|

Find a Journal Entry you want to Edit.

NOTE: The user may edit a ‘NOT APPROVED’ Journal Entry. Once an entry has been ‘APPROVED’ however, another Journal Entry must be entered to clear or reverse it.

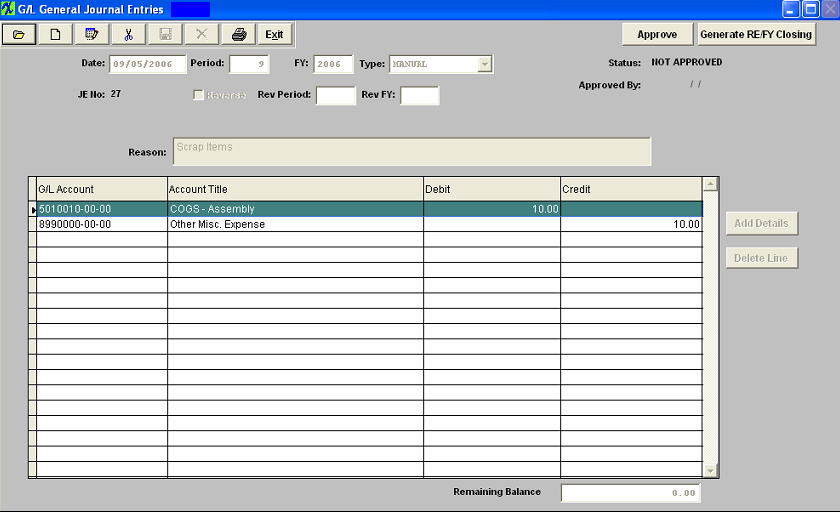

The JE will populate the screen:

Depress the Edit action button.

All fields are editable. When changes have been completed, depress the Save record action button to save changes or depress the Abandon changes action button to abondaon changes.

In order to save the transaction, both DEBITS and CREDITS must equal.

The user may generate two types of entries with the ‘Generate RE/FY Closing’ (Generate Recurring entries/ Fiscal Year Closing) button selection.

The first type, Recurring Entries, must be defined under the Recurring Entry Setup module prior to being available as a recurring type.

The second type of entry is a special kind of Fiscal Year End Closing Entry, which may be generated after all adjustments have been made for a period but before the actual Period Close Closing Entries zero out the income and expense items for the period and transfer the balance to the Balance Sheet's Retained Earnings. It is important that an entry be created to Close the Income and Expense to the Balance Sheet at the end of each Fiscal Year Period Close. Without such an entry the Balance Sheet will be out of balance by the amount of profit (or loss) incurred, because such an entry was last posted to the Equity Accounts. Such a transfer and closing should not affect reprint of Income Statements for Prior Periods but a Posting to a Prior Period will affect the Balance Sheet / Income Statement for the affected period. A General Journal Entry must be generated to close those Prior Period income and expense items to Retained Earnings if the company chose to allow posting to prior periods.

Journal Entry must be approved before it may be posted. After checking for accuracy, approve a Journal Entry by selecting the ‘Approve’ button and enter an authorized administrative password.

|