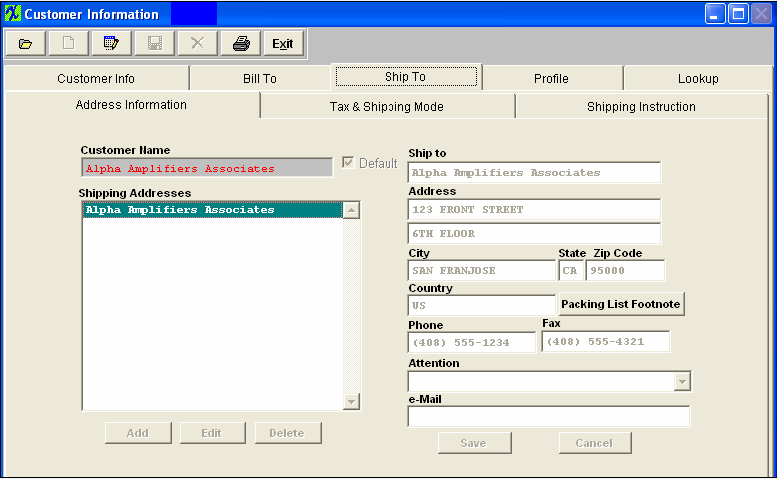

| Ship-To Tab |

Ship To Address Information Fields & Defintions

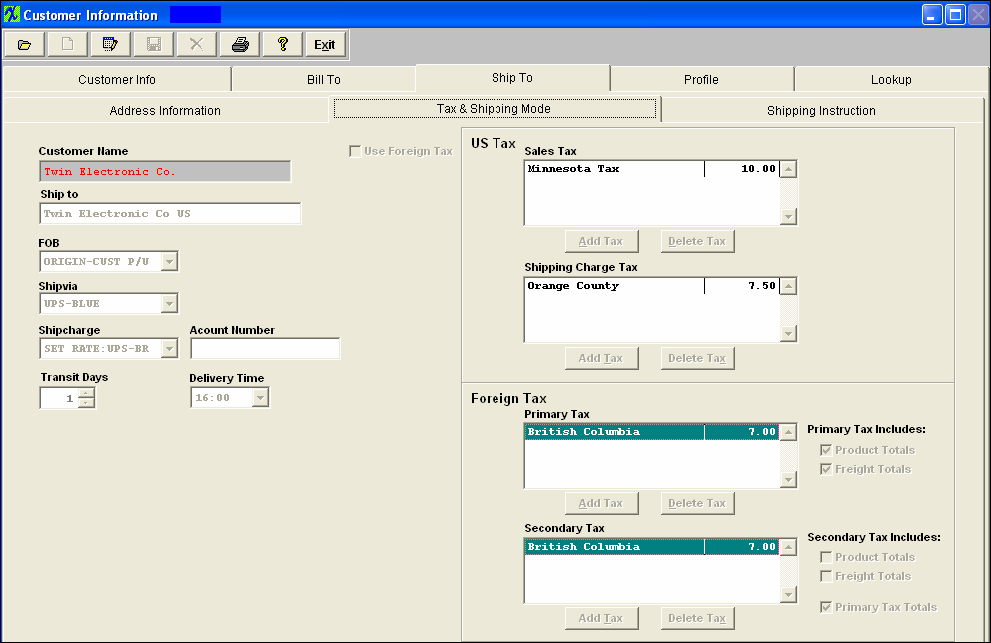

Ship To Tax & Shipping Mode Fields & Definitons

| Customer Name |

The name of the customer. |

| Ship to |

The chosen Ship-To name for which the data applies. |

| FOB |

The FOB Terms established for the customer. Must be established in the FOB setup prior to use. |

| Shipvia |

The Ship Via definition established for the customer, as entered in Ship Via setup. |

| Shipcharge |

The shipping charge classification used for charging the customer, as entered in Ship Charge setup. |

| Transit Days

|

The number of days from user’s dock to customer’s dock, based on ship-via method. |

| Account Number |

The freight account number if the customer wishes the freight to be shipped against their own account. |

| Delivery Time |

The customer - preferred delivery time to their dock. |

| Use Foreign Tax |

Check this box to use Foreign Tax for this specific ship to address. Once checked for a specific address it should not be switched back to US Tax. (If customer has two addresses, one that uses US tax and one that uses Foreign tax then user should setup one address without the Foreign tax box checked and one address with the Foreign tax box checked). |

US Tax

|

Sales Tax

|

The sales tax to be charged on taxable items shipped to this address. |

| Shipping Charge Tax |

The sales tax to be charged on freight costs for shipping to this address. |

|

This button allows the user to select a tax authority based on the ship-to locations for the customer. The tax authority codes must be established in the Sales Tax Authority Table setup prior to using. |

|

This button allows the user to select an existing tax authority for the customer for deletion |

Foreign Tax

|

Primary Tax

|

This tax will be calculated first, when the "Use Foreign Tax" box is checked. |

| Primary Tax Includes |

Option to Apply Tax on the Product, Freight or both. ManEx recommends that once these boxes are setup they should NOT be changed.

Note: The tax rate will not be affected in the Credit Memo if user changes the tax setup in customer module, but the primary and secondary tax checkboxes will be affected, just like the shipping address if user changes that in the customer module.

|

| Secondary Tax |

This tax will be calculated after Primary tax when the "Use Foreign Tax" box is checked. |

| Secondary Tax Includes |

Option to Apply Tax on the Product, Freight, both or Primary. ManEx recommends that once these boxes are setup they should NOT be changed.

Note: The tax rate will not be affected in the Credit Memo if user changes the tax setup in customer module, but the primary and secondary tax checkboxes will be affected, just like the shipping address if user changes that in the customer module. |

|

This button allows the user to select a tax authority based on the ship-to locations for the customer. The tax authority codes must be established in the Sales Tax Authority Table setup prior to using. |

|

This button allows the user to select an existing tax authority for the customer for deletion. |

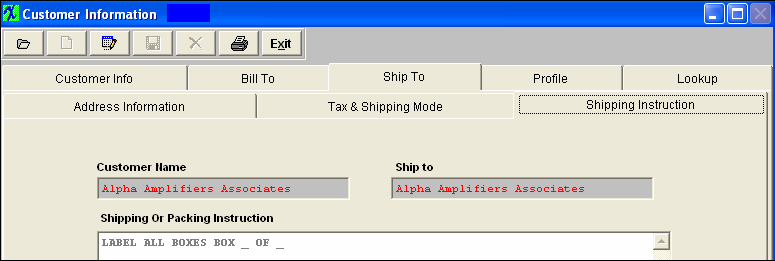

Ship To Shipping Instructions Fields & Definitions

| Customer Name |

The name of the customer.

|

| Ship To |

The chosen Ship-To name for which the data applies. |

| Shipping Or Packing Instruction |

This screen is a memo field that may be used to record directions, notes, cautions, etc. for shipping to this specific Customer Shipping Address. The information entered in this screen will be displayed in the Packing List module for this ship to address only. |

|

|

|

|

|

|

|

|

|

| Article ID: 1719 |