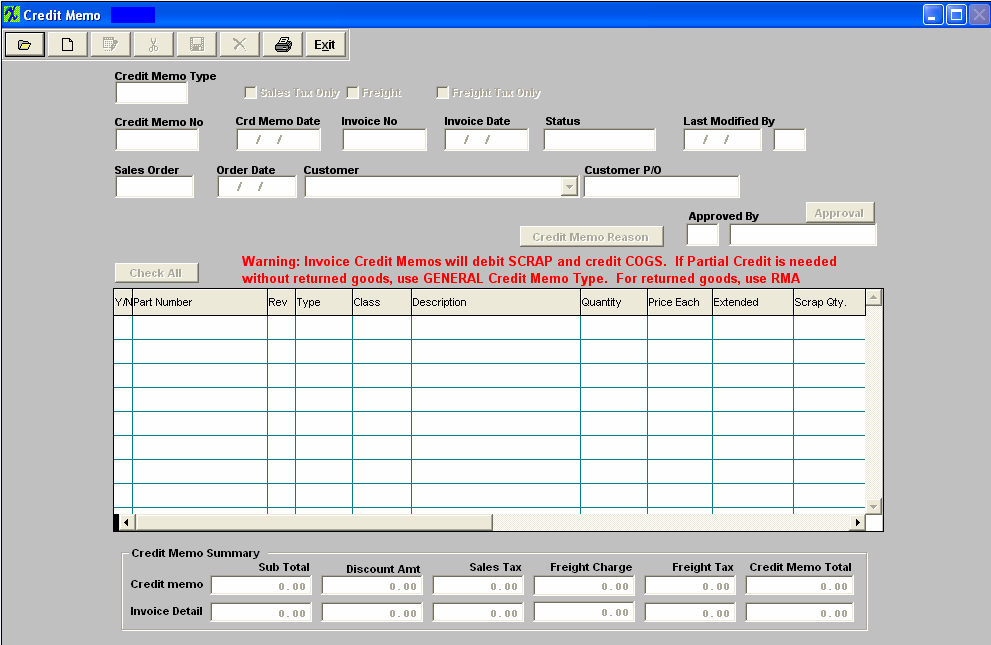

Credit Memo Field Definitions:

| Credit Memo Type |

The type of Credit Memo (Invoice or General). A Credit Memo can be created from two modules: the Accounts Receivable Credit Memo module or the RMA (Return Material Authorization) module. If the RMA is created from an Invoice the CM type will be "Invoice", if the RMA is a stand-alone the CM type will be "General". |

| Sales Tax Only |

This box is checked if the Credit Memo is for the Sales Tax only. This checkbox will NOT be displayed on CMs that are generated via a RMA Receiver. |

| Freight |

This box is checked if the Credit Memo is for the Freight Charge only. This checkbox will NOT be displayed on CMs that are generated via a RMA Receiver. |

| Freight Tax Only |

This box is checked if the Credit Memo is for the tax on the freight charge only. This checkbox will NOT be displayed on CMs that are generated via a RMA Receiver. |

| Credit Memo No |

The unique number assigned to the Credit Memo. Note: If the numbering is set to "Auto" once the "Next" number is selected, the counter moves to the succeeding number, if the abandon changes button is selected that number appears to be considered as used and will be skipped even though the record was never changed. |

| Credit Memo Date |

The date of the Credit Memo. |

| Invoice No |

The invoice number to which the Credit Memo will be applied. |

| Invoice Date |

The date of the Invoice. |

| Status |

Status of Credit Memo (Open, Approved, Edit) |

| Last Modified By |

Date and Initials of User Last Modified By |

| Sales Order |

The unique sales order number to which the Invoice applies. |

| Order Date |

This is the date of the Sales Order. |

| Customer |

The name of the customer receiving the Credit Memo. |

| Customer PO |

The customer’s Purchase Order number authorizing the Sales Order. |

| GL Account Number |

This field will only appear for a General Credit Memo. |

| GL Account Description |

This field will only appear for a General Credit Memo. |

|

This button will open up a screen for entering the reason for the Credit Memo. |

| Approved By |

Intials, date and time of user Approved By |

| Y/N |

The box is for marking the line item on the invoice for crediting. |

| Part Number |

The user’s internal number for the part. |

| Rev |

The revision number pertaining to the Part Number, if any. |

| Type |

The user’s internal type to which the part number belongs |

| Class |

The classification to which the part number belongs. |

| Description |

The user’s description of the part number. |

| Quantity |

The quantity to be credited. |

| Price Each |

The price for 1 quantity of the Part Number. |

| Extended |

Quantity multiplied by Price Each. |

| Scrap Qty |

The amount of the returned stock that will be charged to scrap. The CM fields are populated with the data from the invoice selected. For the line items checked at the left, the qty entered in the Quantity field will default into the Scrap Qty field (this field is read only). This is the qty that will hit the scrap account. The system will automatically debit SCRAP and credit COGS. (If user is creating a Credit Memo for a price adjustment to a Customer Invoice and is NOT returning the goods and does NOT want the GL Transaction to hit the scrap account then we suggest that the user creates a General Credit Memo). |

Credit Memo Summary/Credit Memo Line:

| Sub Total |

This sub-total is the amount of returned product or price change being credited. |

| Discount Amt |

This sub-total is the amount of the discount being calculated into the Credit Memo Total. |

| Sales Tax |

The sub-total is for the amount of sales tax being credited. |

| Freight Charge |

The amount of the Freight Charge being credited. |

| Freight Tax |

The amount of the Freight Charge tax being credited. |

| Credit Memo Total |

The total Credit Memo allowed to the Customer. |

Credit Memo Summary/Invoice Detail Line:

| Sub Total |

This sub-total is the amount of product on the original invoice. |

| Discount Amt |

This sub-total is the amount of the discount on the original invoice. |

| Sales Tax |

The sub-total is for the amount of US sales tax, or Primary and/or Secondary sales tax on the original invoice. |

| Freight Charge |

The amount of the Freight Charge on the original invoice. |

| Freight Tax |

The amount of the US or Primary and/or Secondary Freight Charge tax on the original invoice. |

| Credit Memo Total |

The total of the original invoice. |

The GST (Primary) tax and PST (Secondary) tax is divided into the Sales tax and Freight tax on the Credit Memo Summary/Invoice Detail Line:

For Example:

Primary Tax (GST): 144*10% (sales tax) + 0 (no freight tax is calculated) =$14.40

Secondary Tax (PST): 144*8% (sales tax) + 12*8% (Freight tax) = $12.48

Divided into sales tax and freight tax:

Sales Tax: 144*10% (sales tax) + 144*8% (sales tax) = $25.92

Freight Tax 0 (from primary tax) + 12*8% (from secondary tax) = $0.96

|