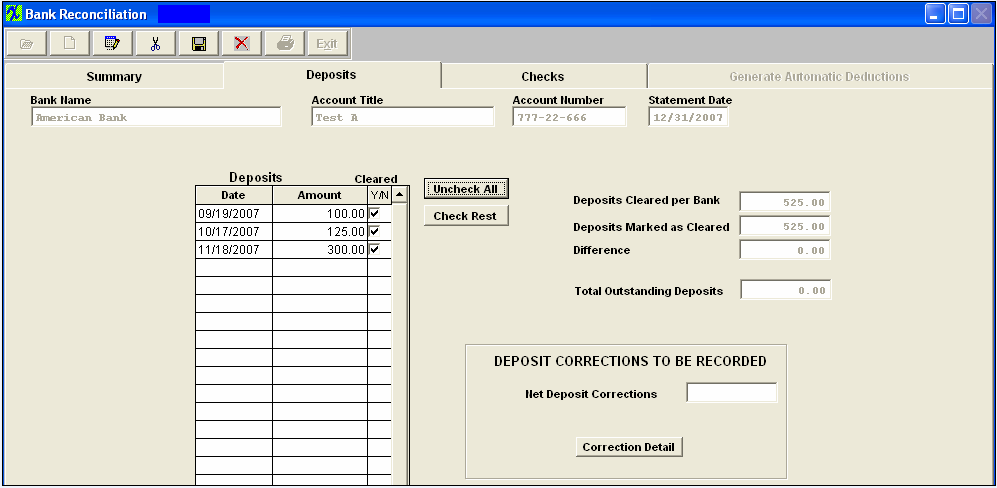

| 1.2.2. Deposits Tab | |

Field Defintions - Bank Reconciliation Deposits tab:

| Bank Name |

The name of the bank which was reconciled. |

| Account Title |

The G/L title for this bank. |

| Account Number |

The number that the bank has for this account. |

| Statement Date |

The date of the bank statement. |

| Deposits |

The date of the deposit, the amount and whether or not it’s cleared. NSF records will display as a negative entry. |

|

If the user wants all of the deposits checks as cleared, this button is used. |

|

The user highlights the first deposit to be checked and then uses this button to check all of the rest. |

| Deposits Cleared per Bank |

This has forwarded from the Summary tab Information from Bank Statement |

| Deposits Marked as Cleared |

This is the sum of all deposits checked in the Y/N column. |

| Difference |

This is the difference between the Deposits Cleared per Bank and the Deposits Marked as Cleared. This should be zero. |

| Total Outstanding Deposits |

This is the sum of all of the deposits listed which were not checked in the Y/N column. |

