Subsequent Bank Reconcilliations

|

Enter Manex.exe

Accounting/Accounts Payable/Bank Reconciliation

|

|

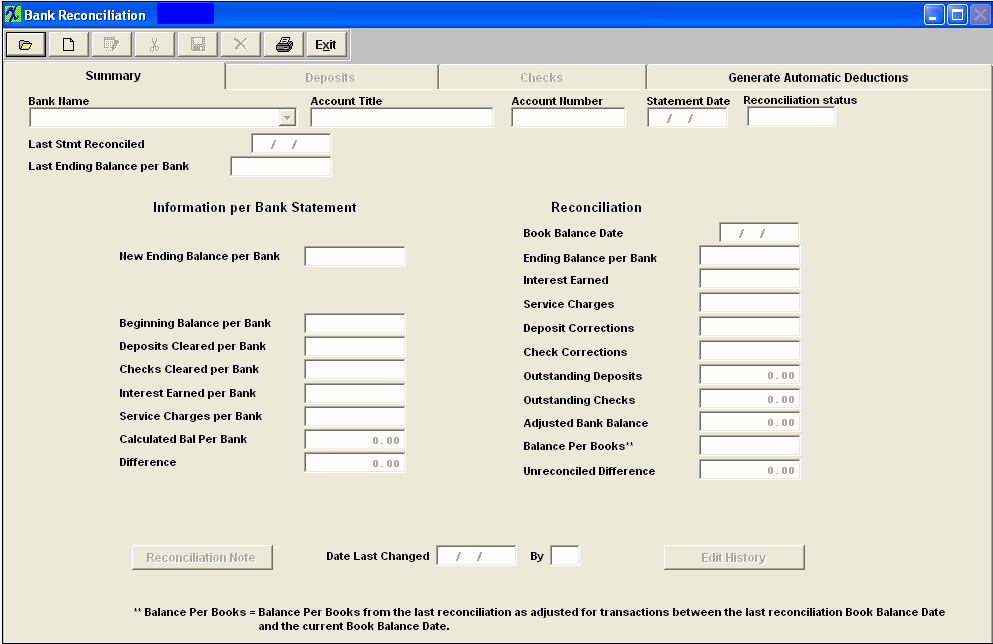

The following screen will appear:

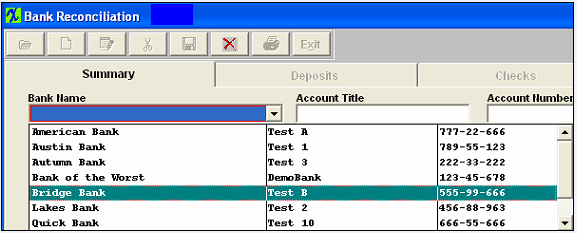

Depress the Add button and type in your password. Depress the down arrow next to the Bank Name field. Highlight the bank of your choice.

.

