| 1. PO Receipt Reconciliation |

| 1.1. Prerequisites for PO Receipt Reconciliation |

|

Users MUST have full rights to the "PO Reconcilliation" in Accounting Security . Users with “Accounting Security Supervisor” rights will automatically have access. The Purchase Order line item has been received and inspected. |

| 1.2. Introduction for PO Receipt Reconciliation |

The PO Receivable Reconciliation provides on screen and printed reports to assist the tracking and payment of outstanding payables. Once the Purchase Order line item has been received and inspected, the received information will forward from the Receiving module to the Accounts Payable Purchase Order Reconciliation. |

| 1.3. Fields & Definitions for PO Receipt Reconciliation |

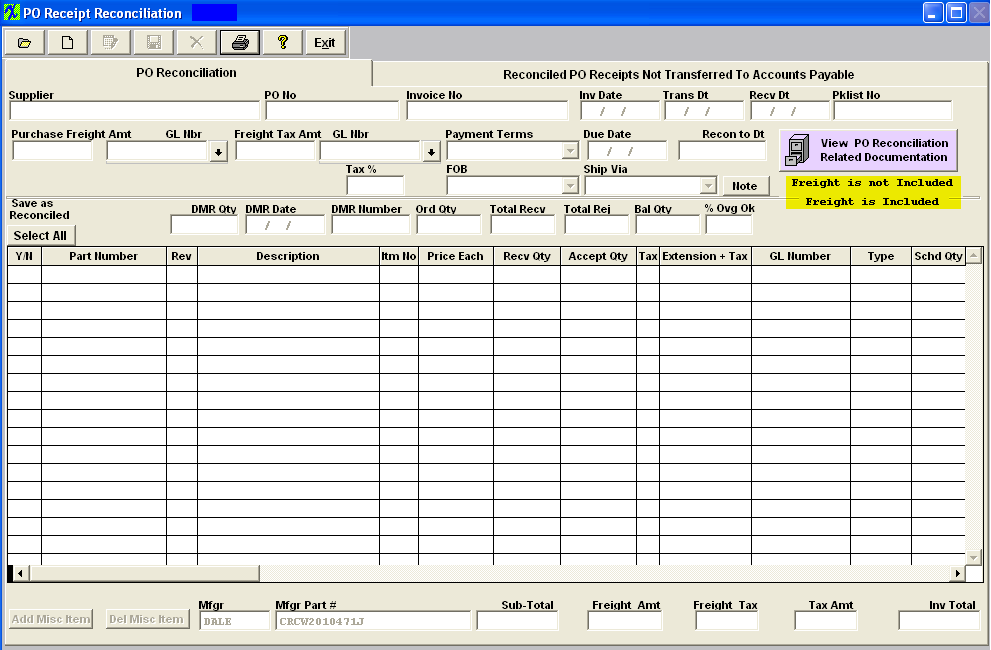

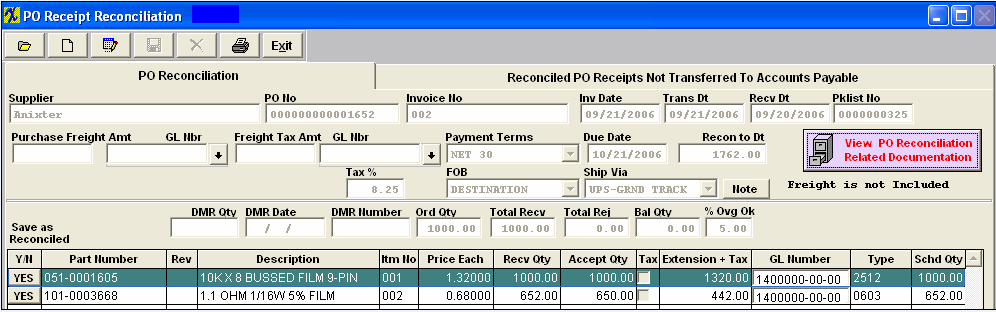

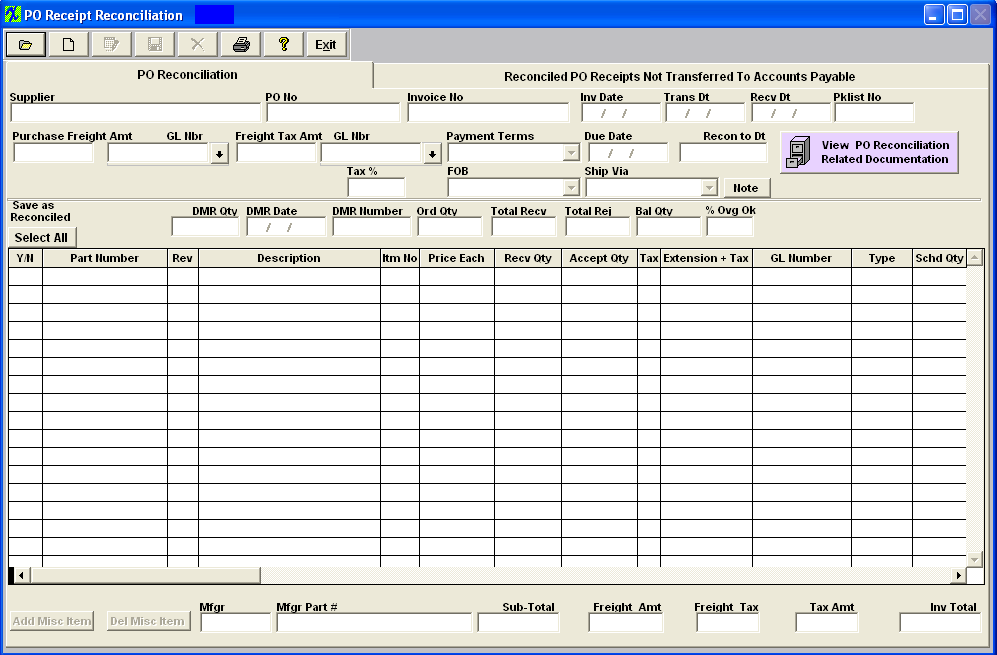

| 1.3.1. PO Reconciliation Tab | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PO Reconciliation Field Definitions

For the item number highlighted:

|

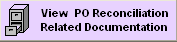

| 1.3.2. Reconciled PO Receipts not Transferred to A/P Tab | ||||||||||||||||||||||||||

|

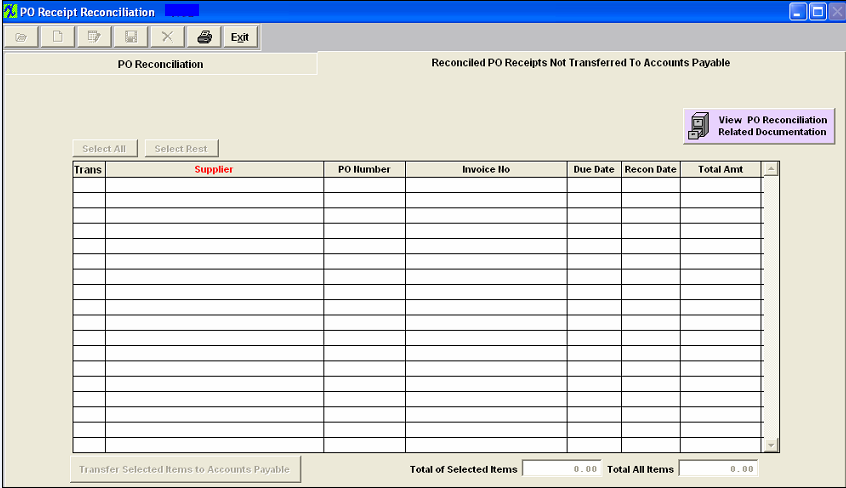

| 1.4. How To ..... for PO Receipt Reconciliation |

| 1.4.1. Find a PO Reconciliation Record | ||||||||

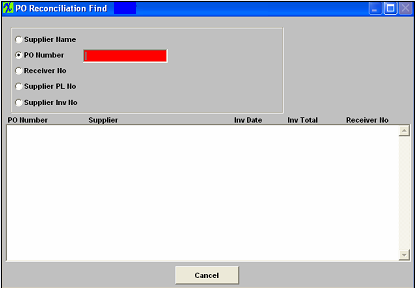

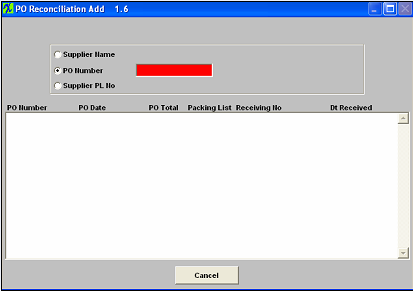

The following screen will appear:

Depress the Find Record action icon.