|

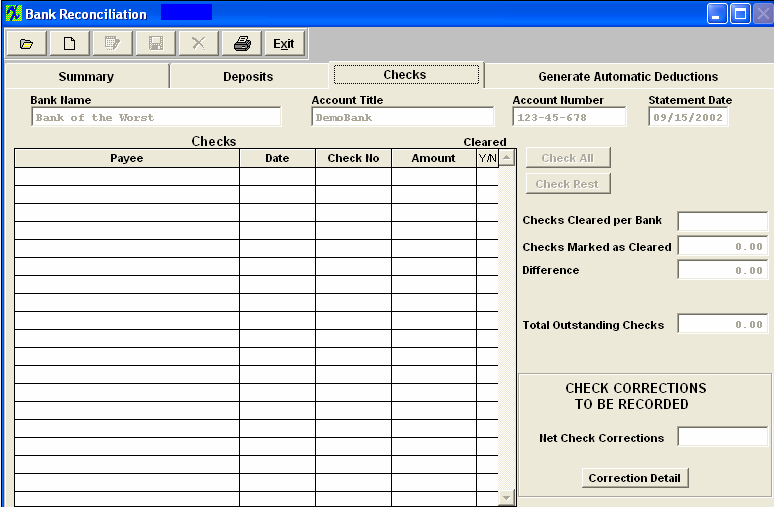

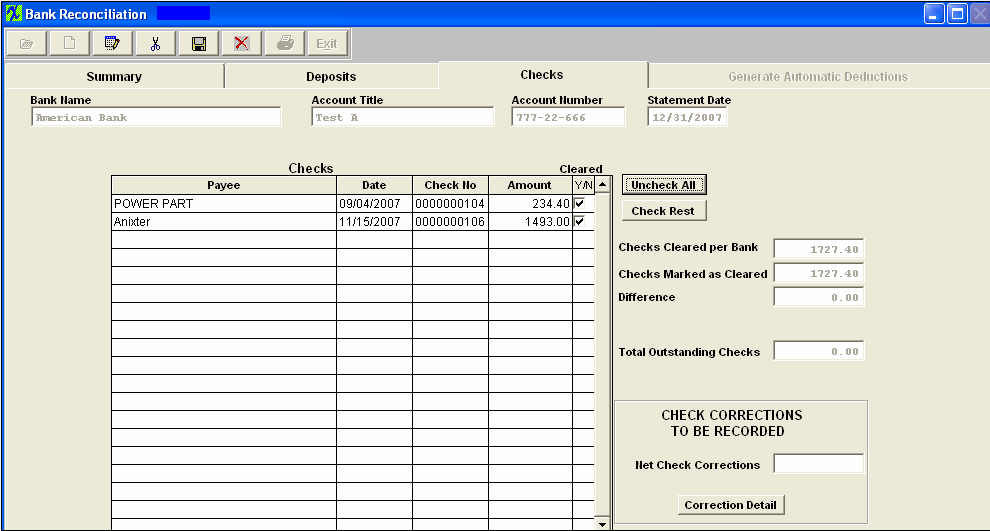

| 1.2.3. Checks Tab | |

| Bank Name |

The name of the bank which was reconciled. |

| Account Title |

The G/L title for this bank. |

| Account Number |

The number that the bank has for this account. |

| Statement Date |

The date of the bank statement. |

| Checks |

The name of the Payee, the date of the check, teh check no, the amount and whether or not it’s cleared. |

|

If the user wants all of the checks as cleared, this button is used. |

|

The user highlights the first check and then uses this button to check all of the rest. |

| Checks Cleared per Bank |

This has forwarded from the Summary tab Information from Bank Statement |

| Checks Marked as Cleared |

This is the sum of all checks checked in the Y/N column. |

| Difference |

This is the difference between the checks that Cleared per Bank and the Checks Marked as Cleared. This should be zero. |

| Total Outstanding Checks |

This is the sum of all of the checks listed which were not checked in the Y/N column. |

|

| 1.3. How To .... for Bank Reconciliation |

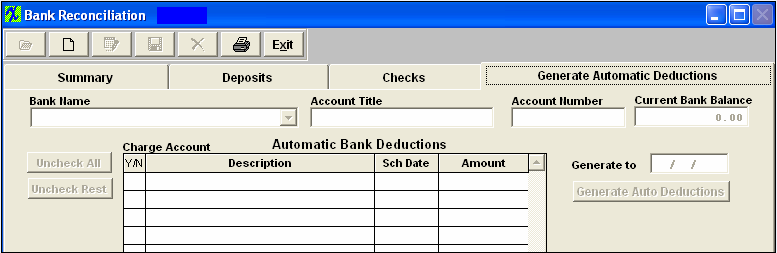

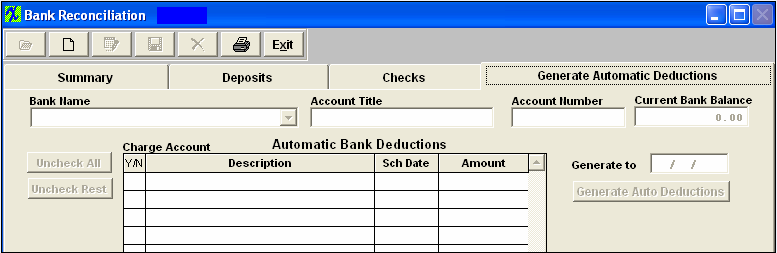

| 1.3.1. Generate Automatic Deductions | |

|

Enter Manex.exe Accounting/Accounts Payable/Bank Reconciliation

This is the companion screen to the Automatic Bank Deduction tab in the Check Payment Scheduling module. In this screen, the automatic deductions which were set up previously will be generated. Upon generation, the appropriate journal entry will generate and the outstanding check list will display the automatic deduction.

