. . . . . . . . . . . . .

|

|

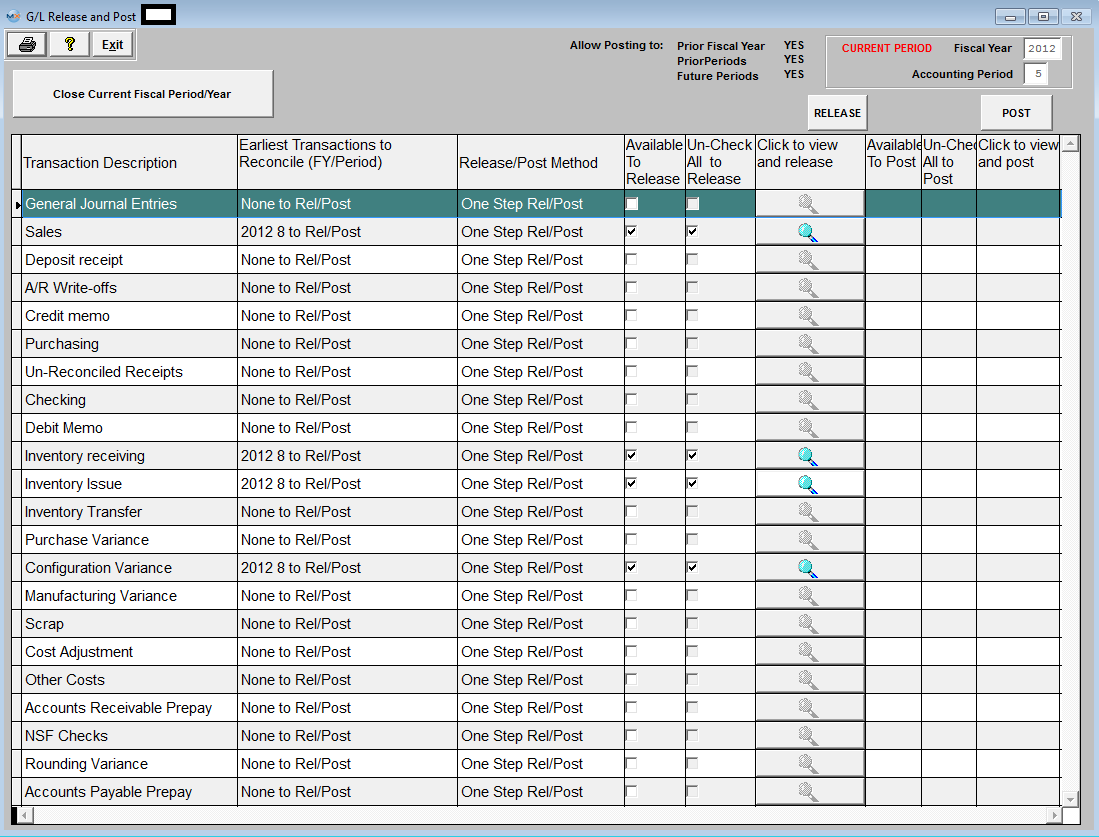

| General Ledger Release & Post Screen |

Transaction Types:

| General Journal Entries |

|

| Sales |

The Journal Entry is created once the Customer Invoice is printed. Accounts Receivable is increased by the total amount of the invoice. Sales are increased by the sales price of the items sold. If freight is charged to the customer, that value is recorded. If sales taxes are charged to the customer, the appropriate entry is created. Also, Finished Goods inventory is relieved and the accompanying entry to Cost of Goods Sold is created.

If the user has created a Credit Memo, the entry to record same is created automatically, pro-rata relieving Accounts Receivable, Sales, etc. AND also Reinstating Inventory for any usable inventory returned by their customer. Any Unusable Inventory returned can be directed to the Scrap Account. The system also accepts General Credit Memos, and creates the entry after prompting the user for the appropriate General Ledger Account Number.

|

| Deposit Receipt |

Once any Bank Deposit is recorded in the ManEx Accounts Receivable module, the Underlying Journal Entry is created, increasing the bank balance and offsetting Accounts Receivable. If the Cash Receipt is for a Customer Prepayment or Deposit, the Journal Entry records the information according to the default set up by the user. Also, any Miscellaneous Receipt prompts the user for the General Ledger Account Number at the time of data entry, then the ManEx system creates the entire entry.

|

| A/R Write-Offs |

The user elects to Write Off any portion of the Customer Invoice, the ManEx system creates the appropriate Journal Entry, reversing pro-rata the entry to Accounts Receivable and sets up the offset to Reserve For Bad Debts.

|

| Credit Memos |

If the user has created a Credit Memo, the entry to record same is created automatically, pro-rata relieving Accounts Receivable, Sales, etc. AND also Reinstating Inventory for any usable inventory returned by their customer. Any Unusable Inventory returned can be directed to the Scrap Account. The system also accepts General Credit Memos, and creates the entry after prompting the user for the appropriate General Ledger Account Number. |

| Purchasing |

ManEx handles payables created via the Purchase Order module, any Miscellaneous Payables entered via the Manual A/P Entry, or a Recurring Payable in the same fashion. Once the PAYABLE is recorded in the A/P Aging area, the entries to record the payables are set up. The entry increases inventory, expenses, assets and accounts payable.

|

| Un-Reconciled Receipts |

When an inventory item is received into stock a transaction is created within the un-reconciled receipts (according to its standard cost) (this is the holder to account for received material) until the receipts are reconciled. |

| Checking |

Once Account Payable Checks have been printed, the ManEx system automatically records the appropriate Journal Entry relieving the bank and the Accounts Payable account.ManEx provides the same type of Journal Entry if a Manual Check is recorded.The entry relieves the bank and increases the appropriate General Ledger Account Number entered by the user at the time of recording.

