| 1. FAQ- Accounting |

| 1.1. FAQ-Accounts Receivable |

| 1.1.1. Can a User add multiple lines to a Credit Memo? |

|

Question: Can a User add multiple lines to a Credit Memo?

Answer: User can NOT add more than one line item per Credit Memo, because the GL account numbers are fixed by the Sales Order and the System Setup. There are additional lines available for the additional charges associated with a line, or multiple lines from the original invoice. A General CM is usually for a generic credit to the customers account. It is not linked to any specific order or invoice, it is just a one line entry for one amount, so there is no need to have more than one item in this scenario. Therefore the one line item that is entered on a General CM has to be related to the one GL account that is entered in the header of the General CM. There have been requests in the past to allow users to enter more than one item on a General Credit Memo. But upon review of the code and tables it would require more data entry from the end users to enter the same information multiple times. Additionally, we would have to completely re-write the CM module and other accounting modules to implement this request. At this point in time the amount of effort to implement this change outways the initial request. |

| 1.1.2. Why doesn't the AR Aging Detail with Prepays as of report match the GL account information? |

Q. Why doesn't the AR Aging Detail with Prepays as of report match the GL account information?

A. You want to be sure that all invoices have been released and posted to the GL. The AR Aging Detail with Prepays As Of report does NOT list invoices that have NOT been released/posted to the GL yet. This report is intended to match the GL account information not the AR Aging screen. Note: If this report is still not matching the GL account information after all transactions have been released and posted to the GL then it may be due to Posted Journal Entries against the AR GL account. These JE's will not be accounted for on the AS OF report yet will affect the GL Account balance and could explain why you are seeing a difference between the two.

Back dating records may also be a possible cause for the Aging As Of reports to not match the Trial Balance at a specific given time. For Example: If the user current date is 10/05/2009 and they enter in an Invoice and Credit Memo dated 10/5/2009. But then on the same day the user applies the Invoice and Credit Memo (dated 10/5) against each other via an AR Offset upon saving the Offset they decided to backdate the offset to 9/30/2009. This will cause the As Of report to temporarily not match the Trial Balance due to the fact that the report will pull in the offset backdated to 9/30, but it will not account for the Invoice and Credit memo records until 10/5/2009. The reports will come back in line after the 10/5/2009 date. Note: You need to be looking at two GL accounts when it comes to the AR Aging As Of Report. This is due to the fact that we include Prepayments. Attached are some Print Screens <<Ar-Aging_versus_GL_Reports_2011-04-14.docx>> that show how the AR Aging can be compared to these two reports.

|

| 1.1.3. Why Can't I enter a Part Number in a General Credit Memo? |

Q. Why Can't I enter a Part Number in a General Credit Memo?

A. The reason we do not allow a part number to be enter into the part number field when creating a General Credit Memo is because usually a General Credit Memo does not apply to a specific inventory item or part number. Any information you wish to reference will have to be populated in the description field and/or note screen. A General Credit Memo is not intended to affect any stock quantity on hand or reduce any inventory stock. It could be mis-leading to the users if a part number is entered in the part number field. If you intend this to be applied to or associated to specific Invoice records then you would create an Invoice CM.

|

| 1.2. FAQ-Accounts Payable |

| 1.2.1. How to Handle Invoices that have been Paid with a CC and has been Released to GL |