Once the Find Process is completed, the applicable data will appear. NOTE: The Edit button will only be available if the PO Receipt has NOT been transferred to AP.

|

| 1.4.2. Add a PO Reconciliation Record | ||||||||||||||

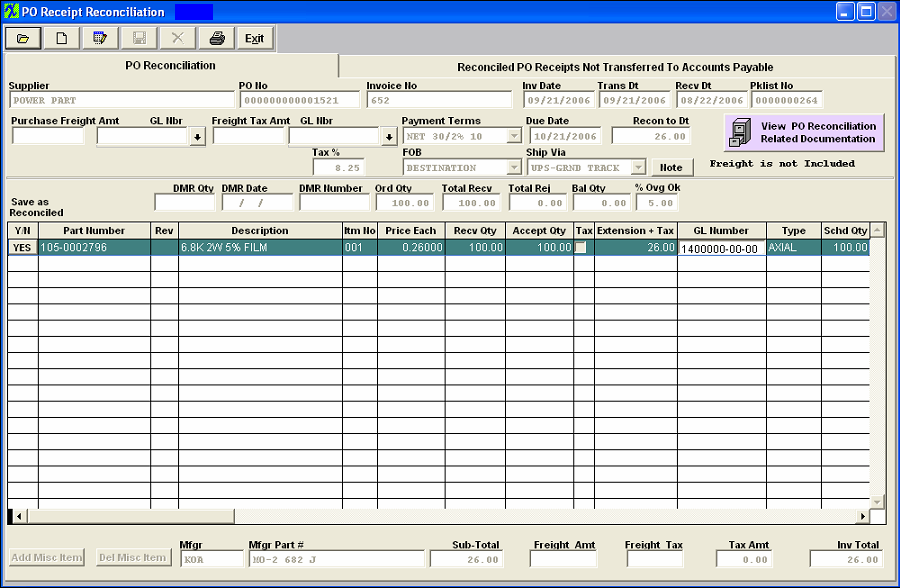

The following screen will appear:

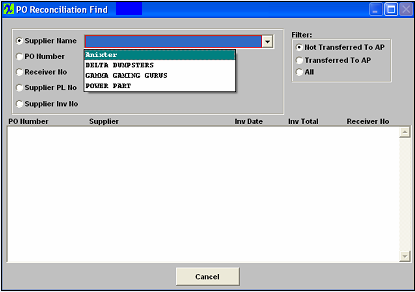

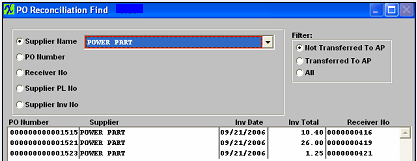

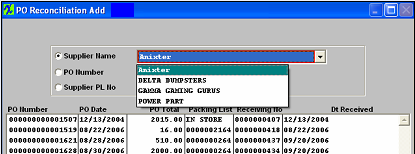

Depress the Add Record action icon. The following screen will appear: Select the Find by radio button; Supplier Name, PO Number or Supplier PL No. If you select by Supplier Name, a list of Suppliers will appear. Once the desired Supplier is selected, a further selection screen will appear. Highlight and double click on the desired Receiving No. If you decide to search by PO Number or Supplier PL No., type the PO Number or Supplier PL into the red box. The screen will fill with the following data:

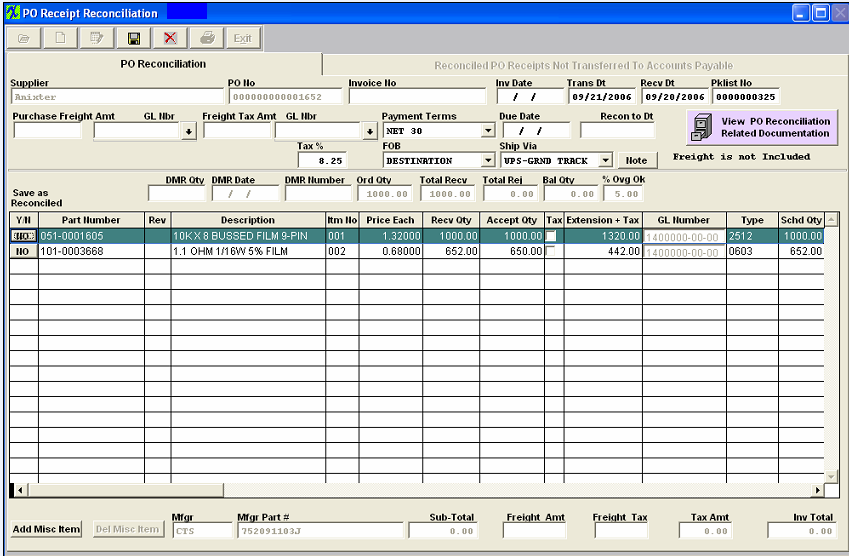

Type in the Invoice Number and Invoice Date. If you want to enter a different Transaction Date and/or Received Date, you may do so.

If there is Freight or Freight Tax associated with the invoice, type the amount into the field.

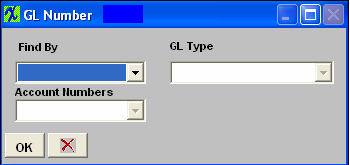

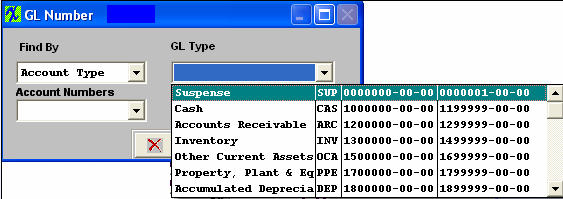

Type in the GL NUMBER or search by depressing the down arrow next to the field. The following selection screen will appear: Depress the arrow next to the Find By field. Select either Find By Account Type or Account Numbers.

If you selected by Account Type, the following listing will appear, once you’ve depressed the down arrow next to the GL Type field: Scroll up or down until the appropriate range is found.

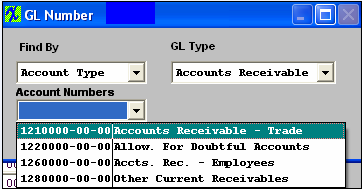

Then depress the down arrow next to the Account Numbers field. The following selection for the posting account will appear: You may change the payment terms or the due date, as desired. If you wish to add a note regarding this Supplier Invoice, depress the Note button. Depress the Edit button. Type in the note. Depress the Save button. Depress the Exit button. If any portion of the Invoice is subject to tax, enter the tax percentage in the Tax % box. The user may change the FOB or Ship Via fields by depressing on the applicable down arrow and making a new selection.

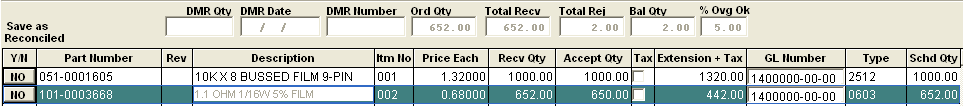

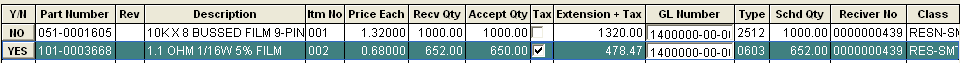

Once a line item is highlighted in the lower section, information regarding DMR, Original Order Quantity, etc. will appear, as follows:

All of the line items on the PO which have been accepted will appear in the lower section. Note: The user will not be able to overpay an invoice. Only those quantities which have been ACCEPTED in PO Receiving will forward. The user may toggle on the Yes/No to reconcile. The user may change the Price Each. If the line item is subject to tax, check that box.

If there is a miscellaneous item associated with the invoice which was not included in the PO, the user may depress the Add Misc Item button at the bottom of the screen. Type in the description of the item, the pricing, whether or not subject to tax, the accepted quantity and type in or select the GL Number. Entering Negative Amounts Note: The user may enter a NEGATIVE amount within this screen. Say to record a Coupon or something of that nature. The user should NOT record an early payment discount here as that is handled by the Payment Scheduling module.