|

|

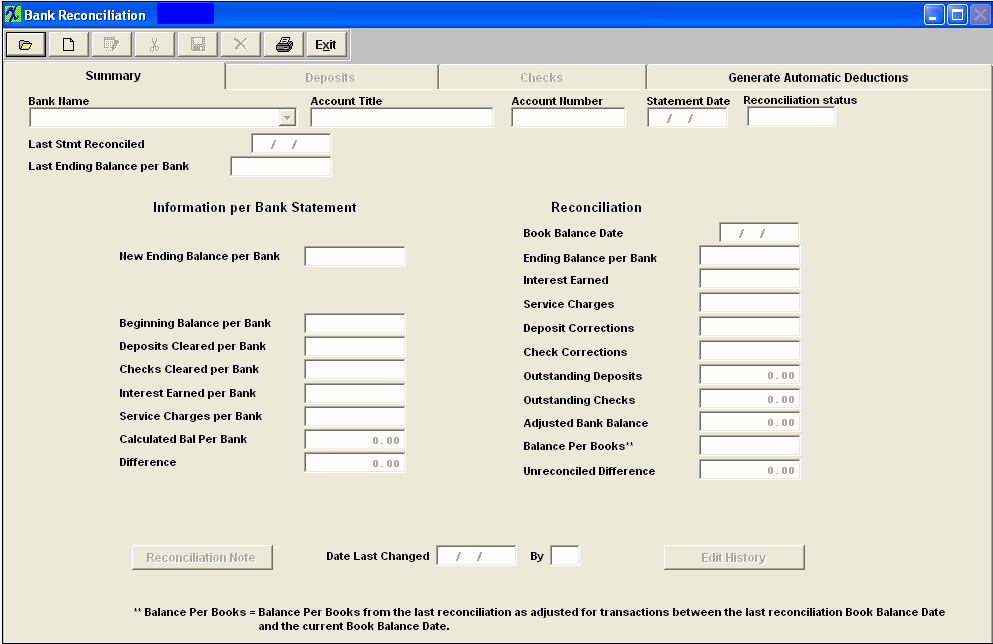

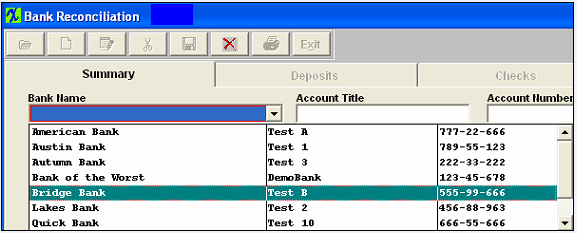

Upon entering the Bank Reconciliation module, the following screen will display:

Note that the Generate Automatic Deductions tab is enabled.

Click on the Generate Automatic Deductions tab and the following screen will appear:

To generate an automatic deduction, depress the Add button and enter your password.

Depress the down arrow next to the Bank Name field. Select the appropriate bank. The Account Title and the Account Number will fill in automatically. Type in the date you want to generate to and depress the Generate Automatic Deductions bar. The list of all of the automatic bank deduction will appear:

In the Y/N field, check the ones you want to be generated. Depress the Save button.

|

| 1.3.2. Adding a Bank Reconciliation |

| 1.3.2.1. Initial Bank Reconciliation | Initial Bank Reconciliation

|

Enter Manex.exe

Accounting/Accounts Payable/Bank Reconciliation

|

|

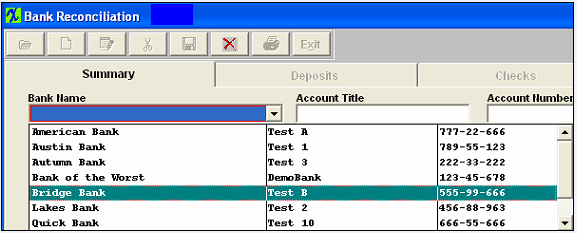

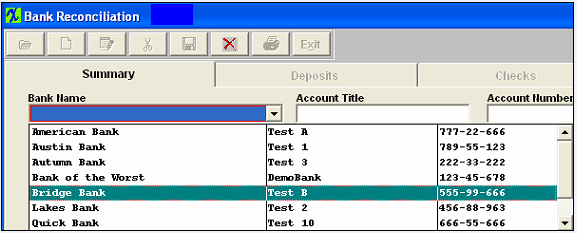

The following screen will appear:

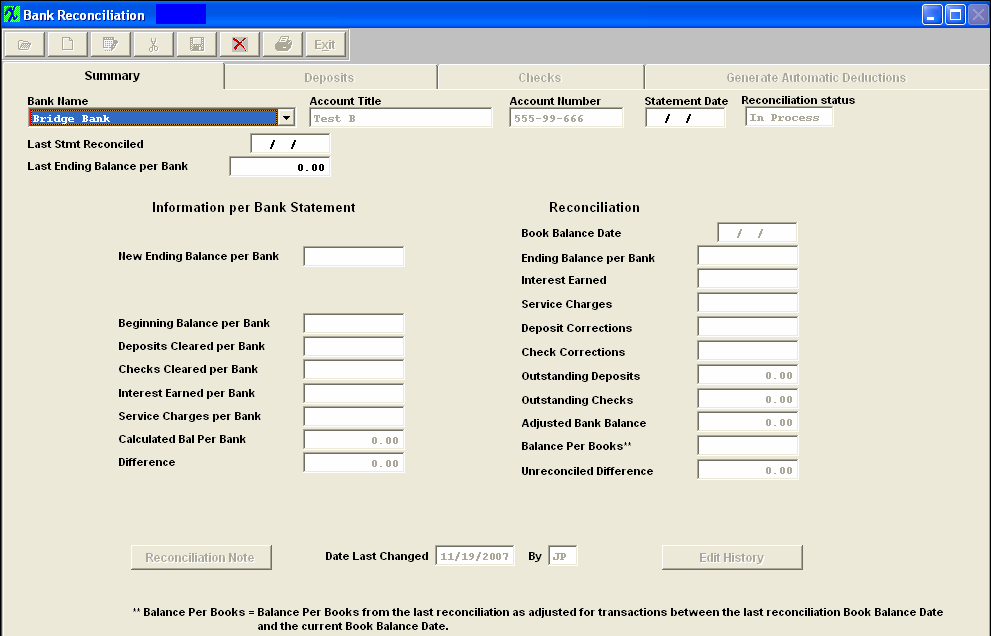

| Depress the Add button and type in your password. Depress the down arrow next to the Bank Name field. Highlight the bank of your choice. |

|

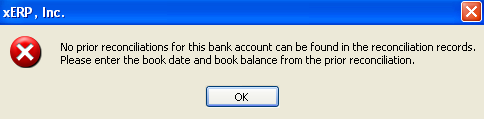

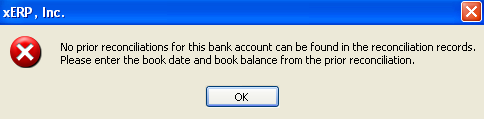

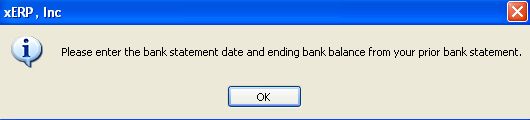

If this is the very first bank reconciliation for that bank, the following message will appear:

To continue, depress the OK button.

|

|

|

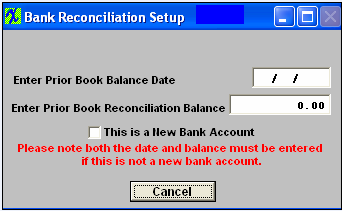

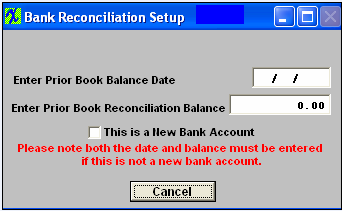

The following Bank Reconciliation Setup screen will appear:

Select "This is a New Bank Account" If this is a brand new bank account that has just been created and never used by the customer before, check the box next to that statement.

|

|

|

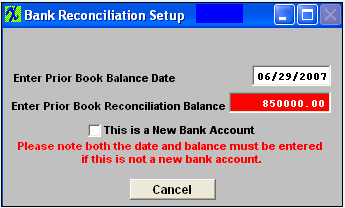

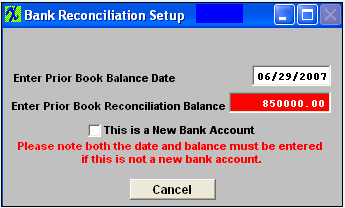

If the bank account has been used by the users for some time (maybe a different software other than ManEx), but this would be the first time that they are actually using the ManEx system to reconcile the account and the system is asking for previous statement information. Then you would enter the Prior Book Balance Date and the applicable balance.

|

|

|

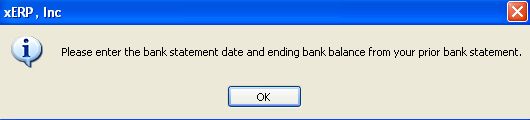

Upon completion of your entry, the following message will appear:

Depress the OK button.

