| 1. Sales Tax Authority Table |

| 1.1. Prerequisites for Sales Tax Authority Table |

|

Complete the attached worksheet and "Mark as Completed RoadMap Section B Item 1-f" before continuing the setup. If Accounting is used, the appropriate General Ledger numbers must have been set up in the Accounting Set Up section.

User MUST have full rights to the "System Setup" in System Security . Users with “Supervisor Rights” will automatically have access. |

| 1.2. Introduction for Sales Tax Authority Table |

This is where the user must enter all sales tax information. The tax ID, Tax Authority description, and rates for various city, county, state, province, etc. are entered. This information is used in Customer Shipping Information and Material Receiving Location default tables. This default setting assigned to each shipping address for each customer will be entered in orders automatically when a new order is added, if the Tax Box is checked. The tax ID is also associated with the user’s Bill-to / Ship to address for purchases, and added to taxable items on a purchase order. The default information in the invoice and purchase order can be modified during the entry process for a new order. This section may not apply to states that do not have local or state sales tax or states with manufacturing local & state sales exemption.

The user may also define the GL accounts to be used for taxes in this section, if the accounting module is active. |

| 1.3. Fields & Definitions for Sales Tax Authority Table |

| 1.3.1. US Sales Tax | ||||||||||

|

| 1.3.2. Foreign Tax | ||||||||||||||||

|

| 1.4. How To ..... for Sales Tax Authority Table |

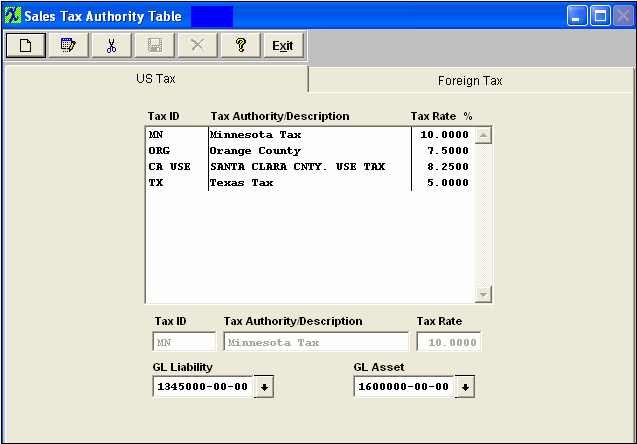

| 1.4.1. Setup the US Sales Tax | ||

|

The following screen will appear:

To modify this screen, the user must click on the Add, Edit, or Delete button and supply the password. That action will enable the screen. Pressing the Add button will enable the data entry boxes at the bottom of the screen for the user to enter new data. Selecting an existing Tax ID and pressing the Edit button will bring the selected information to the data entry box to be modified. Selecting an existing Tax ID and pressing the Delete button will remove the selected information. The user enters in the Tax ID, Description, Rate, the GL Liability Account and the GL Asset Account. Pressing on the down-arrow keys will display the GL account numbers, if the user is using the accounting module. The user must Save or Abandon changes when finished adding or editing screen. Where Used: In the Customer Setup, Sales Orders, Packing Lists, Invoicing, Purchase Setup Receiving and Billing Information, and Accounting.

«Mark as Completed in RoadMap Section B Item 1-f» |

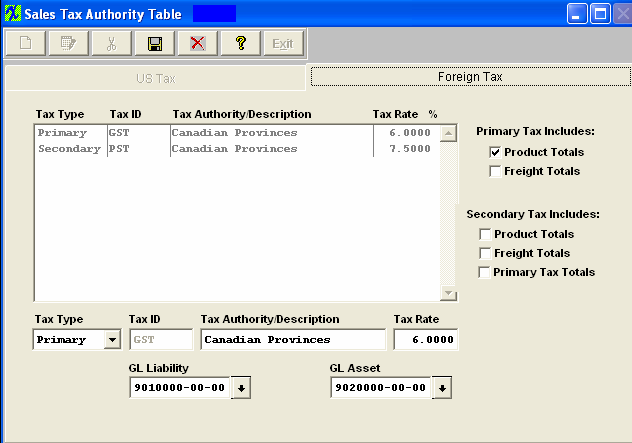

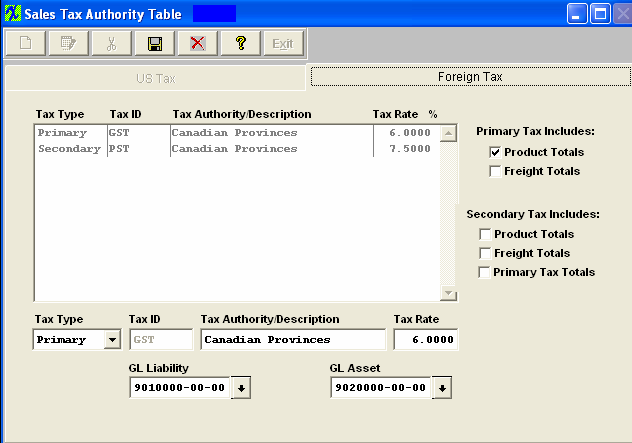

| 1.4.2. Setup the Foreign Sales Tax | ||

|

The following screen will appear:  Depress the Foreign Tax tab

To modify this screen, the user must click on the Add, Edit, or Delete button and supply the password. That action will enable the screen. Pressing the Add button will enable the data entry boxes at the bottom of the screen for the user to enter new data. Selecting an existing Tax ID and pressing the Edit button will bring the selected information to the data entry box to be modified. Selecting an existing Tax ID and pressing the Delete button will remove the selected information. The user selects the Tax Type from the pull down, enters in the Tax ID, Description, Rate, the GL Liability Account and the GL Asset Account. Pressing on the down-arrow keys will display the GL account numbers, if the user is using the accounting module.

If user selects "Primary" tax type, this tax will be calculated first, the calculation will be based on what user checks for Primary Tax to include Product Totals, and/or Freight Totals. If user selects "Secondary" tax type, this tax will be calculated after primary tax, and the calculation will be based on what boxes are checked, Product Totals, and/or Freight Totals, and/or Primary Tax Totals. If user checks "Primary Tax Totals", the tax calculated will be based on only the "Primary Tax Total". The user must Save or Abandon changes when finished adding or editing screen. For examples see the "Foreign Tax Examples.xlsx" or the "canadian provice vats.xls" attached.

Where Used: In the Customer Setup, Sales Orders, Packing Lists, Invoicing, Purchase Setup Receiving and Billing Information, and Accounting.

«Mark as Completed in RoadMap Section B Item 1-f» |