Depress the Add Miscellaneous Item button. Type in the description. Type in the price, as a negative amount. Type in the accepted quantity as 1. Type in or select the General Ledger account number. Once all is completed, depress the Save record action button at the top of the screen.

|

| 1.4.3. Edit a PO Reconciliation Record | ||

The following screen will appear:  Select the record to edit using the Open/Find a record button. Once the Find Process is completed, the applicable data will appear. NOTE: The Edit button will only be available if the PO Receipt has NOT been transferred to AP. All editing for Purchase Order Invoices already transferred to the Accounts Payable MUST be edited in the Manual Invoicing module. |

| 1.4.4. Transfer an PO Reconciled PO Receipt to A/P |

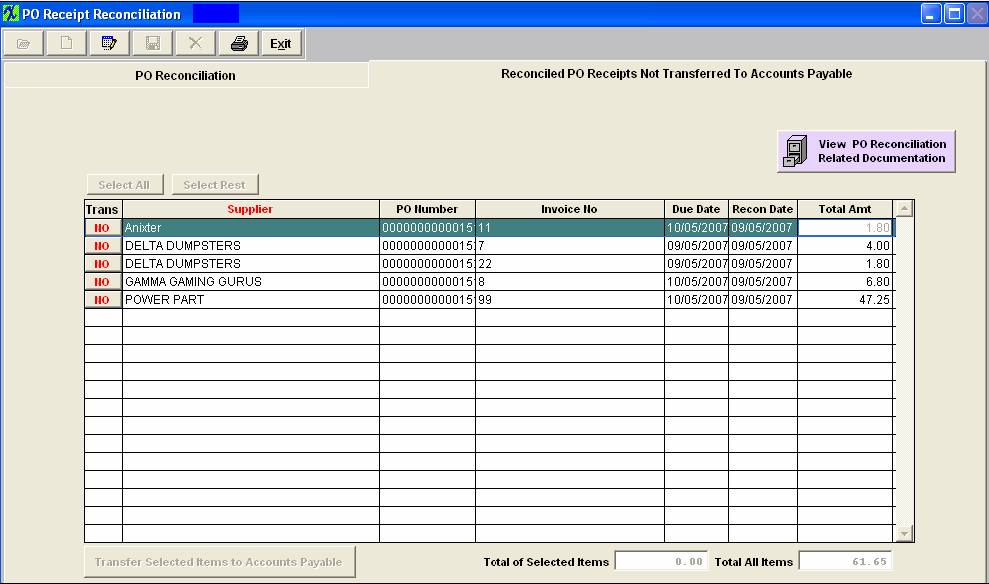

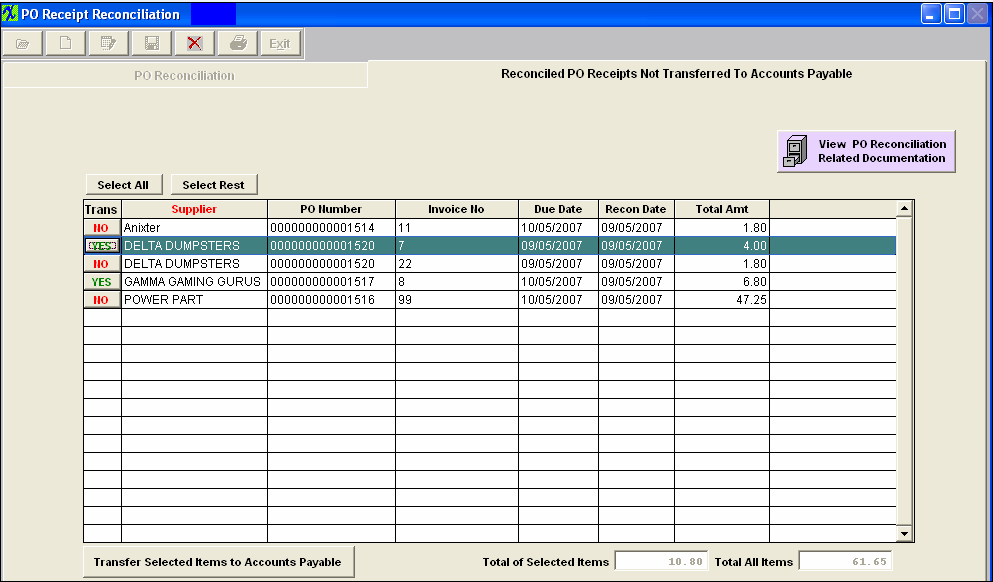

Transfer Reconciled PO's to Accounts Payable

The following screen lists all of the Reconciled PO Receipts, which have not yet been transferred into Accounting Payable.