|

|

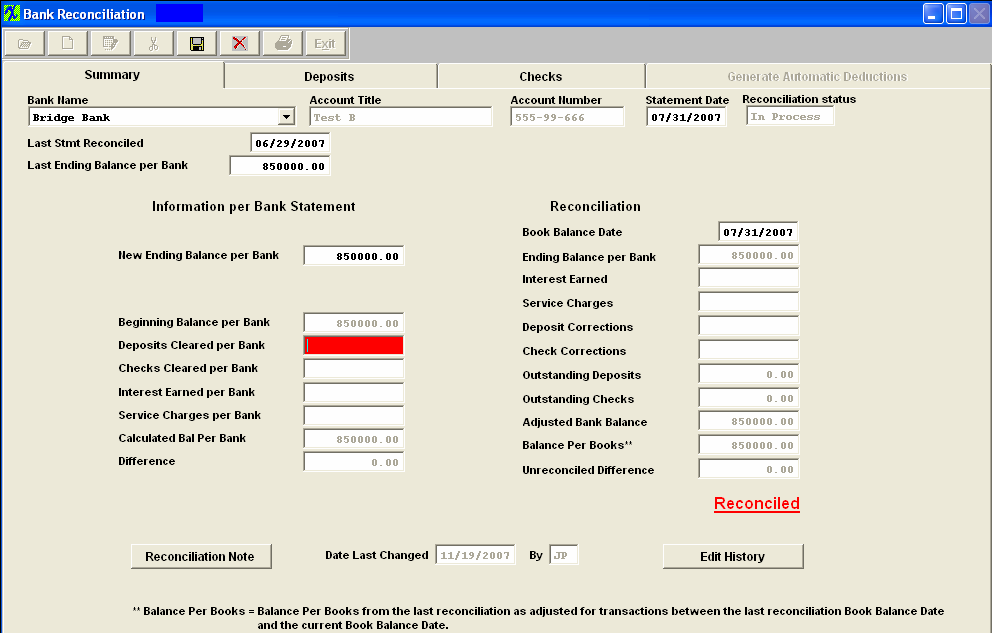

The screen will populate with the following information:

Enter the Last Stmt Reconciled date, the Last Ending Balance per Bank amount, the Statement Date and the New Ending Balance per bank al the rest of the information will default in and account will be reconciled.

Save Reconciliation

|

| 1.3.2.2. Subsequent Bank Reconciliation | Subsequent Bank Reconcilliations

|

Enter Manex.exe

Accounting/Accounts Payable/Bank Reconciliation

|

|

The following screen will appear:

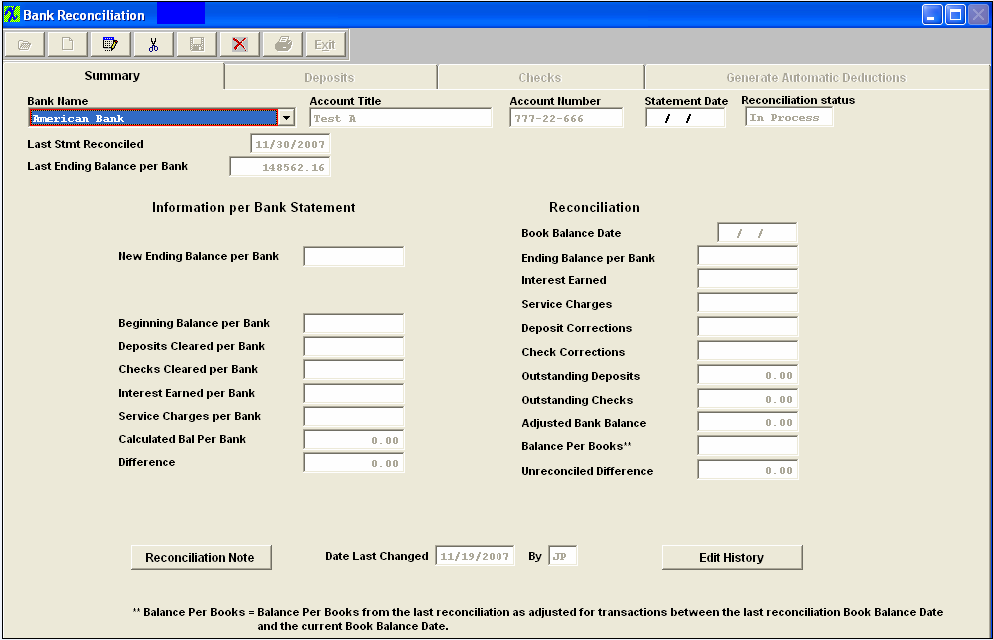

Depress the Add button and type in your password. Depress the down arrow next to the Bank Name field. Highlight the bank of your choice.

.

|

|

All of the pertinent header information will automatically load, along with the Last Stmt Reconciled date and the Last Ending Balance per Bank amount which will also appear in the appropriate fields:

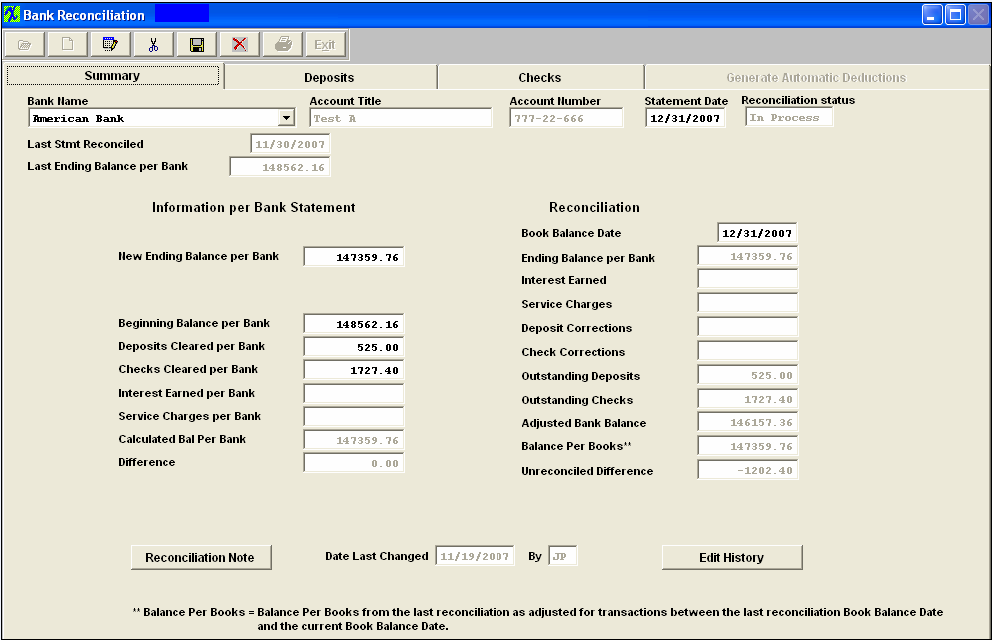

From your bank statement you are currently reconciling, enter the bank Statement Date, the Book Balance Date and the New Ending Balance per Bank. Enter the total deposits cleared per the bank statement and enter the Checks cleared per the Bank Statement. If applicable, enter the Interest earned per the bank statement. If applicable, enter the bank service charge per the bank statement.

Depress the Deposits tab. Check on the Cleared Y/N box if the deposit has cleared the bank per the bank statement. (NSF records will display as a negative entry and will allow users to check them off the same way as a regular depost once they have cleared the bank). If there are any corrections to the bank statement (most unusual), type in the net correction and then enter a complete explanation into the Correction Detail screen. Note: No general ledger entry is created for this amount.

Depress the Checks screen. Check on the Cleared Y/N box if the deposit has cleared the bank per the bank statement. If there are any corrections to the bank statement (most unusual), type in the net correction and then enter a complete explanation into the Correction Detail screen. Note: No general ledger entry is created for this amount.

Return to the Summary Screen. Bank Reconciliation after the Checks and Deposits had been cleared Note: The Balance Per Books field goes off the Posted Date for JEs and NOT the Transaction Date. See the Word attachment <<PS_for_JE_071114.docx>> for an example.