|

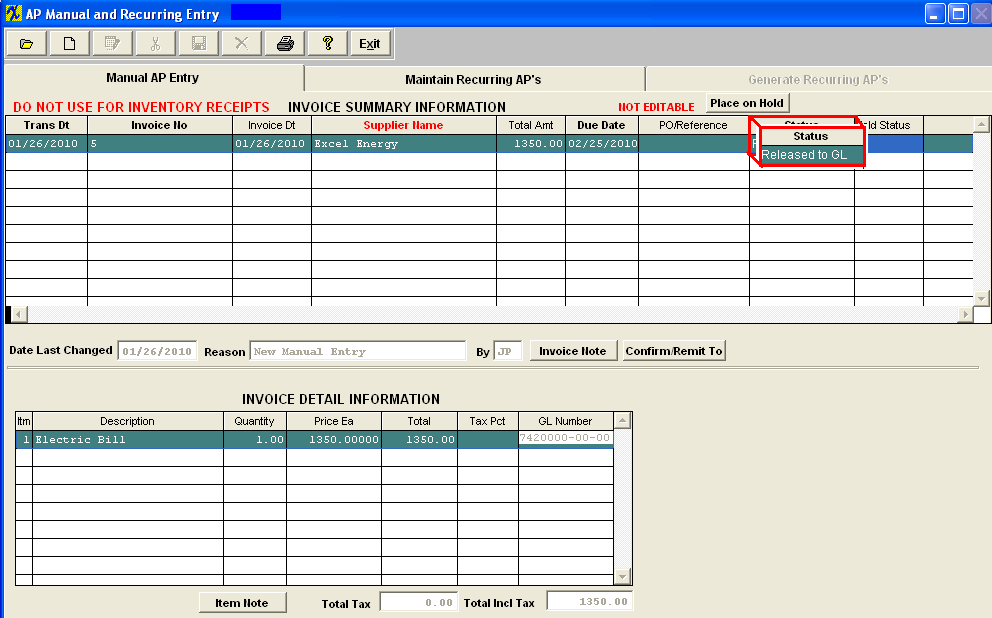

Q. How to Handle Invoices that have been Paid with a Credit Card and has been Released and Posted to GL If the Paid Invoice has been Posted to the General Ledger and the status in Manual AP Entry is "Released to GL":

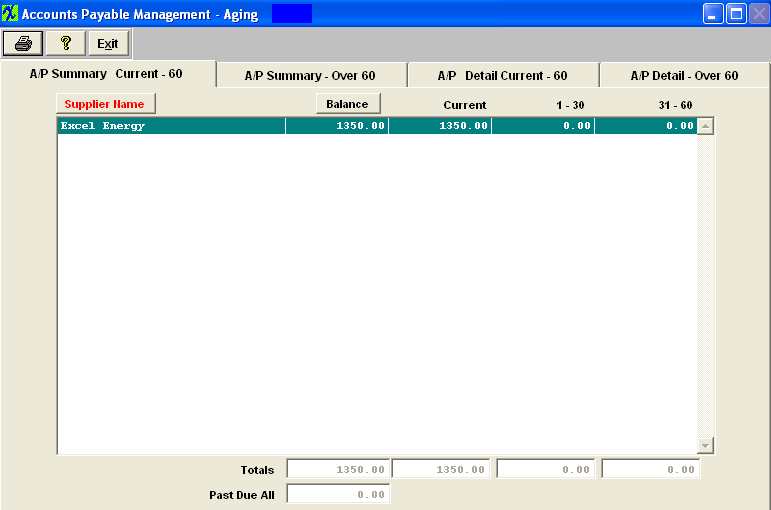

This record will remain on the AP Aging under Excel Energy until the check is created to the Credit Card Company.

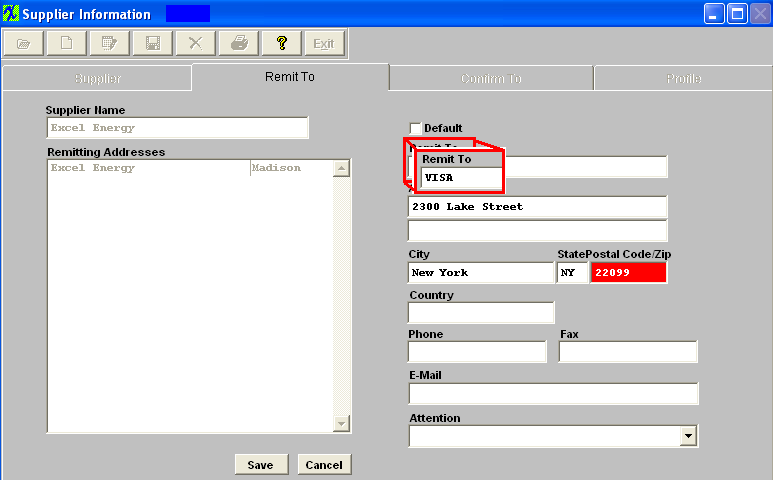

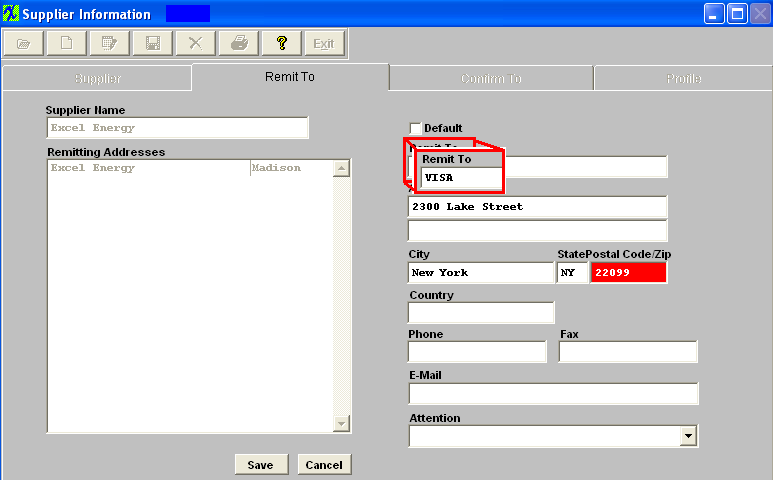

User will still need to add the Credit Card Information to the Supplier Remit To:

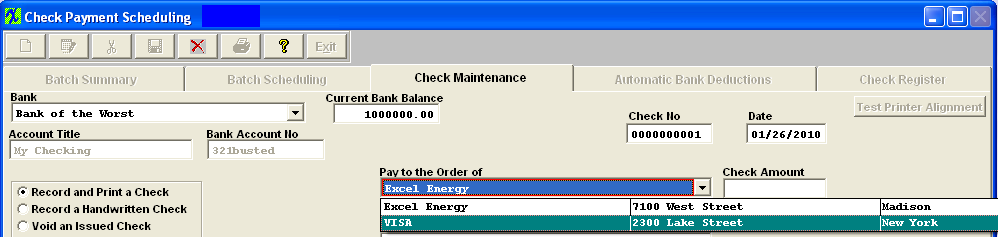

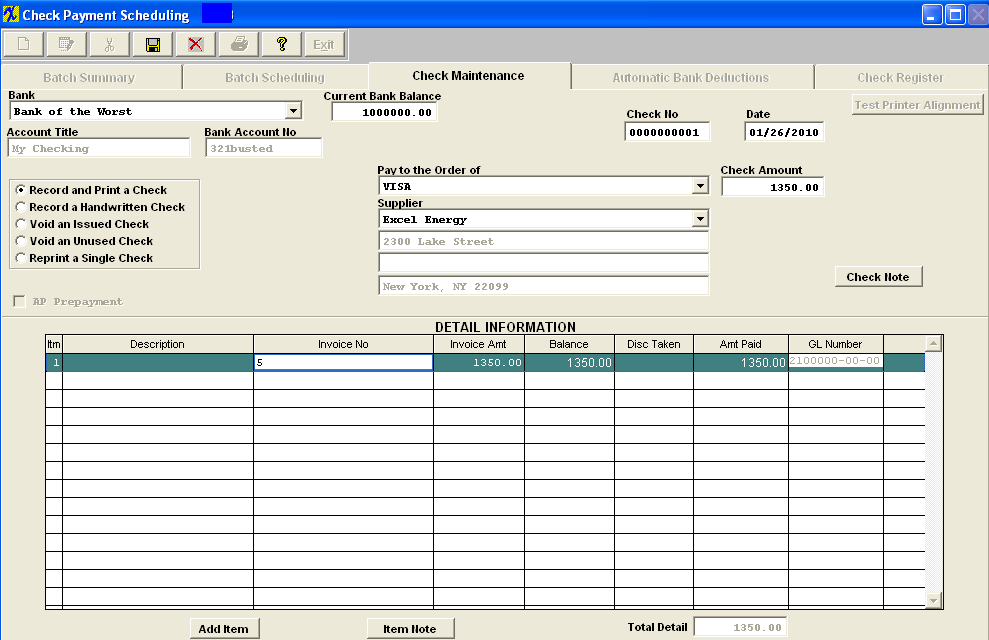

Then within Check Maintenance, the user can Record and Print a Check and select the Supplier, then within the "Pay to Order of":, they you have to select the Credit Card Remit To:

Then go through and add each individual invoice that they would like to pay to the Credit Card Company:

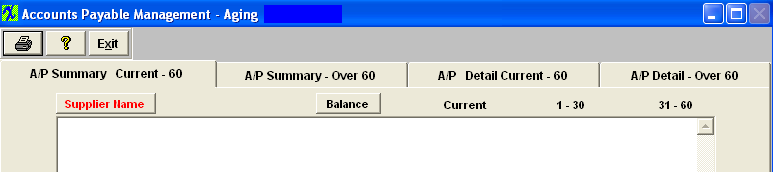

This will clear the Invoice from the AP Aging Screen.

|

| 1.2.2. How to Handle Invoices that have been Paid with a CC and has NOT been Released to GL |

