Q. The Balance Sheet is not sub-totaling Correctly

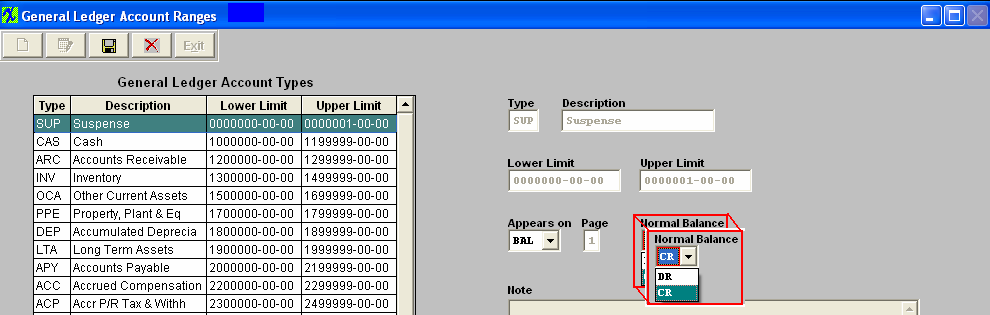

The following is the way that the accounting normal balances are established within the ManEx General Ledger Account Ranges for the printing of the financial statements.

- All asset accounts must be set up with the normal balance value as DEBIT, including contra accounts. The system doesn’t distinguish between a liability and a contra asset on the balance sheet, therefore any contra asset must be identified with a normal balance of debit. This does not mean that the system will treat contra assets as normally having an accounting balance of debit. The debit in this field signifies only that it is part of the asset group and not a part of the liability group for the purpose ofprinting of the financial statements.

- All Liability /Equity accounts must be set up with the normal balance value as CREDIT, including contra accounts. The system doesn’t distinguish between an asset and a contra liability/equity account on the balance sheet, therefore any contra liability/equity must be identified with a normal balance of credit. This does not mean that the system will treat contra liability/equity accounts as normally having an accounting balance of credit. The credit in this field signifies only that it is part of the liability/equity group and not a part of the asset group for the purpose of printing of the financial statements.

Users who have used the old “STANDARD” account setup, found the Depreciation listed as a Credit account instead of a Debit. Because this example was followed, the reports that total the information behave incorrectly. Remember, the system can’t distinguish between an asset or a liability/equity account and that’s why the contra accounts must have the same normal range assigned to them as their parent.

For example, all depreciation accounts should be identified as a debit account, including the contra accounts of Accumulated Depreciation. When transactions are posted, these accounts are automatically (internally) identified as credit transactions. But when totaled, they would normally be totaled as a credit in a debit account or become a contra charge.

There are two possible remedies for incorrect financial reports based on this issue:

1.(preferred) Go to the system setup, and change ASSET contra accounts to be normal balance DEBIT accounts and change Liability/Equity contra accounts to be normal balance CREDIT accounts . Or-

2.Use the print to Excel format for the financial reports, then individually sum up the subaccounts as desired, and perform subtotals as necessary. There are new applications which will be available soon to assist the user in this process.

It needs to be emphasized that the data (all transactions and Journal Entries) in ManEx are correct. It is only the reporting that is affected by the contra accounts being set up improperly for the ManEx System.

Below is the standard setup, and how it should be changed.