Depress the Edit Record Icon. Toggle on the Yes/No column if desired, or depress the Select All button.  Once all selections are made, depress the "Transfer Selected items to Accounts Payable" button. Note: The Reconciled Invoices can’t be scheduled for payment unless they are TRANSFERRED. |

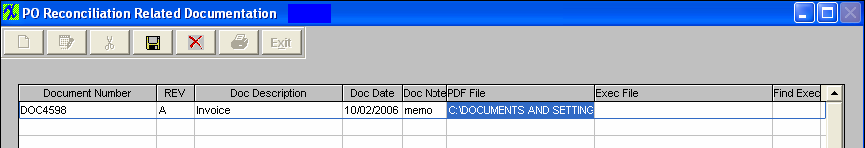

| 1.4.5. Attach a Related Document |

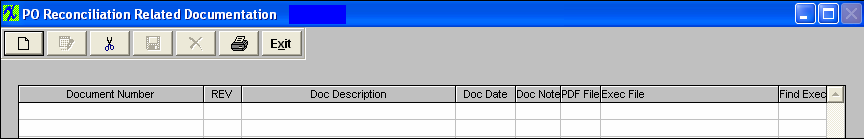

Find an existing PO Reconciliation Record, or Add a new PO Reconciliation record. Depress the The following screen will appear:

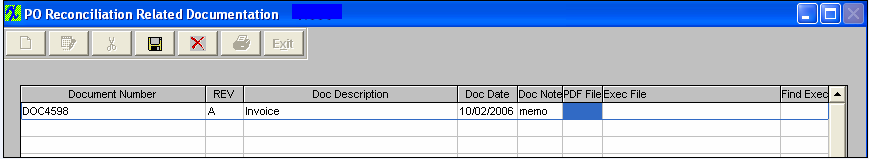

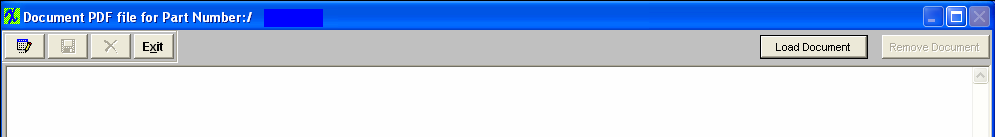

Depress the Add record icon, enter in a Document Number, REV, Doc Description, Doc Date, Doc Note; To load a document double click in the PDF File field and the following screen will appear:

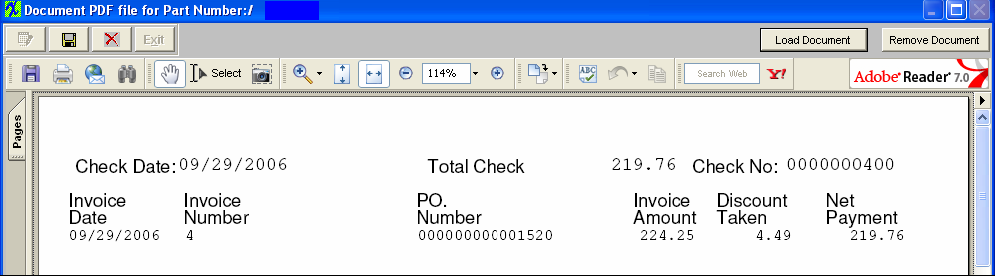

Depress the Load Document button and the following screen will appear: The PDF screen will allow you to load almost any type of document; (Word, Excel, pdf, Images, etc .... ) Locate the document and double click on it and the document will populate screen.