|

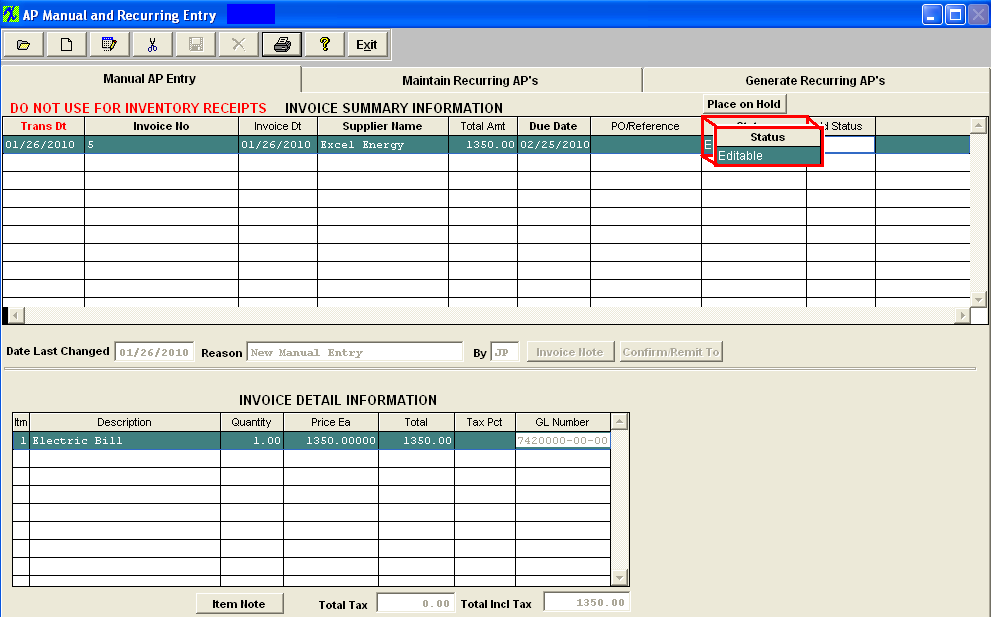

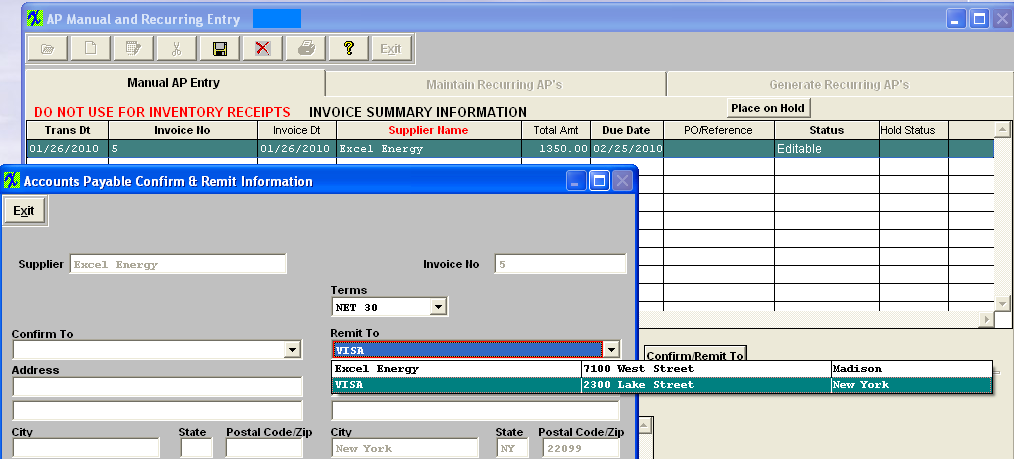

Q. How to Handle Invoices that have been Paid with a Credit Card and has NOT been Released or Posted to GL If the Paid Invoice has NOT been Posted to the General Ledger and the status in Manual AP Entry is "Editable"

User will need to add the Credit Card Company Information to the Supplier Remit To:

Then they will be able to Edit the Invoice through Manual AP Entry selecting the Credit Card remit to information:

This record will remain on the AP Aging under Excel Energy until the check is created to the Credit Card Company.

Once a Check is created and payable to the Credit Card Company it will then clear from the Excel Energy account from the AP Aging Screen.

|

| 1.2.3. If you have single or multiple invoices on AP aging that need to be removed. |

| Q. If you have Single or Multiple Invoices on A/P aging that need to be removed.

A. Use A/P Debit Memo "Open Debit Against Account" to cover single or multiple invoice balances. Make sure to pay attention to the GL accounts that were used on the original invoices if you want the Debit Memo values to offset the values against those GL accounts. As soon as the Debit Memo is approved a transaction is generated to be released/posted to the GL. Then the user will apply the General Debit Memo against the Invoice(s) in AP Offset . In this scenario this type of offset should NOT generate any transactions for posting to GL.

|

| 1.2.4. Is it Possible to Match two Receivers to One AP Invoice? |

Q. Is it Possible to Match two Receivers to One AP Invoice?

A. The receiver #’s are unique to each individual receipt against a PO so there is no way to match two PO receivers to one AP invoice. At this time each receiver would have to have their own invoice. We are aware about this type of request and feel it would be a good idea to add this ability as an enhancement. We have added this onto the list of enhancements requests.

|

| 1.2.5. Why doesn't the AP Aging Detail as of report match the GL account information? |