|

|

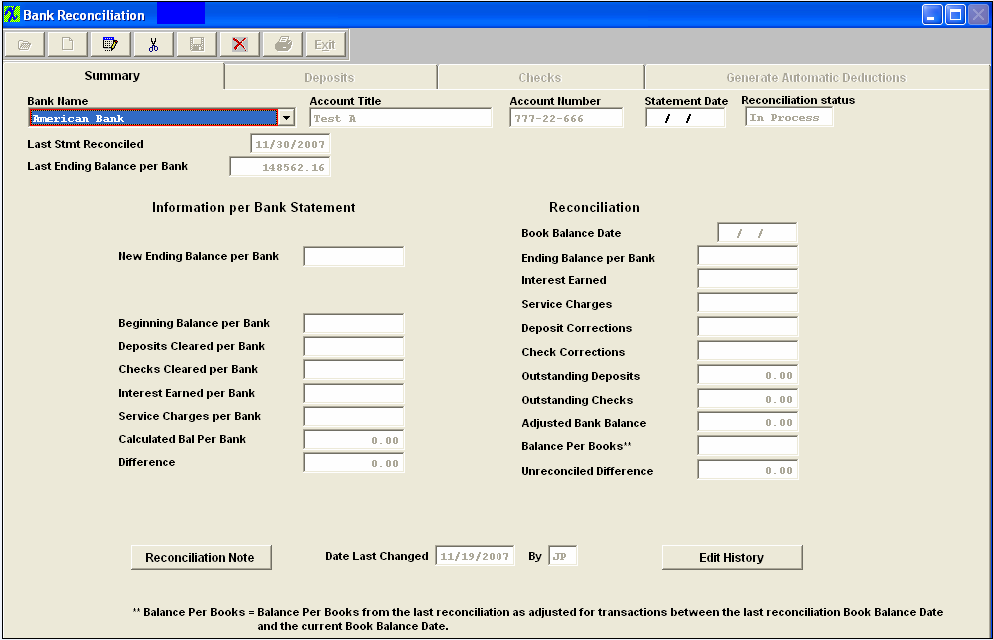

All of the pertinent header information will automatically load, along with the Last Stmt Reconciled date and the Last Ending Balance per Bank amount which will also appear in the appropriate fields:

From your bank statement you are currently reconciling, enter the bank Statement Date, the Book Balance Date and the New Ending Balance per Bank. Enter the total deposits cleared per the bank statement and enter the Checks cleared per the Bank Statement. If applicable, enter the Interest earned per the bank statement. If applicable, enter the bank service charge per the bank statement.

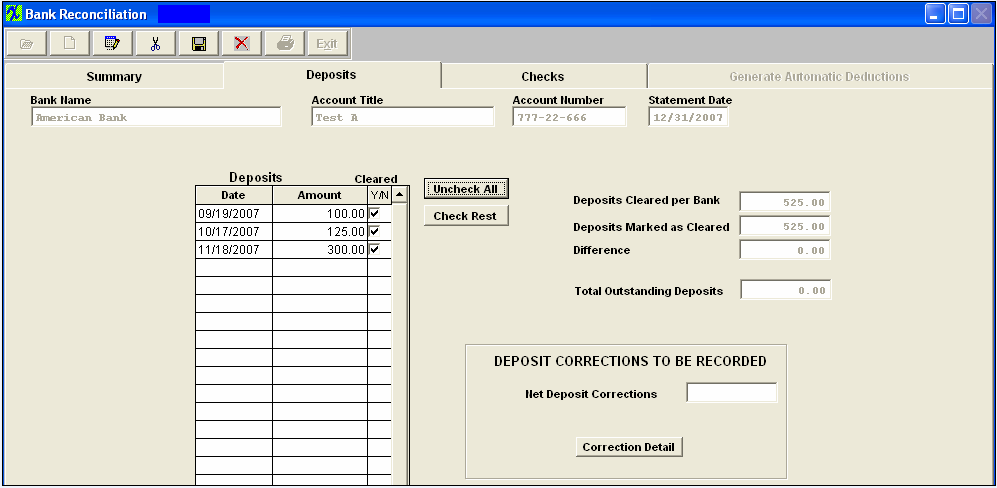

Depress the Deposits tab. Check on the Cleared Y/N box if the deposit has cleared the bank per the bank statement. (NSF records will display as a negative entry and will allow users to check them off the same way as a regular depost once they have cleared the bank). If there are any corrections to the bank statement (most unusual), type in the net correction and then enter a complete explanation into the Correction Detail screen. Note: No general ledger entry is created for this amount.

Depress the Checks screen. Check on the Cleared Y/N box if the deposit has cleared the bank per the bank statement. If there are any corrections to the bank statement (most unusual), type in the net correction and then enter a complete explanation into the Correction Detail screen. Note: No general ledger entry is created for this amount.

Return to the Summary Screen. Bank Reconciliation after the Checks and Deposits had been cleared Note: The Balance Per Books field goes off the Posted Date for JEs and NOT the Transaction Date. See the Word attachment <<PS_for_JE_071114.docx>> for an example.

Save Reconciliation

|