Depress the Save record icon to save or depress the Abandon changes icon to abandon changes. The following screen will appear:

Depress the Save record icon to save or depress the Abandon changes icon to abandon changes. Once documents are saved the "View PO Reconciliation Related Documentation" button will display in Red.

|

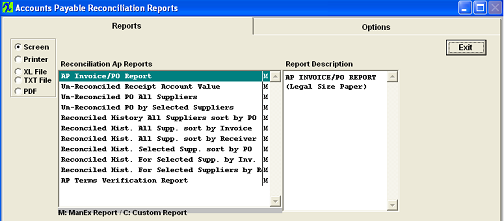

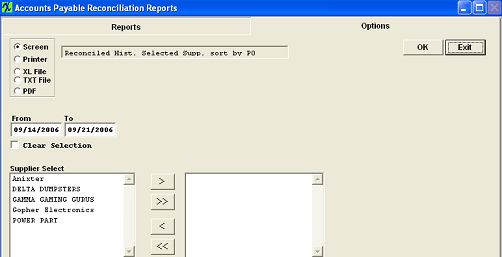

| 1.5. Reports for PO Receipt Reconcilitation | ||||||||||

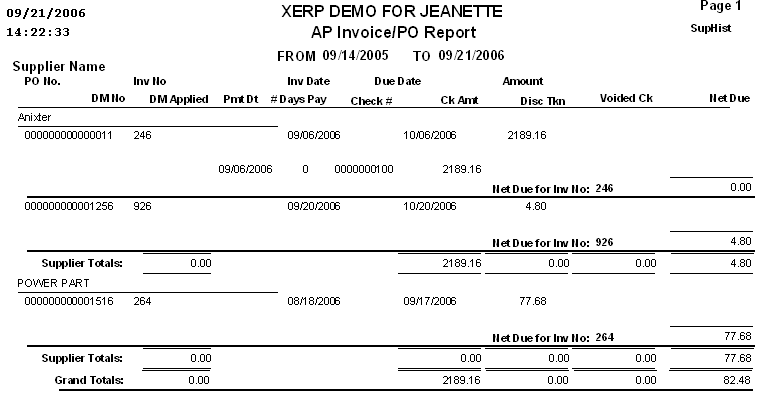

To obtain the AP Reconciliation reports, depress the Reports button. The following screen will appear: Select one of the radio buttons for the output you desire. Select from Screen, Printer, XL File, TXT File, or PDF. Highlight the report. Depress the option tab. AP Invoice/PO Report

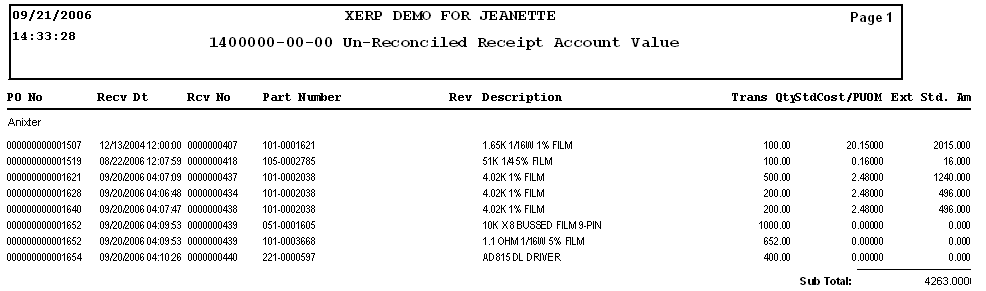

Un-Reconciled Receipt Account Value - This report will show ALL records that affect the GL Account. Including Receipts waiting to be reconciled and items that were rejected at receiving and wailting for a DMR to be processed through the system.

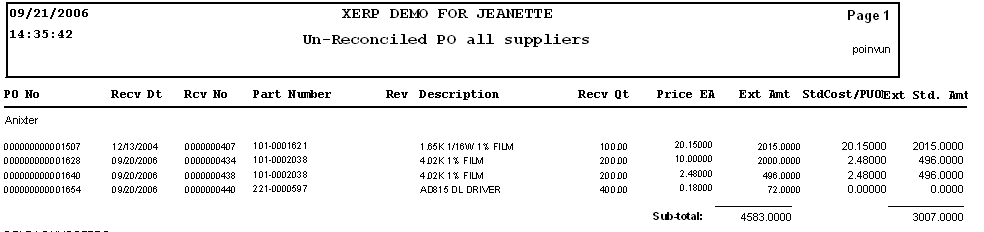

Un-Reconciled PO All Suppliers - This report wil only list receipts that are waiting to be reconciled within AP.