Q. Why doesn't the AP Aging Detail as of report match the GL account information?

A. You want to be sure that all invoices have been released and posted to the GL. The AP Aging Detail As Of report does NOT list invoices that have NOT been released/posted to the GL yet. This report is intended to match the GL account information not the AP Aging screen. Note: If this report is still not matching the GL account information after all transactions have been released and posted to the GL then it may be due to Posted Journal Entries against the AP GL account. These JE's will not be accounted for on the AS OF report yet will affect the GL Account balance and could explain why you are seeing a difference between the two. It may also be due to prepayments, all of the AP Aging reports account for prepayments but will not be accounted for on the AP Aging screen or the AP GL account information due to a different GL number being used for prepayments.

|

| 1.2.6. Why doesn't ManEx allow the Automatic Bank Deduction Records Editable? |

| The reason ManEx does not allow users to edit or make changes to saved Automatic Bank Deduction records is: Say user has a deduction for $100 a month, and then after a few months users wants to change it to $150 a month. If we allowed edits, then after the edits any reports and other references to the first few months would report the amount to be $150 a month when in fact they were $100. So ManEx provides a "Close" button on the form, to close out an automatic deduction ($100 a month) but maintain the original information. Then user would create a new Automatic Bank Dedduction for the $150 a month. |

| 1.2.7. Why isn't the New Remit to Address Printing on the Checks? |

Q. Why isn't the New Remit to Address Printing on the Checks?

A. The AP check module prints the checks per the Remit To information that is associated with each PO.

The system will keep the address information (on existing PO's) that was actually selected at the time the PO was created. If you add a new Supplier Remit To address and mark the new address as the Default. The previously created PO's will still carry the original Remit to (ManEx cannot assume that the user wants to change all Remit To's across the board for already created and approved PO's). The user will be required to edit each PO that the change affects and update the Remit to with the new default (any new PO's created will properly take the new default).

The Invoices created through the PO Reconciliation module also carry the original Remit to Address information. Any invoice that already was created and remains on your AP Aging will need to be edited through the Manual AP Entry screen. IF it was already released to the GL at that time, I don’t think that the Edit feature would be available. If you are unable to edit the Remit to information via the Manual AP Entry, then you can control the Remit to information that will print on the AP Check, by creating a Manual check through the Check Maintenance screen. If you completely delete a Remit To address any previously created PO's will no longer have a Remit to address to refer to, therefore the remit to information on existing PO's will be blank. The AP check module prints the checks per the Remit To information that is associated with each PO, so the address printed on the check will also be blank. So, each PO that still has invoices residing within the AP Aging, will have to be edited and the Remit To information will have to be updated with the new address, if a Remit To address is deleted. We would suggest that the person making changes to the Remit To Address information is careful before deleting one from the system. You have to make sure that any record that has already been associated with that record has been processed through the system, and/or updated with the new address information. |

| 1.2.8. What Check Forms can be Used in ManEx? |

Question: What Check Forms can be Used in ManEx? Answer: There are three types of Check Forms to select from: Standard ManEx Check Layout; Deluxe Form DLT104; or Canadian Check Layout. See Article #3014 for further information on the check forms. |

| 1.2.9. What is the best way to Handle a Wire Transfer to a Supplier Using the ManEx System? |

Q. What is the best way to Handle a Wire Transfer to a Supplier Using the ManEx System?

A. The Best Approach would be to:

Then everything should be accurate from a cost standpoint.

|

| 1.2.10. What is the difference between the "Un-Reconciled PO All Suppliers" Rpt and the "Un-Reconciled Receipt Account Value" Rpt |

Q. What is the difference between the "Un-Reconciled PO All Suppliers" Report and the "Un-Reconciled Receipt Account Value" Report?

A. The "Un-Reconciled PO All Supplier" report will only list receipts that are waiting to be reconciled within AP. The "Un-Reconciled Receipt Account Value" report will display ALL records that affect the GL Account. Including Receipts waiting to be reconciled and items that were rejected at receiving and are waiting for a DMR to be processed through the system.

|

| 1.2.11. Where does the AP Aging Detail Report Pull the Terms From? |

The AP Aging Detail report pull the terms from the Payment Terms. These terms are recorded when the Supplier information is setup. Then if a supplier changes the terms for future invoices, the terms on the existing invoices will not change. For example: If user creates an Invoice and the existing terms are 2-10, net 30 and after the invoice has been created, but before the invoice has been paid the supplier's terms change to COD, the original invoice that was created with the terms of 2-10, net 30 will not change, so the user can still get the 2% discount if they pay that invoice within 30 days.

