| 1. How To .......... |

| 1.1. Inventory Setup | ||

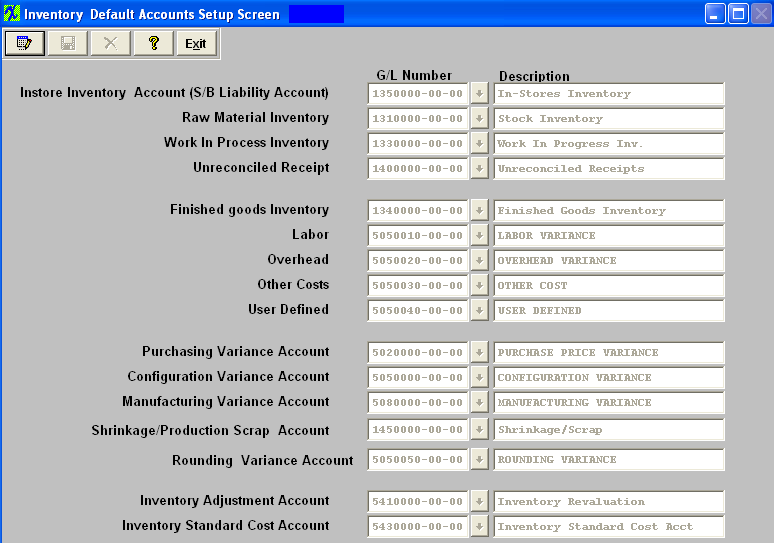

The following screen will appear:  This screen is similar to the Sales-A/R and Purchases-A/P Setup screens. Enter the default accounts associated with Inventory, and these numbers will be available during routine entry of data.

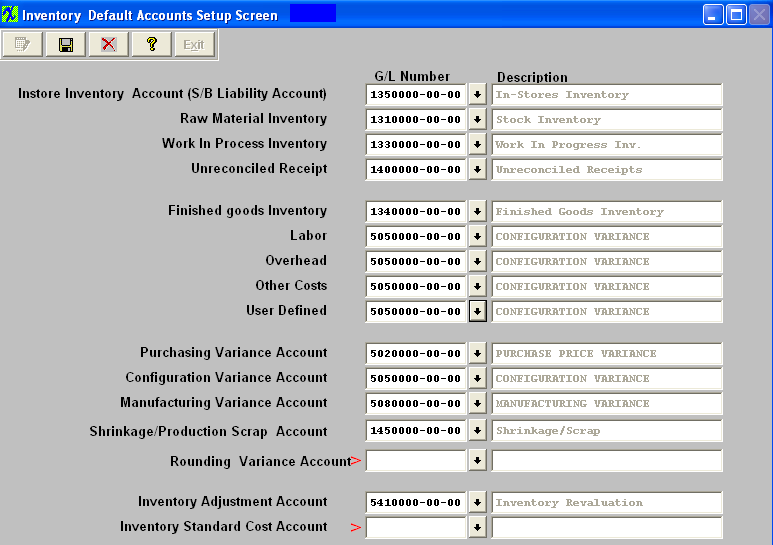

If you have the Multi-Plant version of Manex, prepare defaults for each division set up previously in G/L Divisions /Departments . Note that the accounts selected as defaults must have the class of posting in the General Ledger Account Setup screen. Depress Edit , to change the defaults or setup new account number for the Labor, Overhead, Other Costs, and/or User Defined.

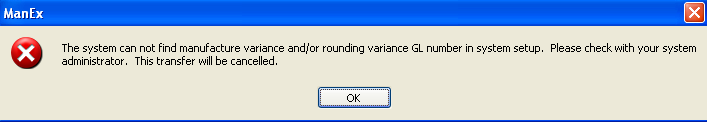

It is up to the users to establish a G/L account for the Rounding Variance account. A G/L account MUST be established for this account. If this field is left blank when users transfers product to/from the FGI or Scrap work center in Shop Floor Tracking they will receive the following message:

It is up to the users to establish a G/L account for the Inventory Standard Cost account. This gives the user the option to have the Cost adjustment and Inventory adjustment broken out to hit two seperate G/L accounts. If this field is left blank any transaction made from the Std Cost Adj module will default in the same GL account number as the Inventory Adjustment account, so no data will be lost if the users neglect to populate this field with a new G/L account number. Once changes have been made depress the Save button to save changes or the Abandon Changes button to abandon changes.

The InStore Inventory Account should be a Liability Account. The IPS inventory does not carry any value until pulled to a kit. This is why it needs to be a Liability GL account. Because at the time you pull the inventory to a Kit, is the first time a transaction is created in the system and at that point in time the IPS stock that you issued to the kit becomes a liability that you owe to the Supplier per contract. See Article #3268 for further detail.

The inventory account should be an Asset account, normally under Current Assets. The Cost adjustment account should be an Income/Expense account, normally under Cost of Goods or Inventory Adjustments. Asset Accounts are Balance Sheet accounts and are shown on that statement, Income/Expense accounts are on the Income statement. So if you have a cost adjustment to reduce inventory by $500 you are saying that you have $500 less than you should so that has to be expensed and recognized in the Profit and Loss, the transaction would be: Debit Credit Cost Adjustment 500.00 Inventory 500.00 The Inventory account would be reduced by $500.00, the total of all of the inventory accounts (Raw Goods, Finished goods, etc) would be reduced by $500, the total Current Assets would be reduced by $500 and the Total Assets would be reduced by $500, Current earnings would be reduced by $500 and Total Liabilities would be reduced by $500. On the income statement, the Cost adjustments would be increased by $500, depending what category the put the account, the sub total of that group would increase by $500, gross income would be reduced by $500 and total income would be reduced by $500.00 |