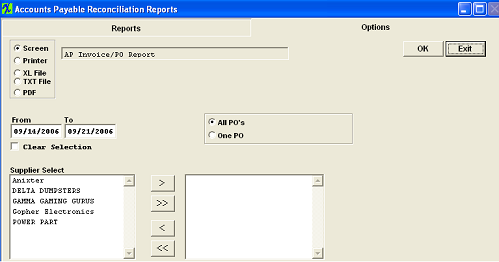

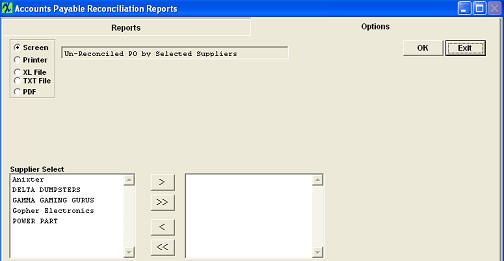

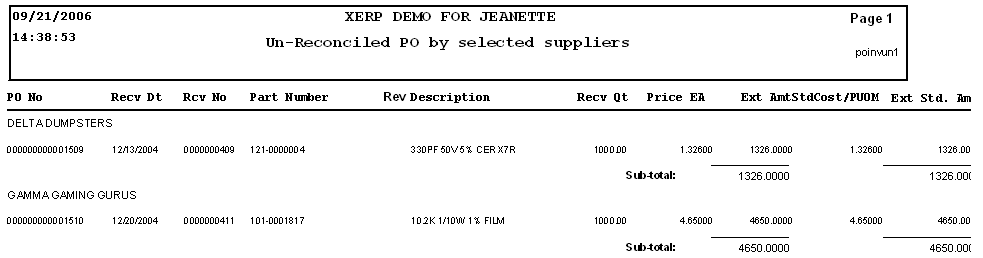

Un-Reconciled PO by Selected Suppliers

The following screen will be displayed. Highlight the Supplier(s) of interest. Depress the > button. If you want all of the Suppliers, depress the >> button. Depress the Ok button. The following report will be displayed.

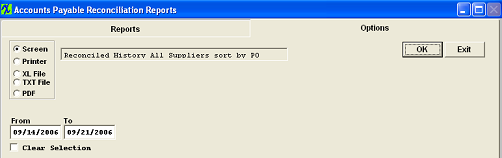

Reconciled History All Supplier sort by PO

The following report will be displayed.

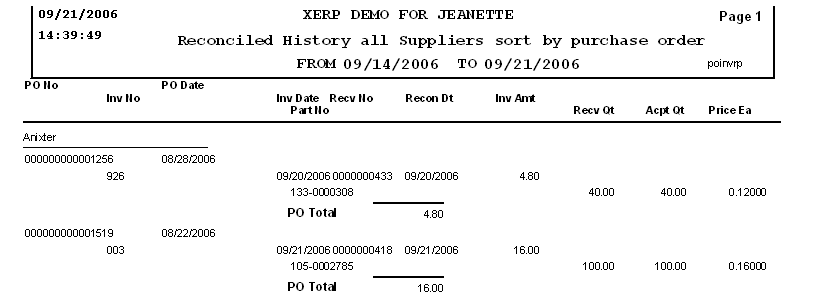

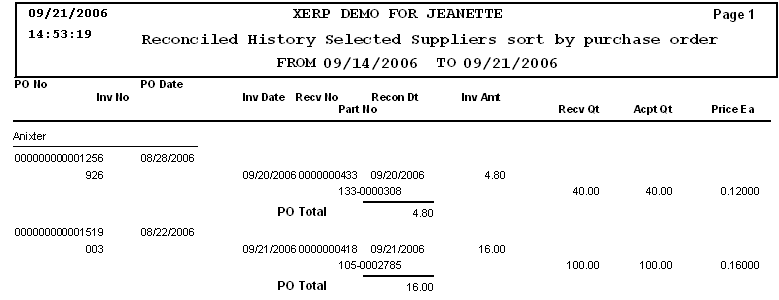

Reconciled History Selected Suppliers sort by PO

Highlight the Reconciled History for Selected Suppliers sort by PO report. (This report is also available to sort by Invoice or Receiver) Depress the Options Tab. The following screen will appear. Enter the From and To date range. Depress the Ok button. The following report will be displayed.

AP Terms Verification Report

|