The system allows the supplier to change the terms in the Purchase Setup module. The purpose of that is to give them the flexibility to setup whatever they want to with customers and suppliers per invoice. But the AP Aging Report needs to have one term to determine the Aging colmuns. If we had each invoice list its own terms on the report and attempt to calculate the aging based on each invoice it would cause additional problems within the reporting,etc. . .

|

| 1.3. FAQ-General Ledger |

| 1.3.1. Balance Sheet Not Sub-Totaling Correctly | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

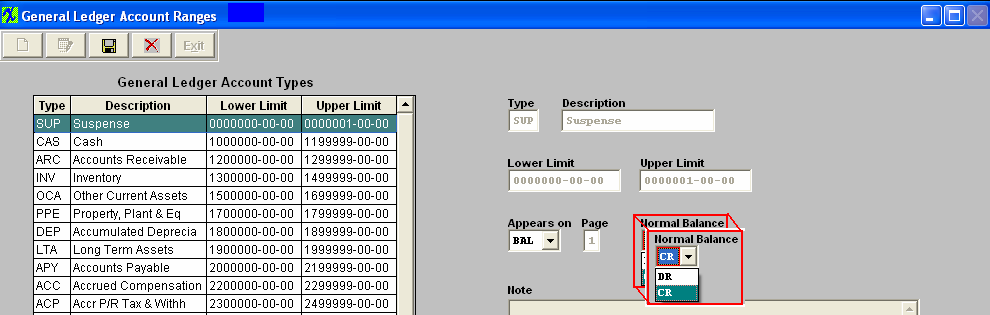

Q. The Balance Sheet is not sub-totaling Correctly The following is the way that the accounting normal balances are established within the ManEx General Ledger Account Ranges for the printing of the financial statements.

Users who have used the old “STANDARD” account setup, found the Depreciation listed as a Credit account instead of a Debit. Because this example was followed, the reports that total the information behave incorrectly. Remember, the system can’t distinguish between an asset or a liability/equity account and that’s why the contra accounts must have the same normal range assigned to them as their parent. For example, all depreciation accounts should be identified as a debit account, including the contra accounts of Accumulated Depreciation. When transactions are posted, these accounts are automatically (internally) identified as credit transactions. But when totaled, they would normally be totaled as a credit in a debit account or become a contra charge. There are two possible remedies for incorrect financial reports based on this issue: 1.(preferred) Go to the system setup, and change ASSET contra accounts to be normal balance DEBIT accounts and change Liability/Equity contra accounts to be normal balance CREDIT accounts . Or- 2.Use the print to Excel format for the financial reports, then individually sum up the subaccounts as desired, and perform subtotals as necessary. There are new applications which will be available soon to assist the user in this process. It needs to be emphasized that the data (all transactions and Journal Entries) in ManEx are correct. It is only the reporting that is affected by the contra accounts being set up improperly for the ManEx System. Below is the standard setup, and how it should be changed.

Note: No changes are required for the individual accounts, only the Normal balance in the following screen must be changed: |

| 1.3.2. Is there a report that will give you the Detail of a Kit Closure Variance? |

|

Q. Is there a report that will give you the Detail of a Kit Closure Variance?

A. For further detail See Article #3235

|

| 1.3.3. Why doesn't the Beginning Balance on the Trial Balance rpt doesn't match the GL Cross Tab Rpt? |

Q. Why doesn't the Beginning Balance on the Trial Balance rpt doesn't match the GL Cross Tab Rpt?

A. The Detailed GL Cross Tabbed Report for Fiscal Year is the ONLY Cross Tabbed report where the beginning balance will match the Trial Balance report beginning balance. The other Detailed GL Cross Tabbed reports are calculated a bit differently then the Trial Balance report, so they will more than likely never match the Trial Balance rpt.

|

| 1.3.4. Why isn’t a General Ledger number appearing on the Trial Balance Report? |

|

Why isn’t a General Ledger number appearing on the Trial Balance Report?

Make sure you have the record released and posted to the transaction and if that did not update the trial balance, then you can run the “Rebuild the Accounts Table” utility to rebuild all accounts and update the trial balance. Be sure you have all users logged off when running the utility. |

| 1.3.5. Why the Posted Sales GL Reports Slow Down in 9.0? |

Users will experience a longer report compile time for the Posted Sales report in 9.0 or later. The reason this report will now take a longer time to compile is due to the changes we made in the routine to pickup the COGS at the time to the Inventory Issue instead of the time of posting. In these changes to make the transactions correct we now have to analyze 5 tables to get the information instead of only looking at one table. |

| 1.3.6. Why is the Unreconciled Receipt considered as an Asset? |

Question: Why is the Unreconciled Receipt considered as an Asset?