If the user has voided any previously printed or Manual Checks, the ManEx system automatically reverses the original entry

|

| Debit Memos |

If the user has created a Debit Memo against any Active A/P Balances, the entry to reverse the payable is created automatically, pro-rata reversing the original payable.Additionally, when the user creates a Discrepant Material Return from Inventory, a Debit Memo will forward to Accounts Payable. The applicable entry will be created debiting Accounts Payable and crediting Raw Materials Inventory.

|

| Inventory Receiving |

An entry is created at the time the user Records a Receipt via the Inventory handling function. Raw Materials Inventory is increased with the offset as defined by the user.

The other way these entries are created is when the assembled product is moved to the Finished Goods work center in the Shop Floor Tracking module. The entry created by the system is to increase Finished Goods Inventory, with the offset to Work In Process. If there was a Configuration Variance (see below) this entry is also created.

|

| Inventory Issues |

There are four types of inventory issues:

An entry is created at the time the user records an Issue via the Inventory Handling function. Raw Materials Inventory is decreased with the offset as defined by the user.

The other way these entries are created is when the raw material components are pulled for a Work Order. The Entry created by the system is to increase Work In Process Inventory, with the offset to Raw Materials Inventory.

When a Physical Inventory is reconciled, the user may update the Inventory Master for the Inventory On Hand. Note that this action requires a supervisor’s password or specific Post Inventory Adjustments authorization in the Security Utility tab. All of the Reconciled Count Numbers will update the Quantity On Hand in the Inventory Master.Additionally, the requisite Journal Entires for any variances will forward into the accounting module.

Note that Journal Entries will not be created in the following circumstances:

Consigned stock

In Store additions

|

| Inventory Transfers |

If, when a Cycle Count is reconciled with the Inventory Records, the count is different than the record, then the user is prompted whether to accept the difference or to recount and re-enter. Count Adjustments are logged to the GL Adjustment Account, if accounting is used.

|

| Purchase Variance |

When parts are procured, the purchase order may have a price different than the standard cost. To balance the accounts payable values with the increases in inventory, the difference between the standard cost and the purchase price (based on the PO Reconciliation done in Accounting with the actual invoice) is charged to PPV, or Purchase Priced Variance. E.G., if a parts standard cost is $1.00, and the INVOICE is $1.15, then $1.00 is credited to inventory, $0.15 is credited to PPV, and $1.15 is debited to AP. There are FIVE reports available that detail out the source of the transactions.

For more information on the four Variances see Article #3053 |

| Configuration Variance |

When the standard cost of an assembly is different from the sum of the standard costs of its components, the difference must also be addressed in WIP. E.G., if the standard cost of an assembly is $10.00, and the sum of the standard cost of the BOM components is $11.00, then upon moving the assembly from WIP to FGI, WIP is credited with $11.00, Configuration Variance is Debited $1.00 and Inventory is debited $10.00. There are FOUR reports available that detail out the source of the transactions.

For more information on the four Variances see Article #3053 |

| Manufacturing Variance |

When the work order has had material kitted to it in addition to that called out by the BOM, or the kit is finished with missing parts (maybe freebies that didn’t get to inventory), the difference between the total issued to the work order and the total value of the BOM parts becomes the Manufacturing Variance. E.G. one batch of parts got lost even though they were kitted to the work order, and a second batch of parts was issued to the work order, the second batch would be a manufacturing variance, since they were lost in the manufacturing process. There are FOUR reports available that detail out the source of the transactions.

For more information on the four Variances see Article #3053 |

| Scrap |

At the end of the production process, items transferring into the Scrap Work Center create an accounting entry increasing the scrap default account and decreasing WIP for the value of the number of units of the assembly at the assembly’s Standard Cost.

Additionally, when an Engineering Change Order deletes a line item and that line item is defined as “SCRAP”, an entry increasing scrap and decreasing Raw Materials Inventory is generated.

Within Inventory Handling, the Entry created is to record the movement of Inventory from one warehouse location to another increasing or decreasing General Ledger accounts as defined by the user.

|

| Cost Adjustments |

This entry is created in the Standard Cost Adjustment Module. Once the rollup is completed, any adjustments to General Ledger forward to Accounting. The user is allowed to Post Changes to Standard Cost and to generate the General Ledger Entries. Note: This requires a high level accounting password.

|

| Other Costs |

Includes Labor, Overhead, User Defined, and Other Costs |

| Accts Receivable Prepay |

These transactions are for an A/R Offset.

|

| NSF Checks |

If checks previously deposited are returned, the entry to reinstate any Accounts Receivable balance and to lower the appropriate bank account is created automatically when the user records a returned check.

|

| Rounding Variance |

If there is a small percentage assigned to run scrap, and the components are in units of Each, we can't issue fractions of a component to the work order. So we would round up to the next integer. For example, if there is a qty of 1 part per assembly (with a 2% run scrap) @ $1.00/ea and the Work Order is for a quantity of 10 we would issue 11 parts @ a total of $11.00 instead of 10.2 parts @ a total of $10.20. So we would be adding the value $11.00 to WIP, but only taking out the quivalent value of $10.20 based on the BOM standard cost. So the difference between the std cost calculation and the actual kit issuance (in the example, $0.80) would be charged to the Rounding Variance upon kit close. For more information on the four Variances see Article #3053 |

| Accts Payable Prepay |

These transactions are for an A/P Offset. |

|

|

|

|

|

|

|

|

|

| Article ID: 5088 |

|