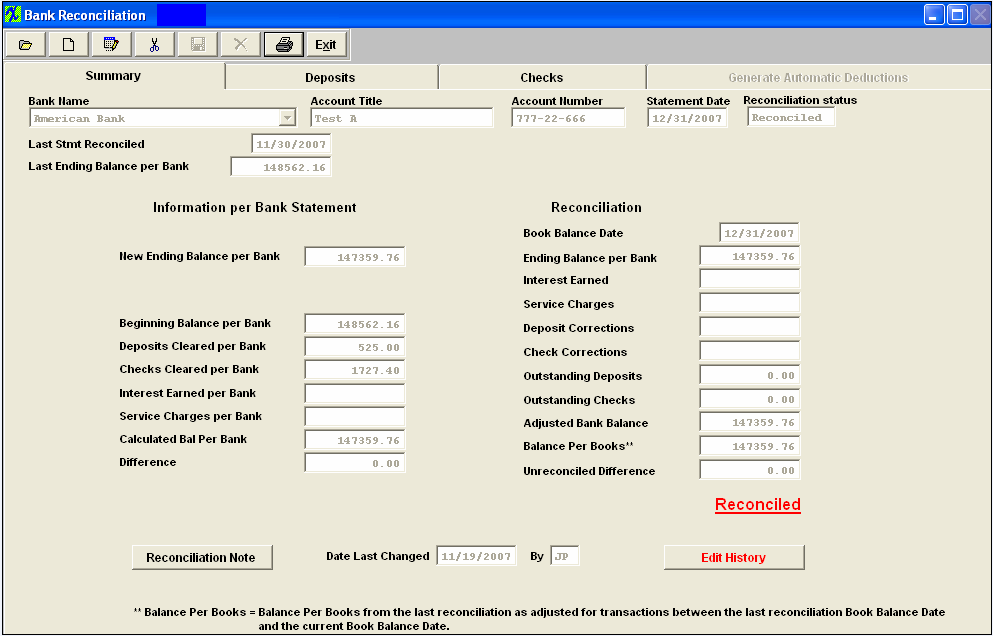

Save Reconciliation

|

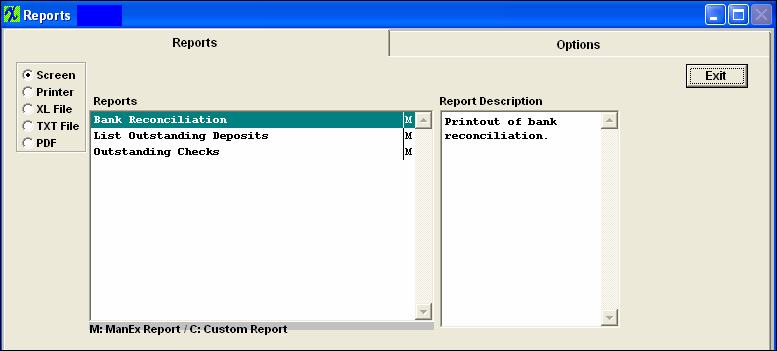

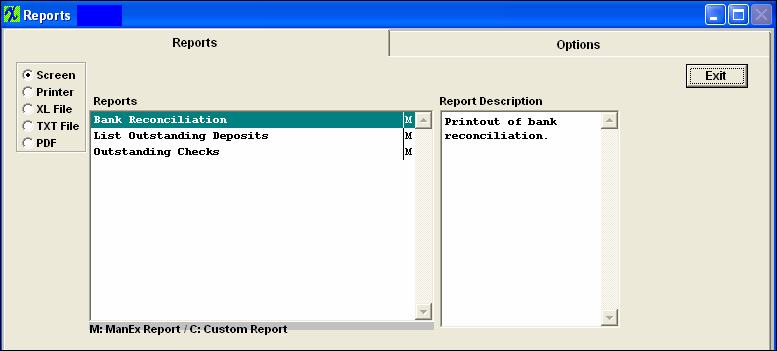

| 1.4. Reports for Bank Reconciliation | Depress the Reports icon and the following listing will appear:

Bank Reconciliation report

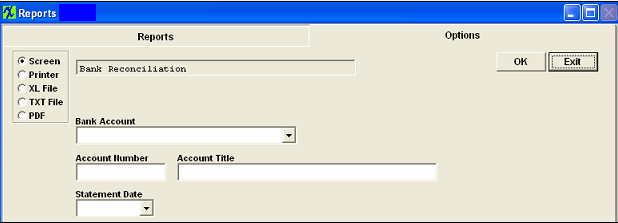

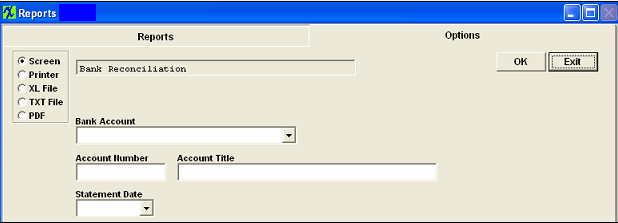

Highlight the Bank Reconciliation report and depress the Options tab. The following screen will display:

Select one of the radio buttons for the output you desire; Screen, Printer, XL FIle, TXT File, or PDF.

Depress the down arrow next to the Bank Account field. A listing of banks will appear:

Click on the desired bank. The Account Number and Account Title will fill in automatically.

Depress the down arrow next to the Statement Date field:

Select the desired statement date.

Depress the OK button.

|

|

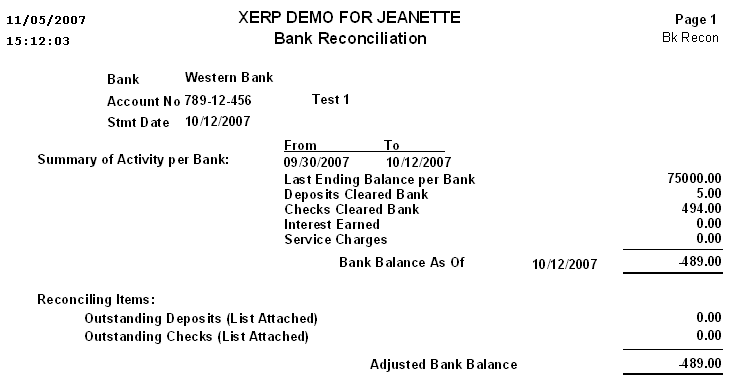

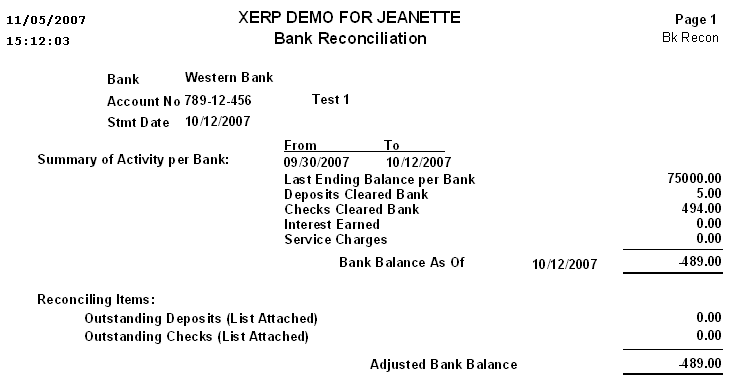

The following reports will be displayed:

List Outstanding Deposits Report

|

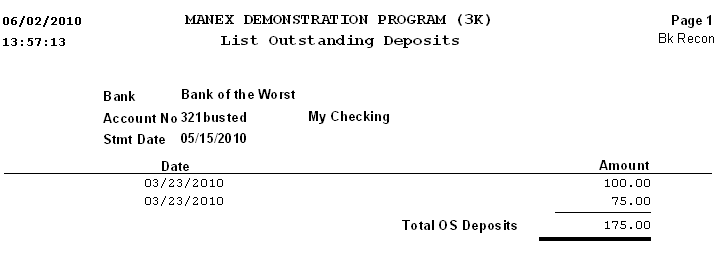

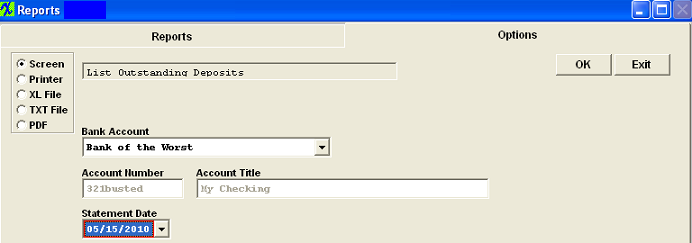

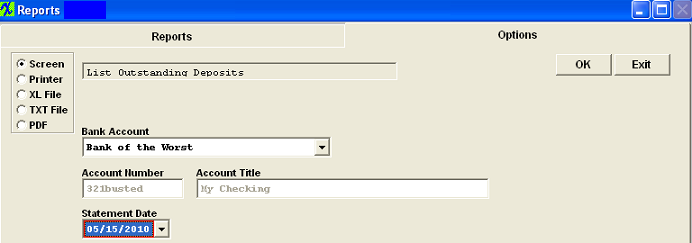

Highlight the List Outstanding Deposits report, then enter the Options tab.

Select one of the radio buttons for the output you desire; Screen, Printer, XL FIle, TXT FIle, or PDF.

Make your Bank and Statement selections. The screen will appear as below:

|

|

The following report will be displayed:

Outstanding Checks Report

|

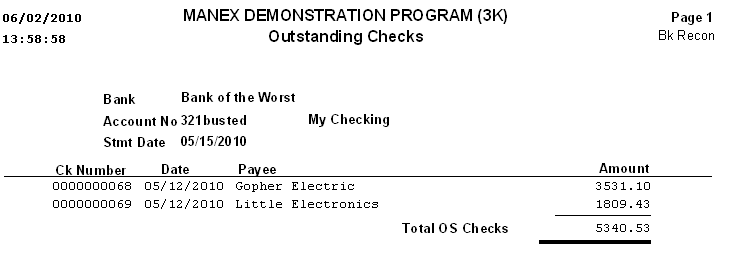

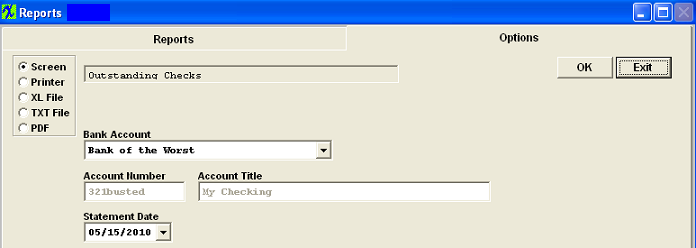

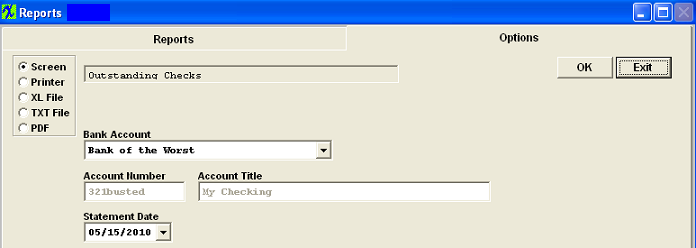

Highlight the List Outstanding Checks report, then enter the Options tab.

Select one of the radio buttons for the output you desire; Screen, Printer, XL File, TXT File, or PDF.

Make your Bank and Statement selections. The screen will appear as below:

|

|

The following report will be displayed:

|

|