Answer: This item represents inventory that has been received but the purchase order has not been reconciled with the purchase order, so we don’t want to put it into inventory until it has been reconciled so this is basically a holding account until it has been reconciled and transferred over to inventory. We set it up this way to recognize that we have received the items and recognize both the asset and the liability we owe the supplier. |

| 1.3.7. 200th Journal Line |

Q. How do I continue once I've reached the 200th line item in a General Journal Enty? A. There is currently a two hundred (200) line edit limit within the Journal entry window.You may overcome this limit by saving then editing the same journal entry as displayed below. To overcome 200 line limit: IN GENERAL JOURNAL ENTRY SCREEN, TYPE IN THE FIRST 199 ACCOUNTS: LOOK AT THE REMAINING BALANCE: TYPE THIS AMOUNT INTO SUSPENSE ACCOUNT:

NOTE THAT THE REMAINING BALANCE FIELD IS NOW 0.00 SAVE THE ENTRY. EDIT THE ENTRY. HIGHLIGHT THE SUSPENSE LINE. DEPRESS THE DELETE LINE BUTTON. TYPE IN THE SUSPENSE ACCOUNT NUMBER. 0000000-00-00, at the prompt. APPROVE THE REMOVAL WHEN THE CONFIRM MESSAGE DISPLAYS BY DEPRESSING THE YES BUTTON. THE OUT OF BALANCE CONDITION WILL RETURN.

Continue typing in the opening entry. |

| 1.4. FAQ-General Accounting |

| 1.4.1. Balance Per Books and Balance Per Bank have discrepancy |

Issue:

Source: This was more than likely due to a Deposit or Check Correction made within the Bank Reconciliation in prior statements. Resolution: If users need to enter in a Deposit or Check Correction through the Bank Reconciliation module for what ever reasons, they then have to remember to go back to process the needed Deposit or Check for the correction amount. (via the AR Bank Deposit or AP Check modules) ManEx system can not create the correcting transaction through the Bank Reconciliation module because the system will not know what the other side of the Transaction will need to be. Note: User can also use the General Journal Entry module to process the correction transaction through the system. General Journal Entries also affect the Bank Balance within the ManEx System.

|

| 1.4.2. Can ManEx Value Raw Material based off of the Purchase Price versus Std Cost? |

| Can ManEx Value Raw Material based off of the Purchase Price versus Std Cost? |

Q. Can ManEx Value Raw Material based off of the Purchase Price versus Std Cost? A. Our system operates on a “Standard Cost Basis” (SCB). This means that the value of inventory does not fluctuate based on the purchase price, and that users do not have to use FIFO (First In, First Out) inventory management for financial reasons. (They may wish to because of other considerations, such as shelf life.) Because of SCB, we necessarily utilize Purchase Price Variance (PPV) to account for the difference between the SCB value and the actual purchase cost. This measure also helps companies set their standard cost, based on a review of the PPV for given components. Once a reasonable standard cost is established, then the Purchasing department has metrics through the PPV reports to determine whether or not they are improving on price negotiations, or are unable to attain the standard cost. Purchasing departments with a positive PPV are contributing to the bottom line of the company. Because of this, Purchasing will tend to navigate standard costs to the higher side of average. With correct Standard Costs, Marketing Department can better control their margins. And Marketing will tend to drive standard costs to the lower side of average, thus improving their margins. ManEx does not have a direct provision for assessing current inventory based on purchase price. An approximation could be offered by combining the PPV of the last month with the on-hand inventory value. This is an approximation, because there may be old and/or obsolete inventory which was received at a significant PPV, and would not be accurately valued considering only the standard cost. But there is provision within ManEx to account for inventory based on purchase price. It involves the utilization of the Project module. All inventory in which the company may wish to evaluate based on the purchase price would have to be allocated to a project at the time of purchase. When this is done, the purchasing information for the components bought against a project is retained. It can be recovered through the use of reports in the Project Module. The job costing module will also identify the purchase price information for components allocated to a job or work order. Another method of tracking original costs is by using Lot Tracking. When Lot Tracking is used, the purchase information is retained with the Lot Information. A report may then be generated to report the original pricing of lot tracked material in inventory. While these two methods are currently available, a third is in development. When we complete the IPKey development, and of the company elects to use the IPKey tracking, we will be able to create reports that will identify the purchase price of all inventory, although it will not be the book value of inventory. |

| 1.4.3. Does the Inventory Adjustment account need to be balanced to $0 at month end? |

Q. Does the Inventory Adjustment account need to be balanced to $0 at month end?

A. No, only if you wish, you can do a journal entry to clear the account and charge it to any other account of your choice, e.g. COGS.

The inventory adjustment account gathers information from the Cycle Count, Physical Inventory, and the cost rollup modules. The values entered are the offsets of the values actually made to inventory accounts. When we change the value of inventory by adding or removing value (either by change in standard cost or in inventory counts), we have to record the other side of that transaction somewhere, and it goes to this account. |

| 1.4.4. How Can I Manage Off-Site Production? |

Q. How Can I Manage Off-Site Production??

A. See the attached document <<Offsite_Management.docx>> for a suggested process to follow in Offshore/Off-Site Production situations to follow for the safest and cleanest way to manage off-site production using the ManEx system.