|

gltype

|

gltypedesc

|

lo_limit

|

hi_limit

|

stmt

|

stmtpage

|

norm_bal

|

|

SUP

|

Suspense

|

0000000-00-00

|

0000001-00-00

|

BAL

|

1

|

CR

|

|

CAS

|

Cash

|

1000000-00-00

|

1199999-00-00

|

BAL

|

1

|

DR

|

|

ARC

|

Accounts Receivable

|

1200000-00-00

|

1299999-00-00

|

BAL

|

1

|

DR

|

|

INV

|

Inventory

|

1300000-00-00

|

1499999-00-00

|

BAL

|

1

|

DR

|

|

OCA

|

Other Current Assets

|

1500000-00-00

|

1699999-00-00

|

BAL

|

1

|

DR

|

|

PPE

|

Property, Plant & Eq

|

1700000-00-00

|

1799999-00-00

|

BAL

|

1

|

DR

|

|

DEP

|

Accumulated Deprecia

|

1800000-00-00

|

1899999-00-00

|

BAL

|

1

|

CR

|

|

LTA

|

Long Term Assets

|

1900000-00-00

|

1999999-00-00

|

BAL

|

1

|

DR

|

|

APY

|

Accounts Payable

|

2000000-00-00

|

2199999-00-00

|

BAL

|

1

|

CR

|

|

ACC

|

Accrued Compensation

|

2200000-00-00

|

2299999-00-00

|

BAL

|

1

|

CR

|

|

ACP

|

Accr P/R Tax & Withh

|

2300000-00-00

|

2499999-00-00

|

BAL

|

1

|

CR

|

|

ACL

|

Other Acr. Curr Liab

|

2500000-00-00

|

2699999-00-00

|

BAL

|

1

|

CR

|

|

ACT

|

Accrued Taxes

|

2700000-00-00

|

2799999-00-00

|

BAL

|

1

|

CR

|

|

CNL

|

Current Notes & Lia

|

2800000-00-00

|

2899999-00-00

|

BAL

|

1

|

CR

|

|

LTL

|

Long Term Liabilitie

|

2900000-00-00

|

2999999-00-00

|

BAL

|

1

|

CR

|

|

EQT

|

Equity

|

3000000-00-00

|

3999999-00-00

|

BAL

|

1

|

CR

|

|

SAL

|

Sales

|

4000000-00-00

|

4099999-00-00

|

INC

|

1

|

CR

|

|

SDS

|

Sales Discounts

|

4900000-00-00

|

4999999-00-00

|

INC

|

1

|

DR

|

|

DCS

|

Direct Cost Of Goods

|

5000000-00-00

|

5099999-00-00

|

INC

|

1

|

DR

|

|

PMC

|

Period Material Cost

|

5100000-00-00

|

5199999-00-00

|

INC

|

1

|

DR

|

|

PLC

|

Period labor Costs

|

5200000-00-00

|

5299999-00-00

|

INC

|

1

|

DR

|

|

POC

|

Period Overhead Cost

|

5300000-00-00

|

5399999-00-00

|

INC

|

1

|

DR

|

|

IAD

|

Inventory Adjustment

|

5400000-00-00

|

5499999-00-00

|

INC

|

1

|

DR

|

|

MRC

|

Manufacturing Repair

|

5500000-00-00

|

5599999-00-00

|

INC

|

1

|

DR

|

|

FRT

|

Freight & Duties

|

5700000-00-00

|

5799999-00-00

|

INC

|

1

|

DR

|

|

CCL

|

Cogs Clearing Accts.

|

5900000-00-00

|

5999998-00-00

|

INC

|

1

|

DR

|

|

GRM

|

Gross Margin

|

5999999-00-00

|

6000000-00-00

|

INC

|

1

|

CR

|

|

LEX

|

Labor Expenses

|

7000000-00-00

|

7099999-00-00

|

INC

|

1

|

DR

|

|

PTB

|

Payroll Taxes & Bene

|

7100000-00-00

|

7199999-00-00

|

INC

|

1

|

DR

|

|

RDE

|

R & D Expense

|

7200000-00-00

|

7299999-00-00

|

INC

|

1

|

DR

|

|

EQP

|

Equipment Expense

|

7300000-00-00

|

7399999-00-00

|

INC

|

1

|

DR

|

|

OCC

|

Occupancy Expense

|

7400000-00-00

|

7499999-00-00

|

INC

|

1

|

DR

|

|

OPR

|

Operating Expense

|

7500000-00-00

|

7699999-00-00

|

INC

|

1

|

DR

|

|

TRV

|

Travel & Entertainme

|

7700000-00-00

|

7799999-00-00

|

INC

|

1

|

DR

|

|

MCS

|

Marketing & Customer

|

7800000-00-00

|

7899999-00-00

|

INC

|

1

|

DR

|

|

OIN

|

Other Income

|

8000000-00-00

|

8499999-00-00

|

INC

|

1

|

DR

|

|

OEX

|

Other Expenses

|

8500000-00-00

|

8999999-00-00

|

INC

|

1

|

DR

|

|

TAX

|

Income Tax Expense

|

9000000-00-00

|

9099999-00-00

|

INC

|

1

|

DR

|

|

NET

|

Net Income

|

9900000-00-00

|

9999999-00-00

|

INC

|

1

|

CR

|

Note: No changes are required for the individual accounts, only the Normal balance in the following screen must be changed:

To change the normal balance, do the following. Depress the Edit button. Type in your password. Depress the down arrow under the Normal Balance selection. Select Debit for all contra assets or Credit for all contra Liabilities/Equity accounts. Depress the Save button. |