This concept assumes that Customer PO’s all come to the main plant, and they want the shipments from the main plant. When a new customer is obtained, that is okay dealing with the offsite facility, and that facility is up to speed to handle it, new customer PO's can be sent directly to the offsite facility, who then ships directly back to the customer. This concept can also be used if the main plant wants to use the offsite plant for subassemblies, by simply creating PO's to them for subassemblies. This arrangement will keep the offsite books tidy, keeping offsite expenses on their own ledger. To keep track of sales by facility, a prefix for the offsite facility can be added to the purchase orders. |

| 1.4.5. How Does the Std Bld Qty (SBQ) affect the Configuration Variance? |

Q. How Does the Std Bld Qty (SBQ) affect the Configuration Variance?

A. First off, the Variance measures the extended cost of the components on the Bill of Materials for an assembly against the standard cost itself of the same assembly. Now, if the user has NOT included setup cost in the standard cost of the assembly, then they should not use the setup cost in kitting, etc. and the variances will track properly.

BUT, if they do use the Setup Cost in kitting, then they should also use it in calculating the standard cost for the assembly. And both will take into account the standard build quantity (SBQ). And I believe that’s where there is the huge difference with different SBQ. They are using setup quantities in kitting, but didn’t use it to set the standard cost. Now, additionally, the SBQ is used to account for the difference between a work order that was built with a quantity different than the SBQ. If they set a SBQ at 100, (and use the setup quantities in the kit), and build a work order quantity of 100, then yes, they should end up with zero variance. But if they built less than the SBQ, they will have an unfavorable variance. If they build more than the SBQ, then they will have a favorable variance. These cases represent the difference because the value of the setup parts is different from the standard cost when the work order has a different value than the SBQ, and the cost of the setup is amortized across the quantity in the work order. |

| 1.4.6. How does the Cost Rollup Work in Manex? |

Manex Cost Rollup The first step is to roll buy parts by determining the percentage change from rollups based on average purchases to the current standard cost, and look at a selected group of items. Put another way these would be items for which the average cost varied from the current cost by the percentage entered. If a zero is entered for the percentage, then all items are calculated and displayed. Then the user has the option to select to change to the average cost, or insert a cost manually, or do nothing. If the user elects to change the standard cost, and there is inventory, there is a cost adjustment transaction to the GL to account for the changed inventory value. After rolling the costs for buy parts then the user rolls up the buy parts for assemblies. This has to be done for each level of assembly used in your BOMs. The same options are available for modifying the standard cost. One difference for assemblies is that all of the costs in the item master (material, labor, oh, other, UDF) for lower level parts are rolled into the material cost for the upper assembly. There are also calculations that will amortize the cost of setup and run scrap over a standard lot size, to avoid lumping all of these into the cost of one part. Again, if there is inventory for the parts (assemblies) being changed, then there are GL transactions recorded to account for changes in inventory value. Where are the standard costs used? They are used throughout the system for any transaction involving parts and inventory. The standard cost is the value used when material is transferred from one location to another. This includes warehouse to warehouse, to kits, receiving and issuing parts, dmrs, sales orders, etc. The standard is also used to determine the variances. These include purchasing, configuration and manufacturing variances. In Sales Orders, the standard costs are used to determine the Cost of Goods Sold. |

| 1.4.7. How Unreconciled Receipts Flow Through Accounting? |

Q. How Unreconciled Receipts Flow Through Accounting?

A. See Attachment

|

| 1.4.8. How is the Issue Cost on the Kit to Close report calculated? | |||||||

|

| 1.4.9. Is there a report that will give you the Detail of a Kit Closure Variance? |

Q. Is there a report that will give you the Detail of a Kit Closure Variance?

A. For further Detail See Article #3235

|

| 1.4.10. Why doesn't the Balance Sheet $$ Match the $$ on the WIP Valuation Report? |

|

| 1.4.11. Why is the Transaction Date 01/01/02 appearing on new Records? |

A. Why is the Transaction Date 01/01/02 appearing on new Records?

Q. Check the computers's internal battery it may be weak or dead. The date 01/01/02 is the default date that a PC displays if the internal battery that keeps the date/time function running goes dead. The fields that have the date 01/01/02 are fields that are populated with the VFP function DATE(), which picks the date up from the local computer that the application is running on. That's the only way we can get what we believe is the current date.

I |

| 1.4.12. Why doesn’t the Kitting screen and WO Shortage Reports include Setup Scrap? |

Q. Why doesn’t the Kitting screen and WO Shortage Reports include Setup Scrap?

A. The Setup Stscp box MUST be checked on the BOM Header Information if you want the setup scrap qty’s to be included in the Kitting, WO Shortage Reports and MRP calculations.

If you want the Run Scrap qty’s to be included in the Kitting, and WO Shortage Reports the Run Scrap must be selected in the Kit Default Setup . |

| 1.4.13. WIP Value |

| WIP Value Article #893 |